Executive Summary

As we enter the 2019 holiday season and the year (and decade!) comes to a close, I am once again so thankful to all of you, the ever-growing number of readers who continue to regularly visit this Nerd’s Eye View blog (and share the content with your friends and colleagues, which we greatly appreciate!). As we entered the decade of the 2010s, this blog was still in a nascent stage on the Kitces.com website, with just 1,225 people coming to read the entire month of December 2009; today, far more people than that read our blog posts in just the first two hours after each article is published and emailed out to everyone! And I have even more exciting ideas about how we can do more and be even better for the advisor community in 2020… stay tuned for more announcements in the coming weeks!

We recognize that although this blog is a weekly habit for thousands of advisors, not everyone reads every blog post that is released from Nerd’s Eye View throughout the year. As many of you noted in response to our recent Reader Survey, most choose which articles to read based on headlines and topics that are of interest. Yet in practice, this means that an article once missed is often never seen again, ‘overwritten’ (or at least bumped out of your Inbox!) by the next day’s, week’s, and month’s worth of content that comes along.

Accordingly, just as I did last year and in 2017, 2016, 2015, and 2014, I've compiled for you this Highlights List of our top 20 articles in 2019 that you might have missed, including some of our most popular episodes of the Financial Advisor Success podcast. So whether you're new to the blog and #FASuccess podcast and haven't searched through the Archives, or simply haven't had the time to keep up with everything, I hope that some of these will (still) be useful for you! And as always, I hope you'll take a moment to share podcast episodes and articles of interest with your friends and colleagues as well!

In the meantime, I hope you're having a safe and happy holiday season. Thanks again for another successful year in 2019, and I hope you enjoy all the new features and resources we'll be rolling out in 2020, too!

Don't miss our Annual Guides as well - including our list of the "20 Best Conferences for Financial Advisors in 2020", our new “2020 Master Conference List For Financial Advisors”, the ever-popular annual "2019 Reading List Of Best Books For Financial Advisors", and our increasingly popular Financial Advisor “FinTech” Solutions Map, along with our ever-popular "Advisor's Guide To The Best Financial Planning Software (For You)"!

2018 Best-Of Highlights Categories: Retirement Planning | Insurance Planning | Tax Planning | General Planning | Industry Trends | Practice Management | Marketing | Behavioral Finance | Financial Advisor Success Podcasts

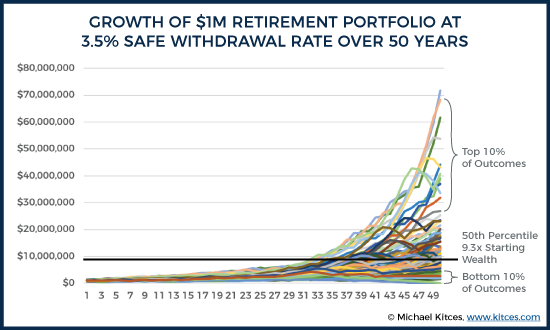

Retirement Planning

The Problem With FIREing At 4% And The Need For Flexible Spending Rules – The modern form of “retirement” emerged largely as a result of the industrial revolution and the shift from farm to factory, where for the first time humans ‘worked’ for a business until the point they were ‘obsolete’ as factory workers… at which point they had to be ‘retired’ from the factory, and by then needed to have accumulated enough financial assets to sustain themselves when they no longer had any productive human capital left. Yet in the decades since, the concept of retirement has morphed from a transition when one no longer can work, to a period where one can save enough to enjoy a period of non-work leisure… which in turn has made it more and more appealing to accumulate faster and faster towards retirement, in an effort to minimize the working years and maximize the leisure years, encapsulated today in the “FIRE” (Financial Independence, Retire Early) movement. Yet the caveat of trying to FIRE out of work as early as possible – sometimes by one’s 40s or even 30s – is the fact that human beings generally aren’t built to be idle for multi-decade periods of time (especially during our otherwise healthy and productive years!), which means the potential for post-retirement ‘work’ is actually quite likely in FIRE scenarios… which, ironically, would make it feasible to FIRE even sooner! Perhaps the greatest challenge, though, is that such extreme early retirement leaves a very long time to be in ‘retirement’, such that the classic “4% rule” of retirement should probably be a 3.5% rule (given the longer time horizon). On the other hand, having a potentially-50-year time horizon for retirement, where long-term balanced portfolios often generate 6% to 8% returns and the FIRE retiree is withdrawing at only 3.5%, means that eventually, such conservative spending can produce astonishingly outsized “excess” retirement funds (as with a 3.5% withdrawal rate for 50 years, there’s an equal likelihood of a $1M nest egg depleting a year or two short, as there is of that $1M nest egg growing to a whopping $71M instead!). Given this extreme dispersion of potential outcomes – thanks to multiple decades of compounding either good or bad sequences of returns – those who reach Financial Independence at an early age must arguably plan for more flexible spending rules in the first place, setting ‘guardrails’ to remain in a safe zone of (relative) spending, with a means to make mid-course small-but-permanent adjustments to the downside if markets are unfavorable, and also to have a plan about how to ratchet spending higher if markets cooperate instead.

The Problem With FIREing At 4% And The Need For Flexible Spending Rules – The modern form of “retirement” emerged largely as a result of the industrial revolution and the shift from farm to factory, where for the first time humans ‘worked’ for a business until the point they were ‘obsolete’ as factory workers… at which point they had to be ‘retired’ from the factory, and by then needed to have accumulated enough financial assets to sustain themselves when they no longer had any productive human capital left. Yet in the decades since, the concept of retirement has morphed from a transition when one no longer can work, to a period where one can save enough to enjoy a period of non-work leisure… which in turn has made it more and more appealing to accumulate faster and faster towards retirement, in an effort to minimize the working years and maximize the leisure years, encapsulated today in the “FIRE” (Financial Independence, Retire Early) movement. Yet the caveat of trying to FIRE out of work as early as possible – sometimes by one’s 40s or even 30s – is the fact that human beings generally aren’t built to be idle for multi-decade periods of time (especially during our otherwise healthy and productive years!), which means the potential for post-retirement ‘work’ is actually quite likely in FIRE scenarios… which, ironically, would make it feasible to FIRE even sooner! Perhaps the greatest challenge, though, is that such extreme early retirement leaves a very long time to be in ‘retirement’, such that the classic “4% rule” of retirement should probably be a 3.5% rule (given the longer time horizon). On the other hand, having a potentially-50-year time horizon for retirement, where long-term balanced portfolios often generate 6% to 8% returns and the FIRE retiree is withdrawing at only 3.5%, means that eventually, such conservative spending can produce astonishingly outsized “excess” retirement funds (as with a 3.5% withdrawal rate for 50 years, there’s an equal likelihood of a $1M nest egg depleting a year or two short, as there is of that $1M nest egg growing to a whopping $71M instead!). Given this extreme dispersion of potential outcomes – thanks to multiple decades of compounding either good or bad sequences of returns – those who reach Financial Independence at an early age must arguably plan for more flexible spending rules in the first place, setting ‘guardrails’ to remain in a safe zone of (relative) spending, with a means to make mid-course small-but-permanent adjustments to the downside if markets are unfavorable, and also to have a plan about how to ratchet spending higher if markets cooperate instead.

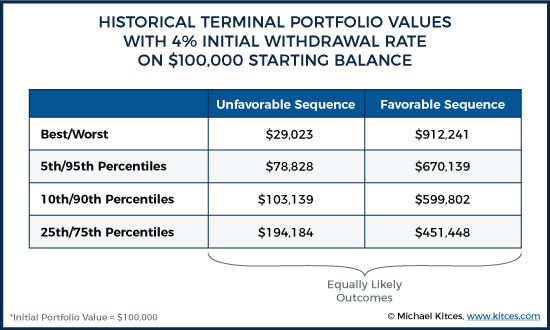

The Extraordinary Upside Potential Of Sequence-Of-Return Risk In Retirement – One of the key challenges of determining what constitutes ‘reasonable’ spending in retirement is that, even if the advisor is right about the anticipated long-term returns of the retirement portfolio, there’s a risk that ongoing withdrawals on top of a series of early bad returns will cause the portfolio to be fully depleted before the good returns finally arrive to average out in the long run. As a result, retirees must generally spend less than what expected returns alone would otherwise predict is affordable, to defend against this “sequence-of-returns” risk. Yet the caveat is that while a bad sequence of returns coupled with ongoing withdrawals can catastrophically deplete a portfolio too quickly, a good sequence of returns that outpaces withdrawals can quickly compound the portfolio so far ahead that substantial excess wealth accrues instead! In fact, because of how long-term returns compound to the upside, favorable sequences of returns actually produce far more excess wealth outcomes than unfavorable sequences risk to the downside. For instance, taking a 4% initial withdrawal rate has an equal (10%) likelihood of leaving all the retiree’s principal left over at the end of retirement… or leaving 6X the starting account balance remaining instead! Which means not only is it important to give at least some consideration to the potential and upside “risk” of getting a favorable sequence of returns, but the asymmetric nature of sequence risk to the upside suggests that simply spending conservatively and adjusting later if a “good” surprise occurs may be too likely to leave dramatic levels of unspent wealth that could have been enjoyed earlier. So what’s the alternative? To plan, in advance, for retirement spending strategies to be more dynamic… at minimum, to have a ratcheting plan in place to lift a low initial spending rate higher if the sequence is favorable (or at least, is not unfavorable), and for those who are willing to be more flexible in their retirement spending, to set guardrails in advance to know both when to cut spending in a bad sequence, and when to lift it higher in a more favorable one. The bottom line, though, is simply to recognize that sequence-of-return risk truly cuts both ways, creating both the risk of depleting a portfolio too early with a bad sequence (even if returns do average out in the long run), but also the risk of the retiree waiting too long to fully spend and failing to enjoy the assets and income that turned out to be available because a favorable sequence of returns occurred instead!

The Extraordinary Upside Potential Of Sequence-Of-Return Risk In Retirement – One of the key challenges of determining what constitutes ‘reasonable’ spending in retirement is that, even if the advisor is right about the anticipated long-term returns of the retirement portfolio, there’s a risk that ongoing withdrawals on top of a series of early bad returns will cause the portfolio to be fully depleted before the good returns finally arrive to average out in the long run. As a result, retirees must generally spend less than what expected returns alone would otherwise predict is affordable, to defend against this “sequence-of-returns” risk. Yet the caveat is that while a bad sequence of returns coupled with ongoing withdrawals can catastrophically deplete a portfolio too quickly, a good sequence of returns that outpaces withdrawals can quickly compound the portfolio so far ahead that substantial excess wealth accrues instead! In fact, because of how long-term returns compound to the upside, favorable sequences of returns actually produce far more excess wealth outcomes than unfavorable sequences risk to the downside. For instance, taking a 4% initial withdrawal rate has an equal (10%) likelihood of leaving all the retiree’s principal left over at the end of retirement… or leaving 6X the starting account balance remaining instead! Which means not only is it important to give at least some consideration to the potential and upside “risk” of getting a favorable sequence of returns, but the asymmetric nature of sequence risk to the upside suggests that simply spending conservatively and adjusting later if a “good” surprise occurs may be too likely to leave dramatic levels of unspent wealth that could have been enjoyed earlier. So what’s the alternative? To plan, in advance, for retirement spending strategies to be more dynamic… at minimum, to have a ratcheting plan in place to lift a low initial spending rate higher if the sequence is favorable (or at least, is not unfavorable), and for those who are willing to be more flexible in their retirement spending, to set guardrails in advance to know both when to cut spending in a bad sequence, and when to lift it higher in a more favorable one. The bottom line, though, is simply to recognize that sequence-of-return risk truly cuts both ways, creating both the risk of depleting a portfolio too early with a bad sequence (even if returns do average out in the long run), but also the risk of the retiree waiting too long to fully spend and failing to enjoy the assets and income that turned out to be available because a favorable sequence of returns occurred instead!

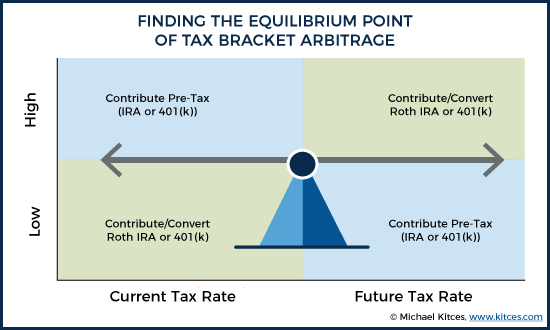

The Importance Of Finding Your Tax Equilibrium Rate For Retirement Liquidations – No one wants to pay any more in taxes than they have to, and Judge Learned Hand is famous for stating that, “Anyone may arrange his affairs so that his taxes shall be as low as possible.” Which, in practice, usually entails engaging in tax strategies that minimize taxes… or at least defer them as long as possible. Except the caveat is that when it comes to tax deferral, there really is such thing as being “too good” at doing so, given the progressive nature of income tax brackets with higher tax rates on higher income levels (such that when Required Minimum Distributions begin, a retiree may be thrust into a tax bracket higher than he/she ever faced during the accumulation years or earlier retirement years in the first place!). Accordingly, the reality is that sometimes the best way to arrange affairs to minimize taxes is actually not to defer them and potentially increase future tax rates, and instead accelerate the income into lower tax brackets today. With the caveat that if too much income is accelerated, the individual may simply drive themselves into higher tax brackets today, finishing with less wealth than they would have if they simply relied on good old-fashioned tax deferral instead! Thus, the optimal outcome really is a balancing point between the two – seeking out an “equilibrium rate” that accelerates enough income to fill up lower tax brackets today but still defers enough income to fill up (just) the lower tax brackets in the future as well. And while it can be difficult to know for certain what future tax rates will be, the very nature of doing financial planning (and especially retirement projections) is to determine the current trajectory of wealth accumulation… which means with some relatively simple and straightforward assumptions about future Social Security and pension payments, RMD calculations, and anticipated interest, dividends, and capital gains, it really is feasible to make a reasonable approximation of an individual’s future tax rates to determine where the ideal equilibrium will be. And then engage in strategies from accelerated retirement account liquidations to partial Roth conversions and capital gains harvesting, as necessary to ensure that any currently-lower tax brackets are filled up to reach the equilibrium point. Ultimately, the ideal tax bracket to fill up will vary by the individual and their overall wealth and circumstances, with many retirees (even millionaires) remaining in (and thus only aiming to fill) the 12% ordinary income bracket (and 0% capital gains rates) with proactive planning, while more affluent retirees may aim for the 22% or 24% brackets and the 15% capital gains rate, and the wealthiest households may seek out any tax rate equilibrium that is not the top tax bracket (as anything lower than the highest tax rate is a relative improvement!). The fundamental point, though, is simply that the best way to plan around taxes in retirement is not to defer too much income, nor too little, but to seek out and find the equilibrium rate that balances out tax rates in the present and the future!

The Importance Of Finding Your Tax Equilibrium Rate For Retirement Liquidations – No one wants to pay any more in taxes than they have to, and Judge Learned Hand is famous for stating that, “Anyone may arrange his affairs so that his taxes shall be as low as possible.” Which, in practice, usually entails engaging in tax strategies that minimize taxes… or at least defer them as long as possible. Except the caveat is that when it comes to tax deferral, there really is such thing as being “too good” at doing so, given the progressive nature of income tax brackets with higher tax rates on higher income levels (such that when Required Minimum Distributions begin, a retiree may be thrust into a tax bracket higher than he/she ever faced during the accumulation years or earlier retirement years in the first place!). Accordingly, the reality is that sometimes the best way to arrange affairs to minimize taxes is actually not to defer them and potentially increase future tax rates, and instead accelerate the income into lower tax brackets today. With the caveat that if too much income is accelerated, the individual may simply drive themselves into higher tax brackets today, finishing with less wealth than they would have if they simply relied on good old-fashioned tax deferral instead! Thus, the optimal outcome really is a balancing point between the two – seeking out an “equilibrium rate” that accelerates enough income to fill up lower tax brackets today but still defers enough income to fill up (just) the lower tax brackets in the future as well. And while it can be difficult to know for certain what future tax rates will be, the very nature of doing financial planning (and especially retirement projections) is to determine the current trajectory of wealth accumulation… which means with some relatively simple and straightforward assumptions about future Social Security and pension payments, RMD calculations, and anticipated interest, dividends, and capital gains, it really is feasible to make a reasonable approximation of an individual’s future tax rates to determine where the ideal equilibrium will be. And then engage in strategies from accelerated retirement account liquidations to partial Roth conversions and capital gains harvesting, as necessary to ensure that any currently-lower tax brackets are filled up to reach the equilibrium point. Ultimately, the ideal tax bracket to fill up will vary by the individual and their overall wealth and circumstances, with many retirees (even millionaires) remaining in (and thus only aiming to fill) the 12% ordinary income bracket (and 0% capital gains rates) with proactive planning, while more affluent retirees may aim for the 22% or 24% brackets and the 15% capital gains rate, and the wealthiest households may seek out any tax rate equilibrium that is not the top tax bracket (as anything lower than the highest tax rate is a relative improvement!). The fundamental point, though, is simply that the best way to plan around taxes in retirement is not to defer too much income, nor too little, but to seek out and find the equilibrium rate that balances out tax rates in the present and the future!

Insurance Planning

Figuring Out The “Best” Healthcare Option For “Early” Retirees – Despite the long-standing worry that prospective retirees have about the risk of running out of money, a recent consumer survey shows that the number-one worry for most Baby Boomers now is actually how they’re going to handle medical costs in retirement, as healthcare expenses continue to compound faster than the general rate of inflation. The good news for retirees is that upon turning age 65, the availability of Medicare turns health care costs into a largely stable and “plan-able” expense (as Medicare Part B and Part D, plus a Medigap supplemental plan, turns retiree medical expenses almost entirely into fixed insurance premiums instead). The caveat, though, is that Medicare itself generally isn’t available until age 65 (at least for those not otherwise disabled earlier in life), which means for “early” retirees (i.e., those who retire at a pre-Medicare-eligible age), the challenge is figuring out how to bridge health care from retirement until Medicare. Fortunately, there are a number of potential options, including COBRA coverage for those who retired from a company with greater than 20 employees (though COBRA generally only lasts for 18 months as a limited bridge to Medicare), converting a group health insurance plan into an individual policy, or purchasing health insurance coverage on a guaranteed-issue basis via a state health insurance exchange (within 60 days of when the employer’s plan is terminated, or during the annual open enrollment period), potentially supplemented by the accumulating (tax-preferenced) value of a Health Savings Account. Notably, pre-Medicare health insurance options are generally significantly more expensive than Medicare itself… but coverage options are available for early retirees, making the health-insurance-for-early-retirees question an expense that can be effectively financially-planned for!

Tax Planning

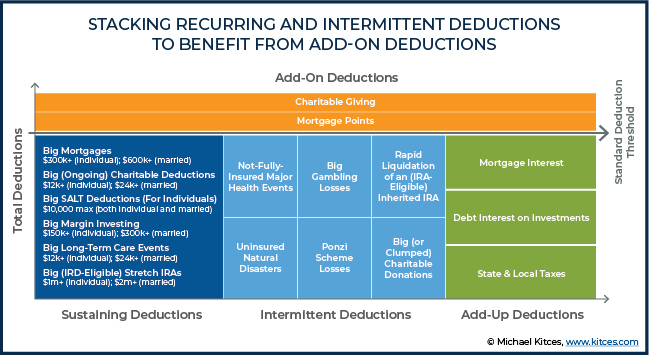

The 6 Types Of Itemized Deductions That Can Still Be Claimed After TCJA – The Tax Cuts and Jobs Act of 2017 simplified the Internal Revenue Code by collapsing together what was previously a $6,350 Standard Deduction and $4,050 Personal Exemption (for individuals in 2017, or $12,700 and $8,100 respectively for a married couple) into a single larger Standard Deduction of $12,000 (for individuals, or $24,000 for married couples). The net result was a small increase in the total amount of deductions (from $10,400 to $12,000 for individuals, and $20,800 to $24,000 for married couples), but a significant increase in the required threshold to itemize deductions in the first place (as deductions are only itemized when they exceed the Standard Deduction, and the Standard Deduction rose from $6,350 and $12,700 to $12,000 and $24,000 respectively). As a result, it’s significantly more difficult now to reach the threshold to itemize deductions at all, with estimates that only 10% of all households will likely itemize deductions in the future! On the other hand, the fact that it’s so difficult to itemize effectively means there are relatively few common and easily identifiable ‘triggers’ that determine whether someone will likely itemize (and therefore have itemized deduction planning opportunities, including large medical expenses, taxes paid to other governmental entities (albeit up to the $10,000 SALT cap), substantial interest paid (either for a mortgage, or for investment purposes), charitable giving, casualty and theft losses, and the remaining miscellaneous-but-not-subject-to-the-2%-of-AGI-floor deductions (e.g., gambling losses, Ponzi scheme losses, and the Income-In-Respect-Of-A-Decedent deduction). Notably, though, several of these typically only occur on an intermittent basis, while just a few – like a sizable ongoing mortgage, regular charitable giving, an ongoing health event resulting in large medical expenses, or stretching an inherited IRA with large IRD deductions – will typically sustain itemized deductions on an ongoing basis. Which is important to distinguish, as while those with sustaining itemized deductions may claim such deductions on an ongoing basis, the rest will want to be mindful of ‘lumping and clumping’ strategies to group deductions together in a single year to get over the Standard Deduction threshold at least once every few years (and then take advantage of ‘add-on’ deductions that can be stacked on top in the years they are over the threshold!).

The 6 Types Of Itemized Deductions That Can Still Be Claimed After TCJA – The Tax Cuts and Jobs Act of 2017 simplified the Internal Revenue Code by collapsing together what was previously a $6,350 Standard Deduction and $4,050 Personal Exemption (for individuals in 2017, or $12,700 and $8,100 respectively for a married couple) into a single larger Standard Deduction of $12,000 (for individuals, or $24,000 for married couples). The net result was a small increase in the total amount of deductions (from $10,400 to $12,000 for individuals, and $20,800 to $24,000 for married couples), but a significant increase in the required threshold to itemize deductions in the first place (as deductions are only itemized when they exceed the Standard Deduction, and the Standard Deduction rose from $6,350 and $12,700 to $12,000 and $24,000 respectively). As a result, it’s significantly more difficult now to reach the threshold to itemize deductions at all, with estimates that only 10% of all households will likely itemize deductions in the future! On the other hand, the fact that it’s so difficult to itemize effectively means there are relatively few common and easily identifiable ‘triggers’ that determine whether someone will likely itemize (and therefore have itemized deduction planning opportunities, including large medical expenses, taxes paid to other governmental entities (albeit up to the $10,000 SALT cap), substantial interest paid (either for a mortgage, or for investment purposes), charitable giving, casualty and theft losses, and the remaining miscellaneous-but-not-subject-to-the-2%-of-AGI-floor deductions (e.g., gambling losses, Ponzi scheme losses, and the Income-In-Respect-Of-A-Decedent deduction). Notably, though, several of these typically only occur on an intermittent basis, while just a few – like a sizable ongoing mortgage, regular charitable giving, an ongoing health event resulting in large medical expenses, or stretching an inherited IRA with large IRD deductions – will typically sustain itemized deductions on an ongoing basis. Which is important to distinguish, as while those with sustaining itemized deductions may claim such deductions on an ongoing basis, the rest will want to be mindful of ‘lumping and clumping’ strategies to group deductions together in a single year to get over the Standard Deduction threshold at least once every few years (and then take advantage of ‘add-on’ deductions that can be stacked on top in the years they are over the threshold!).

Maximizing The Pre-Tax Treatment Of Investment Advisory Fees After TCJA – One of the many changes made by the Tax Cuts and Jobs Act of 2017 was the repeal of miscellaneous itemized deductions through 2025… which was especially concerning to many financial advisors, as it included the elimination of the deduction for investment advisory fees. Of course, the reality is that not all taxpayers were eligible to claim a deduction for advisory fees in the first place, as not only did it require the taxpayer to itemize, but also that their advisory fees exceeded 2% of their AGI (along with other such miscellaneous itemized deductions)… but even then, the advisory fee deduction could be lost to the Alternative Minimum Tax (AMT). Still, though, many clients of advisors have been impacted by the loss of the deduction for advisory fees… and are now looking for any opportunity they can find to reduce the repeal’s impact and still get at least some tax benefit for advisory fees paid. One ‘simple’ way to help clients retain the pre-tax nature of advisory fees is to find a bona fide way to continue deducting the expenses; for instance, clients who are small business owners may claim a portion of the total advisory fee as a deductible business expense (under IRC Section 162 for the deduction of ordinary and necessary expenses of a business), at least to the extent that business-related advice (e.g., succession planning, retirement plan services, business-related tax strategies, etc.) has been provided. Another way that advisors can help clients mitigate the impact of the lost advisory fee deduction is to help clients pay fees from the most efficient source. As fortunately, AUM-style investment advisory fees for a client’s retirement account (e.g., a traditional IRA or a Roth IRA) can actually be pulled directly from the applicable retirement account, allowing the expense to continue to be paid with pre-tax dollars (at least when pulled from a pre-tax retirement account in the first place). Hybrid advisors (i.e., those with both an RIA and broker/dealer affiliation) may also wish to reevaluate when it is in a client’s best interest to have them pay for the advisor’s services with advisory fees, as ironically, while the financial ‘advice’ industry has steadily been moving away from commissions and towards fees, the Tax Cuts and Jobs Act gives a distinct tax preference paying advisors via commissions over fees (because trading commissions can be added to the cost basis of a position, reduce the proceeds of a sale, or reduce the amount of taxable income produced by a pass-through investment before the income is, in turn, passed through to the investor). And when it comes to standalone RIAs, while they cannot receive commissions for the sale of securities (to get pre-tax treatment for their clients), RIAs may try turning their investment models into pooled investment vehicles like mutual funds or ETFs (allowing the advisor to bill their advisory fees as a management fee to the fund itself, which means clients effectively pay the RIA’s fee via the mutual fund/ETF’s expense ratio on a pre-tax basis). Alternatively, some advisory firms may look to limited partnerships as another potential method of mitigating the loss of the deduction for advisory fees, by again trying to claim the RIA’s fees as a “management fee” for the business, rather than a pass-through expense of the investment partnership (at least for clients who meet the Accredited Investor requirements). Unfortunately, though, the creation and maintenance of a mutual fund or ETF structure, or a series of private placement limited partnerships for clients, can add a significant level of operational overhead to a firm (and may not even be feasible for all clients and situations). The bottom line, though, is that while the loss of the deduction for investment advisory fees may be painful for many, there are still at least some ways that financial advisors and institutions can help their clients pay investment-related expenses in a tax-efficient (pre-tax) manner!

How The New QBI Deduction-Reduction Ruins The Value Of Pre-Tax Retirement Plans For Small Business Owners – The Tax Cuts and Jobs Act of 2017 gave birth to the new IRC Section 199A, which allows certain owners of pass-through businesses to receive a deduction for up to 20% of qualified business income. While the new deduction will be a powerful way for many business owners to reduce their tax liability, it comes at a(n indirect) price… the Section 199A deduction will dramatically reduce the value of tax-deductible retirement plan contributions. This new “deduction-reduction problem” with pre-tax retirement contributions arises from the fact that the Section 199A deduction only applies to “qualified business income”, which is essentially the profits of a company. But when an S corporation makes an employer contribution to an employer-sponsored retirement plan, that contribution, itself, reduces corporate profits. Thus, there is less profit on which the 199A deduction can potentially apply. The sum of these moving parts is that, for some S corporation owners, a contribution to an employer-sponsored retirement plan will effectively result in a partial deduction for the contribution itself, but still subject the entire contribution, plus all future earnings, to income tax upon distribution in the future. And while prior to the issuance of recent Final Regulations on Section 199A, it was widely assumed that this issue was only applicable to owners of entities taxed as S corporations (since contributions to retirement plans for sole proprietors and partners do not reduce business profits, but rather, are taken as personal above-the-line deductions on the new Form Schedule 1 [formerly on the bottom of page 1 of Form 1040]), the new Final Regulations make clear that sole proprietors and partners must also ‘back out’ these amounts from business profits prior to the application of the 199A deduction. Thus, the “deduction-reduction problem” created by the Section 199A deduction will impact far more small business owners than previously thought. But just because a business owner isn’t getting the same bang-for-the-buck on a tax-deductible retirement account contribution doesn’t mean that they should throw in the tax-preferred-retirement-savings towel altogether! Instead, 401(k)s with a Roth-style option will simply become more valuable. And for those business owners looking to sock away more for retirement than the $19,000 maximum Roth 401(k) deferral for 2019 ($25,000 if age 50+ by year-end), making after-tax contributions to the 401(k) plan (potentially to convert later under the “Mega-Back-Door Roth” strategy) can be an increasingly attractive option as well. Of course, the irony is that Specified Service Business owners, whose income is so high that the QBI deduction is phased out anyway (such as high-income financial advisors, doctors, lawyers, consultants, and accountants), will not be adversely impacted by the deduction-reduction problem, and those who believe that their future marginal tax rate will be significantly lower than the marginal tax rate they face today may still find it worthwhile to contribute anyway (even with only a partial deduction today), along with those who have no other tax-preferenced retirement savings option (as even a partial deduction is still better than not taking advantage of a retirement account at all!). Ultimately though, the most important thing for business owners and their advisors to realize is that the impact of the Section 199A deduction impacts not only a business owner’s income itself but also which type of retirement plans will really provide the maximum benefit in the future!

General Planning

Protecting And Guiding Clients With Diminishing Mental Capacity – As financial advisory firms increasingly focus on Baby Boomer retirees, boomers themselves grow inexorably older each year, and medical advances make it feasible for people to live longer and longer, the advisory industry is increasingly facing the potential that clients will experience cognitive decline and diminishing mental capacity within the span of the advisor-client relationship. The rising frequency of diminished mental capacity is already beginning to capture the attention of both regulators and legislators to protect seniors from financial elder abuse, and the fact that financial advisors are often intimately involved with their clients’ finances puts us in a unique position to potentially intervene in such situations. Accordingly, the recent Senior Safe Act grants protections for financial advisors who report to the authorities potential incidents of financial exploitation against seniors, NASAA has created a Model Act for states to adopt that would permit advisors and broker-dealers to delay disbursements from a client’s accounts if they suspect financial exploitation (mirrored in FINRA’s own recent Rule 2165), and FINRA’s new Rule 4512 mandates that brokerage firms obtain the contact information for a “Trusted Contact Person” in the event that a client may not be competent. However, from a more practical perspective, advisory firms must be prepared not only to help protect clients against elder financial abuse but also simply to help them navigate their ongoing financial decision making in the face of potential cognitive decline. Accordingly, advisory firms can establish their own processes and procedures to ensure a client’s Power Of Attorney is on record with the firm, maintain the appropriate contact information (and permission) to reach out to other family members if cognitive decline is observed, and consider refinements to how advice and conversations themselves are documented and sent as follow-up to clients to help ensure that a client’s cognitive decline doesn’t lead to a legal dispute with the advisory firm itself!

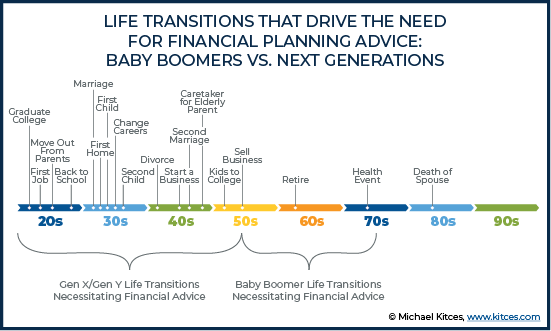

How The Financial Planning Process Differs For Young Clients: Not Simpler, But Different Complexities – The rise of the assets-under-management (AUM) model has driven a concomitant shift in financial advisors to focus increasingly on Baby Boomer retirees – for the same reason that Willie Sutton robbed banks: “That’s where the money is.” To the point that some in the industry have raised the question of whether the pendulum is swinging too far to retirees, and that it’s time to start doing more financial planning for next-generation clients as well. Except the challenge for most advisory firms is that it’s not profitable to do financial planning for younger clients, who simply don’t have sufficiently-sized investment accounts on which a percentage-of-AUM fee model can generate enough revenue to compensate the advisory firm to deliver the advice. For which advisory firms can adopt various “fee-for-service” models, from charging minimum fees based on a percentage of income, to flat monthly retainer fees. Except then, the pressure is on the advisory firm to justify the value of the financial planning advice being given to clients for that fee, especially if the younger clientele tends to have ‘simpler’ financial needs in the first place. Yet the reality is that younger clients with fewer assets and lower net worth still experience the kinds of tumultuous life transitions that necessitate engaging a financial advisor in the first place. In fact, ironically, older retirees typically only experience a few major life transitions in the span of their retirement decades – retirement itself, a major change in health, and the death of a spouse – while it’s younger clients who actually experience a steady stream of major life transitions that may necessitate a financial advisor, from getting a new job to going back to school, starting a business, getting married (or getting divorced!), having children, and more. And while younger clients may have less in the way of investments and assets, they still face substantial complexities when it comes to their cash flow itself, from how to transition from a dual-income household to a stay-at-home-parent (or back again) after the birth of a child or a decision to go back to school, merging finances during a marriage (or separating them again after a divorce), to adjusting household spending while launching a business. Which means, in the end, while the focus of financial planning may shift for next-generation clients – from monitoring the health of their assets to monitoring the health of their income instead – arguably younger clients don’t really have ‘simpler’ financial advice needs in the first place. Instead, they have a different set of complex financial advice needs… and an even greater need for the cyclical and ongoing financial planning process in the first place, because of the pace and frequency of the life transitions that impact their financial situation throughout their 20s, 30s, and 40s!

How The Financial Planning Process Differs For Young Clients: Not Simpler, But Different Complexities – The rise of the assets-under-management (AUM) model has driven a concomitant shift in financial advisors to focus increasingly on Baby Boomer retirees – for the same reason that Willie Sutton robbed banks: “That’s where the money is.” To the point that some in the industry have raised the question of whether the pendulum is swinging too far to retirees, and that it’s time to start doing more financial planning for next-generation clients as well. Except the challenge for most advisory firms is that it’s not profitable to do financial planning for younger clients, who simply don’t have sufficiently-sized investment accounts on which a percentage-of-AUM fee model can generate enough revenue to compensate the advisory firm to deliver the advice. For which advisory firms can adopt various “fee-for-service” models, from charging minimum fees based on a percentage of income, to flat monthly retainer fees. Except then, the pressure is on the advisory firm to justify the value of the financial planning advice being given to clients for that fee, especially if the younger clientele tends to have ‘simpler’ financial needs in the first place. Yet the reality is that younger clients with fewer assets and lower net worth still experience the kinds of tumultuous life transitions that necessitate engaging a financial advisor in the first place. In fact, ironically, older retirees typically only experience a few major life transitions in the span of their retirement decades – retirement itself, a major change in health, and the death of a spouse – while it’s younger clients who actually experience a steady stream of major life transitions that may necessitate a financial advisor, from getting a new job to going back to school, starting a business, getting married (or getting divorced!), having children, and more. And while younger clients may have less in the way of investments and assets, they still face substantial complexities when it comes to their cash flow itself, from how to transition from a dual-income household to a stay-at-home-parent (or back again) after the birth of a child or a decision to go back to school, merging finances during a marriage (or separating them again after a divorce), to adjusting household spending while launching a business. Which means, in the end, while the focus of financial planning may shift for next-generation clients – from monitoring the health of their assets to monitoring the health of their income instead – arguably younger clients don’t really have ‘simpler’ financial advice needs in the first place. Instead, they have a different set of complex financial advice needs… and an even greater need for the cyclical and ongoing financial planning process in the first place, because of the pace and frequency of the life transitions that impact their financial situation throughout their 20s, 30s, and 40s!

Industry Trends

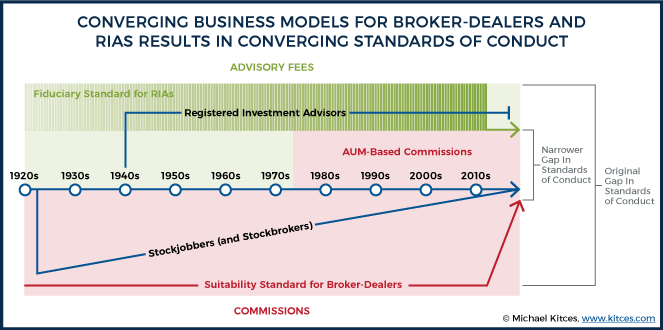

The Great Convergence And The Death Of Fiduciary Differentiation (For RIAs) – For the past several decades, RIAs have increasingly differentiated themselves and their advice from competing broker-dealers by the “best interests” fiduciary standard that RIAs owe to their clients, from outright marketing themselves as fiduciaries and “fee-only”, to proactively signing “Fiduciary Oaths” to their clients (that other broker-dealers wouldn’t and couldn’t sign). This fiduciary distinction is rooted in the fact that RIAs were created from the start to be providers of investment advice (subject to a fiduciary duty for that advice), while broker-dealers originally were created to play a vital role in the capital formation and secondary markets processes (which included selling investments, in the form of stocks and bonds to prospective investors, often underwritten by the broker-dealer’s investment banking division, and subject to a lower suitability standard consistent with the sales-centric role they were created to fulfill). But over the past several decades, as technology has increasingly commoditized the core functionality of broker-dealers, from a “discount” brokerage reducing the price to execute trades (without a stockbroker to facilitate them), to online platforms making no-load funds available to consumers directly (without a broker-dealer to sell them), the RIA and broker-dealer channels have gone through a Great Convergence. To the point that today, a consumer may pay 1%/year for ongoing financial advice in the form of a fee-based wrap account, a C-share mutual fund trail, or an advisory fee, and not even make a distinction between the choices. In turn, this Great Convergence has led to a flurry of proposals on new standards, as regulators have recognized that as the gap between broker-dealers and RIAs has been reduced over the years, so too did the gap in the standards of conduct between them need to be narrowed as well. Resulting in the release earlier this summer of the SEC’s new Regulation Best Interest, lifting the standard of conduct for broker-dealers to a “Best Interest” standard… which may not be a full-scale fiduciary duty, but nonetheless will grant – and in fact, require – that broker-dealers now explain their standard of conduct as being an obligation to act “in the best interests of the customer when making a recommendation.” Which leaves little room for RIAs to market their fiduciary obligation to act “in the best interests of the client” as a differentiator when broker-dealers will be able to use substantively identical words and raise the question: “How will RIAs differentiate themselves in the future?” In the long run, arguably, the best path forward for most advisors will simply be to actually differentiate on their services and what they actually do for clients, rather than their standard of conduct in the first place. Still, though, the irony is that the more fiduciary advocates push for higher standards across the industry… the less likely it is that being a fiduciary with higher standards will ever be an effective differentiator again in the future.

The Great Convergence And The Death Of Fiduciary Differentiation (For RIAs) – For the past several decades, RIAs have increasingly differentiated themselves and their advice from competing broker-dealers by the “best interests” fiduciary standard that RIAs owe to their clients, from outright marketing themselves as fiduciaries and “fee-only”, to proactively signing “Fiduciary Oaths” to their clients (that other broker-dealers wouldn’t and couldn’t sign). This fiduciary distinction is rooted in the fact that RIAs were created from the start to be providers of investment advice (subject to a fiduciary duty for that advice), while broker-dealers originally were created to play a vital role in the capital formation and secondary markets processes (which included selling investments, in the form of stocks and bonds to prospective investors, often underwritten by the broker-dealer’s investment banking division, and subject to a lower suitability standard consistent with the sales-centric role they were created to fulfill). But over the past several decades, as technology has increasingly commoditized the core functionality of broker-dealers, from a “discount” brokerage reducing the price to execute trades (without a stockbroker to facilitate them), to online platforms making no-load funds available to consumers directly (without a broker-dealer to sell them), the RIA and broker-dealer channels have gone through a Great Convergence. To the point that today, a consumer may pay 1%/year for ongoing financial advice in the form of a fee-based wrap account, a C-share mutual fund trail, or an advisory fee, and not even make a distinction between the choices. In turn, this Great Convergence has led to a flurry of proposals on new standards, as regulators have recognized that as the gap between broker-dealers and RIAs has been reduced over the years, so too did the gap in the standards of conduct between them need to be narrowed as well. Resulting in the release earlier this summer of the SEC’s new Regulation Best Interest, lifting the standard of conduct for broker-dealers to a “Best Interest” standard… which may not be a full-scale fiduciary duty, but nonetheless will grant – and in fact, require – that broker-dealers now explain their standard of conduct as being an obligation to act “in the best interests of the customer when making a recommendation.” Which leaves little room for RIAs to market their fiduciary obligation to act “in the best interests of the client” as a differentiator when broker-dealers will be able to use substantively identical words and raise the question: “How will RIAs differentiate themselves in the future?” In the long run, arguably, the best path forward for most advisors will simply be to actually differentiate on their services and what they actually do for clients, rather than their standard of conduct in the first place. Still, though, the irony is that the more fiduciary advocates push for higher standards across the industry… the less likely it is that being a fiduciary with higher standards will ever be an effective differentiator again in the future.

How Much Does A (Comprehensive) Financial Plan Actually Cost? – Despite the rising popularity of financial advisors offering financial planning services, and charging separately for financial planning, remarkably little has actually been published about what financial advisors actually charge for the service. Which is striking for both consumers, who want to know what a plan might cost, and for financial advisors themselves, who may want to benchmark whether the pricing for their financial plans is ‘reasonable’ relative to their advisor peers and competitors (rather than solely setting the price based on its time-and-labor cost to the advisor). In our latest Kitces Research study on “What Financial Advisors Actually Do”, we found that the average cost for a standalone comprehensive financial plan is $2,400 (up from $2,200 in a 2012 study from the Financial Planning Association). Notably, though, our research finds that more and more advisory firms who offer financial plans actually are charging for them separately – rather than merely bundling the plan into their AUM fees – and in fact, there is a growing rise of financial advisors who are charging for financial plans solely in a “fee-for-service” manner (hourly fees, monthly subscription fees, or annual retainer fees), rather than blending fees with AUM at all. In addition, not surprisingly, financial plan fees did vary significantly from one firm to the next, although as it turns out, the biggest driver of financial planning fees is not the cost (i.e., how long it takes) to produce the plan, nor even how comprehensive the plan is, but the affluence of the client themselves paying for the plan in the first place. In other words, clients with more financial means to pay for a financial plan… tend to pay more for a financial plan. Opening a debate of whether more affluent clients pay more for financial plans simply because they can afford to do so, because they tend to use more experienced advisors with deeper expertise (even if “the plan” itself is the same), or simply because their higher net worth and affluence means they perceive more value in the financial plan to begin with. On the other hand, it’s notable that, because financial advisors only spend about 50% of their time on client-facing activities in the first place, advisors are still greatly limited by how many financial plans they can do and how many clients they can support, which ultimately limits their ability to charge for their time and generate revenue. However, the research does indicate that advisors who have advanced professional designations, and more years of experience, do manage to command higher financial planning fees in the marketplace. Though again, this appears to be less a function of advisors with greater credentials and experience charging higher fees, per se, and more the result of experienced and credentialed advisors being more effective at attracting the more affluent clients who are willing to pay higher fees and perceive greater value in the financial plan in the first place. Which means, in the end, when it comes to setting the cost and determining value, the answer to “what should a financial plan cost” truly is in the eyes of the beholder.

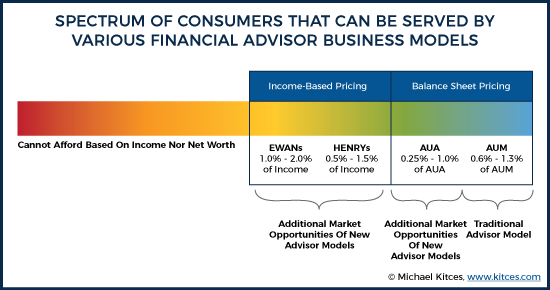

The New 1% Advisory Fee: 1% Of Income, Instead Of 1% Of Assets – Despite the rise of critics questioning whether the AUM model is the most effective way to align what the client pays with the value being provided, the accelerating momentum of major firms transitioning to the model suggests that not only is the AUM model here to stay… but there may soon be too many financial advisors using the same AUM model to pursue the same relatively-few households who have sufficient liquid assets available to invest and who are actually willing to delegate them to an advisor in the first place! Yet the reality is that the opportunities for financial advice go far beyond just those who have at least $100,000 of investable assets available to roll over to an advisor to manage. For instance, some advisors are now shifting to an “Assets Under Advisement” (AUA) model that aims to charge clients not just a percentage of their managed portfolio, but a percentage of their entire net worth (on which the financial advisor is providing even broader holistic financial advice), opening up a larger segment of Mass Affluent (and Millionaire) households who have the financial ability to pay for advice, but not the liquidity to access it by rolling over an investment account (e.g., because their assets are tied up in a 401(k) plan where they’re still working!). However, the even-bigger opportunity to expand financial advice is not just to shift from charging a percentage of assets to a percentage of net worth (under advisement), but to charge a percentage of income instead. Which opens up yet another swath of consumers – commonly known as the HENRYs (“High Earner, Not Rich Yet”) – who may not have substantial assets or net worth, but have more than enough income to pay for advice directly out of that income, whether on an hourly, monthly subscription, or annual retainer basis. And while for high earners, the most straightforward approach may be to simply shift from charging 1% of assets to 1% of income, the reality is that just as AUM fees are typically tiered on a graduated fee schedule – with higher-percentage fees for smaller portfolios and lower fees for sizable accounts – a percentage-of-income fee could be tiered as well. In fact, at a 2%-of-income fee, even median-income households (earning approximately $60,000/year) become economically feasible to service with human financial advice… for which even a 2%-of-income fee can often be recovered by providing good advice on the other 98%, at a cost that is little more than what such individuals would pay in commissions on even a modest IRA rollover into A-share mutual funds or via an insurance product purchase. In other words, charging 1%-of-income under a fee-for-service advice model isn’t just about the HENRYs, but a far wider range of Earners Wanting Advice Now (EWANs) who have the financial wherewithal to pay for it (as a percentage of the income they have, not the assets they don’t!). The key point, though, is simply to understand that, while the AUM model continues to be popular, has a lot of benefits that make it psychologically easy for consumers to pay, and is highly scalable, it is naturally limited in market size to those who have liquid portfolios available to manage. While the rising shift to alternative fee-for-service models, particularly a percentage-of-income fee, opens up entirely new “blue oceans” of HENRY and EWAN consumers who are not served today by holistic financial advisors!

The New 1% Advisory Fee: 1% Of Income, Instead Of 1% Of Assets – Despite the rise of critics questioning whether the AUM model is the most effective way to align what the client pays with the value being provided, the accelerating momentum of major firms transitioning to the model suggests that not only is the AUM model here to stay… but there may soon be too many financial advisors using the same AUM model to pursue the same relatively-few households who have sufficient liquid assets available to invest and who are actually willing to delegate them to an advisor in the first place! Yet the reality is that the opportunities for financial advice go far beyond just those who have at least $100,000 of investable assets available to roll over to an advisor to manage. For instance, some advisors are now shifting to an “Assets Under Advisement” (AUA) model that aims to charge clients not just a percentage of their managed portfolio, but a percentage of their entire net worth (on which the financial advisor is providing even broader holistic financial advice), opening up a larger segment of Mass Affluent (and Millionaire) households who have the financial ability to pay for advice, but not the liquidity to access it by rolling over an investment account (e.g., because their assets are tied up in a 401(k) plan where they’re still working!). However, the even-bigger opportunity to expand financial advice is not just to shift from charging a percentage of assets to a percentage of net worth (under advisement), but to charge a percentage of income instead. Which opens up yet another swath of consumers – commonly known as the HENRYs (“High Earner, Not Rich Yet”) – who may not have substantial assets or net worth, but have more than enough income to pay for advice directly out of that income, whether on an hourly, monthly subscription, or annual retainer basis. And while for high earners, the most straightforward approach may be to simply shift from charging 1% of assets to 1% of income, the reality is that just as AUM fees are typically tiered on a graduated fee schedule – with higher-percentage fees for smaller portfolios and lower fees for sizable accounts – a percentage-of-income fee could be tiered as well. In fact, at a 2%-of-income fee, even median-income households (earning approximately $60,000/year) become economically feasible to service with human financial advice… for which even a 2%-of-income fee can often be recovered by providing good advice on the other 98%, at a cost that is little more than what such individuals would pay in commissions on even a modest IRA rollover into A-share mutual funds or via an insurance product purchase. In other words, charging 1%-of-income under a fee-for-service advice model isn’t just about the HENRYs, but a far wider range of Earners Wanting Advice Now (EWANs) who have the financial wherewithal to pay for it (as a percentage of the income they have, not the assets they don’t!). The key point, though, is simply to understand that, while the AUM model continues to be popular, has a lot of benefits that make it psychologically easy for consumers to pay, and is highly scalable, it is naturally limited in market size to those who have liquid portfolios available to manage. While the rising shift to alternative fee-for-service models, particularly a percentage-of-income fee, opens up entirely new “blue oceans” of HENRY and EWAN consumers who are not served today by holistic financial advisors!

Practice Management

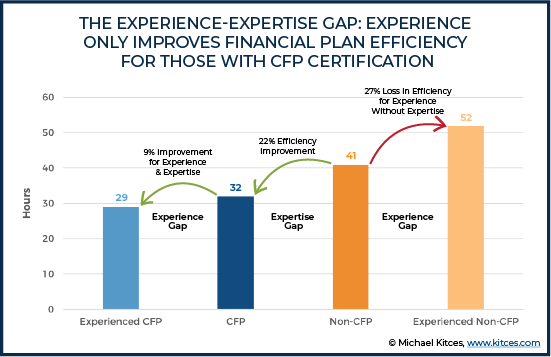

Scaling The Efficiency Of Comprehensive Financial Planning By Creating Repeatable Expertise – The good news about financial planning becoming increasingly comprehensive in its services is that it provides a deeper and stronger value proposition to clients in an increasingly competitive environment for financial advice. The bad news is that going deeper and more comprehensively in the financial planning process literally takes more time – potentially far more time – which in turn both reduces an advisor’s client capacity and can ultimately drive up the advisor’s fees and cost to clients. To some extent, the efficiency of financial planning can be improved by investing into the advisor’s own knowledge (e.g., obtaining CFP certification), as our recent Kitces research study on “How Financial Advisors Actually Do Financial Planning” reveals an emerging “Experience-Expertise” gap (where advisors without CFP certification take more time to do plans as they gain experience, but advisors with CFP certification take less time to do plans as their experience level rises). However, the reality is that the biggest stumbling block in the productivity of producing a comprehensive financial plan is not the breadth of the plan itself and the amount of research it takes to support the plan development process, but the breadth of the clientele for whom the plans are being done; after all, if the advisory firm serves a consistent type of clientele, then even a very broad financial plan would ultimately be one of standardized templates and “repeatable expertise” that requires little to no additional research for each new financial plan. And in turn, as repeatable expertise is developed by working with a consistent type of clientele, that expertise can be trained in others in the firm, making it feasible for senior advisors to delegate an increasing amount of the plan development process to paraplanners that further enhance the overall productivity and profitability of the firm!

Scaling The Efficiency Of Comprehensive Financial Planning By Creating Repeatable Expertise – The good news about financial planning becoming increasingly comprehensive in its services is that it provides a deeper and stronger value proposition to clients in an increasingly competitive environment for financial advice. The bad news is that going deeper and more comprehensively in the financial planning process literally takes more time – potentially far more time – which in turn both reduces an advisor’s client capacity and can ultimately drive up the advisor’s fees and cost to clients. To some extent, the efficiency of financial planning can be improved by investing into the advisor’s own knowledge (e.g., obtaining CFP certification), as our recent Kitces research study on “How Financial Advisors Actually Do Financial Planning” reveals an emerging “Experience-Expertise” gap (where advisors without CFP certification take more time to do plans as they gain experience, but advisors with CFP certification take less time to do plans as their experience level rises). However, the reality is that the biggest stumbling block in the productivity of producing a comprehensive financial plan is not the breadth of the plan itself and the amount of research it takes to support the plan development process, but the breadth of the clientele for whom the plans are being done; after all, if the advisory firm serves a consistent type of clientele, then even a very broad financial plan would ultimately be one of standardized templates and “repeatable expertise” that requires little to no additional research for each new financial plan. And in turn, as repeatable expertise is developed by working with a consistent type of clientele, that expertise can be trained in others in the firm, making it feasible for senior advisors to delegate an increasing amount of the plan development process to paraplanners that further enhance the overall productivity and profitability of the firm!

The Capacity Crossroads And The Small Giant Alternative To Building A Lifestyle Or Enterprise Firm – In the traditional financial advisor business model built around commissions, it was virtually impossible for an advisor to build a business beyond themselves. After all, the commission-based business starts off each year with $0 of income (or at least nearly $0, plus perhaps a bit of ongoing trails), which eliminates any incentive for the firm to ever hire up much staff (beyond other advisors who must go out and generate their own revenue to be able to ‘eat what they kill’). On the other hand, the shift from commissions to recurring-revenue models like Assets Under Management (AUM) or more recently the monthly subscription model makes it feasible to accumulate an ever-growing stream of recurring revenue… such that at some point, the advisor wakes up on January 1st, and there’s already enough revenue to be profitable for the entire year, where the advisor ‘just’ has to service and retain those clients. Yet in an industry where most advisory firms have 90%+ retention rates, and the leading firms are as high as 97% - 98%, the ability to attract clients who are nearly all retained means it’s virtually inevitable that an individual advisor will eventually hit capacity, where they can no longer take on any more clients because there’s no more time to service the next new client on top of all the existing clients. At which point, the advisor reaches the “Capacity Crossroads”, and must decide what to do next: to remain a “solopreneur” lifestyle practice (that never services more clients than the advisor individually can serve) or to become an “Enterprise” firm that hires service advisors to take over those clients and expand capacity so the firm can continue to grow ever larger. However, in practice there’s actually a third option: to become a “Small Giant” (after the Bo Burlingham book of the same name), a boutique-style firm whose goal is not to be the biggest but to be “the best” at what they do, balancing financial and other business, service, and community motives to excel at their craft. Which is an important distinction, because in the end, a financial advisor can become wildly profitable in almost any size firm, from a highly profitable lifestyle practice to a Small Giant boutique or a large-scaled Enterprise… which means the real question at the Capacity Crossroads is not about what to build in order to achieve the advisor’s own personal financial goals, but what the advisor wants to build recognizing that any of the choices can be financially rewarding and that a vision for the future is about how advisors themselves want to work and serve clients!

The Capacity Crossroads And The Small Giant Alternative To Building A Lifestyle Or Enterprise Firm – In the traditional financial advisor business model built around commissions, it was virtually impossible for an advisor to build a business beyond themselves. After all, the commission-based business starts off each year with $0 of income (or at least nearly $0, plus perhaps a bit of ongoing trails), which eliminates any incentive for the firm to ever hire up much staff (beyond other advisors who must go out and generate their own revenue to be able to ‘eat what they kill’). On the other hand, the shift from commissions to recurring-revenue models like Assets Under Management (AUM) or more recently the monthly subscription model makes it feasible to accumulate an ever-growing stream of recurring revenue… such that at some point, the advisor wakes up on January 1st, and there’s already enough revenue to be profitable for the entire year, where the advisor ‘just’ has to service and retain those clients. Yet in an industry where most advisory firms have 90%+ retention rates, and the leading firms are as high as 97% - 98%, the ability to attract clients who are nearly all retained means it’s virtually inevitable that an individual advisor will eventually hit capacity, where they can no longer take on any more clients because there’s no more time to service the next new client on top of all the existing clients. At which point, the advisor reaches the “Capacity Crossroads”, and must decide what to do next: to remain a “solopreneur” lifestyle practice (that never services more clients than the advisor individually can serve) or to become an “Enterprise” firm that hires service advisors to take over those clients and expand capacity so the firm can continue to grow ever larger. However, in practice there’s actually a third option: to become a “Small Giant” (after the Bo Burlingham book of the same name), a boutique-style firm whose goal is not to be the biggest but to be “the best” at what they do, balancing financial and other business, service, and community motives to excel at their craft. Which is an important distinction, because in the end, a financial advisor can become wildly profitable in almost any size firm, from a highly profitable lifestyle practice to a Small Giant boutique or a large-scaled Enterprise… which means the real question at the Capacity Crossroads is not about what to build in order to achieve the advisor’s own personal financial goals, but what the advisor wants to build recognizing that any of the choices can be financially rewarding and that a vision for the future is about how advisors themselves want to work and serve clients!

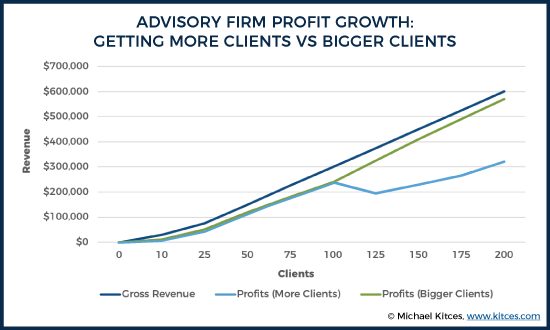

The Economics Of Growth: Why The Second 100 Clients Are Far Less Profitable Than The First – The traditional path to growing an advisory firm – or any business – is fairly straightforward: craft a product or service that you can deliver profitably, and then deliver it profitably to more people, generating more revenue for the business (and more in profits that accrue to the owners). In the early years in particular, when a financial advisor still has a lot of capacity (i.e., time) and not a lot of clients, adding more clients and the revenue they bring can quickly ramp up the income of a financial advisor themselves… at least, until the advisor reaches their capacity. Because once the advisor’s individual capacity is reached – typically around 100 active clients – the only way to continue to add more clients is to add more staff to service them, including another advisor to work with them. Which means that while the firm owner might take home as much as 70% to 80% of the revenue from the first 100 clients – effectively compensated for both the work the advisor does in the business and the profitability of owning a successful advisory business – the same firm owner may only earn 20% to 30% of the revenue for the next 100 clients (where the next advisor is paid for doing the advisory work in the business, while the advisory firm owner is ‘only’ compensated with the profits of growing the business larger!). Which raises challenging questions to the firm owner: is it better to grow by adding the next 100 clients with a far smaller profit margin per client, or simply to try to pursue more affluent clients to make the first 100 clients more profitable to begin with? Not that there is necessarily a right or wrong path, but growing the firm with more clients does mean added staff, overhead, and risk, in an effort to grow a larger business with less incremental profit that comes with it. Which means if advisors are going to go the path of growth through more clients, they should at least do so with eyes wide open… and with an awareness that there are (potentially more efficient) alternatives to growth instead!

The Economics Of Growth: Why The Second 100 Clients Are Far Less Profitable Than The First – The traditional path to growing an advisory firm – or any business – is fairly straightforward: craft a product or service that you can deliver profitably, and then deliver it profitably to more people, generating more revenue for the business (and more in profits that accrue to the owners). In the early years in particular, when a financial advisor still has a lot of capacity (i.e., time) and not a lot of clients, adding more clients and the revenue they bring can quickly ramp up the income of a financial advisor themselves… at least, until the advisor reaches their capacity. Because once the advisor’s individual capacity is reached – typically around 100 active clients – the only way to continue to add more clients is to add more staff to service them, including another advisor to work with them. Which means that while the firm owner might take home as much as 70% to 80% of the revenue from the first 100 clients – effectively compensated for both the work the advisor does in the business and the profitability of owning a successful advisory business – the same firm owner may only earn 20% to 30% of the revenue for the next 100 clients (where the next advisor is paid for doing the advisory work in the business, while the advisory firm owner is ‘only’ compensated with the profits of growing the business larger!). Which raises challenging questions to the firm owner: is it better to grow by adding the next 100 clients with a far smaller profit margin per client, or simply to try to pursue more affluent clients to make the first 100 clients more profitable to begin with? Not that there is necessarily a right or wrong path, but growing the firm with more clients does mean added staff, overhead, and risk, in an effort to grow a larger business with less incremental profit that comes with it. Which means if advisors are going to go the path of growth through more clients, they should at least do so with eyes wide open… and with an awareness that there are (potentially more efficient) alternatives to growth instead!

Revenue Productivity Ratios: The 3 Most Important Numbers To Manage In An Advisory Firm – As advisory firms grow, it’s crucial to both measure and manage the productivity of the firm and its employees. At the individual level, productivity is typically measured by evaluating the amount of time it takes to complete various key tasks. At the firm level, it’s measured through key “revenue ratios” that become Key Performance Indicators (KPIs) for the entire business. The first key revenue ratio that all advisory firms should measure is Revenue Per Client – literally by dividing the total revenue of the firm by the number of clients. The significance of the revenue/client ratio is that it is the most straightforward way to understand an advisory firm’s ‘typical’ clientele, to immediately identify clients that may unprofitable (i.e., significantly below-average revenue/client), and to determine which clients are so far above the firm’s average that it may be worthwhile to segment them out as “A” clients and then provide additional services to them. In addition, given that the typical solo advisor only ever has the capacity for 50-100 active clients in total, understanding the advisor’s revenue/client ratio provides an indication of their maximum earning potential as well (at least until/unless lower-revenue clients are replaced by higher-revenue ones!). As advisory firms grow, and become multi-advisor, so too does the next revenue ratio for productivity shift, from revenue/client (for an individual advisor’s clients) to revenue per advisor themselves. By measuring revenue/advisor, it’s quickly possible to see which advisors in the firm are more efficiently servicing their clients (and the associated revenue), by literally handling more revenue per advisor. On the other hand, extreme deviations in the revenue/advisor ratio can also provide an indicator of not just efficiency and productivity, but significant over- or under-servicing of clients as well. And for the largest advisory firms, the key measure of productivity becomes revenue per employee, the most straightforward way to quantify, in the aggregate, how much staff it takes across the enterprise to service each segment of the firm’s clients and revenue. In turn, advisory firms that measure these three Key Performance Indicators of advisor productivity can then evaluate how they compare to other firms at a similar size, using industry benchmarking studies… and then take the necessary steps to manage accordingly!

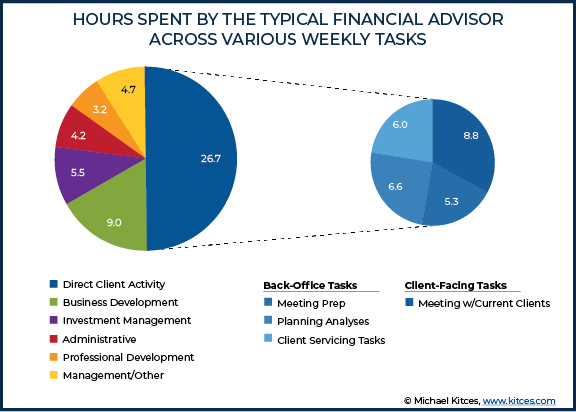

How Do Financial Advisors Actually Spend Their Time? – Notwithstanding the fact that financial advisors are paid to give advice to their clients in meetings with clients, the latest Kitces Research study on “What Financial Advisors Actually Do” reveals that the typical financial advisor spends no more than about 50% on direct client activity-related tasks, and barely 20% of their time actually meeting with clients! In fact, the typical financial advisor spends as much time searching for the next new client (i.e., prospecting and marketing for business development) as they do meeting with all their existing clients from week to week. A phenomenon that has only recently begun to shift with the rise of the recurring-revenue fee-based model, that puts less emphasis on continuous business development for new clients relative to the ongoing servicing (and retention) of existing clients. Still, the fact that so much of an advisor’s time is not spent directly on client activities, and that even the majority of client-related tasks are more “back office” in nature (e.g., client servicing, meeting preparation, and doing various analyses) suggests that there is room for a significant increase in advisor efficiency, either through delegation to staff, better technology, or both. And fortunately, the data reveals that advisors who delegate to support staff are able to generate significantly more revenue and generate a higher income… except as it turns out, this is largely accomplished by the advisor moving “upmarket” and attracting more affluent clients (who each pay a greater fee, as efficient advisors don’t serve more clients but instead do more for them instead). Similarly, the rising use of more capable financial planning software amongst advisors doesn’t appear to be generating any time savings efficiencies and instead is being leveraged by financial advisors to go deeper with clients and to do more in their financial plans (rather than simply doing the plans faster). All of which raises the question of whether the maximum capacity of how many active clients a financial advisor can service is really limited by current technology and staff efficiency, or a more “human” limitation on how many relationships any one person – or any one advisor – can manage in the first place. As thus far, the inexorable rise of technology continues not to lead financial advisors to service more clients, but instead to provide more and deeper services to their (increasingly affluent) clients. Which suggests, in the extreme, that ongoing technology efficiencies may not increase advisor productivity, and instead will simply bring down the cost of financial advice and make it more accessible… which in turn might only further exacerbate the existing talent shortage of financial advisors in the coming decade?