Executive Summary

The rise of the asset-under-management (AUM) model has driven a concomitant shift in financial advisors to focus increasingly on Baby Boomer retirees – for the same reason that Willie Sutton robbed banks: “That’s where the money is.” To the point that some in the industry have raised the question of whether the pendulum is swinging too far to retirees, and that it’s time to start doing more financial planning for next-generation clients as well.

Except the challenge for most advisory firms is that it’s not profitable to do financial planning for younger clients, who simply don’t have sufficiently-sized investment accounts to generate enough AUM fees for the advisory firm to deliver the advice. For which advisory firms can adopt various “fee-for-service” models, from charging minimum fees based on a percentage of income, to flat monthly retainer fees. Except then the pressure is on the advisory firm to justify the value of the financial planning advice being given to clients for that fee, especially when they tend to have "simpler" financial needs in the first place.

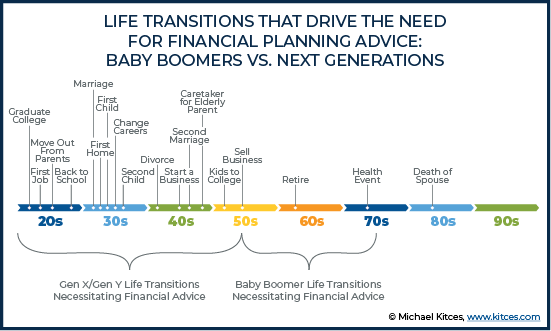

Yet the reality is that younger clients with fewer assets and lower net worth still experience the kinds of tumultuous life transitions that necessitate engaging a financial advisor in the first place. In fact, ironically, older retirees typically only experience a few major life transitions in the span of decades – retirement itself, a major change in health, and the death of a spouse – while it’s younger clients who actually experience a steady stream of major life transitions that may necessitate a financial advisor, from getting a new job, to going back to school, starting a business, getting married (or getting divorced!), having children, and more.

And while younger clients may have less in the way of investments and assets, they still face substantial complexities when it comes to their cash flow itself, from how to transition from a dual-income household to a stay-at-home-parent (or back again) after the birth of a child or a decision to go back to school, merging finances during a marriage (or separating them again after a divorce), to adjusting spending while launching a business. Or simply engaging in strategies to increase income and job potential in the first place.

Which means, in the end, while the focus of financial planning may shift for next-generation clients – from monitoring the health of their assets to monitoring the health of their income instead – arguably younger clients don’t really have “simpler” financial advice needs in the first place. Instead, they have a different set of complex financial advice needs… and an even greater need for the cyclical and ongoing financial planning process in the first place, because of the pace and frequency of the life transitions that impact their financial situation throughout their 20s, 30s, and 40s!

Life Transitions And The “Simple” Financial Planning Needs Of Young People

In recent years, the financial advisory world has turned an increasing focus on working with more “next-generation” clients – those from Generations X and Y, who are still working and may not yet have significant accumulated assets to manage, but who are now saving at an increasingly rapid pace (especially Gen X’ers as they reach their peak earnings years), and who stand to inherit a whopping $30 trillion of wealth from their parents and grandparents in the coming decades.

Yet the challenge historically was that it wasn’t economically feasible to serve next-generation clients as a financial advisor, given that their available assets to manage simply aren’t substantial enough to merit an economically-viable advisory fee to support the time it would take to deliver advice to them.

Fortunately, the emergence of next-generation models like charging a percentage of income (instead of assets), along with other fee-for-service models like ongoing monthly subscription fees for financial planning, makes it feasible to generate a sufficient level of revenue from a client to make it viable to deliver advice to them.

The caveat, however, is that the industry is still struggling with what kind of advice to deliver to next-generation clients, that justifies those advice fees in the first place. After all, the mathematical reality of still being early in the accumulation stage is that how you invest doesn’t matter nearly as much as whether (or how much) you invest each year; in other words, trying to find a few basis points of alpha just doesn’t matter very much for early accumulators (because an extra 1%/year of growth may be worth less than just making an extra month of contributions in the first place), which tends to lead to relatively “simple” asset-allocated portfolios, and a focus on saving instead. For which the age-old advice (that doesn’t even need a financial planner to deliver) is simply “live within your means, spend less than you earn, and save the rest.”

In turn, this approach of doing more “simplified” financial planning for next-generation clients has in recent years expanded into financial planning software tools themselves, with eMoney Advisor recently launching its “Foundational Planning” tools and MoneyGuidePro announcing its new simplified and slimmed down “MoneyGuideOne” solution. In recognition that, while next-generation clients may have interest in some financial planning advice, their more-limited net worth means their financial needs are not as complex as the more affluent retiree clients that financial advisors have focused upon in recent years.

The caveat, however, to doing “simplified” financial planning for next-generation clients in their 20s, 30s, and 40s, is that if you ask them, their financial lives are anything but simple.

After all, it’s throughout the middle decades of the working years that households often face their greatest financial strains, as the series of financial life transitions that occur through those ages – from leaving home to go out on your own as a financially independent (from parents) young adult, to building your career, navigating employee benefits, getting married, buying a house, having kids, changing jobs, getting a divorce, changing careers, getting married a second time, going out on your own to start a business, etc. – all come in quick succession, one after another, every few years.

By contrast, for the typical retired client, the key financial transitions are simply retirement itself (an admittedly very complex life transition), when a major health event occurs (which can impact everything from the retiree’s lifestyle to housing decisions), and the death of a spouse.

Which is important, because it’s the moments of life transition that create financial stress, amplify complexity, make people realize that they need to make a financial (or other behavioral) change, and motivate them to do so. Or at least, to seek out a financial advisor to help with the process!

In other words, it’s the occurrence of a life transition that drives the need for financial advice and a financial advisor. And by a measure of life transitions, arguably it’s next-generation clients who need ongoing financial planning advice even more than the traditional retiree! Because retirees may only face a major life transition that could necessitate a financial advisor once every decade or so… while it’s next-generation clients that face life transitions impacting their financial planning needs every year or few!

What Do You DO When Financial Planning For Young People: Income And Cash Flows

Notably, a key distinction of how the financial planning process differs for next-generation clients versus traditional Baby Boomer clients is not merely the pace (and nature of) life transitions, but the entire focus of the financial planning process itself.

As while Baby Boomer planning tends to focus on assets – or more generally, on their balance sheet – planning for next-generation clients is more about income and expenses, or the “cash flow statement” of the household instead. In other words, most financial planning decisions for next-generation clients aren’t about where and how to allocate the assets (and how to grow them); instead, it’s about where and how to allocate the cash flows of the household’s income (and how to grow that income).

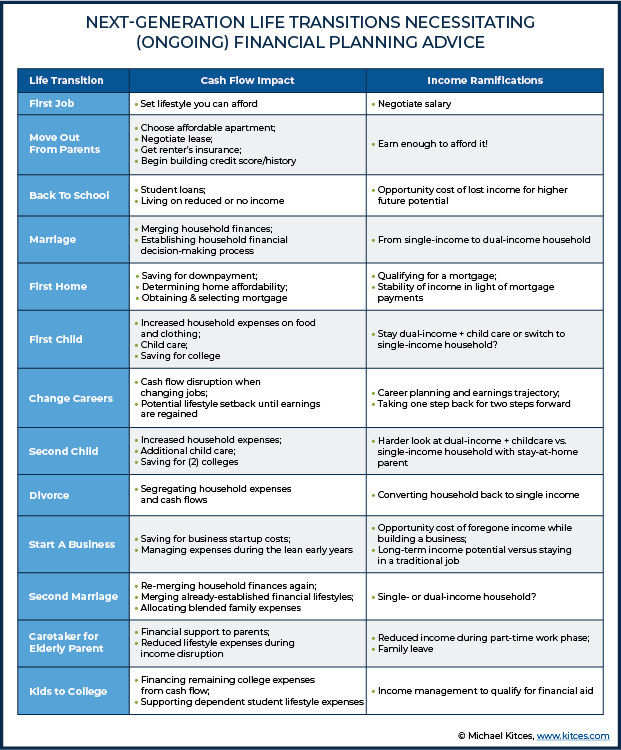

After all, every one of the major life transitions that next-generation clients face has substantial ramifications for the household’s income and cash flows (but not necessarily their assets), from a first job (negotiating salary and benefits) to getting married (merging household finances and bank accounts) to buying a first home (being able to qualify for the mortgage, and actually afford it!) to having children (and managing the cost of childcare as a dual-income household or making the decision to become a single-income household with a stay-at-home parent).

In other words, virtually every life transition has a financial cash flow transition or similar planning issue that accompanies it, necessitating real financial conversations about the household’s income and cash flows itself. And given again the steady pace of life transitions that come with remarkable regularity for most throughout their 20s, 30s, and 40s, just being prepared for this ongoing series of financial planning conversations itself introduces substantial complexity. Just try talking to a new couple about merging their financial lives and whether they will maintain joint or separate bank accounts, or how the couple will now make joint financial decisions (or decide to delegate to one person instead) as a household, or whether the couple should shift from a dual-income household to a primary breadwinner with a stay-at-home spouse to avoid the cost of childcare! To put it mildly, these are not “simple” financial planning conversations!

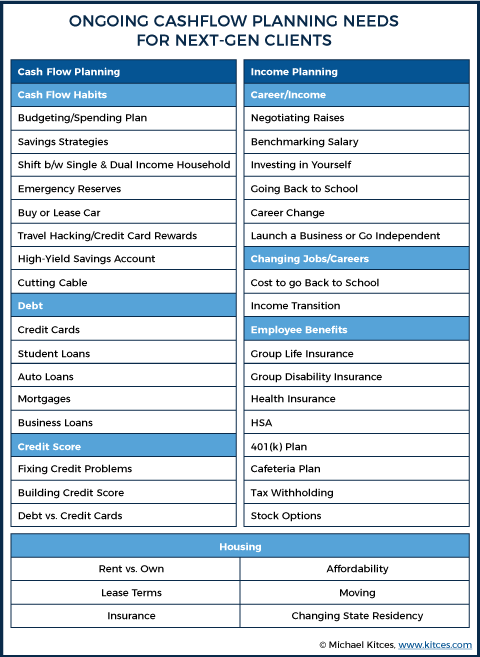

In addition, beyond the life-transition-based cash flow and income issues that may arise for next-generation clients, there’s also a sizable number of ongoing planning issues and opportunities in these areas that may arise from time to time. From a wide range of household spending and cash flow spending/savings opportunities, to managing the debt side of cash flow obligations (and building a credit score to be able to access debt in the future), to career planning issues that directly impact what a household can earn in the first place (from salary benchmarking to negotiating raises or job promotions), to investing in yourself and going back to school, changing careers or starting a business, or simply maximizing the available employee benefits attached to whatever job is available! Not to mention all the housing decisions that not only tie to cash flow (rent or mortgage commitments), but also housing affordability and what can be rented or purchased in the first place (which is determined by income), and the interaction between housing and income (e.g., the ability to move to get a better job or a shorter more manageable commute).

The key point, though, is simply that financial planning conversations with asset-based retirees revolve around their assets, while financial planning conversations with income-based workers revolve around their income (and where it flows). Which is supported by a wide array of topical needs and concerns, as well as an ongoing series of life transitions that trigger more specific financial planning needs and conversations. (Though unfortunately, is not well supported by today’s financial planning software tools!)

A More Cyclical Financial Planning Process For Next-Generation Clients

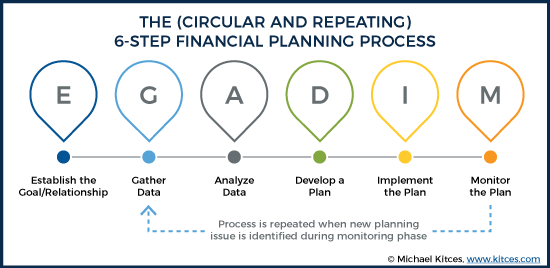

The 6-step (soon to be redefined as 7-step) financial planning process has always culminated with an “implementation” phase – where clients follow through and actually implement the advice – followed by a “monitoring” phase, where the advisor monitors the client’s situation to identify situations where the financial planning process then needs to be re-engaged.

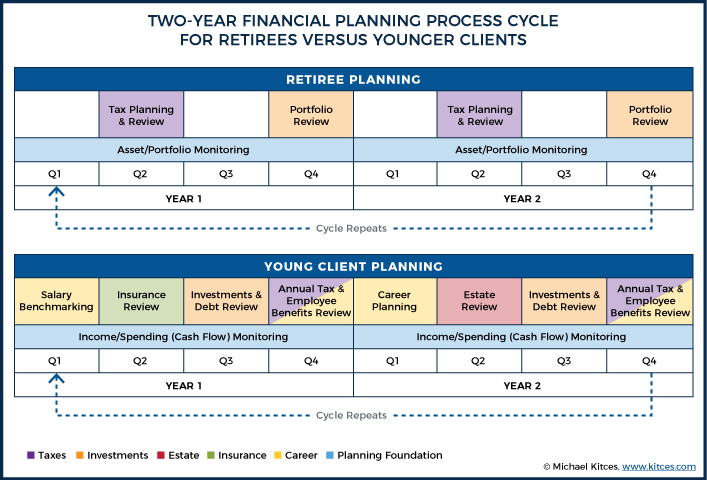

In the traditional financial planning process with retirees (or more generally, with asset-based clients), this “monitoring” process has revolved primarily around the assets themselves. In part, because an ongoing investment management process itself requires an ongoing monitoring process to ensure that the portfolio remains properly invested and in line with its Investment Policy Statement. And in fact because, as noted earlier, relatively few other life transitions typically occur for clients in the later stage of the accumulation or decumulation process – short of the retirement transition itself, a health event, and the death of a spouse – the only monitoring focus left for asset-based clients tends to be monitoring the assets themselves.

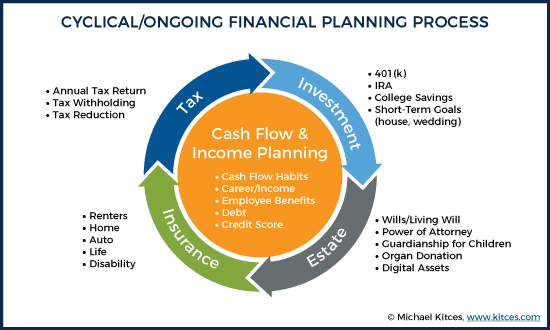

By contrast, when it comes to next-generation clients still in their working years, the ongoing series of life transitions means that the whole range of financial planning needs are more likely to need to be addressed and updated on an ongoing basis, from insurance planning to tax planning, estate planning to college planning, as well as cash flow and income planning and how any changes there impact the client’s trajectory towards retirement.

In other words, the irony is that financial planning for next-generation clients and the ongoing complexities that emerge from a "never-ending" series of life transitions actually make the financial planning process even more conducive to an ongoing cyclical advice relationship, where the key topics of financial planning are monitored and regularly revisited (because they are regularly changing!). While for older clients in later life stages (with fewer life transitions), the monitoring process takes on a more portfolio-centric focus, simply because there often isn’t anything else left to plan for!

As the chart above highlights, not only are there more and more-regularly-changing topics to discuss in the financial planning context for younger clients, but operating on a 2-year cycle means a high likelihood that, by the time the cycle fully repeats, some life event or transition may have already happened that necessitates a change to one or more areas (which will be captured in the cyclical planning process). In the meantime, though, the entire "anchor" around which the monitoring process occurs is also different – in the case of the traditional retired client, it’s tied to monitoring the portfolio to make investment changes, while for the younger client, it’s primarily focused on income/spending monitoring to address the impact of changes in household cash flows.

Ultimately, though, the key point is simply that “young people” with limited (investment) assets don’t actually have simpler financial planning needs. Instead, they have a different range and type of complex financial needs and an even higher number of life transitions that may trigger the need for financial advice along the way. For which there are still many opportunities to charge for financial planning advice, and create value to justify those fees – as while there typically will be less aggregate wealth (at least/especially investment assets) at stake, it simply means that the focus of planning shifts to the income and cash flows that build wealth instead.