Executive Summary

Welcome to the November 2018 issue of the Latest News in Financial Advisor #FinTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors and wealth management!

This month's edition kicks off with the big news that Fidelity has rolled out a new open architecture marketplace aptly called Integration XChange, in what is both a major shift for the RIA custodian towards a more open architecture, a substantial potential threat to TD Ameritrade’s marketplace differentiator, a huge new opportunity for FinTech upstarts to have a second go-to-market channel for RIAs besides Veo, and a creative way to feed Fidelity’s new Consolidated Data initiative.

From there, the latest highlights also include a number of interesting advisor technology announcements, including:

- Riskalyze rolls out a new “GPA” scoring system to evaluate how efficiently a prospect’s (or advisor’s) portfolio allocation maximizes its return potential for a given level of risk tolerance.

- eMoney Advisor launches a new Foundational Planning module that takes a bizarre step into MoneyGuidePro’s past, just as FiServ launches a new Financial Advice Management module that also bears eerie similarities to the MGP interface.

- Edmond Walters re-emerges after a 3-year hiatus with digital marketing platform AdvisorStream to potentially continue what he started with eMoney’s Advisor Branded Marketing.

- AdvicePay announces new integrations with both TD Ameritrade’s Veo and Orion to more easily facilitate fee-for-service billing of financial planning and retainer fees alongside an advisor’s AUM fees.

Read the analysis about these announcements in this month's column and a discussion of more trends in advisor technology, including Vestmark’s acquisition of Adhesion and the rollout of Orion Enterprise, YCharts’ new Model Portfolio tracking and analysis tools, Redtail’s new AI system for advisors and what it might someday do, Hearsay’s CRM overlay system to make it easier for advisors to manage tasks and workflows directly from their smartphone, SigFig’s new CoPilot solution to replace more back- and middle-office functions for human advisors, and the rollout of CapGainValet’s 2018 estimates of end-of-year mutual fund distributions for advisors.

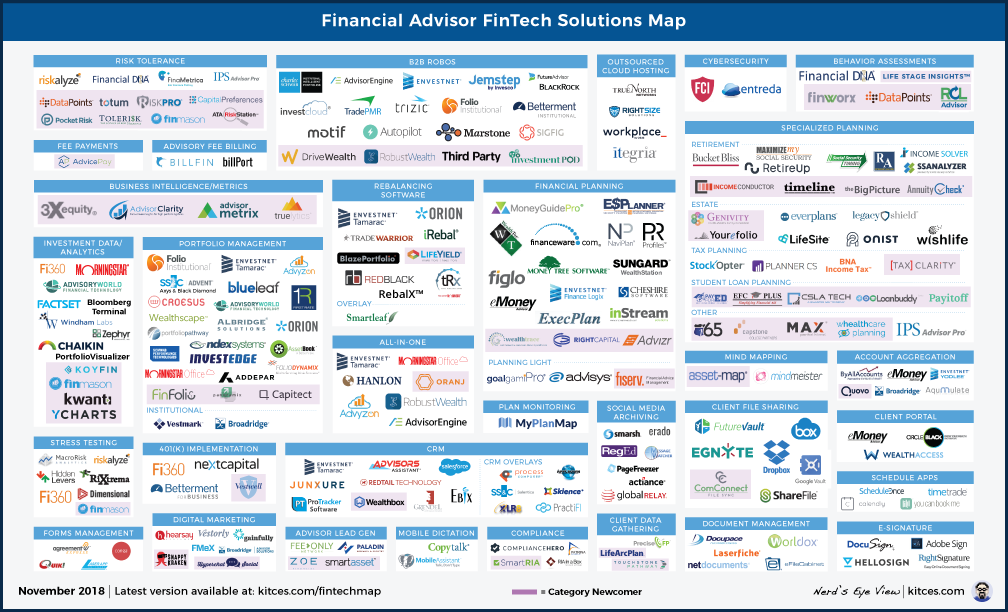

And be certain to read to the end, where we have provided an update to our popular new “Financial Advisor FinTech Solutions Map” as well!

I hope you're continuing to find this new column on financial advisor technology to be helpful! Please share your comments at the end and let me know what you think!

*And for #AdvisorTech companies who want to submit their tech announcements for consideration in future issues, please submit to [email protected]!

Fidelity Launches Integration XChange As Open Architecture Innovation For Advisors Goes Mainstream. For most of our history as financial advisors, technology platforms for advisors were proprietary affairs, as each company sought to build the best proprietary software solutions that would both make their advisors more productive and bind their advisors to them. However, as the comprehensiveness of what financial advisors do became increasingly complex, and the largest firms became ever larger, it “suddenly” became more difficult for large firms to compete with upstart technology players, who found traction in the emerging community of independent RIAs who have the flexibility to choose their own software. Accordingly, TD Ameritrade made its mark back in 2010 as the first major RIA custodian to go all-in on open architecture, leveraging the rise of Application Programming Interfaces (APIs) to allow any new (or existing) technology firm to build its own integrations directly to TDA’s Veo (as a means to access and work with advisors on the TDA platform)… and in the process, driving a disproportionate volume of all advisor tech innovation to build first for TDA. And TDA’s open architecture success has begun to swing the pendulum back the other direction, as Pershing began to shift to a more open-architecture approach (especially around the rise of robo-advisor-for-advisors tools) in 2016, Schwab announced a shift to a more open-architecture approach earlier this year, and now Fidelity has announced its “Integration XChange," opening up more than 100 third-party integrations with the potential to not only connect to Fidelity APIs but also frame Wealthscape pages directly into the advisor’s own website, and support better data flows. The good news of this shift for advisors at Fidelity is a reduced need to rely on Fidelity to develop all the key components of the advisor technology stack (as long as the firm is willing to build around Wealthscape, just as TDA advisors build around Veo), and more options for hopefully better integrations to outside providers. And for Fidelity itself, opening up Integration XChange allows them to both focus resources on their core competencies (Wealthscape) while letting the outside marketplace carry the rest of the innovation burden, while positioning themselves more competitively to TDA for open-architecture-oriented advisors. Although strategically, Fidelity’s long-term play may have less to do with just attracting open architecture advisors or more startup tech innovation, but feeding their new “Consolidated Data” initiative with more and more data from more and more sources (via more and more integration partners), as Fidelity positions its long-term differentiator in not just being “better” at technology, per se, but building an ever-larger data set that gives them more perspective on what their advisors are really doing in order to better identify gaps and opportunities across the entire Fidelity enterprise… all of which starts with making it easier for external providers to feed them more data via integrations in the first place?

Riskalyze Rolls Out “GPA” Scoring Of Portfolio Quality To Further Amplify Business Development Success. In just 7 short years, Riskalyze has become the dominant player in risk tolerance software for advisors, with nearly double the market share of their next closest competitor (FinaMetrica). What’s unique about Riskalyze, though, is not merely its process for asking risk tolerance questions, but the way that it converted risk tolerance software from a due diligence/compliance tool (i.e., “you must know your client’s risk to implement an investment recommendation”), and into a business development tool instead, by making it easy to input a prospect’s existing portfolio (or even for the prospect to input their own portfolio online), compare it to their “Risk Number” (Riskalyze’s risk tolerance score), and almost inevitably scare themselves into action when they see their portfolio is not well aligned to their risk tolerance (as self-directed investors rarely hold well-diversified balanced portfolios). The caveat, of course, is that a subset of consumers do manage to appropriately align their portfolios with their risk tolerance – or may be coming from another advisor who has ensured they’re appropriately aligned – which means Riskalyze’s Risk Number alone doesn’t always drive prospects to action. In this context, it’s notable that Riskalyze announced at its recent annual conference a new second metric it will include in its analysis of portfolios: the Riskalyze GPA (i.e., Grade Point Average), a score of how efficiently the portfolio is generating return for its given level of risk (ostensibly some adaptation of a Sharpe ratio or similar metrics, though Riskalyze states its exact GPA calculation methodology is proprietary). Because the reality is that even if the client’s portfolio overall is reasonably aligned with his/her risk tolerance, it doesn’t necessarily mean it’s the most efficient portfolio for that level of risk; accordingly, Riskalyze’s GPA will score portfolios, from a 1.0 to a 4.3 (giving room for even a “perfect” 4.0 portfolio to earn extra credit!), based on their risk/return efficiency (which means any portfolio can score a 4.0+, from conservative to aggressive, as long as it’s efficient in its return-per-unit-of-risk at that level of risk)… and thereby providing even more room for an advisor to show how his/her portfolio recommendations are better than what the prospect already has (either by better aligning the portfolio to the client’s Risk Number or by showing a portfolio that has a higher Riskalyze GPA for that level of risk). And of course, compliance officers will also likely appreciate the Riskalyze GPA metric, as a means to affirm that its advisors actually are recommending and implementing reasonably diversified portfolios as well!

Redtail CRM Aims To Apply Big Data AI To Small Data Advisors But Will It Tell Us Anything New? Using artificial intelligence and machine learning algorithms to mine big data sets for insights has become a major trend in large institutions across many industries in recent years. But thus far, artificial intelligence has been slow to come more directly to the world of financial advisors. The primary problem is simply that AI tools are designed to work on “big” data sets with millions of data points, and most financial advisors just aren’t that “big,” with just dozens or at the most a few hundred clients. In other words, most independent advisory firms don’t have big data scope in the first place; they have “small data” problems instead – issues to deal with for individual specific clients. In this context, it’s notable that this month Redtail announced a new “artificial intelligence” capability in its CRM, which will read all of the emails and notes in the client file to try to identify both sentiment (whether clients are positive or negative), key phrases (e.g., to better sort conversations), and “entities” (discussion around new topics, brands, products, etc., increasingly referenced in client interactions). The question, though, is what exactly advisors might do with that information that would be useful. After all, it’s usually not “news” to advisors that clients are asking more questions about a particular product or topic… since the advisor fields those conversations with clients every day already, and can “spot” the trending discussion themselves (and it’s often going to be a topic or product the advisor brought up in the first place!). And while Redtail’s new system might spot an incoming client email with a lot of negative comments and highlight it as urgent to respond to (e.g., “this email has a lot of negative sentiment and should be prioritized for response!”), most advisors are already proactively monitoring their email (especially from clients) already and aim to respond to all clients in a timely manner in the first place. Nonetheless, finding potentially more advanced (and relevant and useful?) applications of AI amongst financial advisors has to start somewhere, and notably Redtail has decided not to charge for its AI tool separately as an add-on, and instead with default all of its advisors into the system to begin deepening its own data set (though advisors can opt out if they wish) in the hopes of finding more predictive or actionable insights that may draw more advisors to its AI tools in the future.

Hearsay Aims To Make CRM More Actionable From A Mobile Smartphone With Advisor Actions Overlay. As advisor CRM systems go beyond just being glorified Rolodexes and transform into the central dashboard from which all tasks, activities, and workflows are driven, it becomes increasingly necessary to interface with the CRM directly from “the field” when out meeting with clients and prospects. The challenge, however, is that often there’s so much happening in a modern CRM system, that it’s difficult to navigate and easily see the relevant tasks and items the advisor should focus on. Accordingly, Hearsay announced this month a new CRM overlay system, dubbed “Advisor Actions,” that aims to provide an easier-to-use interface for advisors that need to quickly see “what next” to do from their mobile phone – with potential actions from a new incoming lead that needs a speedy response, to a nudge about contacting an existing client who’s turning age 70 ½ and needs to start RMDs, or identifying clients to reach out to when there’s a big market move. In essence, the Hearsay solution appears to be a form of Morgan Stanley’s “Next Best Action” initiative, but driven more directly by the advisor’s established workflows and triggers (as opposed to having actions cultivated from AI). The Advisor Actions solution was launched from Salesforce’s Dreamforce conference, but will integrate not only to Salesforce’s Financial Services Cloud but also Microsoft Dynamics, and various homegrown CRMs – highlighting Hearsay’s continued focus on large-scale insurance and broker-dealer institutions (where those CRM systems are popular, and where efficient mobile interfaces for those systems are lacking). In fact, arguably the task-centric nature of Advisor Actions is better suited for the traditional salesforce of insurance agents and broker-dealers (who need to implement and follow-up on transactional tasks), than the more financial planning relationship-oriented advisor (where more of the CRM information is needed for overall relationship context). Nonetheless, Advisor Actions is a good example of how the CRM transition from Rolodex to workflow engine creates both opportunities for better efficiency and time focus… but how additional tools and interfaces are needed to truly harvest the efficiencies (either directly in the CRM systems themselves as Redtail is doing with its AI initiative, or the kinds of [mobile] overlays that Hearsay has created).

AdvicePay Integrates To TD Ameritrade’s VEO and Orion For Easier Fee-For-Service Billing. With the ongoing commoditization of basic asset allocation services, more and more advisory firms are feeling the pressure to offer financial planning and wealth management services to bolster their value proposition… often to the point of even charging for it separately. And at the point that advisory firms begin to charge separately for financial planning advice, it becomes feasible to (get paid to) work with “non-traditional” clients who don’t have a portfolio to manage but do have the wherewithal to pay for financial advice directly. Except if the firm isn’t also managing a portfolio, there’s often literally no way to bill the client for their financial planning fees, short of asking them to write a physical paper check, which is difficult to scale and can make clients fee-averse. In this context, AdvicePay facilitates fee-for-service payment processing and billing by allowing advisors to bill their fees directly via credit card or ACH (bank transfer). Except advisory firms don’t necessarily want to have to log into two different platforms just to manage their billing process. Accordingly, AdvicePay this month announced Single-Sign-On (SSO) integrations to both TD Ameritrade’s VEO, and also Orion’s portfolio accounting system, making it possible for advisors to connect to AdvicePay directly from either platform to facilitate their fee-for-service billing processes alongside their AUM fee billing (and for clients to connect to AdvicePay through the Orion portal to confirm their payments as necessary). Although advisor invoicing will still ultimately live within two systems – the RIA custodian for AUM fee billing, and AdvicePay for outside-account fee-for-service billing – at least until AdvicePay can also facilitate AUM fee billing, or RIA custodians integrate more deeply with AdvicePay to invoice outside credit cards and bank accounts (which may be appealing for custodians, as it would allow them to maintain more of their lucrative client cash positions if advisors bill more of their fees from external sources!).

RIAs And Broker-Dealers Converge On Centralized Model Management Tools And Marketplaces. As advisory firms increasingly focus on providing financial planning advice beyond “just” the portfolio itself, investment management itself is becoming increasingly centralized. On the broker-dealer side, the appeal of centralizing portfolio management is not just reduced compliance risk (compared to the dangers of mis-managed Rep-as-PM portfolios), but also a new revenue opportunity (charging its own investment management fees for an in-house TAMP model, or at least providing a centralized platform to access multiple third-party managers). And as centralization of investment management comes to broker-dealers as it has been historically in the RIA channel, Orion this month announced the launch of Orion Enterprise, formally combining its RIA-rooted portfolio management tools with the centralized model management and third-party manager marketplace capabilities of their recent FTJ FundChoice acquisition, to expand beyond “just” its RIA channel roots. Yet while broker-dealers are becoming more “RIA-like” in their centralized investment management capabilities, many large RIAs that in the past already centralized their model management with rebalancing software are becoming more broker-dealer-like as they aggregate larger numbers of advisers and want to offer a wider range of investment options/solutions on their RIA platform. Thus, at the same time that Orion has launched Enterprise to cross from RIAs to broker-dealers, Vestmark (whose roots are in providing investment management tools for broker-dealers) this month announced that it was acquiring Adhesion Wealth Solutions, which had previously built a sizable outsourced-investments solution for RIAs on the Vestmark platform, that Vestmark can now leverage more directly to expand its RIA market share. Thus, in essence, as the RIA and broker-dealer channels continue to converge on the fee-based model of assets under management and channel distinctions of the past start to fade away, historically-RIA providers are looking to increasingly expand into the broker-dealer channel, at the same time that historically-broker-dealer-centric providers are aiming to expand into the RIA channel, as competition continues to heat up.

YCharts Launches Model Portfolio Research And Tracking Tools. 20 years ago, most financial advisors who made investment recommendations to clients worked for a broker-dealer and sold either stocks and bonds, or mutual funds, and needed investment research tools to analyze and select the best investment products for their clients, spawning the rise of Morningstar’s Principia Pro and then its cloud-based Advisor Workstation (or a Bloomberg terminal for advisory firms that were particularly deep in individual securities trading). Yet over the past 20 years, as advisors have shifted towards offering clients asset-allocation model portfolios (instead of “just” individual funds one at a time), there is no longer such a focus on researching individual stocks, bonds, and mutual funds (especially as advisors increasingly use simpler ETFs as their model portfolio building blocks anyway), and instead there is more of a need to monitor and track how the entire model in the aggregate is performing (only then drilling down to the underlying parts). In this context, it’s notable that YCharts, which makes an advisor investment research platform to compete with the likes of Morningstar and Bloomberg, recently launched a new “Model Portfolios” tool specifically designed to help advisors using model portfolios, from the ability to easily backtest various model allocations, track their ongoing performance, and develop more customized blended benchmarks to compare them against. Although similar to Bloomberg’s capabilities, the YCharts model portfolio tools and output doesn’t just live in YCharts, but can also be easily exported to Excel to be manipulated further, making it more feasible for advisory firms to develop their own even-more-customized proposal, tracking, and monitoring spreadsheets.

SigFig’s “Robo”-For-Institutions Platform Expands Into More Full-Scale Advisor Platform. In the years before robo-advisors first showed up, most financial services firms and advisor platforms compared themselves to each other, staking out certain features that were slightly better than their competitors to differentiate, and generally feeling like they had “reasonable” technological progress. Then the robo-advisor movement showed up, and suddenly most financial services incumbents were shamed into realizing how drastically far behind they had fallen, in a world where many firms were still handling account opening processes by fax machine (to speed up the process of otherwise mailing in paperwork with wet-ink signatures), and robo-advisors could open and fund an account in minutes from a smartphone. What followed was a flurry of industry partnerships and acquisitions as existing incumbents sought to scoop up and apply the hyper-efficient onboarding processes themselves, while using their existing client base and marketing scale to gather assets into their own white-labeled “robo” solutions. But in a notable shift, SigFig – one of the early players to transition from B2B to working B2B in partnership with wirehouse UBS – announced this week that it is not only creating self-directed robo platforms for a number of institutions, but is now launching a new “CoPilot” solution designed specifically to be used by human advisors themselves to facilitate not just client onboarding and account applications, but also annual reviews, rebalancing, and even monitor portfolio suitability, in what looks less like just a “robo” onboarding tool and more like a replacement for a wider range of back- and middle-office functions. In other words, SigFig is shifting from robo-onboarding software into operating as a more holistic investment platform for human advisors (while de-emphasizing the humans in back-office roles). Notably, this shift isn’t entirely unique, as platforms like AdvisorEngine have also been trying to migrate from what were originally B2C robo tools into a more holistic onboarding, portfolio reporting, rebalancing, and even CRM platform. However, while many “robo” solutions like AdvisorEngine have focused primarily on the RIA channel – where there is a constant risk they will be edged out by RIA custodians simply improving their own platform and tools – SigFig is building more deeply into the bank channel (launching CoPilot with Citizens Bank), and may be gearing up to leverage the platform more internationally as well (after rolling up UBS’s own internal SmartWealth platform in the UK). All of which serves as a good reminder that while there is clearly a need for advisor technology platforms to be upgraded and overhauled, it’s not enough to just build the technology; it’s also necessary to have a strategy to actually distribute it to platforms who will actually be willing to buy/lease the technology (instead of building their own)… a strategy which SigFig seems to be having the most notable success in actually distributing to willing enterprises.

Has eMoney Advisor Lost Its Vision For The Future Of Financial Planning? Financial planning software has evolved through four major phases over the past nearly-40-years of its history. First, it was product-centric and demonstrated insurance and investment product needs (e.g., Financial Profiles); then it was cash-flow-based, allowing for a detailed analysis of a client’s financial trajectory to make recommendations for adjustment (e.g., NaviPlan); next, goals-based planning software turned planning software mainstream by simplifying the process of “just” planning for a client’s relevant goals (e.g., MoneyGuidePro); and then financial planning software swung back to become more holistic again by building on account aggregation to expand the scope of planning beyond “just” traditional college, retirement, and other product-centric goals (e.g., eMoney Advisor). And now, the leading financial planners are increasingly demanding the next generation of financial planning software tools, build around more detailed tax planning, cash flow planning, detailed retirement distribution planning, and other analytical capabilities that just weren’t feasible up until this point. Yet even as eMoney Advisor continues to gain market share and threatens to overtake MoneyGuidePro with its better capabilities to support the future of how financial planning is being delivered… at its annual conference this past month, eMoney Advisor bizarrely rolled out a tribute to the past – a new solution called “Foundational Planning,” designed to take a simpler and more streamlined goals-based approach to designing and delivering financial plans. In other words, eMoney Advisor just “innovated” what MoneyGuidePro created over 15 years ago!? To be fair, eMoney’s Foundational Planning will tie in to its more “complex” cash-flow-based engine as well, which means clients can be "upgraded" from Foundational Planning into the full eMoney Advisor suite as their needs and financial situation grow more complex. Nonetheless, with advisor frustrations about everything from the lack of customizable investment assumptions, to the awkward way that even some basic tax deductions are entered for clients, and the growth of more specialized competitor tools in everything from detailed tax planning to Social Security planning to retirement distribution planning to student loan analysis, eMoney’s decision to focus its resources on going “downmarket” towards simpler planning instead of improving its capabilities with the more holistic financial planners who have driven the company’s growth to this point speaks volumes about the extent to which its development roadmap is now controlled by non-planning-centric broker-dealers (who want “planning lite” tools) instead of the financial planning community itself. Which is especially ironic, given that the industry has already witnessed numerous “planning lite” software tools all try and fail to gain adoption amongst the roughly 70% of brokers at broker-dealers who haven’t yet adopted financial planning… because the reality is that brokers who aren’t interested in financial planning just aren’t going to do it regardless of how simple the software is (because it’s literally not their value proposition in the first place). In the meantime, the longer than eMoney Advisor loses focus, the wider the door opens for a new financial planning software disruptor to throw its hat into the ring!

FiServ Throws Its Hat Into The Financial Planning Software Ring With “Financial Advice Management.” With more and more roads leading to financial planning as the core value proposition for advisors, the RIA and broker-dealer communities are not the only ones hungering for more financial planning software tools to help gain adoption; banks, which in the past have done “high end” wealth management through their trust departments, are also looking to enter into more mainstream mass affluent financial planning. But implementing software in the bank channel is especially challenging, both because they have their own unique (and sometimes very old legacy) systems to integrate with, as well as a different set of (bank and trust company) regulations to comply with. And while some traditional financial planning software companies have gained at least limited traction in the bank channel, arguably it was a ripe opportunity for FiServ to compete, especially since its bank-channel competitor FIS acquired Sungard’s financial planning software (now known as FIS WealthStation) to do the same thing back in 2015. As one might expect in a world where there will be required integrations to a wide range of existing bank systems, FiServ has indicated that its new “Financial Advice Management” platform will be very modular and API-friendly to connect to other tools; the focus of the software itself appears to be on the “pure” financial planning calculation engine to do retirement projections and tie to investment implementation. Which means, while FiServ’s solution will be a new competitor in the space, its primary innovation does not appear to be a new way of doing and delivering financial planning software, but simply a replication of current tools that happen to be built specifically for the bank channel. In fact, screenshots from FiServ’s own website show a tool that looks remarkably similar to MoneyGuidePro (even including their popular retirement success dashboard dials), tied to investment monitoring tools that alert advisors when there is cash available to invest. Which means FiServ’s Financial Advice Management probably won’t become a competitor to today’s financial planning software leaders in the independent channel, but should give them a competitive positioning opportunity against FIS’s WealthStation with a more modern architecture.

eMoney Founder Edmond Walters Joins AdvisorStream Advisory Board For Next Generation Digital Marketing Solution? When Fidelity acquired eMoney Advisor back in early 2015, the potential for Fidelity to substantially invest into and scale the software was evident… but so was the risk of culture clash between entrepreneurial eMoney founder Edmond Walters and the known-to-be-more-bureaucratic Fidelity management structure. And so it was unfortunate but not entirely surprising that Walters ended out resigning from eMoney barely 6 months after the acquisition closed, and aside from some brief buzz when he joined the board of independent broker-dealer Cetera (ostensibly to help build its technology-centric platform roadmap), not a peep has been heard from Walters for 3 years. But now, Walters has suddenly re-emerged, taking an advisory board position with advisor digital marketing automation platform AdvisorStream, in what is probably not coincidentally almost exactly 3 years after he resigned (allowing what was likely a 3-year non-compete to run its course). Because AdvisorStream will actually compete with eMoney’s own Advisor Branded Marketing solution (which was launched just months after Walters left and was thus likely part of his roadmap in the first place), in an area that has seen numerous competitors, from eMoney’s own solution, to Financial Media Exchange (FMeX) and Vestorly and more recently Snappy Kraken and Hyperchat Social, none of which have yet demonstrated any significant traction in the advisor channel. Yet given the immense popularity of large-scale marketing automation platforms like HubSpot and Marketo along with small-business platforms like MailChimp across most industries, arguably an industry-specific digital marketing platform is still a ripe opportunity (even if none have figured out how to fully execute on it thus far). Of course, Walters will “only” have an advisory board position, and isn’t actually in a position of founder and executive as he was with eMoney Advisor. But given that he innovated deep account aggregation capabilities into financial planning software (creating the now-popular trend), and had already started down the digital marketing road with eMoney before leaving… stay tuned to see what kinds of digital marketing innovations for advisors that AdvisorStream may bring with Walters on board to help set the vision and strategic direction?

CapGainsValet Dials Up For Another Year Of Mutual Fund Distribution Tracking Tools For Advisors. As the end of the year approaches, it’s the season for end-of-year tax planning, which includes not only deciding whether to do an end-of-year Roth conversion or harvest some capital losses, but also to prepare for the potential of late-year mutual fund distributions that may change the tax-planning picture. The good news is that fund companies do typically give warnings a month or two in advance of their end-of-year distributions to aid the planning process. The bad news is that the only way to get that information is to contact each fund company separately to find out whether there are any big distributions coming that may need special planning. To fill the void, financial planner Mark Wilson launched a tool for the advisory community several years ago, known as “CapGainsValet,” that aggregates together all of the fund company’s public distribution information into a central database of links for easy reference. A “Free Search” version provides direct access to 20 of the largest and most popular fund companies (from Vanguard to American Funds, Fidelity to PIMCO and DFA), while the “Pro” version (for a mere $45/year) provides access to a list of nearly 250 fund companies. Notably, CapGainsValet does not actually provide a database of the mutual fund distributions themselves – just a list of links that go directly to the mutual fund distribution reports of the various fund companies (as they’re released). Still, for just $45, the time-savings shortcuts of using CapGainsValet Pro are well worth it, especially when a decade-long bull market, combined with a choppy year in the markets, means there are a lot of embedded gains in mutual funds and a good deal of potential turnover in 2018. In fact, CapGainsValet has already identified 17 funds with end-of-year distributions anticipated to be more than 30% of the entire fund NAV (and over 300 funds that will make distributions of at least 10% of NAV this year). Do you know if any of your mutual fund holdings are in the end-of-year distribution doghouse? Further details directly on the CapGainsValet website, and Nerd’s Eye View readers can receive $10 off the Pro Search version with kitces-18 discount code.

Wealthfront Open ‘Path’ Financial Planning Software Tools For Free And Announces Blockbuster Intuit Partnership. While nearly every one of the original robo-advisors has either shut down (e.g., Hedgeable), expanded into serving advisors (e.g., Betterment for Advisors), or has pivoted entirely to the B2B advisor channel (e.g., SigFig, JemStep, FutureAdvisor, etc.), Wealthfront has remained unique in continued to reiterate its focus on developing a solely-technology-centric solution for consumers. Although over the past 2 years, the company has begun to shift from offering “just” robo-portfolio solutions by rolling out an increasingly sophisticated financial planning software tool called “Path” to its clients. And at the recent Money 20/20 Conference in Las Vegas, Wealthfront announced that Path will be made available for free to any/all consumers who want to use it, as a means of growing its list of prospective clients that it might subsequently upsell to the Wealthfront managed account platform and its proprietary risk parity fund. On the one hand, the strategy makes a lot of sense, as Personal Capital has clearly demonstrated the power of distributing free personal financial management (PFM) tools to consumers as a pathway to upsell clients into more holistic advice (although Path is focused on more modular financial planning needs like buying a home, taking time off from work, or sending kids to college). Especially when coupled to the recent blockbuster announcement that Wealthfront will be partnering with Intuit as well, which both provides an opportunity to cross-sell 30M+ Intuit TurboTax users on Wealthfront’s planning-and-investment-management services, and provides the potential for Wealthfront to directly integrate a wide range of tax-planning data points that could help Path do more tax-sensitive planning (or even offer a standalone tax planning module). Yet on the other hand, offering “free” financial planning to upsell into managed accounts and proprietary funds was the leading way that broker-dealers and insurance companies delivered financial planning back in the 1980s (where planning was the free-loss-leader to profitable proprietary solutions), and steps further and further away from Wealthfront’s positioning 3 years ago with then-Labor Secretary Perez as a “paragon of [unconflicted] fiduciary advice.” And bizarrely, Wealthfront continues to pound the table as being a superior alternative to human advisors, despite the fact that even single human-advisor-based firms like Edelman Financial have grown faster than Wealthfront over the past 7 years (with Edelman Financial up nearly $16B in 7 years, vs Wealthfront’s $11B). Though given Wealthfront’s decision to partner with Intuit and TurboTax – and a segment of self-directed consumers who choose to prepare their own tax returns instead of hiring a human professional to do so – it appears that perhaps Wealthfront is more cognizant than their public rhetoric suggests that their ideal target market was never consumers who were interested in hiring a human advisor, but those who prefer self-directed technology solutions in the first place?

In the meantime, we’ve updated the latest version of our Financial Advisor FinTech Solutions Map with several new companies, including highlights of the “Category Newcomers” in each area to highlight new FinTech innovation!

So what do you think? Will Riskalyze’s scoring system make it easier to show prospective clients how your recommendations can improve their portfolio allocation? Can AI in your CRM really show you insights you wouldn’t have already known about your clients? Would you be more interested in charging separately for planning with an easier and more integrated billing process? Will Wealthfront really challenge human financial planners with increasingly sophisticated financial planning software delivered to consumers directly?

Michael Kitces is a co-founder of AdvicePay, which was mentioned in this article.

Leave a Reply