Executive Summary

After several years of turmoil caused by the pandemic, financial advisor conferences seem to have found a "new [post-pandemic] normal", with events once again growing (some already surpassing their pre-pandemic highs). But that's not to say that the conference landscape was not altered by the pandemic; instead, the pandemic appears to have served as a catalyst that accelerated trends that were already underway, such that financial advisor conferences today look substantively different than they did just a decade ago.

Most notable is the fact that industry associations are not the drivers of advisor conferences that they once were; while a decade ago, 75%+ of this "Best Conferences" list consisted of various events run by industry associations, now it numbers less than 25%. On the other hand, the past decade has seen an explosion of 'vendor conferences', as more and more companies have discovered it's more economical to simply run their own conferences (at a breakeven or even a small loss) than to heavily sponsor the conferences of industry associations.

Some of these vendor conferences are built to bring out their existing advisor users to get feedback about and share the latest regarding their software, but a growing number of specialized conferences unto themselves have industry-leading content in the particular domain of the vendor's expertise, from Snappy Kraken and Nitrogen's advisor marketing conferences to DeVoe and Company's Elevate conference for managing the complex financial advisor enterprise.

At the same time, new conference organizers have emerged as well – entities that see gaps between what conferences vendors host (based on the software or services they sell) and what associations provide – leading to new niche conferences like Advisor2X's "Shift" conference on behavioral finance, to AdvisorCircle's "Future Proof" conference (or as some are calling it, the Future Proof Festival Experience!).

The end result from the advisor perspective, though, is not dissimilar to what it was in the past: an overwhelming number of conferences to choose from, and a great challenge for advisors in figuring out which ones are really worth attending and sinking what is often more than $2,000 (in registration fees, hotels, and airfare), plus several days out of the office, in the hopes that it will prove to be a good use of time.

As someone who has been speaking at 50–70 conferences a year for 18 years myself, I've seen the good and bad of our wide range of industry events, from the industry associations to the broker-dealers and insurance companies and RIA custodians, the rise of vendor conferences and media-driven events, private company events, and more. As a result, I am often asked for my own suggestions of what, really, are the industry's 'best' conferences to attend.

Accordingly, back in 2012, I started to craft my own annual list of 'best-in-class' top conferences for financial advisors, allocated across a range of different categories (as what's best for solo advisors isn't the same as what's best for larger advisor enterprises, what's best for fee-for-service advisors isn't the same as what's best for AUM firms, more technically-oriented advisors will prefer different conferences than those seeking practice management or marketing ideas, etc.).

Having updated our annual conference list every year since, I'm excited now to present my newest list of "Top Financial Advisor Conferences" for the upcoming 2024 year, with a particular focus on parsing through both the industry association events, the growing number of vendor and standalone conference providers… with our usual approach of parsing out the 'best' conference for a wide range of advisors with unique needs, from those who are looking for a conference on marketing or practice management (which varies depending on whether you're a mid-sized firm or larger enterprise), or who want to see the latest in advisor technology, need help in how to price financial planning fees and systematize their advice offering, are simply looking for a good overall conference or particular advanced tax and technical conference… or just want an entirely different conference experience (for which Future Proof stands alone!).

In addition, we've also updated our popular "Master Conference List" of all financial advisor conferences in 2024, both for advisors looking for a wider range of events to attend (if you want to delve deeper into a particular topical area), and for vendors looking for more conferences to exhibit at!

So I hope you'll find this year's 2024 top conferences list (and our updated Master Conference List) to be helpful as a guide in planning your own conference budget and schedule for next year, and be certain to take advantage of the special discount codes that several conferences have offered to all of you as Nerd's Eye View readers!

Where available, Nerd’s Eye View reader discounts are highlighted in red.

Best Conference For/In: Overall Financial Planning | Technology | Business Management | Advanced Tax Planning | Behavioral Finance| Advisor Marketing |

Charging-For-Planning | Conference Experience | Community Conferences

Prior Years’ Best Conferences List: 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | Master Conference List

For Conference Organizers: For the embed code to post a "Top Advisor Conference in 2024" badge to your own conference website or click here to scroll to the bottom of this page.

For Vendors/Exhibitors Considering Sponsorships: Hopefully, this list will be helpful to you in deciding which conferences to potentially attend and exhibit at. For further ideas, please see our comprehensive master list of all financial advisor conferences, along with the earlier years' Best Advisor Conference lists (noted above). There are also many opportunities to exhibit at various FPA chapters, some of which have a sizable (150+) attendance at annual chapter symposia. For those seeking further assistance, I have limited availability to consult directly with companies on distribution and go-to-market strategies to reach financial advisors as well.

The Post-Pandemic Advisor Conference Landscape

While the coronavirus pandemic is viewed by many as a great disruptor, when it comes to the financial advisor world, it seems to have been more of a great accelerator – where slow-moving trends already underway in the financial advisor world were not altered in their trajectory, but accelerated in their pace, packing what might have otherwise been a decade of change into just a few short years.

This can be seen in the shift of advisors who now do a substantive number of their ongoing client meetings via Zoom (even with older clientele who were presumed to 'never' want to meet online) to those who are leveraging more digital marketing techniques to attract new clients… and it is especially visible in the landscape of advisor conferences.

Looking back a decade ago, our own Best Conferences List of 2014 was dominated by industry associations – from FPA to NAPFA to IMCA – that executed on the long-standing model of putting interesting speakers on the stage to attract advisors, using the advisors in attendance to attract sponsors, using the money from sponsors to execute the event and pay for the speakers… and earn a profit by facilitating the 3-way transaction. Which was especially effective amongst the associations serving advisors with professional designations, because those advisors' Continuing Education (CE) requirements ensured a certain minimum level of demand for such (CE-eligible) conference content.

However, even before the pandemic, cracks were beginning to emerge in this model. Even in the late 2010s – before the pandemic – attendance at most association conferences was flat or down from a decade prior to that; a growing number of advisors were leveraging webinars and cheap (or outright free) online CE to fulfill their continuing education requirements, and association conferences were increasingly making pay-to-play arrangements with vendors to get speaking time (an indirect sign that the vendors weren't happy with the status quo of their conference experiences, either).

And then the pandemic happened. For nearly 2 years, financial advisors had to find alternative (online) solutions to fulfill their CE obligations. For some, this raised questions of whether financial advisor conferences would ever return, given how 'easy' it was to find good high-quality CE online.

As it turns out, though, advisor conferences are still very much alive and well in the post-pandemic era… but the kinds of conferences that are successful, and the conference organizers making them happen, look very different than they did in the past.

The Rise Of Vendor-Driven (Niche) Conferences

The traditional advisor conference model was a 3-party transaction – vendors sponsored to cover the cost for speakers, speakers brought advisors, and the advisors interacted with vendors to make the sponsorship worthwhile – facilitated by a conference organizer that leveraged the advisor's obligation to fulfill their CE requirements to ensure that the room was filled and earned a profit for bringing it all together. Until suddenly, in the pandemic, vendors couldn't get in front of advisors by going to conferences (that hadn't been executed for nearly 2 years) and had to come up with other ways to get in front of advisors… and did, by going directly to the speakers that were able to attract advisor attendees and hiring them to appear on vendor-facilitated webinars.

And it worked. So well that as conferences began to re-open after the pandemic, many vendors either doubled down on their strategies to run (and expand) their own 'user' conferences of advisors or even launch new conferences to engage with advisors… recognizing that it was often more cost-effective to run their own conference for advisors – even at a loss – than it was to pay the exhibit hall fees to sponsor other conferences that provided substantially less advisor engagement than just hosting their own.

The key to success was that most vendors provide a particular solution to advisors – they operate in some category or another in the AdvisorTech landscape – which means they are uniquely positioned to host a conference on that and immediately be a differentiated standout in an otherwise crowded landscape. From DeVoe and Company's practice management consulting turning into the Elevate practice management conference, Snappy Kraken's marketing automation tools turning into the Jolt marketing conference, or XYPN LIVE's fee-for-service financial planning platform turning into the XYPN LIVE conference for advisors scaling up alternative fee models.

In other words, the irony is that financial-advisor conferences are going through a similar phenomenon to financial advisors themselves – while the broad-based generalist was historically very successful, as the landscape becomes more crowded, specialized niche providers are attracting focused audiences who have a particular need that provider can solve. Which means the generalist doesn't lose their business to any one competitor; they lose a small bit of business to multiple niche providers that, in the aggregate, result in a major change in market leadership.

New Conference Organizers Plugging The Remaining (Non-CE) Gaps

While vendors that serve advisors have significantly expanded their depth and breadth of conferences leading up to and especially after the pandemic, they're not the only new competitors in the advisor conference landscape. In addition, an emerging crop of standalone conference organizers – whose sole goal is to operate a financially successful advisor conference by going after a particular segment of advisors who aren't well served by the current conference landscape – have also entered the fray.

What's striking about the newest wave of conferences, though, is what they offer and, more importantly, what they don't focus on: continuing education credits. Long considered to be a staple of or even a 'requirement' to organize a successful conference, it turns out that financial advisors are quite willing to pay for conferences that have little or no CE… with the caveat that those events have to be even more focused on solving very specific practice management problems those advisors are facing.

Examples include Bob Veres' Insider's Forum for mid-sized scaling firms, Ross Marino's Advisor2X platform offering its Shift (behavioral finance) conference, Ron Carson's Excell conference for advisors transitioning from practice to business, and Advisor Circle's breakout Future Proof 'festival' for advisors tired of the traditional conference-hotel experience. All of which are focused on particular business challenges that financial advisors face and are not necessarily tied much at all to the traditional delivery of financial planning CE (though some do offer at least a few CE-eligible sessions).

In practice, the new conference organizers are themselves plugging in the specialized niche holes that are not fulfilled by the generalist association events nor by the vendors (who tend to align their conferences around their own solutions). Nonetheless, the end result is the same – a conference landscape that includes an increasingly wide range of specialized conferences for financial advisors, who can then seek out the particular conference that fits their specific needs.

The cumulative result: While a decade ago, 75% of the 'top conferences' for advisors were run by industry associations, now it's less than 25% as vendors (that previously funded association events) are increasingly pursuing more local association events, more targeted conferences that better align to their particular target audience, or simply running their own conferences to attract advisors interested in the kinds of solutions they offer.

While these trends were arguably underway prior to the pandemic, they have undoubtedly been accelerated… and clearly aren't going back to the way things were.

Finding The 'Best' Advisor Conference (For You)

While there are more conference organizers than ever competing for advisor attention, the reality is that there have always been far more conferences to choose from than most advisors can ever attend, leading to questions about which ones are actually good events worth attending. No one wants to go to a conference just to find out whether it's a conference they should have been going to, only to discover that they wasted a few thousand dollars and the better part of a week to find out that the event wasn't really able to deliver as promised.

To help navigate this challenge, since 2012, we've published an annual list of the Best Financial Advisor conferences, based on my own experience speaking at nearly 1,000 conferences over the past 19 years and having seen first-hand which events are particularly good and worth recommending (or not)… and which are the best fit (or not) for any particular type of advisor.

However, in an era where conferences themselves are increasingly specialized, it's not enough to simply highlight which events are well-executed. It's also about the intended focus of the conference, which shapes the agenda and its speaker selection, as well as the host/organizer of the conference (which can be especially good if the focus of the conference is in their sweet spot, or especially bad if it's not). Such that in the end, the 'best' conference is actually relative to the advisor themselves and whatever their own needs are.

Accordingly, in this year's list of Best Conferences, we focus on the 'best' advisor conferences depending on the particular type of need or business challenge that advisors are facing – whether it's advancing their technical knowledge, having better conversations with clients, improving their marketing, scaling their firm, or just feeling a need and desire to connect with other advisors and recharge.

Best Overall Financial Planning Conference: FPA NorCal 2024

The FPA Northern California conference (or "NorCal" for short) is hosted annually by a coalition of about half a dozen Financial Planning Association chapters in the greater San Francisco area. Yet despite being a 'local FPA chapter' (or at least, regional) conference, its finely tuned systems and processes for planning the event – that have been running for more than 50(!) years since its founding as a conference in 1972 – the FPA NorCal conference is consistently, year after year, a national-quality financial planning event.

The FPA Northern California conference (or "NorCal" for short) is hosted annually by a coalition of about half a dozen Financial Planning Association chapters in the greater San Francisco area. Yet despite being a 'local FPA chapter' (or at least, regional) conference, its finely tuned systems and processes for planning the event – that have been running for more than 50(!) years since its founding as a conference in 1972 – the FPA NorCal conference is consistently, year after year, a national-quality financial planning event.

The typical NorCal conference agenda anchors around national-caliber keynote speakers (from investment experts like Schwab's Liz Ann Sonders and Franklin Templeton's Michael Hasenstab and Marci Rossell and DoubleLine's Jeff Gundlach, to business experts and authors like Greg McKeown of "Essentialism" and Cal Newport of "Deep Work", and inspiring pioneers like Salman Khan of Khan Academy), paired with a series of 5 parallel breakout tracks of financial planning content.

The content features a mixture of practice management sessions along with more technical CE, many of which run 75–100 minutes (not just the 'usual' 50-minute CE session) to allow room for the speakers to delve deeper into their topics. Which is welcomed, because the FPA NorCal conference has a rigorous speaker selection and vetting process, and does not permit any 'pay-to-play' sponsored sessions… which makes it a lineup of speakers that advisors would want to talk for longer!

In fact, often, the biggest challenge at NorCal is that you'll want to see multiple sessions that conflict with each other in the same time slot – for which NorCal was also one of the first industry conferences to pioneer the effort of recording every session (general and breakout sessions) and making all recordings of all sessions included as part of the registration fee for all attendees. (So even if you can't attend every session in person, you'll get every bit of content as a registered attendee!)

An added benefit of the NorCal conference is that it's held at the beautiful Palace Hotel in downtown San Francisco and always falls on the Tuesday and Wednesday after Memorial Day… making FPA NorCal a great 'destination' conference to claim a deductible business expense for the flight but starting the trip with a long Memorial Day weekend in San Francisco (or if you prefer, perhaps visiting the wineries of Napa and Sonoma Valley). And for those who like to use their points, the Palace Hotel is a Marriott property!

The one important caveat, though, is that because NorCal started out as a regional conference and has morphed into a national event, it does have a capacity limitation (the main ballroom of the Palace Hotel caps out at approximately 600 attendees), so those who are interested should register early because the event has sold out in many years past!

Who Should Attend: Experienced financial advisors who really want to attend high-quality conference sessions and are looking for a well-run event (or those who simply want a nice destination conference to travel with a significant other!?).

Details: May 28-29, 2024, at The Palace Hotel in San Francisco, CA.

Cost: $1,199 for FPA members and $1,599 for non-members. Early bird price is $979 for FPA members and $1,399 for non-members and is valid between December 18, 2023, and January 31, 2024.

Conference Website: FPA NorCal 2024

Best Technology Conference: Technology Tools For Today (T3) Advisor Conference 2024

In the early days of independent financial advisors, it was large enterprises (e.g., wirehouses and the like) that had all the dollars – and, therefore, all the technology budgets to build tools and solutions for advisors. Those who operated independently usually had little choice but to manage with 'generic' tools that weren't built for advisor needs, or to build their own technology solutions from scratch… and then, if it worked well, perhaps sell the solution to other financial advisors. This 'homegrown' technology path of advisors-turned-tech-developers still defines much of the Advisor Technology landscape today, including Redtail, Junxure, and Protracker CRMs; Orion and Tamarac for performance reporting; iRebal, tRx, TradeWarrior, and RedBlack for rebalancing software; and more.

In the early days of independent financial advisors, it was large enterprises (e.g., wirehouses and the like) that had all the dollars – and, therefore, all the technology budgets to build tools and solutions for advisors. Those who operated independently usually had little choice but to manage with 'generic' tools that weren't built for advisor needs, or to build their own technology solutions from scratch… and then, if it worked well, perhaps sell the solution to other financial advisors. This 'homegrown' technology path of advisors-turned-tech-developers still defines much of the Advisor Technology landscape today, including Redtail, Junxure, and Protracker CRMs; Orion and Tamarac for performance reporting; iRebal, tRx, TradeWarrior, and RedBlack for rebalancing software; and more.

As technology solutions began to emerge for financial advisors, though, a new problem arose: how to find and compare them, especially given that most advisor technology companies (now and particularly back then) simply couldn't afford the exhibitor booths at traditional advisor conferences (where vendors selling $29/month software were expected to pay the same fees as trillion-dollar asset managers!?). The answer was a newsletter, and then a conference by advisor-technology consultants Joel Bruckenstein and David Drucker, which they dubbed "Technology Tools for Today" (T3).

And now, 2024 will mark the 20-year anniversary of the T3 Advisor Technology conference, still operating under the format that it originated with: to be less of a 'conference' (where advisors attend sessions for educational content) and more of a 'trade show' (where advisors come to see the latest wares in the exhibit hall) and attend sessions that are almost exclusively presented by the vendors/sponsors… who showcase their recent releases (what they've spent the past year building) and their roadmap (what they're working on in the coming years), because that's the whole point of a trade show!

In that vein, the best way for advisors to approach the T3 conference is as a shopping trip – a chance to walk amongst the exhibit hall booths to either find a solution to fill a gap in their practices, scout out potential solutions they might want to consider adding (that they didn't even know existed!?), or simply get a glimpse of whether the grass is really likely greener with some other vendor they might switch to (or not). Which can be done in a time-efficient manner by attending the T3 conference, as it's the largest gathering of independent technology providers all in one place for advisors to 'shop' efficiently!

For tech vendors that are deciding whether to participate, it's notable that even by 'trade show' standards, the T3 conference is still not a 'huge' buying audience for companies looking for new users (historically, as much as half of the ~1,000 attendees are fellow software vendors, media, and industry consultants). Though a parallel "T3 Enterprise" track that runs concurrently (specifically targeting the largest broker-dealer and RIA enterprise decision-makers) provides more substantive Enterprise sales opportunities.

But in practice, the primary 'ROI' for software vendors that exhibit at T3 is not measured in new users, but a chance to gain better visibility amongst industry 'influencers' (as T3 has historically been very well covered by industry media and independent consultants), and the potential to establish relationships with other tech vendors that might be future integration partners (or even future strategic acquirers!).

Who Should Attend: Advisory firm owners (or their technology decision-makers in larger advisor enterprises) who are either independent or making the transition to independence and want an efficient way to see the full breadth of advisor technology solutions all in one place.

Details: January 22-25, 2024, in Las Vegas, Nevada

Cost: $999. Early bird pricing of $899 is available until November 1. Nerd's Eye View readers can receive $200 off with the KITCES200 discount code!

Conference Website: T3 Advisor Technology Conference 2024

Best Business Management Conferences: Bob Veres' Insider's Forum & DeVoe Elevate 2024

The traditional financial advisor conference is focused on how to make advisors better at delivering financial advice to clients, with continuing education to advance the advisor's technical knowledge to provide good recommendations, content on how to better communicate with clients and perhaps how to attract more of those clients, and the occasional dose of personal

The traditional financial advisor conference is focused on how to make advisors better at delivering financial advice to clients, with continuing education to advance the advisor's technical knowledge to provide good recommendations, content on how to better communicate with clients and perhaps how to attract more of those clients, and the occasional dose of personal ![]() productivity sessions on how to be more efficient as a financial advisor. Which really does meet the needs of the overwhelming majority of financial advisors (at least, when the content is done well!).

productivity sessions on how to be more efficient as a financial advisor. Which really does meet the needs of the overwhelming majority of financial advisors (at least, when the content is done well!).

However, for a small subset of financial advisors who see themselves less as 'financial advisors' and more as 'financial advisory firm business owners' (to use the Michael Gerber E-Myth delineation)… the traditional financial advisor conference just doesn't cut it. Because the challenges of building and scaling a financial advisory business are different; it's not about best practices in delivering advice and getting referrals and managing your time, but instead about best practices in hiring, training, compensating, and retaining advisor (and other key firm) talent.

Which is the void that is being filled by the "Elevate" and "Insider's Forum" conferences. The Elevate event was created by investment banker and practice management consultant David DeVoe, while Insider's Forum was developed by industry commentator Bob Veres; both seek to address the 3 key challenges that advisory firm owners face as they seek to scale up: 1) how to attract and retain enough human capital talent to serve a growing number of clients, 2) how to attract and retain enough clients to fill the capacity of a growing number of advisors, and 3) how to implement the technology and systems to do it all efficiently and scalably.

Accordingly, neither the Elevate nor Insider's Forum conference has much of any CE on the agenda; instead, the sessions are built for business owners, with prior agenda topics like "Attracting and Retaining Talent: Learn from the Best Places to Work", "The Price of Talent & How To Acquire It Along The Career Arc", "Tracking Your Client Service", and "Solving the Incentive Compensation Puzzle". Which are all crucial topics for advisory firm business owners that are looking to 5X or 10X their businesses in the next 5–10 years!

While both Elevate and Insider's Forum are similar, though, their backgrounds (with Elevate, it's DeVoe's investment banking experience supporting M&A for large firms, while with Insider's Forum it's Bob Veres' practice management background writing for growing RIAs) lead to a slightly different focus in terms of the size and scale of the firm, with Insider's Forum a better match for mid-sized firms (e.g., $3M to $10M of revenue) and DeVoe's better for the larger (e.g., $10M+ revenue) or faster-growing (not over $10M of revenue but will be soon!) types of advisory firms.

Who Should Attend: C-level executives from advisory firms with at least $3M (and up to $10s of millions of) revenue who are tackling the human capital and systematic growth challenges as they scale up their enterprises. Advisors running <$10M revenue firms will likely have a preference for Insider's Forum, while those with $10M+ revenue may prefer Elevate… but consult the agendas when posted to see which is a better fit for your firm's specific needs and circumstances!

Details: Elevate: May 8-10, 2024, in Scottsdale, Arizona; Insider's Forum: September 16-18 in Denver, Colorado

Cost: Elevate: $1,125. Early bird pricing of $795 is available for a limited time. Nerd's Eye View readers can receive $100 off with the Kitces100 discount code!

Insider's Forum: Super early bird pricing is $1,025 for advisory firm attendees and $875 for each additional firm attendee. Nerd's Eye View readers can receive $75 off the first registration for an advisory firm with the code KITCESBVIF!

Conference Website: DeVoe Elevate 2024 & Insider's Forum 2024

Best Advanced Tax Planning Conference: PFP Track At The AICPA ENGAGE 2024

Over the past decade, the ever-present pressure on financial advisors to show their value – increasingly showing value beyond 'just' the results of their managed accounts – has driven advisory firms towards expanding their financial planning capabilities, producing increasingly deep and comprehensive financial plans, and expanding their services beyond the 'traditional' insurance and investment realms further into the world of estate and tax planning. As exemplified by the rapid expansion of estate planning solutions for advisors on the Kitces AdvisorTech Map, and the explosive upward growth of Holistiplan's tax planning software in our recent AdvisorTech Research in particular.

Over the past decade, the ever-present pressure on financial advisors to show their value – increasingly showing value beyond 'just' the results of their managed accounts – has driven advisory firms towards expanding their financial planning capabilities, producing increasingly deep and comprehensive financial plans, and expanding their services beyond the 'traditional' insurance and investment realms further into the world of estate and tax planning. As exemplified by the rapid expansion of estate planning solutions for advisors on the Kitces AdvisorTech Map, and the explosive upward growth of Holistiplan's tax planning software in our recent AdvisorTech Research in particular.

Yet the reality is that as financial advisors are increasingly migrating towards a deeper level of estate and tax planning advice, the CPA world has been migrating increasingly towards financial planning. Which isn't entirely new – in practice, many of the largest RIAs today were formed by former CPAs who broke out of the HNW planning divisions of Big-8 accounting firms back in the 1980s and 1990s to form their own wealth management firms.

In fact, the growth of this 'other world' of CPA Financial Planners from the accounting world long ago spawned their own membership association – the Personal Financial Planning (PFP) section of the AICPA. And the PFP section of the AICPA hosts its own financial planning conference (historically known as the AICPA PFP conference, and now the PFP track within the broader AICPA ENGAGE conference, which brings together multiple sections/divisions of CPAs within the AICPA).

The significance of the PFP track at AICPA ENGAGE is that it's not 'just' another financial planning conference from an industry association; given the AICPA's deep roots in tax (as the membership association for CPAs), it has a particularly deep technical focus (as the base knowledge to become a CPA forms a high bar for a continuing education conference to build upon!), and an especially strong focus on advanced tax planning in particular.

An added bonus in the context of financial planners seeking more advanced planning content is that because the PFP track is now part of the broader AICPA ENGAGE conference, advisors who register to attend ENGAGE also get access to the other tracks… which include a few not relevant at all to financial advisors (e.g., Corporate Finance and Controllers, Advanced Accounting, and Audit), but 2 other tracks that would likely be of interest: the "Advanced Estate Planning" track, and the "Tax Strategies for the High-Income Individual" track. And these are not just 'tracks' akin to a series of single breakout sessions at a larger conference; Advanced Estate and High-Income Tax Strategies were, for many years, entire conferences unto themselves, that similar to PFP were rolled into ENGAGE, and have their own robust multi-track content sessions within their ENGAGE track.

Because the AICPA ENGAGE conference is a broader CPA event – with a number of tracks that have no particular crossover relevance to financial advisors – it is notable that the attendee mix at ENGAGE is very broad. Which in practice makes it somewhat difficult to engage (no pun intended) in networking as an attendee. But for advisors who are simply looking for more advanced and deep technical content – particularly with a tax planning bent – the AICPA's ENGAGE conference and its PFP (and Advanced Estate and High-Income Tax) tracks are a strong offering, with 3- and 4-day passes available to attend all the content!

Who Should Attend: Financial advisors with CFP certification (and ideally other advanced degrees and designations) who are looking for more advanced technical and tax planning content to challenge them, particularly with a focus on HNW/ultra-HNW clientele. (Note: having a CPA license is not required – this is tax planning content, not tax preparation).

Details: June 5-8, 2024, at the ARIA Hotel in Las Vegas, Nevada

Cost: $2,175 for AICPA members and $2,625 for non-members. Early bird pricing of $1,825 for AICPA members and $2,275 for non-members is available until December 4.

Conference Website: AICPA ENGAGE 2024

Best Behavioral Finance Conference: Advisor2X Shift 2024

It doesn't take many years of experience as a financial advisor to begin to witness clients making 'sub-optimal' financial decisions, from overinvesting into a single stock (or holding onto one far longer than they should) to the seemingly inevitable moments of market volatility where some clients need to be talked off the proverbial ledge from selling everything in a panic. And these behavioral challenges of clients aren't just idiosyncrasies of individuals; over the past 20 years, economists have developed an entire body of knowledge, now dubbed "behavioral finance", that highlights the various behavioral biases that lead investors to make persistently irrational decisions.

It doesn't take many years of experience as a financial advisor to begin to witness clients making 'sub-optimal' financial decisions, from overinvesting into a single stock (or holding onto one far longer than they should) to the seemingly inevitable moments of market volatility where some clients need to be talked off the proverbial ledge from selling everything in a panic. And these behavioral challenges of clients aren't just idiosyncrasies of individuals; over the past 20 years, economists have developed an entire body of knowledge, now dubbed "behavioral finance", that highlights the various behavioral biases that lead investors to make persistently irrational decisions.

The caveat, though, is that while the economists have done a relatively good job of documenting and detailing investors' irrational behaviors, their research does remarkably little for advisors who have to figure out what to actually do about it. Which, in recent years, has begun to shift the behavioral focus away from the domain of economics and towards the domain of financial psychology instead.

In this context, it's notable that last year, Ross Marino of Advisor2X decided to launch a new conference called "Shift", which would tackle the topic of behavioral finance for financial advisors leaning not on the teachings of economists but bringing in the tools of financial therapists (whose job is not just to understand that their patients may be behaving irrationally, but to get their patients to actually shift their behavior for the better!). Or what the conference frames more broadly as a "human-first" (rather than an economics-first) approach to providing financial guidance for clients.

In practice, the Shift conference is simply a packed 2-day agenda of content focused on how to help clients actually implement the advice their advisors provide, and how best to get clients to actually make the shifts and behavior changes they need to make in order to move forward. For which the advisor has the opportunity to consider and practice how to better deliver their advice in a way that clients will be more likely to engage so that the advice will actually stick, and the Shift conference provides speakers with real experience who can share how to do it.

Who Should Attend: Financial advisors with an interest in behavioral finance who are looking for new ideas and techniques in how to get clients to actually implement and follow through on the advice that they're providing (or, in some cases, to not take action in situations where the advisor is guiding them to stay the course!).

Details: March 24-25, 2024, at the Walt Disney World Swan Resort in Orlando, Florida

Cost: $299. Nerd's Eye View readers can receive $100 off advisor registration with the code KITCESSHIFT.

Conference Website: Advisor2X Shift 2024

Best Advisor Marketing: Nitrogen's Fearless Summit

When it comes to sales and marketing for financial advisors, most financial advisors are all sales and no marketing. In practice, this is simply a result of how most financial advisors are trained and brought into the business – we start our practices with a lot of time but little or no money and are told to cold-call, cold-knock, network, or do whatever else we can with our very-available-and-inexpensive time to hustle our way to prospective clients and convince them to do business with us.

When it comes to sales and marketing for financial advisors, most financial advisors are all sales and no marketing. In practice, this is simply a result of how most financial advisors are trained and brought into the business – we start our practices with a lot of time but little or no money and are told to cold-call, cold-knock, network, or do whatever else we can with our very-available-and-inexpensive time to hustle our way to prospective clients and convince them to do business with us.

The challenge, though, is that once we approach (or outright whack into) our client-capacity limitations, growth tends to fall flat. There's simply no more time left to invest into the sales-driven business development activities that made us successful. Typically we respond by hiring other younger, newer financial advisors to do what we did – use their plentiful time and lack of resources as new financial advisors to hustle their way to prospective clients. Except this often proves to be problematic; either the new advisor is unsuccessful and leaves the firm (because they couldn't get enough clients), or they're so successful they leave the firm anyway (because they're so good at getting clients on their own they don't need the firm anymore).

The end result of this phenomenon in recent years has been a newfound focus for advisory firms to actually figure out how to market – to 'make the phone ring' with inbound prospects – that can be provided to advisors who are not good at business development (which makes them less likely to leave and go out on their own) but may be fantastic at providing great client service to clients that marketing delivered to them. Which ultimately is significantly more scalable (and long-term profitable) for the advisory firm.

However, up until just the past few years, there really were no conferences for financial advisors focused on marketing (actual marketing, as distinct from just engaging in more outbound prospecting/sales strategies). But now, advisors have 2 strong choices, delivered by vendors that are building marketing technology solutions for financial advisors (and have a vested interest in seeing advisors get better at marketing!).

The first is the Jolt conference, hosted by Snappy Kraken. To the extent that Snappy Kraken is built around providing content marketing automation tools for financial advisors, so too is the Jolt conference focused around content marketing. Which means everything from blogging to video, storytelling to SEO, and website design to branding. For advisors who have some natural inclination to show their expertise by educating clients and creating content – whether via audio, video, or the written word – Snappy Kraken brings together advisor speakers who are doing it successfully to share their best practices. Though notably, Jolt won't be running in 2024 due to limitations in venue availability, and will be back in 2025.

The second option for advisor marketing conferences – that is happening in 2024 – is the Nitrogen (formerly Riskalyze) Fearless Investing Summit. Which might seem unusual as a marketing selection – given Riskalyze's roots as a risk tolerance software solution, and that its Fearless Investing Summit is more focused on investing (as its name implies) – but given Riskalyze's pivot to Nitrogen this year and rebranding not as risk tolerance software but a "Growth Company" that's focused on sales enablement and client engagement, so too has the Fearless Investing Summit pivoted to become more of a Fearless Growth Summit instead (which perhaps will even be a rebrand for the conference in the coming year!?).

Nitrogen brings a somewhat broader approach to marketing and growth content than Jolt's focus on 'just' the many ways of doing content marketing, looking more at how to market an advisory firm in the aggregate (which becomes especially relevant as advisory firms grow to become multi-advisor enterprises). And it will tie in particularly well to advisors on the AUM model, given the strength of Nitrogen's tools to support business development and asset gathering (especially for firms that can establish a good inbound marketing flow!?).

Notably, while both the Jolt and Fearless advisor marketing conferences are driven by vendors that have an advisor marketing solution for sale, both have also found a healthy balance of showcasing some of their own capabilities (for which they are both highly rated in their own categories according to Kitces AdvisorTech Research anyway!) and simply helping to educate financial advisors on how to better execute marketing in their own firms.

Who Should Attend: Financial advisors looking to lift their organic growth rates not just by doing more sales-based activity but better institutionalizing marketing and growth across their entire firm (especially for firms growing into multi-advisor ensembles and enterprises).

Details: Nitrogen's Fearless Summit, October 23-25, 2024, in Nashville, TN

Cost: Nitrogen's Fearless Summit: $549.

Conference Website: Fearless Summit 2024

Best Charging-For-Planning Conference: XYPN LIVE 2024

In the early days of financial planning, advisors were compensated for their advice by getting paid for the implementation – in the form of commissions on the various insurance and investment products they recommended to solve for the client's goals and objectives. On the one hand, this approach was challenging because it meant financial advisors had to do a non-trivial amount of financial planning work upfront, at the risk that they wouldn't be compensated for the advice they provided at the end (if clients didn't actually implement). On the other hand, it meant that financial advisors never had to figure out what to charge for their services, as the commission rates were set by the product manufacturers themselves (and advisors simply received a specified percentage of the amount that was sold).

In the early days of financial planning, advisors were compensated for their advice by getting paid for the implementation – in the form of commissions on the various insurance and investment products they recommended to solve for the client's goals and objectives. On the one hand, this approach was challenging because it meant financial advisors had to do a non-trivial amount of financial planning work upfront, at the risk that they wouldn't be compensated for the advice they provided at the end (if clients didn't actually implement). On the other hand, it meant that financial advisors never had to figure out what to charge for their services, as the commission rates were set by the product manufacturers themselves (and advisors simply received a specified percentage of the amount that was sold).

Over the decades since, more and more financial advisors have adopted models where they're paid outright for their financial advice. In some cases, it's charging fees for standalone financial plans. In other cases, it's charging by the hour for their financial planning time. And in recent years, it's increasingly been about charging ongoing financial planning fees (e.g., in the form of a monthly subscription fee). For some advisors, the shift in business model was simply intended to ensure that they're paid for the time-consuming work that is financial planning – without needing the client to implement in order for their time to be compensated. Other advisors have made the shift specifically to bring financial planning to segments of consumers who have to be engaged this way (e.g., because they don't need to buy financial services products and don't have a financial portfolio to manage, but they want and need financial advice and can only pay for it via an outright planning fee).

The challenge that emerges from this shift, though, is that advisors have to figure out what to charge for their advice and what to do for clients – upfront and ongoing – to validate that fee in a way that was never really necessary when managing portfolios for an AUM fee (where the' market rate' of 1% is a well-known anchor point, and services are well defined and standardized) or when selling a product (where the commission rates were set by the companies that made the products available for sale). Which has created a growing desire amongst financial planners who charge outright planning fees to come together with other advisors to share best practices in how to price the advisor's fee and how to show value for that fee.

With a founding mission of expanding access to financial planning with 'alternative' fee-for-service pricing models, XY Planning Network's annual conference – XYPN LIVE – has effectively become the largest gathering place of advisors charging fees for financial planning and trying to navigate all of the pricing and show-value challenges that advisors face with such business models.

In fact, the XYPN LIVE conference agenda is almost entirely focused on practice management content around pricing, growing, and scaling financial planning firms; advisors can navigate a full 3 days of practice management and solutions content, with sessions like "How to Hire, Manage, and Support a Growing Team", "Streamline Operations and Workflows with your CRM", "Do More Of What You Love: 5 Tasks To Outsource", and "Delivering Exquisite Ongoing Client Care".

Also notable at XYPN LIVE is its unique 'Expo' approach to its exhibit hall – where there are nearly 100 vendors, of which 90% are either service providers or technology vendors focused on making advice firms more efficient and scalable (as contrasted with most conference exhibit halls that are primarily populated with insurance and investment product distributors trying to distribute their products through advisors to get to their clients, instead of building solutions for advisors themselves), in addition to its "Emerging AdvisorTech" Expo that showcases half a dozen emerging new AdvisorTech vendors (a great place to see the next big thing before it becomes big, with prior winners including the first-time debut of Snappy Kraken, Vestwell, Holistiplan, and Income Lab!).

Who Should Attend: Financial advisors who charge hourly, project, or ongoing subscription fees for financial planning (or wish to begin doing so) who are trying to navigate the challenges of how to price, deliver, and scale their fee-for-service planning (and want to compare notes with other advisors doing the same!).

Details: October 15-17, 2024, in Minneapolis, Minnesota

Cost: Registration will open in January. Nerd's Eye View readers can receive $25 off with the KITCES25 discount code!

Conference Website: XYPN LIVE 2024

Best Conference Experience: Future Proof 2024

While the nature of the content, the focus of the speakers, and the composition of the advisor attendees will vary from one advisor conference to the next, the experience of most conferences is quite similar – hosted in a large hotel ballroom or perhaps a wing of a convention center, with rows (and rows, and rows) of seating facing the speakers on stage, coffee breaks in the hallway, a buffet in a cavernous exhibit hall encircled by exhibitors, and nary a jot of sunlight unless you choose to take a break away from the conference activities and walk outside for a few minutes.

While the nature of the content, the focus of the speakers, and the composition of the advisor attendees will vary from one advisor conference to the next, the experience of most conferences is quite similar – hosted in a large hotel ballroom or perhaps a wing of a convention center, with rows (and rows, and rows) of seating facing the speakers on stage, coffee breaks in the hallway, a buffet in a cavernous exhibit hall encircled by exhibitors, and nary a jot of sunlight unless you choose to take a break away from the conference activities and walk outside for a few minutes.

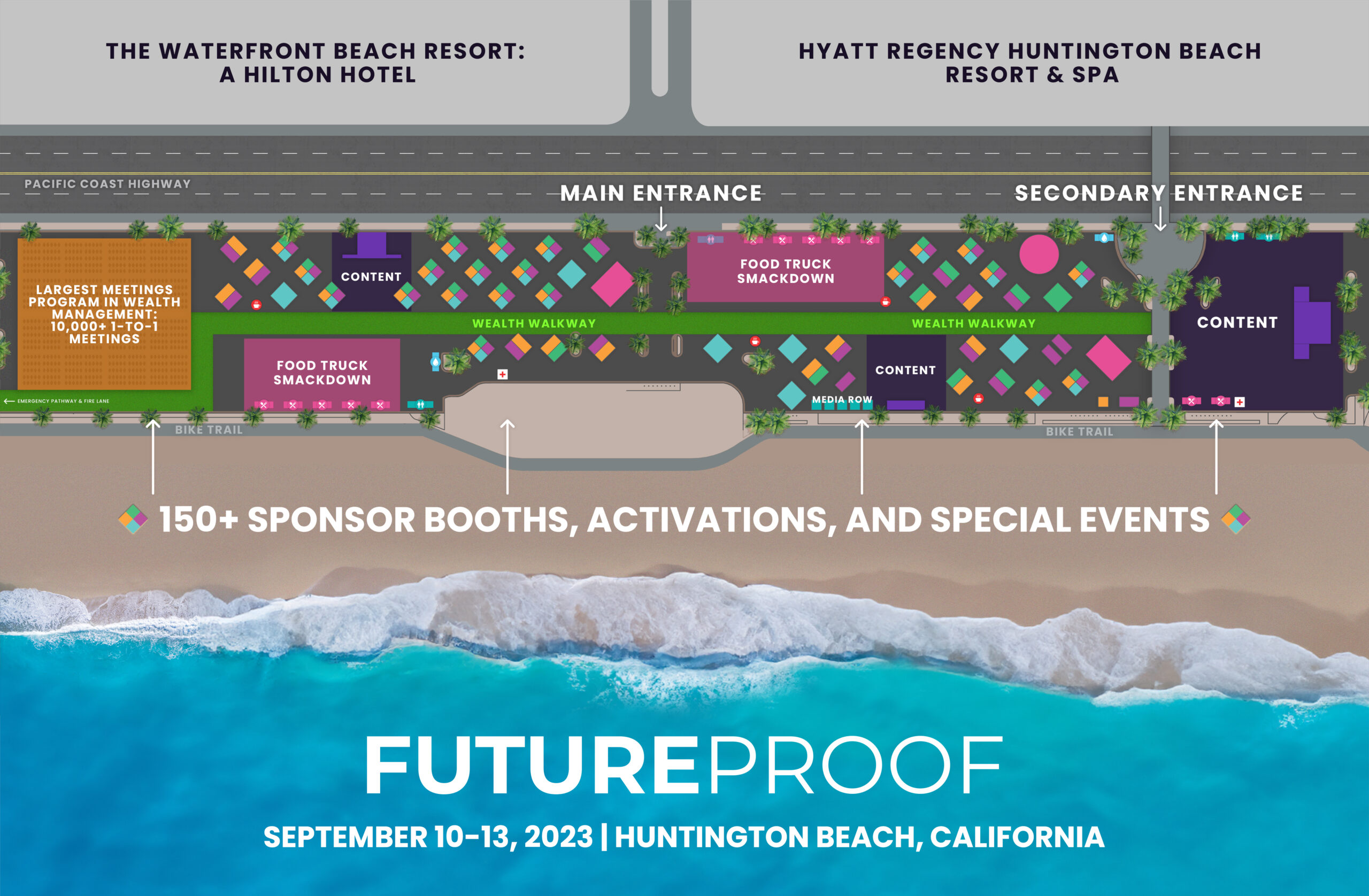

And then there's Future Proof. Which doesn't even represent itself as a financial advisor conference, but instead as a "wealth festival" hosted not just in Huntington Beach, California, but on Huntington Beach… literally, outdoors, just a few dozen feet from the lapping waves of the Pacific Ocean. (Technically, the event activities are draped on top of the beach parking lot, so advisors don't have to walk in the sand to get around. 😊) Where sessions are all delivered under the warm (but not overly hot) California sun from 3 different outdoor content stages, lunch is delivered via local food trucks, and advisors only ever have to walk back across the street to go indoors to the hotel when it's time to go to sleep.

Notably, though, Future Proof isn't just a 'traditional advisor conference held outdoors'. It is, by design, a substantively more networking-oriented conference. Sessions are relatively short (most are 30 minutes), with futurist-oriented topics (apropos of the name, to help you "Future Proof" your practice) designed to spark conversation more so than bring answers. (And with shortened sessions, there is little-to-no CE at all.) Interspersed throughout the day are interviews with interesting talking heads of the industry (from Jeff Gundlach debating the bond market to Joe Duran announcing his latest advisor venture), along with other forms of music and entertainment in what is intended to be much more of a 'festival' than a conference in the first place.

Also unique at Future Proof are their "Breakthru" meetups, where advisors in advance of the conference can provide an indication of the kinds of other advisors they'd like to meet while they're there, and have the opportunity to 'match' with others who are looking for someone similar, into what are then pre-arranged meetings at a series of meetup tables for a 15-minute connection (all facilitated by an app designed by the conference organizers to make it easier to match and meet). Because all meetings are by mutual agreement (both parties have to say they're interested in connecting), the meetings themselves are only 15 minutes (relatively low stakes; if it's not a good connection, just move on quickly), and the meetings are 1:1 (not overwhelming for the introverts who don't like big social crowds), advisors who attended have been incredibly upbeat that they were able to make better connections with peers at Future Proof than the 'traditional' approach of just talking to people during meals and in the hallways, hoping to meet someone with whom they could connect.

In addition to using Breakthru to meet with other advisors, Future Proof also provides the option to use the app to meet up with vendors (an alternative to walking the rows of exhibitor booths that also make an appearance at Future Proof). And advisors who want to meet with exhibitors and agree to a set number of meetings can even get their conference registration fees reduced (or, for leaders at large firms who represent significant buying opportunities for the vendors, waived entirely) in exchange for the facilitated introductions.

Ultimately, though, Future Proof is such an 'un-conference' conference for financial advisors that it's remarkably hard to describe, beyond saying it is a great experience unto itself. Attending is less about the session content (though there are some sessions advisors will probably drift in and out of) and more about the social dynamic of interacting with a wide range of fellow advisors in a comfortable (and lovely outdoors not-conference-room-stuffy) environment, with a conference space (and Breakthru app) that help to facilitate good connections even for those of us who don't like big social settings.

Come to Future Proof expecting to have interesting conversations with other advisors, enjoy the feeling of the warm California sun, and leave feeling refreshed after having spent a few days getting fresh air to go with the fresh conversations and fresh ideas. It's an experience unto itself.

Who Should Attend: Financial advisors who want to get away from the 'traditional' conference and feel it would be refreshing to connect with others in a warm outdoor environment, with a primary value on networking and conversation with other advisors who are similarly energized.

Details: September 15-18, 2024, in Huntington Beach, California

Cost: Pricing to be announced, with potential discounts (and even potential comps for airfare and hotel reservations) for firm leaders willing to take meetings with interested exhibitors.

Conference Website: Future Proof 2024

Going 'Home' To Your Advisor Community

While many financial advisors decide to go to a conference to solve a particular problem – whether it's an educational gap or a practice management/business need – sometimes the reality is that the reason to attend is little more than spending time with 'your people'… the community of advisors that you belong to, and wish to (re-)connect with. Which makes the conference less of a conference, per se, and more about 'going home' to your community.

For most advisors, their 'home' conference is the annual conference of their RIA custodian or broker-dealer platform (which is why events like Schwab IMPACT and LPL Focus are some of the largest conferences in the industry). With the added benefit that not only is it an opportunity to talk to and network with (and perhaps to commiserate with) fellow advisors using the same platform, but it also is an opportunity for the advisors on those respective platforms to see the latest services and capabilities their platforms are rolling out, hear what senior leadership are focused on (or have a chance to ask questions and express concerns), and meet home office staff as well. Not to mention that because advisors with a shared platform tend to have a similar business model and often a similar 'profile' (which makes them a fit for that platform), the other advisors in attendance tend to be reasonably similar and good to network with.

For other advisors, though, their 'home' conference to find community is still via the various membership associations and networks that tend to aggregate commonly situated advisors based on what the organization stands for or is focused on, from the FPA National conference for CFP professionals to the NAPFA National conferences for fee-only RIAs, or more niche communities like the FPA NexGen Gathering (for younger advisors), Kingdom Advisors (for Christian faith-based advisors), the Alliance of Comprehensive Planners (for tax-centric advisors working on retainer), Garrett Planning Network (for hourly financial advisors), or XY Planning Network (for advisors offering financial planning under a subscription or other fee-for-service model). And as noted earlier, the AICPA Engage conference and its associated AICPA Personal Financial Planning (PFP) section provide a unique home for CPA financial planners in particular.

In turn, the rise of vendor conferences is also creating a new kind of 'home' community conference, at least where the technology platform tends to form a major 'hub' around which the advisor's practice is built. Examples include the Envestnet Advisor Summit, Orion Ascent, and eMoney's Advisor Conference. Which again offers opportunities for good networking (advisors using similar systems tend to share other commonalities that give them good chances to share best practices), as well as opportunities to hear the latest and greatest from their vendors and key leadership.

And so for advisors who otherwise aren't certain what conference to attend in 2024, there's no place like Home as the conference of choice. Or alternatively, multi-advisor firms may wish to divide and conquer, with one advisor going to their Home conference and another going to something new for 2024!?

So what do you plan to attend? Do you have any conference favorites that I didn't include in the list? Please share in the comments section below!

Disclosure: Michael Kitces is a co-founder and partner of the XY Planning Network, which operates one of the "best conferences" on this list.

Top Advisor Conference Badge:

You can embed a badge for your conference website or marketing materials using the following:

Copy the embed code below:

Leave a Reply