Executive Summary

While much has been written about the disruptive “threat” of the robo-advisors, the reality is that even after several years, their market share is still a miniscule fraction of 1%. Robo-advisors have had limited success, even in areas with little or no head-to-head competition against traditional financial advisors, like working with Millennial clients.

In fact, the struggles of most robo-advisor platforms have been so significant, they’ve been increasingly pivoting to work with established financial services firms, or to become available to individual financial advisors, in the hopes that such partnerships will allow robo-technology firms to gain the volume and scale they need to succeed.

Yet the caveat is that individual financial advisors rolling out web-based “robo” tools to reach Millennial clients will probably be even less successful than the pure robo-advisors have been! After all, the challenge of client acquisition costs is equally difficult for human advisors as it has been for robo-advisors, yet most existing advisory firms are even less attuned to the challenges of how to effectively execute a digital marketing plan!

Ultimately, this doesn’t mean that “robo-advisors-for-advisors” solutions will be worthless for all, but the key point is to recognize that advisors who want to serve Millennials must start by crafting a service model that is actually relevant and valuable for Millennials, have a means to market to Millennials, and then add a robo-technology solution on top to aid with the implementation. Advisors won’t be able to “out-robo” a robo-advisor; at best, the opportunity is to leverage robo-advisor technology as a part of a broader holistic service offering for Millennials, where advisors can focus on their strengths, and use technology to improve the efficiency of the process... but only for advisors who can solve the marketing challenge first!

The Real Marketplace Challenge For Robo-Advisors

In the first iteration of “robo-advisor” platforms, companies like Wealthfront and Betterment professed that they would disrupt the financial services industry by replacing human advisors with low-cost efficient technology, at a price point around “just” 0.25%/year (when the traditional rule-of-thumb for human advisors is a 1% AUM fee). The concept was relatively straightforward – technology could do “what advisors do”, but cheaper, and consumers would flock to the “superior” low-cost solution.

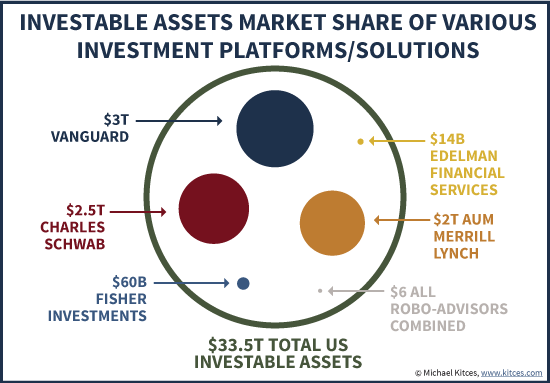

Yet the reality that quickly became apparent is that true robo-advisor platforms are rarely competing head-to-head with human advisors. Instead, their clients were far more likely to be those currently unattached to any advisor, whether a “do-it-yourselfer” who liked the robo-advisor tools, or a Millennial who didn’t have enough assets to meet the minimums of many advisory firms (and didn’t know where to find advisors who would work with them). Accordingly, robo-advisors pursued these channels, from Betterment’s paid affiliate program for personal finance bloggers (often targeting Millennials), to Wealthfront’s CEO doing seminars for Millennial tech employees at companies like Facebook and Dropbox. And as a result, in an investable assets marketplace that Cerulli estimates to be over $33.5 trillion, the combined assets of pure robo-advisors Betterment, Wealthfront, and FutureAdvisor together (about $6 billion of AUM) is less than a 0.02% market share!

Except the challenge that has arisen for robo-advisors is that reaching investors is difficult. When it comes to Millennials in particular, the account sizes are more modest than (older) clients of traditional advisors (according to their Form ADV, the average account size at Betterment is only about $25,000). And at a 0.25% price point, it’s difficult for the company to grow and scale, generating only $25,000 x 0.25% = $62.50 of annual revenue per client. Even aside from the cost of overhead, development to build the platform, and staff to service the business, just the client acquisition costs alone can be prohibitive at $62.50/year of client revenue! For instance, Betterment’s affiliate program was giving up 60%-80% of first-year revenue as an affiliate commission in the hopes that the acquisition cost might be borne out by the lifetime client value with recurring AUM fees!

Notably, the challenge of client acquisition costs is not unique to robo-advisors, though. In fact, the reality is that much of the “high” price for financial advisors today is not actually driven by the cost to deliver advice, but the cost of client acquisition to get advisory clients! After all, the whole source of the popular 1% AUM fee is the 1% trailing commission on mutual funds, which itself was simply a levelized version of the up-to-8% commissions that were once paid by mutual fund companies to their salespeople to distribute the products. In other words, historically, compensation to “advisors” from clients wasn’t actually to pay for their advice at all – they were salespeople, and the compensation was a sales distribution charge of the investment manager, paid to the [advisor] salesperson; ironically, the actual delivery of advice only came about in the past few decades, and simply got attached to the existing payment-for-investment-distribution infrastructure!

But from the perspective of a robo-advisor trying to “disrupt” the industry, the key issue is that the companies misunderstand the problem of the marketplace: making “advice”/advisors lower cost for consumers was not about how to be more operationally efficient than traditional human advisors (although automating a client onboarding process electronically as robo-advisors does certainly help a little), but how to market and distribute their investment management services more “efficiently” and scalably to allow a lower price point!

In other words, what robo-advisors have begun to learn the hard way is that the “if you build it [with technology], they will come” philosophy just doesn’t work in the world of investment management and financial services.

The Growth Of Robo-Advisor Solutions For Advisors

Given the distribution challenges that robo-advisors face – how to cost-effectively acquire a large volume of clients when their price point is so low it’s difficult to compete against larger, more established brands (especially when branding is so crucial in the sale of an intangible service in a low-trust industry!), it’s not entirely surprising to see that a growing number of robo-advisors are experimenting with or entirely shifting from a direct-to-consumer (B2C) model to one where they work with other existing advisors or established financial services firms instead (a B2B model, or a B2B2C model where other businesses use the “robo” technology to serve their own clientele).

Thus, last fall Betterment launched its “Betterment Institutional” partnership with Fidelity and then expanded the Institutional platform to work with any/all financial advisors. Motif began to experiment with a Motif Advisor solution for advisors. JemStep launched its “Advisor Pro” solution, and began taking on high-profile advisor partnerships (including with the RIA taking referrals from the recent Tony Robbins book). And just a few weeks ago, SigFig also announced it was looking to partner with existing financial services firms (in particular, big banks) to monetize its robo solution. (And of course, this ignores all of the “robo-advisor” platforms that simply launched directly or switched almost immediately into the B2B channel, from UpsideAdvisor to Trizic.)

Given that robo-advisors were trying to solve the “wrong” problem (operationally efficient technology with an insufficient marketing/distribution plan), these pivots are entirely logical. For large financial services firms that already have size, brand, and marketing clout (not to mention existing client volume), the incremental operational efficiencies that “robo”-technology can offer really are relevant, as even a tiny operational cost savings per client matters a lot across a large financial services enterprise. At the same time, the pivot also gives these robo-technology platforms “instant” access to a high volume of clients, allowing them to potentially scale their distribution in one fell swoop with a big enterprise partnership.

Except when it comes to individual advisors adopting robo-advisor technology, the benefits are not necessarily so clear…

The Problem With Financial Advisors Trying To Benefit From Robo Technology

From the advisor’s perspective, most “robo” technology tools ultimately amount to little more than a portfolio management system that allows advisors to create models and rebalance to them (similar to many existing rebalancing software tools) and provide performance reporting, paired with an online onboarding process that allows prospective clients to complete the new-account (and transfer/funding) process digitally.

Given industry surveys showing that barely 50% of advisors have yet adopted rebalancing software, and that virtually no custodians or broker-dealers are capable of a fully digital on-boarding process for new clients and their accounts (instead still requiring various hard-paper documents with “wet ink” original signatures), these technology enhancements do represent a non-trivial operational improvement for many individual advisory firms.

Except, similar to the direct-to-consumer robo-advisor platforms, individual advisors have no way to actually scale these solutions because they don’t have a sufficient volume of new clients coming in the door to make it all that beneficial in the first place! In fact, given that Betterment at least has 100,000 clients (and Wealthfront has about 31,000 according to its latest Form ADV), while the typical financial advisory firm manages no more than 20-40 clients per staff member, arguably human advisors using robo technology are even less effectively positioned to actually leverage the value of the technology!

And the situation is especially acute when it comes to using robo-technology tools to reach Millennials. Arguably, almost any advisory firm could benefit by systematizing its investment process, adopting models, and using rebalancing software of some sort (whether as a part of a “robo” platform, or one of the many standalone rebalancing solutions). But when it comes to the “excitement” about having an online onboarding tool that advisors can put on their website to cost-effectively gain Millennial clients, once again “If you build it, they will come” just doesn’t work.

Why Robo-Technology Will Fail To Solve The Millennial Gap For Most Financial Advisors

In the world of digital marketing and growing an online business, whether it is a software company or an investment management solution, in order to get new clients it’s essential to have a good sales and onboarding process. The website must make a good first impression, and do a compelling job of conveying the service, in a manner that looks credible and trustworthy, to “convert” a visiting stranger into a client. And then it must provide an onboarding process that is both efficient for the business and a good experience for the consumer. In this regard, robo-advisors have arguably done a good job of conveying their services and onboarding their clients in a compelling manner.

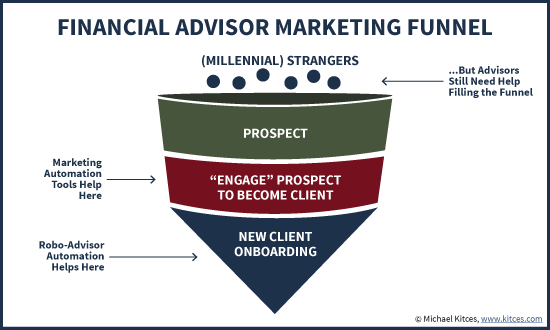

Yet the caveat is that it’s not enough to have a great website that conveys the value of the service and easily onboards new clients, if there isn’t anyone visiting the website to check out those potential [investment or other] services in the first place! In other words, even if you have a website that does a great job converting strangers into prospects and prospects into clients, it doesn’t matter if there’s no strategy to bring in a high volume of traffic to go into the top of this marketing funnel in the first place!

And this, in particular, is exactly where most financial advisory firms are already failing today! As this year’s T3 Advisor Technology conference showed, there are a growing number of marketing automation tools to help engage prospects on the website to become clients, and “robo-advisor” tools to help smoothly onboard those clients, but until advisors solve the top-of-the-funnel marketing problem, it’s all a moot point anyway!

Or viewed another way, even if robo-advisor tools for advisors do an amazing job of allowing prospective clients to turn themselves into actual clients via a website, it still won’t matter if there are no prospective clients visiting the advisor’s website in the first place!!

For instance, if a small advisory firm manages to attract 200 unique visitors to its website every month, and can successfully convert 0.50% of them into clients every month (and of course, in the real world a big chunk of those 200 are probably already existing clients!), the firm will add one new Millennial client per month. At a “typical Millennial” account balance of $25,000, this means over the next 18 months, the advisory firm would bring in… a whopping $450,000 of AUM. And a robo-style price point of 25bps (after all, the advisory firm isn’t offering any additional advisory services or other unique value-add to justify charging more?), that amounts to just $1,125 of annualized revenue in the firm’s “robo” Millennial model by the start of 2017!

Even if the firm has 1,000 unique visitors per month, at a 0.50% conversion rate, the firm will add only about 5 new clients a month, or about $125,000 of AUM per month, or $312/month of new revenue. While that’s a slight improvement, it’s still a relatively slow growth rate compared to the size of an advisory firm that can generate such web traffic.

And that assumes that 0.50% is a realistic conversion rate in the first place. Notably, when popular financial advisor bloggers launched a “robo” platform for their sites, which gather more than a million pageviews a month, they’ve still “only” been reporting new asset flows of $500,000 - $1,000,000 per month (with an average account size of $37,000)… which amounts to no more than one or two dozen new clients per month, and means the conversion rate for their readership is not 0.50% but more like 0.001%! At that rate, an advisory firm with 1,000 unique visitors per month would be lucky to even see one new Millennial client in a year.

In other words, the core problem to a digital marketing strategy is that it requires a very high volume of traffic (likely 10X, 100X, or 1,000X the traffic of a typical advisor’s website), and a continuous refinement process to improve the rate at which site visitors are converted into clients… in a world where most financial advisors have never even installed Google Analytics on their websites to know what their traffic is in the first place (much less refine or improve upon it). And of course, as the direct-to-consumers robo-advisors themselves have discovered, at the typical account size and revenue of Millennials, the costs to generate the necessary website traffic to get clients can be so expensive that the business model itself is barely viable at best (and at the least, requires significant infusions of [venture] capital just to have a chance to sustain in the future!).

Where Robo-Advisor Tools Will Matter In Helping Financial Advisors To Work With Millennials

In the end, the fundamental problem with human financial advisors adopting robo-advisor tools as a means to reach Millennials is that there’s simply no realistic way an existing advisory firm will “out-robo a robo-advisor”. An existing advisory firm’s infrastructure is not built to support a self-directed robo-for-Millennials solution, nor are most advisory firms ready to invest the capital necessary to build a large enough digital marketing platform to make it viable given the low robo-investment-management price point and high client acquisition costs. And even if they did, at that point they’d simply be reinventing a head-to-head competitor against robo-advisors who now have far more [venture] capital and a multi-year head start.

Accordingly, the reality is that if advisors want to really serve Millennials effectively, the key will be to build a higher-value, higher-price-point solution that is unique and differentiated from robo-advisors. In other words, don’t use a robo-platform to try to out-robo a robo-advisor; use it as a part of a broader, more holistic financial planning solution specifically for Millennials, of which investment management is only a small part.

In point of fact, this is why our own XY Planning Network decided to form a partnership with Betterment Institutional earlier this year. Not because XY Planning Network and its advisors hope to beat robo-advisors at their own game. But because the advisors are focused on financial planning as their core value proposition, and get paid for it separately (typically through an ongoing monthly retainer fee), and the implementation of investment management is just a supplemental implementation convenience for clients (for which the advisors typically take a less-than-1% AUM fee to function as support and service for the account, not the “investment guru”). In this context, using a robo-advisor platform – especially one like Betterment Institutional which has no separate transaction fees for each new deposit/investment, which can be deadly for new investors will small accounts – is highly appealing, as a way for such advisors to implement that investment process for Millennial clients at a low cost.

The key point here is that by building a financial-planning-centric service for Millennials, these advisors have the opportunity to create an ongoing financial planning service model that is actually relevant to Millennials, where the focus is on annual budgeting, managing credit card and credit debt (because many have more debt than assets!), human capital advice (e.g., career coaching and salary benchmarking), reviewing employee benefits, etc. In this context, investment management is just one of a wide array of planning services offered, albeit one where the advisor can actually aid in the implementation.

This model is a stark difference in how most established advisory firms are trying to approach the Millennial generation today, where a baby-boomer-centric firm decides to start doing client events and outreach to the children (and grandchildren!?) of their current clients, in the hopes of managing the client’s pot of money for the next generation after the client passes away. This is a strategy I suspect will be of very limited success, because the reality is that most Millennials will quickly realize the firm isn’t actually built to deliver services relevant and valuable to them, and instead is simply trying to reach them in order to keep their parents’ money!

Ultimately, though, the bottom line is simply this: for financial advisors to really reach Millennials, they need to craft and offer a service and solution that is truly relevant and valuable for Millennials. Trying to “out-robo a robo-advisor” will not be the winning solution – as advisors don’t have the brand, marketing capabilities, or capital to compete head-to-head with venture-capital-funded technology companies – and just adding on a self-service robo-technology platform to an existing advisory firm website with little or no traffic will not realistically be a success either (though there are reasons why advisors might consider robo-technology to gain efficiencies in other parts of their practice!). Nor will it be effective to just roll out a web-based "robo" solution to the children of current clients, who will not likely be very interested in a firm that clearly isn’t actually interested in them (just their parents’ money). Ultimately, serving Millennials effectively will be about creating financial planning service and delivery models that are truly relevant for them… and at that point (and only at that point!), robo-technology finally becomes a remarkably effective means to help those clients on the path to success!

So what do you think? Will robo-advisor tools for advisors really help us to serve Millennial clients more effectively? Or will it a re-crafted service model for advisors to really attract and be relevant to the next generation of clients?

Disclosure: Michael Kitces is a co-founder of the XY Planning Network, which was mentioned in this article.