Executive Summary

Welcome to the August 2024 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

This month's edition kicks off with the news that Orion and Riskalyze have both announced that they are "unbundling" several key components of their previously all-in-one offerings, highlighting how, after more than a decade and hundreds of millions of dollars of investment into building all-in-one solutions, providers may now be finding that approach to be too restrictive for their own growth – since in reality, many advisors would rather 'just' buy the individual parts they want (instead of needing to buy the whole package)!

From there, the latest highlights also feature a number of other interesting advisor technology announcements, including:

- Envestnet has announced that it is being acquired and taken private in a $4.5 billion dollar deal with Bain Capital after more than a decade of building and buying tech solutions to compliment and amplify its asset management marketplace core – only to find that assembling a whole that's worth more than the sum of its parts turned out to be a bigger challenge than expected (and even more so at the scale of an asset management business)

- Altruist has announced the launch of two new features to its custodial platform and technology suite: A high-yield cash management account offering 5.1% APY, and a tax loss harvesting tool for which it will charge advisors 10bps for accounts using the feature – which perhaps highlights how custodians are finding ways to layer on more direct "platform" fees as the flaws of traditional "indirect" revenue sources like cash sweeps have been increasingly exposed as of late

- Powder, which makes an AI-enabled client document parsing tool to reduce the work for advisors of reading through investment account statements and estate planning documents, has announced the completion of a recent $5M seed funding round – but in light of the success of tools like Holistiplan (for tax returns) and VRGL (for investment statements) that have each honed in on one specific use case, the question is whether Powder will similarly find a salient pain point for advisors (that advisors will actually trust technology to handle for them) to build its solution around

Read the analysis about these announcements in this month's column, and a discussion of more trends in advisor technology, including:

- Future Capital has emerged as a new solution for managing clients' held-away 401(k) assets, competing with Pontera (which had previously been the only major player in this space) – though as new regulatory scrutiny of Pontera has emerged that could conceivably extend to Future Capital as well, the big question is whether held-away asset management tools will need to significantly amend their technology and business practices to comply with regulation, and if so, how that would affect the cost and the value of the services they provide

- RISR, a new tool designed to make it easier for advisors to engage with business owner clients by enabling basic business valuation and analysis, has announced a $1.5M pre-seed funding round, highlighting the desire for tools that can demonstrate an advisor's value for business owners for whom what really matters has less to do with traditional investments and more to do with growing (and eventually a successful exit from) their business

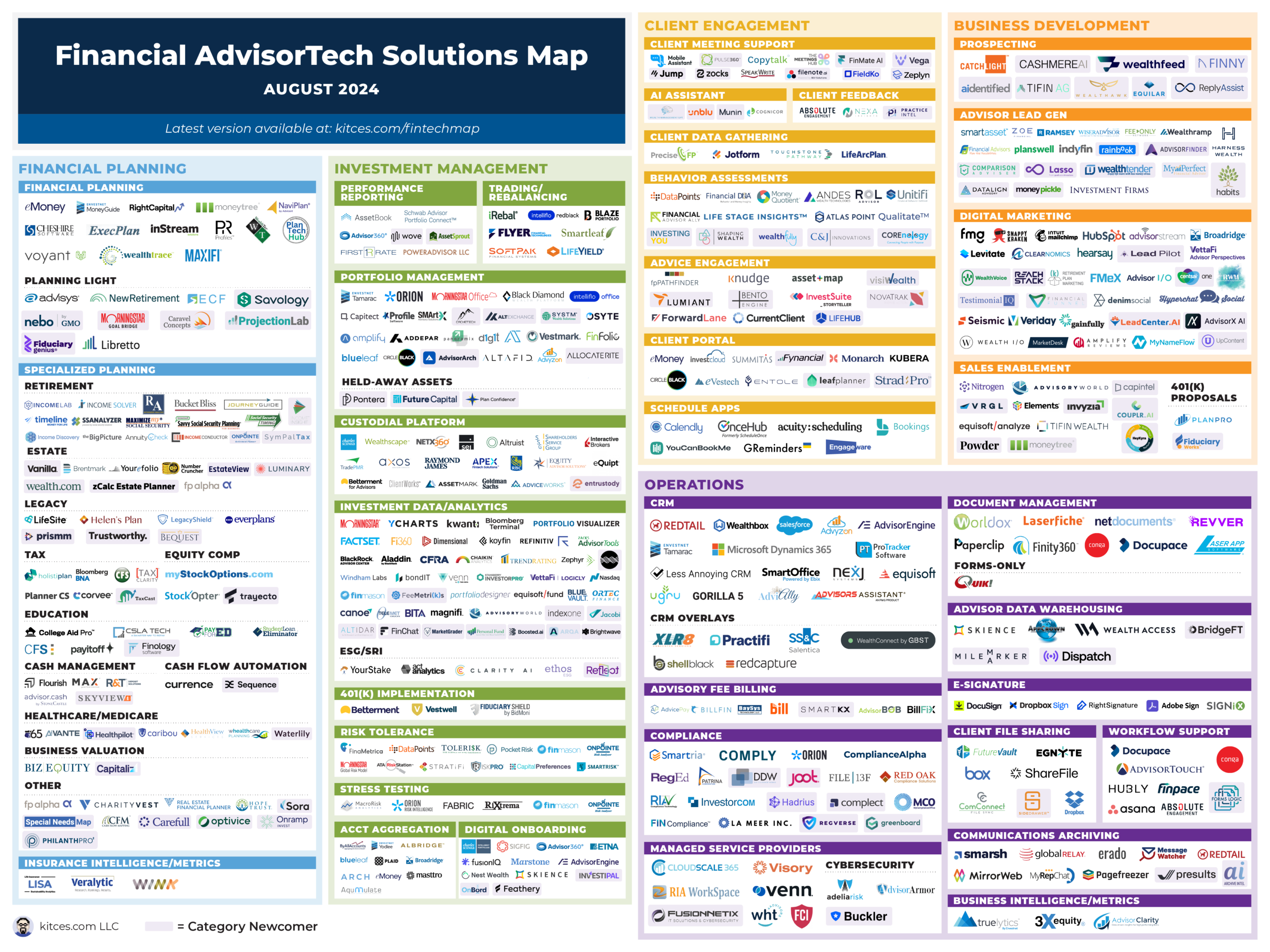

And be certain to read to the end, where we have provided an update to our popular "Financial AdvisorTech Solutions Map" (and also added the changes to our AdvisorTech Directory) as well!

*And for #AdvisorTech companies who want to submit their tech announcements for consideration in future issues, please submit to [email protected]!

The "Great Unbundling" Of AdvisorTech Takes Shape As Orion And Nitrogen Introduce A La Carte Offerings

For as long as AdvisorTech has existed, there have been two competing philosophies around how to build an advisor tech stack. On one end are proponents of "all-in-one" solutions, where all of the technology's core components are unified and by definition fully "integrated" together into a single offering; and on the other end are believers in a "best-of-breed" approach where advisors look for the best individual solution for each component that they need, and try to weave the top solutions in each category together into a functional whole.

The all-in-one side has long maintained that the technologies advisors use (and the data that underlays it) are too complex to solve with a patchwork of integrations, and in a world where data increasingly needs to be efficiently and accurately replicated across an advisor's numerous systems, the most important thing is that it all just works together. At the same time, the best-of-breed proponents argue that it's impossible for a single player to be the best at 'everything', and that it shouldn't be necessary to compromise on the quality by buying anything less than the 'best' standalone provider of each key component of an advisor's tech stack.

At an industry level, the debate between the all-in-one and best-of-breed approaches has swung like a pendulum over multiple decades. In the 1990s, it was impossible to integrate anything unless it was actually built together, and as a result the best technology of the era was all-in-one software found at the largest firms (i.e., wirehouses) with the largest number of advisors, which allowed the firms to effectively amortize the substantial cost of building out the technology across their base of advisors.

The pendulum swung the other way in the 2000s, when the rise of the Internet and APIs allowed software creators to create point-to-point connections with one another, giving advisors the ability to buy the tools they wanted to and still have them talk together as an all-in-one would have. As a result, new technology providers proliferated in this era – which on the one hand, gave advisors far more options to choose from; but on the other hand, led to what became a comically crowded landscape of AdvisorTech solutions. Eventually, the growth of new solutions outpaced the vendors' own ability to maintain an increasing number of integrations between them all, and integration capabilities that had at first been seen as a way for advisors to gain all kinds of new efficiency ultimately became one of their biggest pain points (as evidenced by Kitces Research showing that advisors are less happy with their integrated tech stacks as a whole than they are with each of the individual components).

In the 2010s, then, the pendulum swung back towards the all-in-one approach. Fueled by the entry of venture capital in the AdvisorTech space, a new generation of companies invested into all-in-one solutions, either building them from the ground up (like Advyzon and Riskalyze/Nitrogen) or taking outside capital to acquire components piece by piece and integrate them in-house (like Orion and Envestnet). All told, hundreds of millions of dollars were poured into building and assembling all-in-one platforms, as providers and their investors banked on advisors flocking to solutions that solved the widest breadth of their integration needs.

In the news this past month, however, are the latest signs that the massive investment in one-stop solutions has not provided the returns its investors have hoped for. As notably, both Orion and Nitrogen – two of the largest providers building towards all-in-one platforms – announced that they were repackaging their offerings to substantively unbundle their all-in-one capabilities.

In the case of Orion, it has already previously unbundled its Risk Intelligence (previously Hidden Levers) and compliance supervision software (previously BasisCode) to be available to advisors on an "a la carte" basis, while it now plans to offer its automated trading and rebalancing solution (previously Eclipse) as a standalone tool later this summer as well. Meanwhile, Riskalyze announced that it would be breaking up its solution into 3 main offerings centered around risk tolerance (Nitrogen Risk Center, including proposal generation and client engagement tools), research (Nitrogen Research Center, with investment research and model management), and financial planning (Nitrogen Planning Center, with accumulation and distribution modeling software), while also re-launching the "original" Riskalyze risk tolerance and proposal generation tool on a standalone basis at its decade-ago price of just $99/month.

For advisors who already use these products as an all-in-one as originally intended, these announcements won't necessarily change much: Both companies are still offering various "stacks" that offer discounts for advisors who want the entire bundled solutions together in one. But for advisors who aren't interested in buying everything in the package but only want the key components of each, they now have the opportunities to buy "only" what they want – whether that's a standalone rebalancing tool like Orion Trading or a risk tolerance tool like Riskalyze – without committing to replacing large portions of the tech stack with other tools they may not have wanted to use (and thus resent paying for) and incurring the significant switching costs of a large-scale technology overhaul. In other words, both Orion and Riskalyze can now increase their appeal to best-of-breeders without necessarily sacrificing their appeal to the all-in-one crowd.

Still, the implications of the Orion and Riskalyze news are profound from an industry perspective, since again, these and other companies have spent tens or hundreds of millions of dollars to build and buy their way to all-in-one solutions – only to find that model to be so restrictive to their own growth that they're compelled to break apart the bundle to maintain their trajectory. In its own announcement, Orion even acknowledged that only around 20% of its advisors are actually using any of its fully-integrated "stack" products, which implies that nearly 80% of Orion advisors (who just by using Orion are already at least somewhat predisposed to the all-in-one approach?) simply want to buy the parts of Orion's offerings that they're already planning to use and don't want to be pushed into switching over to use the rest.

Ultimately, though, it seems unlikely that either all-in-one or best-in-breed will be the dominant approach in the long run. As with the rivalry between Apple and Android products, there will always be a consumer (or in this case, advisor) segment that wants their solutions to be curated and packaged into a well-integrated whole, while others prefer to piece together their own preferred combination of solutions. But for an industry that has spent immense amounts of time and energy over the last decade on pounding the table about the inevitability of all-in-one technology, the beginnings of a "Great Unbundling" as signified by the Orion and Riskalyze news highlights the reality that building an all-in-one that is competitive in all categories all the time – or acquiring components to fit together in a way that works at least as well as the sum of its parts – is perhaps far more difficult and expensive than even these mega AdvisorTech companies realized?

Envestnet Agrees To Be Acquired By Bain Capital For $4.5B After Struggling To Become More Than The Sum Of Its Parts?

The emergence of the Internet in the late 1990s coincided with the beginnings of a large-scale shift in the financial advice industry away from broker-dealers compensated on commission to sell investment products and towards RIAs paid on an AUM basis to implement diversified asset-allocated portfolios. Whereas previously buying a stock or a mutual fund had required picking up a phone and calling a broker, the Internet age brought with it the rise of discount Internet brokerage firms that were, as the ubiquitous E*Trade ads trumpeted, "so easy that a baby can use it". And so there was a broad move away from commissions and towards AUM-based advice and investment management, where "self-service" online trading technology was less likely to disrupt advisors' business model.

As AUM-based advisory firms grew and matured, it was only natural for centralized platforms to emerge that would make it easier to build and manage those diversified asset-allocated portfolios more centrally to gain economies of scale, rather than each portfolio being custom-built for each client by each individual advisor. Which led to the rise of Turnkey Asset Management Platforms (TAMPs), along with Separately Managed and Unified Managed Accounts (SMAs and UMAs) – and in turn, to marketplaces for advisors to find such asset management solutions, for which the runaway leader in the 2000s was Envestnet.

By 2010, Envestnet had achieved a dominant market position and had had a successful IPO, and the company began to look at what was next. The increasingly inevitable conclusion was that investment management, and advisory firms overall, would be ever more reliant on technology to drive efficiency and growth – which meant that the most effective way for Envestnet to stay relevant was to move beyond its core asset management focus and towards becoming a technology platform more generally. After all, "marketplaces" themselves were increasingly technology driven, from Amazon to eBay, which meant if Envestnet wanted to be the next generation platform marketplace for advisors, it needed to become a technology hub, too.

Accordingly, Envestnet proceeded to variously build and buy more and more technology to serve advisors both in the broker-dealer channel (with the development of ENV2) and the RIA channel (with the acquisition of Tamarac and later MoneyGuide), interlaced with consumer financial data (with the acquisition of Yodlee). The idea was that combining pieces of technology and asset management distribution into a functioning whole and finding innovative ways for them to work together would create an entity that was worth more than the sum of its parts, and would lead to hyper-accelerated adoption of their marketplace (akin to Airbnb or Uber's explosive marketplace growth).

The caveat, though, is that as big as the market for advisor technology is, the economics of software-as-a-service are still dwarfed by the basis points-based asset management model. Which made it difficult for Envestnet to sufficiently monetize its technology acquisitions on their own terms, and steered the company to try to create more and more marketplaces embedded within its tech solutions, expanding beyond asset management into developing markets for annuities, insurance, lending, and trust solutions, all in an attempt to create more avenues through which to drive advisor purchases of products their clients might need, via Envestnet's technology platform.

However, as many all-in-one providers have learned, it's hard to sell advisors on a complete package solution, even when it includes popular, best-in-class software (as both Tamarac and MoneyGuide were considered to be in the 2010s). And even if advisors didn't necessarily flock to Envestnet's software options to rapidly scale its SaaS software fees, it could still get an arguably even better return on its technology investments if they had delivered exponentially more sales through its marketplace offerings… but that uptick didn't materialize at the anticipated pace, either. And so in recent years Envestnet has encountered stagnation and decline in its stock price, increasing pressure from activist investors, and the departure of its CEO and co-founder Bill Crager.

And now, as was announced last month, Envestnet will be seeing a change of ownership, as the company has agreed to a $4.5 billion take-private deal with Bain Capital. Notably, the $63.15 share that Bain is paying represents only a small premium over the current share price, is nearly 30% lower than the 2020 peak price of $89.04, and is only barely 10% higher than its nearly-$57 share price it had 9 years ago, back in 2015 before it began its slew of late-2010s all-in-one-oriented acquisitions.

The big industry question around the acquisition is what exactly Bain plans to do with Envestnet strategically from here. The company's longstanding public struggle has been around how to gain synergy and deeper integrations to drive more significant user and revenue growth within its tech platforms, and especially to its asset management and other marketplaces (where it earns the bulk of its revenues and profits), and so the leading theory is that if Envestnet can't drive asset-management-marketplace levels of ROI on its technology, then it will divest at least some of its tech components to refocus on its core marketplace business. Which could augur the potential divestiture of Yodlee (the account aggregation solution that Envestnet has long struggled to monetize effectively) as well as more popular independent advisor platforms like MoneyGuide and Tamarac. And given reports that Bain is financing its acquisition with a multi-billion dollar slice of debt, it would make even more sense to consider selling off some of Envestment's less profitable divisions to pay down that debt after the deal closes.

For advisors, it's always reasonable to worry about the fate of technology they're using when a provider's parent company is acquired, and rumors of divestiture or spinoffs abound. However, it's notable that Envestnet's advisor technology platforms are still financially sizeable lines of business, with many tens of millions of dollars in revenue, and consequently there isn't any realistic risk that Bain would choose to simply shut them down. Rather, they would more likely be sold off to a private equity firm that wants to invest into them to add capabilities and grow, or perhaps to another strategic acquirer that has ideas about how to leverage and expand them further (not dissimilar to Fidelity's acquisition of eMoney or TDAmeritrade's purchase of iRebal). In other words, divestiture of MoneyGuide or Tamarac doesn't have to be bad news – in fact, it might even serve to bring waves of new investment into the technology platforms that have likely struggled to get the same level of new investment as a "non-core" part of Envestnet's business.

Ultimately, though, the Envestnet news is yet another striking example of a platform that sought to build and buy its way to an all-in-one solution for advisors, only to have advisors seek out and push towards more "unbundled" solutions when given the freedom to do so. Which is a hard enough challenge to navigate in the software-as-a-service business, but remains even more difficult when trying to do it at the scale of a basis-points enterprise.

Altruist Adds High-Yield Cash Account And Tax Loss Harvesting Add-On, Foretelling A Shift Away From (Client-Paid) Indirect Revenue Towards (Advisor-Paid) Platform Fees?

A unique phenomenon of the RIA marketplace in the U.S. as compared to all other countries with independent advisors is that RIA firms don't need to pay a "platform fee" to access most of the core custody and clearing services they need to manage their clients' investment portfolios. While various types of platform fees are common in the broker-dealer world (whether indirectly in the form of payout grid cuts or as a direct payment of 10-30 basis points for an investment platform), RIAs are typically able to start doing business with 100% of their revenue once they have assets on the custodial platform.

Of course, the custodial platforms don't give away their services for free. Instead, they generate revenue by indirect means that come from the underlying assets that clients hold on the platform. Even now that trading ticket costs are mostly a thing of the past, custodians still make money via revenue sharing with mutual funds, payment for order flow, margin interest, proprietary funds, and perhaps the biggest moneymaker of all (especially in the current high interest rate environment), net interest earned on cash sweep accounts.

On the one hand, custodians need to generate revenue somehow, and at least in theory, earning it indirectly via client assets as opposed to charging advisors outright might add up to the same thing in the end, since if clients didn't "pay" through their own investments they might still end up paying by other means as advisors pass on the cost of a platform fee in the form of higher advisory fees. But on the other hand, custodial platforms generating the majority of their revenue from cash sweeps gives rise to practical challenges that make it less than ideal for advisors and their clients.

For one thing, as interest rates have risen overall, customers have grown more sensitive to having cash in an account that isn't generating much yield, while electronic banking (and third-party apps like MaxMyInterest) have made it much easier to transfer money around to chase the highest yield. And as advisors themselves have increasingly grown aware of the profits earned by custodians on cash sweeps, they've made more of an effort to keep clients' funds fully invested, and to recommend any excess cash be moved into a high-yield savings or cash management account. All of which has reached something of a breaking point recently, with a wave of firms announcing repricing of their cash sweep accounts (including Wells Fargo, Morgan Stanley, and Charles Schwab) to entice clients to keep their cash on-platform, as well as a lawsuit against LPL for its own cash sweep practices.

The alternative to indirect revenue sources like cash sweeps, of course, is simply for custodians to charge a direct platform fee to replace them, while offering lower-fee funds, waiving ticket charges where they do exist, lower margin on interest, and higher rates on cash. All told, the fee would likely need to be from 10-15bps per year to make up for the lost sources of indirect revenue, i.e., the amount they make from cash sweeps, revenue sharing, margin interest, and all the rest.

Against this backdrop, there were two notable recent announcements from Altruist, the newest major RIA custodian competing for market share with the "Big 2" of Schwab and Fidelity.

First, back in March the custodian launched a new high-yield cash account that currently offers a 5.1% APY – which is notable because Altruist itself earns revenue on cash sweeps that would presumably be reduced by a new, competing cash product (although it's certainly possible that cash sweeps aren't a big enough revenue source for Altruist for the new feature to substantially affect the firm's margins).

The second and more recent announcement is that Altruist is rolling out a new tax-sensitive investment feature, dubbed TaxIQ, that features an add-on tax loss harvesting feature, for which Altruist will charge advisors 10bps per year on taxable accounts that use the feature (unless the advisor uses Altruist's model marketplace, in which case the feature is free). Which on the surface is simply a new value-add feature that Altruist is making available for advisors who want to pay for it. But in practice – being a feature that few advisors would likely not want to use, given how embedded tax loss harvesting is in other portfolio management software like iRebal – looks more like a way for Altruist to add a layer of fees onto its custodial offering, at least on the taxable accounts to which it applies.

These two developments are each notable on their own, but when looking at them together, a new picture emerges: Altruist made one move that could potentially reduce one of its indirect revenue sources from clients (by offering a competing cash product to its sweep program), and then shortly afterward it made another move that will create a new direct revenue source from advisors (by launching, and charging for, a new tax loss harvesting tool) that makes up for the loss of the indirect revenue.

The introduction of the tax loss harvesting feature does set up an interesting decision for advisors. For those who already do tax loss harvesting (e.g., with a tool bundled into other portfolio management software or manually through review of client portfolios), the feature could be seen as primarily a time savings and convenience tool for the advisor, for which the 10bps fee would logically be a cost absorbed by the advisor in exchange for better leveraging their time on non-portfolio management tasks.

But for those who don't do already any kind of systematic tax loss harvesting, the feature is more about added value to the client in the form of creating new tax savings on their investments – which means the cost could conceivably be passed on to the client to the extent that the feature can generate tax alpha above and beyond 10bps. So for some advisors, it might make more sense to "eat" the 10bps fee, while for others, it might be more logical (and justifiable) to pass it on to the client, depending on whether the advisor was already doing tax loss harvesting for "free" to begin with.

In both cases, however, the 10bps fee might seem a little excessive on its own: For an advisor that charges 1% on AUM, it's doubtful they would want to spend effectively 10% of that revenue on each taxable account to save what might amount to a few hours per year spent on tax loss harvesting. And passing on effectively a 10% fee increase to the client might not be palatable either, especially if the advisor has already been providing tax loss harvesting for free in the first place. In which case, maybe splitting the fee – 5bps for the advisor, and 5bps for the client – is the best way, since at least in theory both advisor and client get some value out of the tax loss harvesting feature. And of course, the tool is "free" on funds through Altruist's model marketplace – although that shifts it back into the realm of indirect fees that are ultimately paid by the client, and all the conflicts that present. In that case, should the advisor reduce the client's fee by 5bps to reflect the value the advisor is getting from their "free" use of the tax loss harvesting tool?

There may be no "right" answer in all of this, but it all serves to highlight the murkiness around who benefits from (and conversely, who pays for) services and technology in the asset management realm. From a pure software standpoint, the technology that many advisors already use to implement rebalancing and tax loss harvesting (like Orion and Black Diamond) charge traditional SaaS fees that add up to nowhere near 10% of revenue. Whereas, for instance, Schwab offers iRebal, which can automate tax loss harvesting for "free" to all advisors on its platform (with the cost of offering the tool being more than made up through cash sweep revenue on the back end). Altruist, by contrast, looks to be offering tax loss harvesting not as a "loss leader" a la Schwab, but as a way to supplement its custodial revenue (and perhaps be able to offer more competitive features on the client side, such as a high-yield cash account).

So the real question going forward is whether the majority of custodians will continue to profit mainly from clients' underlying assets, or whether they will start to charge platform fees (which after all, is what they do in the broker-dealer channel and in every other country). And if the future will be all about platform fees, will custodians simply charge straight basis points for custody to get the 10-15bps they need, or will they, like Altruist, instead make up the cost through tech add-ons like tax loss harvesting, model marketplaces, or other capabilities?

Powder Raises $5M For Its AI-Enabled Document Scanning And "Enrichment" Tool

The stories of peoples' financial lives are told in the documents that are generated continuously as time goes by. From the steady monthly or quarterly cadence of bank and investment statements to the annual pile of tax filings to the more sporadic updates like insurance policies and estate documents, people develop a long digital or physical paper trail that, when viewed together, traces the shape of their financial picture. And so when a financial advisor works with a new client or prospect, one of the first steps in the process is usually to gather up this trove of financial documents to get up to speed on their financial status and identify key issues or planning opportunities.

Historically, reviewing documents was a manual process that involved poring over actual paper documents – in organized binders if the advisor was lucky, but all too often piled haphazardly in a shoebox consisting of whatever papers the client could find around the house. More recently as peoples' financial lives have moved online, it's become easier to share and organize digitized versions of clients' financial documents; however, the need has still remained for advisors to look at everything themselves to find the key pieces of information, which means that getting familiarized with the client's financial situation might still entail numerous hours of document review as part of the "data gathering" process.

But in just the last few years, technological advancements have allowed for much more automation of the document review process. Optical Character Recognition (OCR) technology allows a computer to "read" text from digital documents, and several tools in the AdvisorTech world have applied OCR capabilities to the specific document types that advisors commonly review, including Holistiplan for tax returns; FP Alpha for tax, insurance, and estate documents; and VRGL for investment account statements. In each case, the technology scans digitized versions of the client's documents, and is trained to find and pull out the key pieces of information into a standardized report. Which all told gives the advisor at least a high-level summary of what's in the documents in a small fraction of the time, and can highlight areas where the advisor might need to dig in for a closer look (so that time actually spent reading document details is more targeted and efficient).

In this vein, it's notable that Powder, maker of a document-scanning tool for scanning and analyzing clients' investment and estate documents, announced this month that it has raised $5 million in a recent seed funding round.

For advisors, Powder is one of a growing number of tools that seek to expedite the document review process, which in Powder's case aims to cover both account statements, and estate planning documents. Notably, beyond simply scanning for existing information on documents like bank and brokerage statements, Powder also includes an AI element that it uses to fill in missing information (e.g., missing ticker symbols from an investment statement) or augment existing information, which could also make it useful as a tool to standardize and "scrub" client data for export into the advisor's other software. The AI component is also what enables Powder to parse estate planning documents – which unlike investment account statements, are highly unstandardized, written in paragraph form, and require significant expertise to understand from the prose and legal-ese what is actually being described.

Yet the breadth of document types that Powder aims to analyze raises the question of how, exactly, a tool like Powder would conceivably fit within an advisor's practice. As it's one thing to use technology to quickly scan and summarize a stack of investment statements – nearly all advisors need to do this type of review anyway, and it's easier to get comfortable with the technology when it can be easily cross-checked against the standardized statements it's summarizing, especially when data around investment holdings is already heavily standardized with names and ticker symbols. But it's another thing entirely to rely on software to parse a client's will and/or trust documents, which can get so complex that not all advisors do it in the first place, and those that do often need specialized training for themselves to learn how to navigate legal documents… which means they might be hesitant to trust technology to accurately capture every detail of legal complexity (to the extent that they may ultimately end up doing their own pass of the documents after the software is done, just to make sure it got everything right, resulting in little or no actual time savings). For the specific subset of firms that do both types of document analysis (and can entrust technology to handle both), the time savings of a tool like Powder could be substantial, but firms that would only use it for one document type or the other might find Powder's $500-per seat monthly subscription rate more expensive than they're willing to pay for the time savings it would create (particularly if the estate document reviews don't actually save much time because the advisor still has to review them?).

Still, the news of Powder's recent seed round speaks to the emerging demand for tools that can reduce the amount of time advisors spend on sorting, reviewing, and summarizing client documents in the data gathering process. Other tools have found success by honing in on a particular advisor pain point or use case – e.g., creating client-friendly summaries of key tax information (like Holistiplan) or visualizing the client's current investment proposal to generate a proposal (like VRGL) – which have given them the advantage of significant market share among what are still fairly few competitors. Which means that the big question going forward will be what other pain points are out there for a tool like Powder to solve, whether that's the completion and standardization of client account data, the distillation of complex estate documents – or some other iteration that we have yet to see?

Future Capital Emerges As A Competitor To Pontera For Held-Away 401(k) Management

Historically, there has long been something of a barrier between the custodial assets that clients pay advisors to manage and the assets in their employer-sponsored retirement accounts like 401(k) plans. This wasn't much of an issue traditionally, since more often than not clients would hire an advisor when they were nearly retired or had already done so, and they were free to roll over their employer account into an IRA. However, as the demographics of advisory clients have skewed younger in the last 20 years towards people who are still working and saving (and therefore "locked in" to their current 401(k) plan for the foreseeable future), the barrier between 401(k) and non-401(k) assets began to present more of a challenge to advisors who want to advise holistically on all of the client's assets.

In large part, this was because 401(k) assets, being held on a different platform than the advisor's custodian with no discretionary authority available to trade in the account, couldn't be managed in the same way as a client's other assets. Which first of all meant that that advisors couldn't bill on them as they would the rest of their AUM (since the advisor couldn't provide "continuous and regular" services, i.e., implementing trades on behalf of the client). But even for advisors who were happy to bundle advice on their clients' 401(k) assets in with the rest of the services included in their advisory fee, the lack of any real integration of 401(k) plan providers with the advisor's systems for portfolio management and trading made for an extremely inefficient process of analyzing investment options, recommending trades, and integrating the 401(k) account's investment strategy with the rest of their portfolio.

And on top of all that, there was the challenge of actually getting trades implemented. Without discretionary authority, advisors had two very imperfect ways of implementing trades in clients' 401(k) accounts. Either they could send their trade or rebalancing recommendations to the client for them to handle on their own (which almost inevitably would involve several emails' worth of back-and-forth to follow up and ensure the client actually made the trades), or the advisor could use the client's account login information to log in as the client and make the trades themselves (which not only creates data security issues for advisors storing client passwords themselves, but also opens the advisor up to the risk of being considered to have custody over client assets, and can potentially violate state securities regulations in states that have adapted some version of NASAA's Account Access Model Rule).

In 2018, FeeX emerged (later rebranding itself as Pontera) after pivoting from its roots as a way for consumers and advisors to compare fees across 401(k) investment options to become a tool for advisors to actually manage client's 401(k) accounts (as well as other held-away assets). Since then, Pontera has gained traction as a way for advisors to monitor and rebalance clients' 401(k) accounts while mitigating the security, custody, and compliance issues of collecting and using client login information. For all of which Pontera charges a not-insubstantial fee of 30bps for new accounts – which in part reflects the value of the service it provides (particularly for advisors who decide to bill on their existing clients' 401(k) assets, or who are able to serve new clients who wouldn't otherwise have met the advisors' minimums), but which also reflects the fact that little competition to Pontera has arisen in the last 6 years that could conceivably put pressure on its pricing.

But given Pontera's success it was only a matter of time before that competition would come along, and in June Future Capital announced that it was launching a new tool called Construct which, much like Pontera, allows financial advisors to manage clients' held-away 401(k) assets.

For advisors who do (or want to) manage client 401(k) accounts, there's obvious benefit in having more options to choose from. Obviously having more providers in the market incentivizes each one to keep innovating to improve its product and to keep its prices in check, and there's also more room for advisors to pick a tool that feels right to them from a user interface and functionality standpoint. Notably, though, Future Capital isn't transparent about its own pricing, so time will tell whether a price competition will emerge between the two providers.

Future Capital's rollout also comes at an interesting time, given that regulators in at least two states have issued explicit warnings to advisory firms that the use of Pontera, and "credential sharing" technology more broadly, could constitute a violation of clients' user agreements with their 401(k) plan providers and even "dishonest and unethical" conduct on the part of the advisor – concerns that would almost certainly extend to Future Capital as well if its product functions similarly to Pontera, which could present challenges if more regulators start to scrutinize advisors' held-away asset management.

Nevertheless, it's clear that Pontera's popularity among advisors has been noted by other entrepreneurs in the AdvisorTech industry, and although the field for held-away asset management is uncrowded, it seems certain that more competition will pop up – especially given that, with the expansion of features like employer matches, auto-enrollment, and auto-increase, more and more of workers' assets seem likely to be held in 401(k) accounts, making it all the more valuable to have ways to efficiently and compliantly advise on them.

The big question going forward will be how much ongoing regulatory scrutiny impacts the growth of tools like Pontera, Future Capital, and any other future competitors in the space. It seems likely that those issues will be resolved by data-sharing agreements with 401(k) plan providers, but the increased cost of sharing that data might further increase the cost of held-away asset management, to the extent that it's questionable whether it's even adding enough benefit to be worthwhile – particularly as more and more advisors serve 401(k) plan participants by actually embedding themselves in the 401(k) plan and offering advisory services directly to participants. So while solutions like Pontera and now Future Capital are popular with advisors as a novel workaround to the existing challenges of advising on clients' 401(k) assets, the future market for those tools is highly dependent on not only whether or not regulators will continue to allow the workaround, and whether there is even an ongoing need for a workaround if more options like working directly with 401(k) plan participants come about.

RISR Raises $1.5 Million For Its Solution To Engage With Business Owners On What Matters Most To Them

As advisor coach Mitch Anthony likes to say, money goes into motion when life goes into transition. And for this reason, financial advisors have often sought out clients going through transitions in life, from widows and divorcees to workers transitioning into retirement to executives unwinding their deferred comp plans to business owners looking to exit and decide what to do with their post-liquidity millions. The challenge for many advisors, though, is that in an industry whose roots are built around portfolio management, it's hard to have a compelling conversation with most successful business owners about what the advisor can do for them. After all, their balance sheet is often fully tied up in their own business, meaning they don't just don't have much to talk about when it comes to investment – at the end of the day, they just want to talk about their business and how to make it more successful.

In practice, financial advisors who work with business owners usually work with them as close to end-stage liquidity as possible, and often pursue designations like the CEPA and CExP that can train them on how to talk to owners and navigate potential experts. All so that the advisor can add their expertise and value to the process pre-liquidity, and give them the opportunity to win the owner's assets post-liquidity.

In that vein, it's notable that in the news this month is RISR's announcement of a $1.5 million pre-seed funding round to build out a platform that makes it easier for financial advisors to provide a basic business valuation to business owner clients who might – someday – plan to sell and exit the business.

In the same way that investment proposal tools like Morningstar or VRGL give advisors a starting point for a conversation with clients based on where they are today, a business valuation tool like RISR creates a viable alternative for business owners who are more interested in talking about the asset that matters to them most. Especially if the business owner has never been through a valuation before and might not have any idea what their "number" would be. And perhaps most importantly, going through even a basic valuation may help business owners see for the first time what levers they can pull to increase that valuation before they exit – which positions the advisor who guides them through that valuation as an expert consultant who can help see them through the process. (And for its part, RISR's solution includes features like Quickbooks integration and optical scanning of business tax returns that can expedite some of the data gathering part of the process.)

From an industry perspective, working with business owners requires a depth of knowledge and expertise to provide meaningful advice on maximizing their business's value (the scope of which is mostly beyond the traditional CFP curriculum) to the extent that it constitutes a niche unto itself. And while most advisors aren't themselves valuation experts and won't ultimately provide the valuation that sets the price for what a business can sell for in the marketplace, they can still provide value in giving a valuation as a starting point. Which helps to explain why there are other tools in the business valuation category for financial advisors (such as BizEquity and Capitaliz), which while being useful for advisors who do work with business owners, aren't adopted widely among advisors who don't work specifically in that niche.

In the long run, however, as pressure continues to grow on financial advisors to further specialize and drill down into specific niches, companies like RISR are positioned well to help advisors engage with their clients in terms of what matters to them. Given the size of the businesses involved (which at that level of specialization can range into the tens of millions), the dollars at stake, and the opportunities that come both as the owner works to grow their business and when it's time to sell, the business-owner-advice niche that RISR seeks to pursue would seem to be an attractive one – the only question is how many advisors ultimately decide that going down the long road pursue the specialized knowledge needed to serve business owners is worth the potential rewards at the end.

In the meantime, we've rolled out a beta version of our new AdvisorTech Directory, along with making updates to the latest version of our Financial AdvisorTech Solutions Map (produced in collaboration with Craig Iskowitz of Ezra Group)!

So what do you think? Do the "unbundling" of Orion's and Nitrogen's offerings make them more worth considering than when they were part of an "all-in-one" solution? Who should ultimately pay the cost of a feature like Altruist's tax loss harvesting tool when both advisors and clients arguably benefit from it? Will the addition of a competitor to Pontera meaningfully reduce the cost of providing held-away asset management? Let us know your thoughts by sharing in the comments below!