Executive Summary

The choice of an advisory firm’s custodial affiliation is easily one of its most important business decisions. The advisory firm is the front end of the client relationship, but it entrusts client assets, and key aspects of their service, to a custodian that safeguards the money and provides the underlying platform. And given the logistical challenges of switching between custodians, inertia often leads firms to stick with the same custodian for years or decades, even when a better fit might exist.

Many firms have chosen to work with the largest players in the RIA custodial space, benefiting from their size and scale. But the impending merger of Schwab Advisor Services and TD Ameritrade Institutional will reduce the number of options available for RIAs and force firms currently on TD’s platform either to be subsumed into Schwab’s platform or to switch to an alternative custodian. And while RIAs that take no action might face the specter of being relocated to a custodial platform they didn’t choose, other firms might take a more active approach in considering whether a move to one of a growing number of custodial options might be in their best interest.

In this guest post, industry commentator Bob Veres explores the range of considerations for firms thinking about moving on from “Schwabitrade” or from their current custodian, offering profiles of seven alternative platforms and reviews from advisors currently using them.

As a starting point, advisory firms can evaluate custodians on several levels based on their specific needs, from the cultural fit to their technological capabilities to the customer service a firm can expect to receive by determining whether the platform has a tiered structure where the largest firms get the best levels of service. An additional consideration is whether the custodian has a retail presence, as those without one won’t be competing directly with advisors in the marketplace (and the custodian’s management will be focused on the needs of advisors on the platform rather than spending much of their time trying to bring in more retail business).

Another differentiator between custodial platforms is their pricing structures. While some of the largest platforms may (nominally) offer their service for ‘free’, they still need to bring in revenue somehow (often in the form of below-market-rate cash sweep accounts). Other custodians offer a range of fee options, from ticket charges to flat subscription fees. This optionality can give fee-conscious advisors (and their clients) the ability to choose what makes the most sense for them.

Ultimately, the key point is that a growing number of custodial platform options are available for advisory firms, and the range of unique service cultures, technological capabilities, and pricing structures offers firms the opportunity to find the one that best suits their (and their clients’) specific needs!

[cp_popup display="inline" style_id="147307" step_id = "1"][/cp_popup]

RIA Custodians Featured In This Article:

BNY Mellon/Pershing | Shareholders Service Group (SSG) | TradePMR |

SEI | Equity Advisor Solutions |Axos Advisor Services | Altruist

The choice of an advisory firm’s custodial affiliation is easily one of its most important business decisions. The advisory firm is the front end of the client relationship, but it is entrusting client assets, and key aspects of their service, to the company that safeguards the money and provides the underlying platform.

Why bring this up now? Because an estimated 7,000 RIA firms have between now and Labor Day 2023 to decide whether they and their clients would benefit if they allowed their custodial relationship to be purchased, or if it makes business sense to seek a new relationship on their own. In just over a year (the timeline has finally been set), the former TD Ameritrade Institutional will be absorbed into Schwab Advisor Services.

In just over a year, those advisory firms – and all their clients – will be relocated from Veo One to a newly-revamped Schwab custodial platform, and become affiliated with a custodian that they did not choose to affiliate with initially.

Ironically, many of them originally chose TD over Schwab in the first place because of cultural issues; others because they were deemed ‘too small’ to be accepted by Schwab in their early stages; still others because they preferred TD’s open custodial software platform to Schwab’s more narrowly-focused one.

Meanwhile, a number of larger advisory firms that embraced a dual-custodial approach are going to find themselves moving back to a single custodian.

In many ways, this is a negative consent decision; that is, advisors are informed of the transition, and if they do nothing, then they will be part of the transition. The physics of inertia suggests that most TDAI-affiliated advisory firms will go along and keep their business with Schwab as the acquiring custodian.

Others are waiting to evaluate their post-consolidation service experience before considering a change. “My little firm is going to be swept into that TDA-Schwab transition next year,” one advisor told me, speaking for many. “Frankly, if it wasn’t such a hassle moving hundreds of clients, cost basis, performance data, I would strongly be considering going elsewhere. TDA’s service has been awful in the last 2 years, and if Schwab treats us like a second class advisor since we are under $100 million, we will be seeking a home elsewhere in 2024 or 2025.”

An unknown number of firms, meanwhile, are planning to be proactive about their custody arrangements and are exploring the alternatives.

This article was written for those advisors who are considering a switch. It offers a bit of due diligence on the custodial alternatives they might want to consider. Some readers are likely to be surprised at how much competition is out there, and how popular those competitors are with the advisory firms that are using them.

The interesting truth is that there is no shortage of attractive options for advisors who are looking for a new – or better (at least for them) – custodial relationship. And every firm that decides to shift to one of the alternatives makes the marketplace that much more competitive.

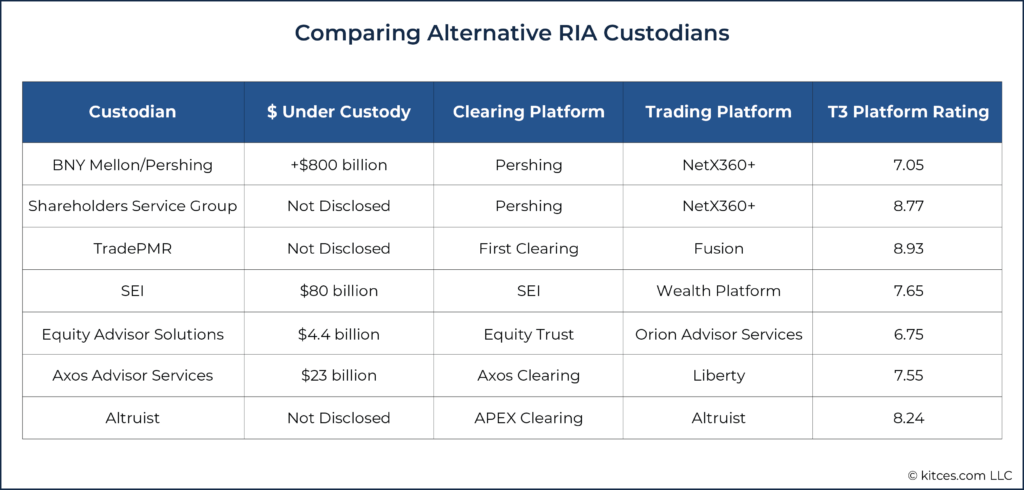

Beyond Schwab itself, and #2 RIA custodian Fidelity, the alternatives range from Pershing Advisor Solutions, which was, even before the merger, the second-largest independent custodial option when measured by its combined RIA and broker-dealer assets for which they provide custody and clearing services, to newcomer Altruist, which (by virtue of its newness) offers the most tech-advanced software platform. There are long-established firms like Shareholders Service Group (SSG) and TradePMR. There is a newer platform created by the SEI organization, and two rejuvenated alternatives: Equity Advisor Solutions (many of whose executives worked at the former Fiserv platform) and Axos Advisor Services, which was purchased by an online banking entity from Morgan Stanley, and was once known as E*TRADE Advisor Services.

In the minds of many observers, the ‘Schwabitrade’ merger that seemed to diminish competition in the RIA custodial space might end up increasing it, by ultimately driving more interest in smaller, more personal custodial platforms, whose scale could rise dramatically in the next year or two.

As you read this article, I invite you to browse through the profiles of alternative RIA custodial platforms, looking for a cultural fit, more advanced technology, or a platform that will give a firm of your size the same service levels that the profession’s largest custodian often only reserves for its largest RIA relationships.

Which firms qualified for inclusion, besides the Big 2 that RIAs already know about (Schwab and Fidelity)? The most obvious differentiator is firms that don’t have any retail presence – another way of saying that they don’t compete directly with advisors in the marketplace.

Advisors who custody with any of these custodians don’t have to worry that the firm is closely studying RIA service and pricing models in order to create a more compelling offer for their own retail clients. Or that decisions are made at the Home Office based on what the executive team thinks will bring in more retail business, and advisors become a bit of an afterthought because they represent a smaller part of the revenue stream.

Each firm included in this report also offers a contrast to the Schwabitrade/Fidelity policy of providing ‘tiered service’ that is highly personal for the largest firms and scales down from there to a phone center for the smallest advisors. The service ‘discrimination’ (is there a better word for it?) at the larger custodians is now out in the open, and while large firms may be happy with it (they are able to negotiate the strongest arrangements for themselves, given their size and assets), and some small-to-mid-sized firms may accept it as a trade-off (in order to access Schwabitrade’s or Fidelity’s platform and resources), as advisory firms increasingly ask more pointed questions, service levels – especially amongst small-to-mid-sized firms – is increasingly becoming a competitive issue. One where many of the alternative RIA custodians highlighted here are explicitly aiming to differentiate themselves with a better offering (which, ironically, was also how TD Ameritrade’s Institutional platform grew and drew market share away from Schwab and Fidelity over the preceding 15 years before it was acquired, too).

BNY Mellon/Pershing: A Menu Of Models

Advisory firm relationships: 700+

$ under custody: $800 billion+

Clearing platform: Pershing

Trading platform: NetX360+

Platform rating in latest T3/Inside Information software survey: 7.05

Website: BNY Mellon/Pershing

Some readers might question Pershing’s inclusion in this report; when you think of ‘alternatives,’ the image that comes to mind is a niche player, and Pershing is one of the three largest custodians in the RIA space by a variety of measures. A different division is the leading custodian in the independent broker-dealer space.

But if an ‘alternative’ is a custodian that offers a different model from the Schwabitrade and Fidelity platforms, then Pershing sits comfortably on this list. Like the others, the company doesn’t have a retail division; nor does it offer tiered service which favors larger RIAs over smaller ones.

Pershing is also different in that it markets to a particular ‘niche,’ albeit a broad one: SEC-registered firms ($100 million AUM and above) that are professionally managed and committed to growth. The RIA custodial division’s average advisor relationship has more than $1 billion in AUM, but not a few of those firms started out in the $200 million range, and took full advantage of the practice management/business consulting services that the firm offers its advisors.

These consulting services are a differentiator. Most custodians offer some form of practice management advice, but during the time when Mark Tibergien was running what was then called Pershing Advisor Solutions, the firm took this service up a few notches. After a recent reorganization, Pershing’s consulting offer now includes seven distinct disciplines, each with its own team whose members will sit with advisory firms to oversee and facilitate implementation. The list includes business consulting and practice management (the latter working through broker-dealers); technology consulting (auditing a firm’s tech stack and making recommendations); operations and back office consulting; a team of implementers who will help RIA firms develop internal APIs and remote signature technology; enterprise solutions for larger firms that want to provide customized client services; and what might be called technology advocacy, which becomes a relationship manager of technology relationships between Pershing, the 500 tech firms that plug into its ecosystem, and advisory firms who might be requesting features or more responsive service.

Pershing RIA Custody Pricing Options

As most advisors now know, the sudden surprise introduction of a zero-commission pricing model for stock and ETF trades some years back was driven primarily by competition in the retail space. Schwab’s zero commissions announcement was a bold gambit to attract more do-it-yourself investors, and the other discount brokers – including Fidelity and TD Ameritrade – were forced to match the offer. To preclude rebellion, advisors on their platforms were given the same pricing structure.

Because it doesn’t have a retail presence driving its decisions, Pershing had the luxury of listening to its advisors before responding, and incorporated their input into choices for how to compensate the custodian for the services it provides.

“For some time before this, we had felt that the pricing model in the custodial landscape has been ripe for disruption,” explains Ben Harrison, the company’s Managing Director and Head of Advisor Solutions. “There’s been this conflict that everybody is aware of, that has been just too daunting to address: that product fees pay a lot of the freight, and the spread on the cash sweep accounts was really subsidizing a big part of an advisory firm’s custody relationship.”

Option one is for the advisory firm to continue to pay trading costs as they had been before the zero-commission announcement. Alternatively, advisors could opt for the same deal a firm would get from Schwab and Fidelity: free trades, but Pershing will make money on the cash accounts.

Under option three, advisors could opt to pay a flat subscription fee for all their custodial services and access to the custodial technology. The fee will range from $25 to a cap of $75 a month per client account, depending on the size of the client accounts. Any monies that a client has invested in the BNY Mellon ETFs are excluded from the portfolio size calculation.

The standard custodial revenue model includes product fees paid by funds and ETFs, and larger fees paid for shelf space in the mutual fund supermarkets. For now, Pershing will continue to collect those fees, as most of its larger competitors do (though, it should be pointed out, not Shareholders Service Group, TradePMR, or Altruist).

Under each arrangement, the firms custodying with Pershing will receive a dedicated service representative and team, and will receive full access to the consulting services. For RIAs that want to make a switch and still work with a larger entity, Pershing is an obvious solution. For $100 million+ AUM firms with an ambition to grow, the consulting services represent an attractive option.

Pershing’s Recent Custodial Tech Upgrades

The question about Pershing’s custodial platform has always been its NetX360 technology, which is shared across its BD and RIA platforms. Because it was developed primarily for the BD world, the tech didn’t have to offer a lot of front-end conveniences; the broker-dealers historically would put their own front-end on the software for their reps. When Pershing committed to the independent RIA space, the software’s feature set became an obstacle, because most RIAs don’t have the capabilities to build their own technology front-end; anecdotally, you hear a lot of ‘the service is good but the tech platform is not up to the competition’ kind of remarks. The platform offered all the features of the competing technology, but navigating through all those options was confusing.

However, Pershing recently unveiled a modernized front-end to the software; the NetX360+ became available to users in July.

The differences are too numerous to mention, but they include a customizable dashboard that can display different data and windows (the firm calls them ‘blocks’) for people who play different roles in the firm. The management team might boot up NetX360+ and see a variety of business analytics, including total AUM and changes over the past 12 months (time periods can be adjusted) for inflows and outflows. Another ‘block’ will show client-related activities in progress.

Meanwhile, somebody working in the back office will see ‘items for attention,’ which can be thought of as a CRM for custodial issues. Which of the firm’s clients have service opportunities like a distribution coming up, not enough funds in the account to meet an upcoming check request or to cover the next advisory fee billing, or have a portfolio position that is missing the cost basis. An advisor might see a list of clients and issues relating to their accounts, including a ranked order of which of them are clicking into their private account platform, and how often – potentially a way to tell which clients are getting nervous about the markets.

The portfolio management team would see a screen with constantly updated market news and tracking of the performance of the model portfolios. In each case, the user can click to get more details: details on a particular portfolio position that has declined recently, or a client’s various accounts, etc.

The result is that the front end of the custodial platform has been tamed and customized to different users. Initially, the tech support team at Pershing will handle these dashboard customizations, and RIA users can then refine them as needed. Behind the scenes, a machine-learning process will evaluate which features are being accessed most frequently by different users, and suggest streamlined refinements to the dashboard and menu structure.

Before long, advisors will have another way to interface with Pershing. While some outsourced investment solutions are moving aggressively into the custodial space (SEI being the best example, see below), Pershing is creating its own investment platform. The initiative, called Pershing X, will leverage the in-house Albridge platform as a multi-custodial portfolio management/reporting solution that becomes the hub for advisors who want to use Pershing-managed accounts (formerly Lockwood) for their clients, take advantage of an in-house index replication solution, or pull in the full marketplace of separately managed accounts. The platform will also offer lending and banking solutions through the parent company, and a way to parse through and access insurance products in the marketplace.

This ‘every-product-solution-under-one-roof’ marketplace approach will be familiar to Envestnet users. Pershing X is aiming to become the second comprehensive product marketplace platform in the advisor space.

Pershing Advisor Solutions Reviews From Advisors

What do advisors think about the Pershing model? Lyle Wolberg, Senior Financial Life Advisor at Telemus Financial Life Management (locations in Southfield and Ann Arbor, MI, and Chicago, IL) says that his firm made the shift to Pershing from National Financial when it dropped its in-house broker-dealer in 2011 and moved to a fee-only revenue model. “We interviewed a bunch of custodians,” says Wolberg. “It was pretty clear that Pershing was the best choice for us.”

Why? Telemus is right in the sweet spot for Pershing’s original target market, with $3.3 billion under management and 1,200 household relationships. The firm was looking for growth opportunities and found Pershing’s practice management counseling especially helpful. “We liked [former Pershing Advisor Solutions CEO] Mark Tibergien, and his thought processes and ideas helped us focus on high-net-worth clients,” says Wolberg. “They came in and looked at our technology platform, and how we were using our staff, and our fee billing.”

The transition from dually-registered to fee-only was relatively smooth, but Pershing did help with a potential sticking point. “We create client portfolios with individual tax-exempt and taxable bonds,” says Wolberg. “Before we went fee-only, clients would pay a markup on every bond we purchased on their behalf, but we didn’t charge a fee. We moved from a markup to a fee,” he continues, “so it was the same yield.”

In the initial negotiations, Telemus secured a commitment that Pershing would allow the company to shop its existing relationships and do bond trades away from the Pershing bond desk – something TD Ameritrade and Schwab were reluctant to allow. “We don’t make any money on those bond trades,” says Wolberg, “and we didn’t want the custodians taking a little bit out of the transactions either.”

Telemus also required a strong banking relationship. “The blending of the BNY platform with Pershing was important to us,” says Wolberg. “Our high-net-worth clients needed the investment credit lines and mortgage products that BNY offered.” “The banking and lending solutions allow us to compete with the JP Morgans of the world, in terms of matching rates,” adds Telemus CEO Matt Ran.

Finally, Telemus had been affiliated with UBS and Merrill Lynch in its earlier incarnations, and Pershing allowed the firm to track assets that were still managed at UBS.

Any drawbacks to the Pershing relationship? Ran is looking forward to the next upgrade of NetX360. “Pershing’s biggest shortcoming is their technology, in comparison with the other custodians,” he says. Telemus uses Orion as its client reporting platform, so the inconveniences are minimized; most of the portfolio management work is handled through Orion.

What about the service? “I have mostly calls with Pershing staff,” says Ran. “Whenever we run into hiccups, or if there is an issue with something, we get a great response,” he adds. “I don’t know that we would get the same level of service at the other custodians.”

Focus Financial is an investor in Telemus, and that allows Ran to compare notes with other Focus firms. “Talking with the firms that use Schwab,” he says, “they don’t seem to have the same feel about the relationship that we do.”

Pershing Support For Organic Growth

GM Advisory Group, with $3 billion under management, would seem to also be in the Pershing sweet spot – but it wasn’t that way when the firm started the relationship. “We had maybe $150 million when we first approached Pershing in 2008,” says Frank Lavrigata, the firm’s Director of Portfolio Management. “We had fewer than ten employees then, which means we were one of their smallest clients at that point. I think they saw the opportunity with us.”

Before making the switch, the firm shopped around among the other large custodians, seeking the firm that would be most helpful to an ambitious organic growth plan. “The other major competitors were all pretty similar,” says Lavrigata, noting that Schwab and Fidelity’s retail operations seemed to come first in management’s eyes. “Pershing was unique,” he adds. “Keeping the money safe is pretty much all they do, and we liked the fact that our clients hadn’t heard of Pershing before we told them about them.”

But the deciding factor was customer service. “They will do anything they can to help us with our client situations, more than what we could see at the other major custodians,” Lavrigata explains. “We want to be able to pick up the phone and say, I need this now, and have them deliver on it.”

Adds Operations Manager Rosemary Santana: “A lot of it comes down to collaborating with them to further develop our practices and procedures. They focus on the way we want to serve our clients,” she says, “rather than on the paperwork and the hassle of getting documents together.” Santana adds that, in the pandemic environment, the client onboarding process continued to work smoothly.

Lavrigata also likes the fact that Pershing can facilitate mobile check depositing, which, he says, Schwab declined to allow at the time. And in the initial decision, his firm also factored in the independence to be able to select investments without any competing incentives.

“If you clear through Fidelity, you’re incentivized to use Fidelity mutual funds,” he says. “At Pershing, there is never any incentive to put one investment over another. They have given us the platform we needed so we could have an unbiased relationship.”

Shareholders Service Group: A Conflict-Free Relationship

Advisory firm relationships: 1,600+

$ under custody: (Not Disclosed)

Clearing platform: Pershing

Trading platform: NetX360+

Platform rating in latest T3/Inside Information software survey: 8.77

Website: Shareholders Service Group

Peter Mangan, co-founder and CEO of Shareholders Service Group (SSG) in San Diego, CA, used to say, jokingly, that the announcement that Schwab was acquiring TD Ameritrade was “the biggest increase in our marketing budget (that we haven’t had to spend any money on) in years. It generated more prospect calls than anything we could have done on the marketing end,” he says.

SSG was born shortly after the TD Waterhouse (TDW) acquisition of Ameritrade in 2005. Mangan and SSG Marketing Executive Vice President Barry Boyte were veterans of the Jack White (predecessor) organization, and became key executives in the TDW advisor service platform before launching SSG. The firm has positioned itself as the most service-focused and reliable platform on the market – although in recent years, technology support has emerged as a huge part of the service package today. Dan Skiles serves as SSG President, after having served as Schwab Advisor Services’ chief technology officer. As a thought leader, he wrote the technology column in Investment Advisor for a number of years.

SSG Flexibility For Smaller And New RIAs

A big part of SSG’s growth has come from smaller firms just starting out. The firm has a longstanding reputation for accepting and fully serving, without qualification, brand new advisors with zero AUM, as well as a broader range of advisors without high AUM levels. “My experience has been that people don’t start an advisory firm without a plan to bring on new clients,” says Mangan.

SSG is also well-positioned to work with larger advisory firms looking for that second custodial relationship – exactly the people who are most unnerved by the TDAI acquisition.

“We’re hearing, I used to be at Schwab, and I left them, and I don’t want to go back,” says Skiles. “Or: I have assets with both firms, and that was by design, but now I need to have assets somewhere else. Or: They’re going to be huge now, and I’m very anxious about what ‘huge’ means to me and my [not-so-huge] firm.”

Mangan adds that some dual-custody advisors who had been working with TDAI have begun allocating all new money to SSG, in part to hedge their bets, in part to improve the quality of service. The lack of a retail division, and especially of direct competition with advisors, is another plus. Mangan has famously promised to SSG-affiliated advisors that if they promise not to become institutional custodians and compete with him, then SSG will promise not to become an advisory firm and compete with its advisors.

SSG Service Team Structure For RIAs

SSG clears through BNY Mellon/Pershing, and can no longer be considered a small competitor, since it now supports 1,600 RIAs, using Pershing’s new NetX360+ platform. Trading fees are $4.95 per trade.

Like the other custodial options in this article, the firm makes a point of the fact that it doesn’t have a retail division. “Our advisors said, paying trading fees is better than going to zero if the effect is that we don’t compete with them,” says Mangan. “The response was: please don’t look like [Fidelity or Schwab]. Please don’t play the same revenue games.”

That basically means that the firm doesn’t have product-based incentives to recommend one fund or category of ETF over another. And SSG doesn’t generate its revenue from cash sweep accounts. “With the Fed raising interest rates, one of our FDIC cash sweep options is yielding 50 basis points higher than our custodial competitors,” says Mangan. “And it offers FDIC insurance up to $2.5 million, vs. $250,000 at other custodians.”

“If our advisors decide to have any cash at all, they’re managing it,” adds Skiles. “At other custodians, advisors have to trade out of the sweep accounts into money market products to get a little more yield. In addition to the time and effort, it also slows everything down,” he adds. “Suppose a client calls today and says, hey, I forgot to tell you but the tuition is due for my son’s college education. I need to get $20,000 immediately to the university. If that money isn’t in the sweep, it’s going to take at least a day until it’s available to the client.”

Another selling point for SSG is the lack of advisor segmentation; the firm gives everybody access to the same experienced service people. “We’ve all read how Schwab advisors under $200 million are going to get a different service experience vs. firms above that, and firms over $1 billion get more,” says Skiles. “All those segmentation games are directly tied to revenue and profitability from the advisor. We don’t do that at SSG,” he adds. “If you call in here, we don’t route your call based on how much assets you have. You speak to an associate directly and immediately.”

“We continue to add staff and have also benefited by retaining our long-time team members,” adds Mangan. “Average experience across the firm in serving RIAs is 19+ years, which is another big reason why we still have zero hold times.”

The SSG same-day service promise looks attractive compared with the long wait times and even longer fulfillment times at Schwabitrade. “A lot of custodians are telling their clients they have to meet year-end deadlines [far in advance of December 31st] if they want to get things done for their clients, like required minimum distributions, setting up new types of accounts that must be set up in 2022, etc., etc. We don’t tell them they have to get everything in by the 20th or whatever. When they send it in, we do it, and get it done on time.”

Mangan adds: “We believe we can run our business on the theory that all of the advisors we support are important. This strategy has been very successful for us.”

SSG RIA Custodian Pricing For Fiduciaries

William Cuthbertson, founder and CEO of Fiscalis Advisory in Mission Viejo, CA, was custodying at TD Ameritrade Institutional when news of Schwab’s purchase broke over the news wires. Before starting his firm, Cuthbertson had previously worked with a firm that custodied at Schwab, and deliberately chose TD Ameritrade at the time for what he considered to be the most viable alternative, and what some at the time had called ‘the anti-Schwab,’ supportive of the profession and focused on client service.

“Schwab is a very different culture,” he says. “I felt like TD had their hearts in the right place, and I was worried that that attitude was about to disappear. I was worried that my custodian’s approach to business would change in ways that I wouldn’t be pleased with,” he adds. “I didn’t expect the service to improve as the merger created such a huge firm, and I didn’t think that Schwab was after businesses like mine [$43 million AUM] when they made the purchase.”

But Cuthbertson says that his decision to rethink his custodial relationship began and ended with looking at the situation from the standpoint of his clients. If he was going to make a switch to avoid being swept up in the merger, what would be the best option, not for him, but for his clients?

“I looked at how Schwab makes money, and TD makes money,” he says, including below-market cash options, payment for order flow, and other largely-undisclosed revenue sources that can drain client accounts. “When I did my due diligence, the question always was: how would this impact my clients in terms of the fees they pay?” Cuthbertson adds. “And of course I wanted to get better service as well, which allows me to be more responsive to my clients.”

The search led him to Shareholders Service Group – which, he says, is even more of the things that he was looking for when he originally selected TD as his custodian. “Everything I checked out meant that my clients would be paying less and getting better service with SSG,” he says. “Even after paying the trading fees, SSG was better for my clients.”

Cuthbertson acted relatively quickly, starting the transition from TD to SSG in early 2020 – only to discover that the complicated repapering process was going to be further hindered by a global pandemic that prevented the SSG team from coming to his offices.

“They were going to come in and set up client meetings and handle all the paperwork,” Cuthbertson says. “They ended up helping me do it all digitally. They prepared the paperwork based on the information I gave them, and were a real partner in helping us get things done.”

Both sides took their time, so the process took nine months. “I let it drag out; that is not on them,” Cuthbertson admits. “I would get to it whenever I had the free time to work on the transfers.”

How would he compare his service experience at SSG compared with TD? “TD was willing to fix things when problems arose,” says Cuthbertson. “I wasn’t unhappy with their service. But like most large firms, the service people who were really good would get snagged by the organization to move up, and then we would have a new class of people answering the phones. You would find yourself in the role of being part of the training for those new folks, because you’ve handled it multiple times, and the new person on the phone hasn’t been in these situations before.”

He added that sometimes his paperwork would be flagged by the TD service team as not in good order, and when he asked why, the person he was talking to was not the person who had flagged it. “There wasn’t continuity and conveyance of information – the kind of communications problems you get into when you’re working with a large organization,” Cuthbertson says.

And at SSG? “Their service experience is 180 degrees different,” says Cuthbertson. “They’re competent, professional, and prompt. When you have an issue, they resolve it on the spot.”

This, he says, is true even when the service request is out of the ordinary. “I was going through a standard regulatory review with the state of California,” Cuthbertson says, “and they had some questions about my trading authority and whether or not I should be considered a discretionary advisor with some of my clients. I needed to get some clarification. There is no way I could have gotten that clarification from TD,” he adds. “I had it in 48 hours from SSG.”

In another case, a client was buying a house, and the process happened much more quickly than Cuthbertson had anticipated. “I was expecting to have a few days notice to get the down payment wired over,” he says, “and instead I had a few hours notice. So I called SSG, and they made it happen right then and there. Normally something like that would take a day,” Cuthbertson adds, “but because this was a special circumstance, they took care of it immediately.”

When talking with advisory firms that work with SSG, you often hear stories about how the company principals would field calls and follow through on service requests. Cuthbertson relates the time when an outsource provider he was working with had their database breached. “It got me to wondering, what kind of security steps should I take to protect myself in those cases?” he says. “Should I request all my client account numbers to be changed?”

He called SSG for guidance on how that might work. “The first person I spoke with, I said, who can I talk to who would tell me what would be required to make this happen if I came to that conclusion?” says Cuthbertson. “That person said, I think you need to talk to [SSG president] Dan Skiles. He would know the most about that. Can I have him call you back?”

The result? “Dan called me back an hour later and we had a conversation about it,” Cuthbertson recalls. “He helped me better understand the situation I was dealing with regarding the service provider and client security and protecting client information. At Schwab, I would never get that kind of attention. That person, that level, would never talk to someone like me, and the same at TD. That’s not a criticism; it’s an observation,” he is quick to add. “They just can’t function that nimbly.”

Cuthbertson admits that even with the transition team helping out, it takes a lot of time and energy to get all the paperwork taken care of for client accounts to move over. He believes that this large inconvenience is creating a dilemma that many advisory firms are facing now.

“I could have stayed where I was and avoided all the work of transferring accounts and assets, and my clients would have been completely unaware that there was a better solution for them and their finances,” he says. “It is what you do in private,” Cuthbertson adds, “that really determines whether you’re a fiduciary. It’s a question that a lot of us face from time to time: am I willing to do some extra work in order to live up to my fiduciary responsibilities? Speaking just for myself, I felt like I couldn’t NOT do it. And,” he says, “it turned out to be a great choice. I’m glad I did it.”

SSG Service Reviews From Advisors

Dave O’Brien, of EVO Advisors in Richmond and Irvington, VA, appreciates SSG’s meat-and-potatoes approach to service. “I feel like they are an extension of my team,” says O’Brien. “They’ve gone through some good growth, and they have new people on their team,” he adds, “but the folks that we’ve worked with know us, know our business, and we always get the same responsiveness. Somebody always takes responsibility, with ownership. We don’t get that from the other custodian that we work with.” (He declines to name it.)

O’Brien likes the fact that he knows SSG’s company principals personally. “Our operations director can call Tim, their head of trading, and say ‘We’ve got a negative trade date balance because that ETF trade that you put in the other morning got whipsawed and the price went way up, and now the client has a negative balance. Tell me what you want me to do.’ And,” says O’Brien, “they’ll fix it right there on the spot.”

He adds: “I have said this to so many people over the years: I trust them. You want a custodian where you know you can rely on them, because from the SEC’s perspective, they don’t care about the financial planning work that we do. They care about the trading. They care about the investment management. As the compliance officer at our firm, I know they have our backs and I trust them.”

O’Brien adds that he relies on technology guidance from Skiles and his team. “They’re very good at negotiating discounts on technology,” he says. “The integrations we use are seamless: Orion, MoneyGuidePro, Salesforce. Talking with folks who work at other custodians, I’ve become convinced that the guidance and discounts are better where I am than where they are.”

Similarly, as a former (18-year) manager and software developer for Hewlett Packard, Sunit Bhalla, at OakTree Financial Planning in Fort Collins, CO, is routinely asked to speak on conference technology panels, and when asked to describe the advantages of working with SSG, he is quick to cite the expertise of Skiles. “When Dan Skiles arrived, that definitely upgraded their technology game,” he says. “They offer best-in-class technology at a discount.”

But his reasons for working with SSG are a bit more complicated. “I started my business in 2008 with no assets,” says Bhalla, who currently manages $50 million of client money. “I called around to TDAI, Fidelity, and Schwab, but none of them would take on somebody who was just starting out. Then I talked with the people at SSG and they said, come on over. I opened my first account in 2009 with them, and they were tremendously helpful and offered personal service. They never made me feel like I was a small customer,” he adds. “I remember calling SSG’s offices early on, and Peter, their CEO, answered the phone. That happened a few times.”

When asked about the current working relationship, Bhalla says: “There are three main things that I like about them. One is that they are great for me and my business,” he says, saying that the firm offered business advice and best-of-breed technology at a discount. “They will do anything they can to make me and my clients successful.”

“Second,” says Bhalla, “is that they’re great for my clients. That means quick service turnaround times. And three: it is a partnership relationship. Even their top-level people will pitch in on the advisor work, and they know the advisors who the firm is servicing on a personal level.”

Of course, Bhalla watched the pricing evolution at the other custodians and waited to see how SSG would react. “During the race to zero equity trades, SSG was very thoughtful about what they wanted to do,” he says. “They didn’t go down to zero in equity trades, but they did lower them to $4.95.”

Bhalla executes fund trades almost exclusively, paying $15 a transaction for most funds, $20 for Vanguard, Dodge & Cox, and other lower-cost funds, and, he says, SSG is included in the $10 DFA trade arrangement.

He prefers the cash alternatives to what the larger competitors are offering. “When I first started looking at the custodians, the Schwab, Fidelity, and TD sweep accounts for invested cash were paying extremely low rates,” says Bhalla. “SSG was reasonable from the start. They have the StoneCastle option, just like MaxMyInterest, where you can put in $2.5 million and they will find ten different banks to spread the money around, FDIC insured, with probably better rates than you can get from any brick-and-mortar bank, definitely much better than what Fidelity and Schwab are offering. And there’s also access to Vanguard money market funds,” he adds.

Bhalla concedes that all custodians have to make money. “SSG doesn’t make it on hidden fees, order flow routing, or other ways that the other custodians make money on,” he says. “They’re very transparent about how they make their money. I think they’re treating my clients fairly, where they pay an amount that makes sense for the level of service.”

Anything else? “I don’t have any fear of them trying to steal my clients,” says Bhalla. “I’ve talked with other advisors who tell me that their custodian sent out an email about their retail services, about having the custodian manage their money. SSG doesn’t deal with retail investors.”

Like O’Brien, Bhalla describes his relationship with SSG as a partnership. “I think of it as SSG is like a fee-only advisor,” he says. “Like us, the way they make money is transparent. They charge a reasonable amount, and offer good service. I could not get the service they provide from other custodians,” he adds, “because I’m small. But here, I can call their offices and I might get the CEO or a VP of something, and always somebody who knows me and my firm. It is the ideal combination: We get the nimbleness and the personal service of SSG, along with the stability and security of Pershing.”

TradePMR: Personalizing The Platform

Advisory firm relationships: 400+

$ under custody: (Not Disclosed)

Clearing platform: First Clearing

Trading platform: Fusion

Platform rating in latest T3/Inside Information software survey: 8.93

Website: TradePMR

TradePMR, located in Gainesville, FL, was born out of another mega-custodial purchase two and a half decades ago, similar to the one that is currently making headlines. When TD bought Waterhouse Securities and integrated the accounts held at Jack White & Co., the consolidation was plagued by a lot of back-office snafus, including clients receiving account statements that previously had seven digits on them, and now were (alarmingly) listed as $0.

The constant back-office problems incensed TradePMR CEO Robb Baldwin, who at the time ran a sizable RIA. “There were about 25 advisors who literally woke up one morning and they had zero accounts under management, and their client account statements were zero, and nobody knew what happened to the money,” he says, noting with wry understatement that the ‘lost’ assets and zero balances on the account statements created some interesting client communication challenges.

“I had a real black eye with my clients and my community,” Baldwin adds, “because, as they pointed out, they didn’t pick the custodian that was creating all these problems; I did. They looked to me for answers, and didn’t like the fact that I didn’t have any. It took us 90 days to find the assets and be able to assure clients that their money was back in their account – and in the process we lost all basis, all transaction history. We had to keep paper statements to be able to go back and give clients the information they needed on their tax forms.”

Rather than complain, Baldwin decided to take matters into his own hands and create a back-office platform that he and some of his best friends in the business could rely on. He could rely on it because he owned and designed it himself.

And once he was building his own custodial platform, why not improve on the model?

“I wanted to provide a home for advisors who wanted white glove service and a real relationship with their custodian,” says Baldwin. “And I wanted it to offer top-rated technology.”

TradePMR Digital Experience

Today, TradePMR offers a total turn-key package of software solutions integrated into its internally-built Fusion trading/client reporting platform. Having trading, rebalancing, and reporting built directly into the custody technology makes it ideal for firms that are looking for a seamless tech experience. TradePMR has also been popular with breakaway brokers who are accustomed to being provided with an integrated in-house package of tools.

The other advantage of creating its own technology is that TradePMR is able to deliver customized technology solutions at the request of the larger advisory firms – at a time when those firms increasingly want to build and brand their own unique client experience. In a presentation at the 2022 T3 Advisor Technology conference in Denton, TX, one of the advisors in an advisor tech panel discussion noted that his firm had gone to its other custodial relationships – Schwab, TD, and Pershing – asking for their help creating a customized piece of its service model – and for some reason, he could never quite get an answer.

When he called TradePMR, the answer was more welcoming: Show us what you want and we’ll see if we can do it. The solution turned out to be doable after all. Beyond that, with TradePMR’s open API, advisory firms with in-house development teams can build their own data links through a variety of Fusion integrations. This also delivers the former TD Ameritrade experience for software vendors; instead of requiring the custodian to build their integrations, they can do it through the API suite.

TradePMR was perhaps the first custodian on the market to offer a digital account opening experience, which has since evolved into a simplified data-gathering process that automatically maps client information to the required forms and documents. “We’ve built out a great team of transition specialists who help pre-plan the conversion in advance,” says Baldwin, “where the advice firm can load up all their clients inside of Fusion, run their current system in parallel as they gather the digital signatures, and then they can open the accounts one at a time or wait until the end of the month and push the button, and all the ACATs go through, all the accounts are opened, and everything moves over right then and there.”

The key point that Baldwin is especially sensitive to, given the origin story of his firm, is that every detail can be checked once or twice in advance before the switch – so that clients aren’t receiving confusing account statements and making angry calls to their advisor. But he says that a lot of the actual work these days isn’t in transferring money; it’s in making sure all the various software wires between the advisory firm’s tech stack and the custodial platform are connected and integrated with each other.

“Advisor technology has become so complex these days,” says Baldwin, “that you have to really dig in and make sure everything works at the new custodian the same way it did at the old one.” Referring to the proposed Labor Day weekend changeover from Veo One to the still-under-construction new Schwab custodial platform, he adds: “It’s not something that you want to do over a weekend.”

Baldwin says the phones in his offices started ringing as soon as Schwab announced its proposed acquisition – and they haven’t stopped. “There’s a lot of uncertainty right now,” he says. The roughly 130 recent RFPs (Requests For Proposal), he says, are asking about technology and the connectivity points, the pricing, and the ever-elusive cultural ‘fit’ where the RIA’s values and goals align with their custodian’s (Proprietary investments? A division that competes with advisors in the retail space? Fully transparent pricing?).

But beyond that, the inquiries all seem to center around one common denominator.

“Every single phone call that we get, they ask: can we speak to any number of your advisors?” says Baldwin. “We want to hear from them about service. That is their number one concern at this point in time.”

TradePMR Custodian Pricing And Typical Advisory Firm

When asked to define his firm’s “sweet spot” of ideal advisor relationships, Baldwin says: “We don’t look at them from the perspective of size or assets. In fact,” he adds, “one of the last pieces of information that we gather from them is their asset size. We want to know how they work with their clients, how they manage money, and their growth perspective, and what it has been for the last five years. What stage of the business are they in? How many households do they serve?”

The point is to get to know if there’s a fit with the advisory firms the same way a financial planner will size up new potential clients. This also determines the negotiated pricing model, which could involve zero trading commissions, or monthly fees.

“We’re doing it every which way these days,” says Baldwin, “from ticket charges [currently $6.95 on stocks and ETFs, $14.95 on mutual funds] to asset-based pricing, to some advisors paying us a fixed dollar amount per year, broken out quarterly.” Regardless, the firm doesn’t require – as Schwab does and TDAI has traditionally – that every advisor's client sweeps cash into a single account, which pays below-market rates. “Our advisors have the option to choose any and all money fund alternatives,” says Baldwin. “We don’t block Vanguard or Fidelity money market funds from being available to our advisors, if they’re looking for a more permanent solution for cash management for their clients.”

“Advisors who go through the RFP process are seeing us the way TD positioned itself 25 years ago,” says Baldwin. “We’re small, we’re nimble, we’re quick, we are very tech-friendly with lots of integrations, we provide great service and access to the firm’s leaders if something needs to be done,” he adds. “That’s the old TD model, and it’s what everybody wanted. TD provided that culture, those systems, that atmosphere, and it worked well for them. The same formula has been working well for us.”

TradePMR Lending Options

When he decided to leave Wells Fargo to go independent several years ago, David Hohimer of Hohimer Wealth Management in Seattle, WA spent 18 months evaluating not only the independent RIA custodians, but also the independent broker-dealers in the marketplace. And he found that for one of his most important criteria, the options were surprisingly limited.

“We do a lot of lending,” Hohimer says, explaining that his clients, collectively, have taken out more than $100 million in loans for things like a new vacation home or home remodeling. His firm helps them use their portfolios to collateralize those loans in order to get an attractive interest rate.

But when he looked at the options, Hohimer found that many custodians were not set up to facilitate these securities-based loans the way he had been accustomed to. “Schwab has a bank, but the rates were really expensive, and they wanted to circumvent you and try to get the client to sign off on some higher-priced lending,” he says. “Fidelity uses U.S. Bank and Goldman Sachs, and we had a problem with that. TD Ameritrade didn’t do that kind of lending.”

The selection process came down to BNY Mellon/Pershing and TradePMR, and Hohimer liked the service, the technology, and the access to key executives at TradePMR. “And their lending platform is second to none,” he says.

Hohimer is multi-custodial, but roughly $660 million of the firm’s $800 million in client assets is housed at TradePMR. Why does the firm still have assets at TDAI? The TD Ameritrade (now Schwab) relationship came about because Hohimer’s firm invests client assets in non-tradeable alternative investments, which TradePMR and First Clearing don’t hold on their platform.

“So we broke out that part of our business to TD Ameritrade,” Hohimer explains. Similarly, Hohimer established a Schwab relationship when a large corporate client moved a $40 million qualified plan to Hohimer, with the stipulation that Schwab remain the custodian.

Doesn’t that make things a bit complicated? “A little bit,” Hohimer admits. “But Orion lets us roll all of those custodians into one single operating system.”

Where is the new money going? “TradePMR is our primary partner, and they’ve done a great job for us,” says Hohimer. “They’re always going to be our primary custodian.”

TradePMR Transition Support

BLB&B Advisors, in Montgomeryville, PA, was founded in 1964 and has been an RIA since 1971, founded by two Air Force pilots from the Philadelphia area. John Lawton, the company’s CEO and son of one of the founders, says that his firm is multi-custodial (relationships with Fidelity, BNY Mellon/Pershing, and TradePMR), but many of the firm’s assets started at Wheat First’s clearing, and shifted due to Wheat’s acquisition by Wells Fargo to TradePMR, since TradePMR has become the Wells RIA interface to its First Clearing custodial platform.

“When we shut our broker-dealer down, moving to TradePMR was an easy transition for us,” says Lawton. TradePMR now holds a significant percentage of the firm’s $1.5 billion in AUM.

How would he describe the firm’s service and customer relationships? “TradePMR is very quick to move on things,” he says. “A firm with between $100 million and $400 million can get great personal service from them, where they might get lost in the shuffle at some of the larger custodians.”

As an example, Lawton says he can get TradePMR CEO Robb Baldwin on the phone whenever he needs to, and interacts regularly with managing director Rob Dilbone. “Yesterday, I said to Robb, can I catch up with you?” says Lawton. “He picked up his cell phone – and he didn’t know it was me until we talked. We talked for 15 minutes about some digital marketing stuff we’re doing.”

After that conversation, TradePMR’s Chief Marketing Officer, Jessica Shores, jumped in to help design the digital marketing program at BLB&B.

Lawton also appreciates the advanced technology built into TradePMR’s Fusion workstation.

“It does everything as far as servicing client accounts,” he says, “and with their new open APIs, you can bolt on best-of-breed software and configure it to how you want it.” His firm uses the Thompson SmartStation software that is available from the platform through Wells Fargo. “It’s really good for client proposals and rebalancing and managing the portfolios,” he says. Meanwhile, he cites the new EarnWise platform as a superior option for online account opening.

TradePMR Reviews From Advisors

If BLB&B represents one of the larger firms with a TradePMR relationship, Bischoff Wealth Management Group in Greenwood, IN, is on the smaller end of the spectrum, staffed by CEO Brian Bischoff plus a full-time client associate and two part-time associates. The firm moved to TradePMR from Schwab when its assets totaled about $150 million.

“We were on the low side of Schwab’s RIA population,” says Bischoff. “I feel like I got lost in the shuffle, not being a multi-billion dollar RIA. When we moved, I felt that we could be better served, and grow faster, if we were working with a firm that could give me more personal attention,” Bischoff adds. “When I was looking at options, I was able to communicate directly with Robb Baldwin, and I told him what I wanted to accomplish and how we wanted everything to work in the clients’ best interests. There is no way,” he continues, “that I would have been able to talk directly with Schwab’s CEO, or have them make the adjustments I needed to fit my business model.”

When asked to describe the TradePMR relationship, Bischoff talks about the constant tech upgrades that let him leverage his small staff. “Their technology is second to none,” he says. “At Schwab or Wells Fargo or Merrill Lynch, the large institutions, it is hard for them to keep up with the best offerings, with their legacy systems. When I went from Wells Fargo to Schwab,” he adds, “I was really surprised that the technology wasn’t very different. Now, at TradePMR, they are nimble enough to really keep us working with first-class technology.”

Examples? “They just implemented a new performance reporting system through Black Diamond,” says Bischoff. “I don’t see how it could possibly be any better, whatever else is out there – and we get it at a fraction of the cost of what it would cost an RIA to implement it themselves.”

Second, Bischoff talks about a ‘personal family feel.’ “Knowing the people you’re dealing with on a daily basis,” he says, “and having direct communication with the people at the top when you need it, fits my clientele better than what we had before.”

He and his team communicate service requests with the same five-person team on the trading desk and cashiering. “They know you, you know them, and if there are any issues, they can be resolved fairly quickly,” says Bischoff.

Bischoff Wealth Management has set a goal of reaching $1 billion in AUM within ten years, and Bischoff says that TradePMR’s marketing and service support have helped him nearly double in the past four years. “I don’t really see any issues as far as TradePMR being able to handle the kind of volume we’re planning to bring,” he says. “They give you the autonomy to be totally flexible and run your business in the best interests of the client. Robb and his management team,” he adds, “have done a phenomenal job of continuing to grow their services and the firm itself. I can see myself staying here for the rest of my career.”

SEI: Raising The Bar

Advisory firm relationships: 5,000

$ under custody: $80 billion

Clearing platform: Self

Trading platform: Wealth Platform

Platform rating in latest T3/Inside Information software survey: 7.65

Website: SEI

What did SEI think about its largest custodial competitors following each other to zero transaction costs on ETFs and stock transactions? “Not only did we go that route; we actually did it in 2016,” says Erich Holland, Head of Sales and Experience at SEI’s independent advisor business. “And our zero transaction costs includes institutional class share mutual funds as well – the DFAs and Vanguards of the world.”

The challenge for SEI in this custodial competition is that the firm has a strong reputation in a completely different business. Its history in the advisory marketplace began when, in the early 1990s, SEI was one of the leaders in managing and consulting for large pension pools and institutional assets. During the early age of the TAMP concept, SEI began offering the same access to separately-managed accounts, plus institutional performance and attribution reporting to the advisor space. At the time, most of the other outsourced providers were new to the business, primarily the larger existing advisory firms that were starting to offer to manage assets for their peers. SEI stood out because it treated advisors just like it treated its institutional investors.

The custodial initiative follows essentially the same path. The firm’s custody platform was born and popularized in the institutional space, and is now used by 11 of the top 20 U.S. banks. SEI Executive Vice President Wayne Withrow says that when the company decided to make a $1 billion upgrade to its custodial technology, the senior management team decided to do what it did with institutional asset management: to make the full feature set available to the advisor marketplace – once again giving them access to capabilities that are routinely used by much larger entities.

Meanwhile, the company has been building out its custodial management team. The most notable hires were Gabriel Garcia as Managing Director of RIA Client Experience and Business Development, and Shauna Mace as Managing Director and Head of Practice Management. Garcia was formerly a senior executive under Mark Tibergien at BNY Mellon/Pershing, responsible for building out that platform as it emerged as the profession’s third-largest custodian. After Tibergien’s departure, his professional journey included working in a top executive position at E*TRADE Advisor Services, which had similar ambitions before the acquisition by Morgan Stanley in early 2020. Mace, the founder of Inspire Growth, has worked as an independent practice management consultant and is continuing, under the SEI umbrella, to help the company’s advisory firms adjust to the new realities of the marketplace and scale their businesses.

SEI Total Wealth Technology Platform For RIAs

In addition to scaling institutional solutions to advisory businesses, SEI’s culture and history have focused on taking work and responsibilities off of the advisor’s desk. So it probably isn’t a surprise that the custodial division started a trend (followed now by others) to expand its custodial technology into a broader array of capabilities. Advisors who custody at SEI log onto a total wealth management platform – a set of integrated business solutions that includes technology that advisors on other platforms have to buy separately.

The front end is a built-out version of the Oranj trading and account management platform that SEI acquired from a large RIA/multi-family office firm in early 2021. There are actually two aspects to the platform which are different from what advisors get from the larger custodian competitors. The first is enhanced trading across accounts or households, plus automated tax-lot-level rebalancing (which can be set in a variety of ways), and a variety of institutional performance measurement tools that the firm has always provided through its outsourced investment platform. The result is that the SEI Wealth Platform functions much like the all-in-one, back-office software packages that are becoming increasingly popular in the advisor space, such as Orion, AdvisorEngine, and Advyzon.

The other aspect is more original: the integration of a variety of front-office features woven into the custodial tech, rebranded from Oranj to SEI Connect.

These features include a client portal and client engagement tools. “We’ve built out the secure vault, secure messaging, aggregation and integration through Plaid – and generally the ability for advisors to communicate back and forth with their clients,” says Holland. “SEI Connect is a collaboration tool as well as a vault.”

Meanwhile, SEI’s digital onboarding has recently gone through a major upgrade. “With one single interaction, an advisor can be set up on the SEI Wealth Platform, engage the client and gather client data through a 100% digital interface, go through the e-signature process, establish accounts and a transfer with the paperwork taking ten minutes or less,” Holland explains. Garcia adds that the account aggregation integration with Plaid means that instead of advisors and clients having to send an account statement to get the ACATs process moving, they can simply pull the necessary data electronically.

Why build all those features that advisors can easily purchase on the outside? “In order to help advisors run a successful advice business,” says Holland, “we think there are must-haves that shouldn’t be up for debate. These should all be standard with the custodial relationship, rather than add-ons.”

The firm started a trend which, readers will notice in these profiles, has caught on among the competitors to the custodial giants. The ever-expanding feature set of custodial platforms is one of the most interesting issues to watch in the coming years – and, of course, whether Schwabitrade and Fidelity finally decide to follow suit.

SEI Service Team Structure For RIAs

Like the other custodians profiled here, SEI doesn’t have a retail arm and doesn’t compete with advisory firms in the marketplace. Holland answers the question that comes up most frequently when he talks with advisory firms: RIAs who use the independent SEI platform are free to use any investments they wish; they are not restricted to or required to use SEI’s separate accounts. (But of course, those separate accounts are available.)

Another key issue is service. Where other firms are throwing more bodies at the phones in order to reduce hold times, Holland says that SEI rethought the structural efficiency of delivering responsive service to advisory firms. “We have our service folks and our relationship folks literally sit at the same desk across a glass pane from one another,” he says, “and it has been a wildly successful business model.”

“That model provides an immediate exchange of information and a lot more collaboration and understanding of the firms we work with,” adds Garcia. “It’s a unique experience that we didn’t have at the firms I was working with before.”

Holland says that advisory firms are asking about ‘tiered service structures’ that are a part of the Schwabitrade and Fidelity platforms. Would a $250 million AUM million advisory firm be able to get a dedicated service representative? What about down to $50 million? “You would if you had $5 million under management,” says Holland. “We’ve been champions for the independent advisor, and we’ve lived that,” he adds, noting that the only difference between smaller and larger firms is that larger firms may have more than one service representative due to the volume of actions they’re taking.”

Reportedly, when advisors ask if they can speak with an advisory firm that uses the larger custodial firms, they are told that the information is proprietary. At SEI, they’re given the contact information of their choice from several advisory firms (with permission) and are told to ask any questions they wish. “We try to make matches based on firm profiles,” says Holland, “so they can get an unbiased, unfiltered background that would be most relevant to their own challenges.”

SEI Pricing For RIA Custodial Services

The other frequent question is pricing, and SEI’s model is somewhat unique. SEI’s sweep cash accounts pay competitive rates, taking one of the largest potential revenue sources off the table. “Most of our competitors make most of their profits off the cash allocations,” says Holland. “For us, we built a lot more communication and transparency into our relationship model.”

Instead, advisors pay SEI via a bps-based platform fee, based on the type of business they’re doing – and the highest fees, Withrow says, are still in single-digit basis points. “It doesn’t vary widely based on what people want to do,” he says.

“The thing advisors are asking themselves,” says Withrow, “is: what do I need on the platform to support my business? I don’t want advisors to have to go out and say, well, how am I going to collect my fees? How am I going to rebalance my accounts? I have to send out statements; I have to do performance measurement. What do I use for that?"

“We do all of that; you just go out and service your clients,” Withrow adds. “We’re offering an unbundling of the foundational scale of our TAMP and banking businesses. For some advisory firms, that could be a pretty compelling proposition.”

“By RIA custody standards, we are a smaller platform,” Garcia concedes. “But we are a 54-year-old publicly-traded company that serves $1.3 trillion in total assets. We bring stability and commitment and balance sheet and capabilities to the advisor marketplace that you don’t find elsewhere.”

Adds Holland: “We’re champions of the RIA market, providing a very similar value proposition to what independent advisors are providing to their clients.”

SEI Advisor Reviews

What is the opinion of advisors who are using SEI’s new upgraded platform? Scott Everhart, of Everhart Advisors in Dublin, OH, initially had no interest in adding a second custodial relationship. The firm has about $650 million on its wealth management side and manages 320 corporate retirement plans in the ERISA world. (In 2018, the firm was named by Plan Sponsor magazine as the Advisory Team of the Year in the mega team category.)

Everhart became aware of SEI when it was one of the few companies that could handle an isolated case involving a client who had invested through a captive insurance company. Somehow, during the conversation, a member of Everhart’s staff mentioned to an SEI counterpart his firm’s frustration with software integration with their current (not to be named) custodian.

“The software worked some of the time and not others,” says Everhart. “All we needed was for it to rebalance accounts with tax-efficiency for our taxable accounts. We discovered that SEI automates all of that. Their software has been very user-friendly,” he adds.

The firm started moving assets over to SEI on an experimental basis and liked the quality of the service so much that today, most new assets are going to SEI. Everhart describes the difference as a good business partnership (SEI) vs. a big-company vendor relationship (the other custodian).

“When something gets off-track – and they always do, because nobody is perfect,” says Everhart, “I have a hard time moving up the chain at [my other custodian] to get to a decision-maker. At SEI,” he adds, “we can immediately get to people who can solve the problem.”

Meanwhile, Everhart says that his MoneyGuidePro software has a good integration with the SEI platform. “We are a planning-first firm, and they are doing everything we need to have done on the asset management side,” he says. “We were absolutely not looking for another custodian,” he adds, “but the crack was the software challenge, which got them in the door with us – and they have exceeded expectations ever since.”

Another SEI user, Pollock Investment Advisors, falls somewhere in the middle of the pack in terms of size (150 clients, $250 million in assets). Its initial relationship with SEI was relatively small. “We started our firm in 2006,” says company co-founder (with his brother Jim) Rob Pollock. “Jim worked at a bank trust department, managing a small cap fund, and I was on the investment and equity committee of a fast-growing boutique firm,” he adds. “We decided that we wanted to be very selective with who we would take on as clients. There’s so much work that goes into onboarding a client and building a relationship, that we wanted to weed out problems ahead of time.”

The young firm placed $20 million with SEI’s TAMP system. “That solved our smaller client and account problem,” says Pollock. “We could take on more business and not be burdened by it.”

Pollock was unusually experienced in custodial platforms, having custodied in his career with Paine Webber, First Michigan, and Pershing. So it caught his attention when the level of service with smaller accounts at SEI exceeded the service he was getting with his current (not to be named) custodian.

“Long before they opened up their new platform, we noticed that every account and every client we worked with at SEI, we were dealing with the same people whenever there was a problem,” Pollock says. “Their service was spectacular, and their continuity of personnel is off the charts. We never have to revisit a problem every time we call. Someone owns it, and they have a tracking system that is fantastic.”

Pollock asked SEI if it would be possible to transfer all of the company’s assets over, but not in TAMP accounts. “I told them, you guys are a nice TAMP, but the platform is the golden egg,” he says. “Your culture is what you should be selling, not your TAMP.”

SEI eventually used Pollock’s firm as a test case to grow the custodial platform, and with the rewrite and built-in capabilities, Pollock has dropped Advent Axys and is using SEI as the client performance reporting and rebalancing engine. “All the things we used to do in Axys, we can now go right to the portal and see what we need to see,” he says. “Axys cost us $20,000 a year,” adds Pollock. “That’s not a small expense for a $2 million (revenues) firm.”

Meanwhile, the company wanted to stop managing individual muni bonds and corporates. “We discovered that SEI has everything from independent managers to ladders, barbell strategies, whatever you need for one client or multiple clients,” says Pollock.

There is no requirement or pressure to move client assets from the independent platform into SEI’s separate accounts, but Pollock says that he does use one of SEI’s managed volatility funds in client portfolios.

Is there anything missing? Pollock says that SEI is still working on accommodating private real estate deals (which Pollock Investment Advisors offers), and individual 401(k) client accounts are currently not included in the household rebalancing system. “I would say the only weak link of the platform would be the aggregation,” Pollock says. “You can do it, but it’s still not as seamless as it needs to be. They’re working on that as well.”

Integrations? Pollock says the link to the firm’s Orion Advisor Services planning software went from good to excellent, and he can make customized requests for any future software the firm brings in.

As an example of SEI’s responsiveness, Pollock points to the reporting function that can be used internally or in the client portal. “We’ve always done a manual report for every client, with beginning value, contributions, withdrawals, internal withdrawals from IRAs to a trust or taxable account, fees, everything,” says Pollock. “It would take us a month of staff time to get that completed.”

One day, the Pollock brothers met with SEI representatives and made a rather bold request.

“We said, is there any way this report could be built into the platform?” says Pollock. “If we had that data in real time instead of once a year, we could know, from a marketing and sales and growth perspective, where the money was coming from, how much is net new, what we brought in gross and net.”

Working with Pollock’s ops manager and a younger advisor, SEI managed to program the report onto the platform. “It took them about a month,” says Pollock. “And it saves us a month’s worth of work every year.”

“SEI cares more,” adds Pollock. “We tell our clients that WE care more, which I know is nebulous and intangible,” he adds. “But we know what it looks like, because we do, and they do.”

Equity Advisor Solutions: Creative Custodian

Advisory firm relationships: 135

$ under custody: $4.4 billion

Clearing platform: Equity Trust

Trading platform: Orion Advisor Services

Platform rating in latest T3/Inside Information software survey: 6.75

Website: Equity Advisor Solutions

Here’s an interesting challenge. How, as a small custodial firm, would you provide custodial technology that not just matches, but is actually superior to the giant competitors who spend hundreds of millions on their tech platforms? You pay a licensing fee for the best off-the-shelf trading and rebalancing platform you can find.

“We wanted to create a really phenomenal front-end for advisors, something better than the usual custodial software platform,” says Sean Gultig, the founding CEO of Equity Advisor Solutions (EAS). “So we did an RFP, and looked at a whole bunch of systems out there, and selected Orion. From a technology perspective, it gave us a very strong offering, because every time Orion creates new capabilities, our advisors benefit from them.”

Many advisors consider TD Ameritrade Institutional’s VEO system to be the gold standard in custodial tech, but Orion – as an overlay over custodial structures – provides a broader set of capabilities, plus integrations with an estimated 63 other software solutions. Instead of affiliating with a custodian and then having to pay for a portfolio reporting overlay on the custodial platform, EAS-affiliated advisors get the whole package for free – in a more streamlined straight-through format. Advisory firms that have been using Orion, or teams moving to independence who want Orion’s advanced trading and rebalancing capabilities included in their custodial platform, will find EAS to be an attractive custodial alternative.

EAS’s other point of differentiation will be more interesting to a small cohort of RIAs. If an advisory firm is recommending/managing nontraditional, radically uncorrelated client assets like private equity, non-traded REITs, or cryptocurrencies, then EAS should probably rise to the top of their consideration, because unlike just about everybody else profiled here, the firm will custody and report on those assets in the client vault and client account statements.

“If the firm has any of those assets, we can accommodate them through the sister company at Equity Trust Company,” says Joseph Gerdes, who took over as CEO of Equity Advisor Solutions in May of this year. “We also do the tax accounting and process the tax forms through an outsourced vendor, and we’re planning to bring those capabilities in-house.”

Equity Advisor Solutions Pricing And Service Team Structure

EAS traces its origins to a Denver-based custodian called Fiserv Investment Support Services, which was the fourth-largest advisor custodian at the time. Fiserv was purchased by TD Ameritrade in 2008, and in 2010, Gultig began recruiting Fiserv’s previous management team, with a desire to build another service-focused custodian that would clear and custody through Equity Trust. Its revenue model was designed to be flexible, because RIA firms come in all shapes and sizes.

Early in the discussions, EAS will examine the advisory firm’s book of business and negotiate a custom fee schedule. The firm can opt for zero commission trades if EAS can make the relationship profitable on cash balances. EAS might propose subscription fees if that’s what the advisory firm prefers.