Executive Summary

Financial plans play an important role for both clients and advisors, as they not only help clients gain a clear perspective of their current financial position, but also provide advisors with a systematic way to organize their analyses and communicate their recommendations to the client. However, there is no standard style of what is included in these plans, and as financial planning software has gotten more sophisticated and capable over time, "The Plan" has gotten longer and longer with additional (optional) components, giving financial advisors significant latitude when it comes to how they create and deliver plans (although the option they choose can be driven in part by the way they charge clients as well as the available technology).

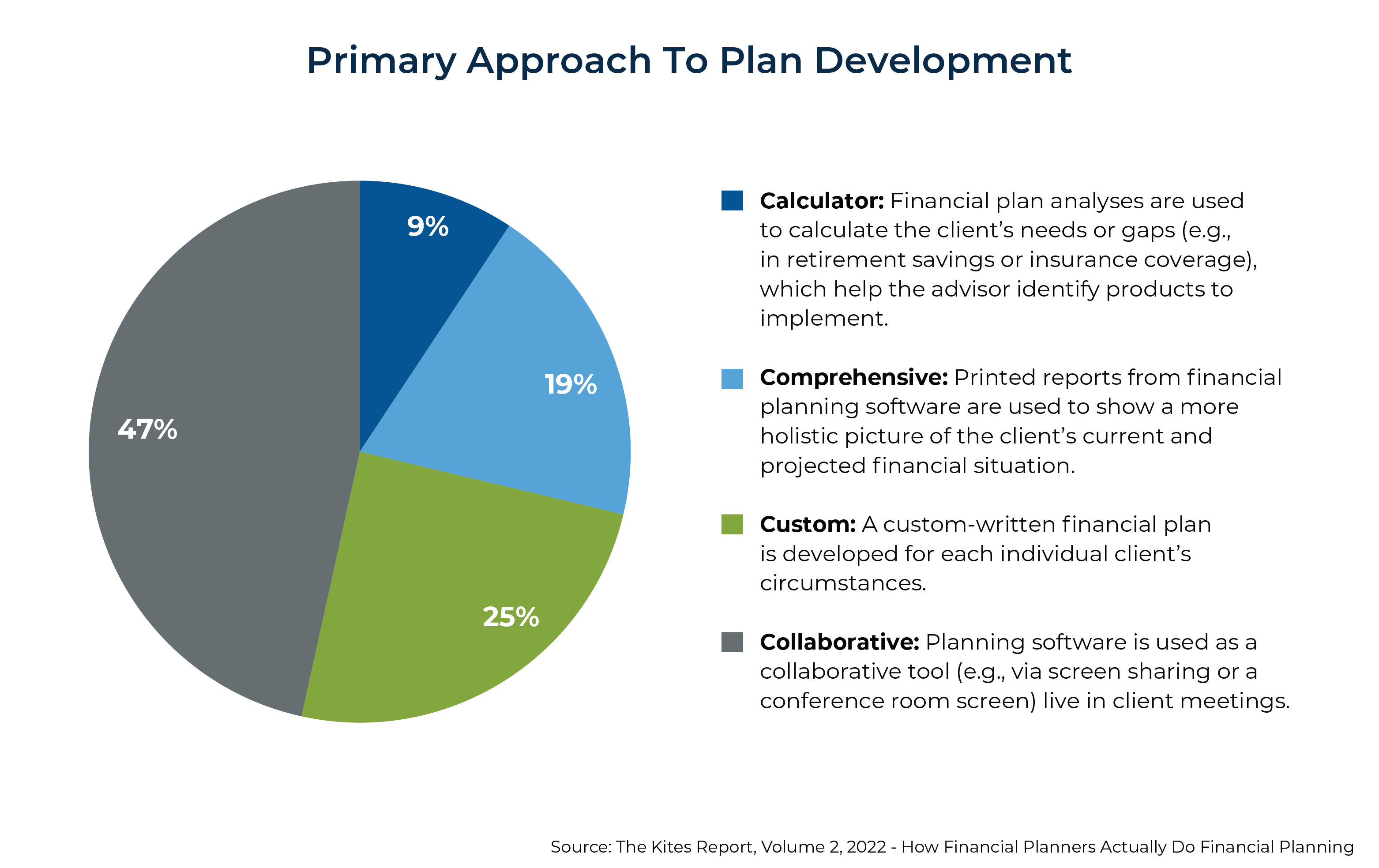

While advisors have traditionally delivered their plans in static, written format, Kitces Research data indicate that a "collaborative" approach to plan development (where planning software is used as an interactive, collaborative tool in client meetings) has become increasingly popular, used by 47% of respondents, compared to 32% in 2020. This was followed by 25% of respondents who reported using a "custom" plan approach where advisors developed a custom-written plan for each client's circumstances, 19% primarily producing "comprehensive" plans consisting of printed reports from financial planning software, and 9% using "calculator" plans that calculate the client's needs or gaps, which help the advisor identify specific products to implement.

While the potential revenue and income benefits of a collaborative plan approach are mixed (on average, advisors who use this approach fare better than those producing custom-written reports, come in about even with those taking a calculator approach, and fall behind advisors using printed plans from financial planning software programs), advisors producing collaborative plans also tend to update client plans more frequently and have more client touchpoints throughout the year. Which could lead to better client retention over time (and potential client amenability to fee increases), given the ease of making plan adjustments and increased engagement the advisor can facilitate.

Notably, advisors considering a collaborative approach to financial plan development and delivery (or who have already implemented such an approach) have a range of software options that can enhance the collaborative planning experience (e.g., eMoney's Decision Center, MoneyGuide Pro's Play Zone, and RightCapital's interactive features). In addition, staff members included in the planning conversation can further enhance the delivery of collaborative plans (e.g., by running the technology while the advisor guides the conversation).

Ultimately, the key point is that as technology has improved and virtual meetings have gained popularity among advisors (and their clients), many advisors have adopted a collaborative approach to financial plan production and delivery. Which can create a more interactive planning experience (compared to static written plans) and more frequently updated plans, while potentially increasing client engagement and improving client retention!

Just as the financial advice industry has changed over the past several decades, so too have the financial plans that advisors produce for their clients. From years past, when financial plans were largely used as tools to identify investment and insurance products for clients to purchase, to the present day, when financial plans themselves are often the centerpiece of the value being provided (at least for fee-only planners), the role of the plan has changed over time. This trend, along with advances in advisor technology, has also led to changes in how advisors approach plan production (e.g., using standard printed reports from financial planning software rather than custom-produced plans). And now, further advances in planning software programs, along with a shift to virtual meetings during the pandemic, have led many advisors to create and deliver plans collaboratively with their clients, which data suggest can save the advisors time (particularly compared to producing a custom written plan for each client), and potentially create a more engaging experience for clients.

The Evolution Of "The Plan"

Financial plans not only help clients gain a clear perspective of their current financial position, but they also provide advisors with a systematic way to organize their analyses and communicate their recommendations to the client. However, there is no standard style of what is included in these plans, and as financial planning software has gotten more sophisticated and capable over time, "The Plan" has gotten longer and longer, with additional components, giving financial advisors significant latitude when it comes to how they create and deliver plans (although the option they choose can be driven in part by the way they charge clients as well as the available technology).

For advisors who work on a commission basis, preparing a plan in a 'calculator' style might make the most sense, where financial plan analyses are used to calculate their client's needs or gaps (e.g., in retirement savings or insurance coverage) and help the advisor identify products to implement. In this case, the plan only needs to be long enough for the advisor to demonstrate their client's needs and identify the insurance or investment products that can help meet these needs.

For fee-only advisors, "the plan" itself takes on added importance, as it can serve as the centerpiece of the advisor's value proposition. And financial planning software has allowed advisors to take a comprehensive approach to plan development and delivery, using printed reports from these software programs to show a more holistic picture of the client's current and projected financial situation. But for advisors taking this approach who are looking to demonstrate their value to prospects and clients, it can be tempting to create longer plans, with the idea that the longer the plan, the more opportunities there would be to find problems that result in recommendations that demonstrate the advisor's value to the client. With this mindset, a 40-page plan with 12 planning recommendations might be seen as good, while a 100-page plan with 25 action items could be considered great.

But for both advisors and their clients, a lengthier plan is not necessarily better. From the advisor's side, longer plans can mean a greater time commitment to prepare them, reducing the amount of time they have for business development or serving a growing client base. And for clients, actually reading and following through on a plan that stretches out to dozens of pages can be a daunting prospect.

Further, while financial planning software programs have helped advisors methodically organize and analyze client data, these programs produce fairly similar reports. Which can make it challenging for advisors who want to stand out; some advisors provide customized written plans to their clients as a way to differentiate the deliverable (the plan itself) or to go beyond by supplementing 'just' the analyses that the planning software supports with more personalized content. This has led to a trend of increasingly comprehensive financial plans; for instance, data from the 2022 Kitces Research study, "How Financial Planners Actually Do Financial Planning", show that 54% of respondents produce plans with at least 13 components, compared to 35% in the 2020 edition of the study and 39% in 2018. Notably, the study also indicates that those producing the most comprehensive plans are not necessarily rewarded with higher revenue or earnings compared to those producing less-comprehensive plans.

Amid the growing comprehensiveness of financial plans, the COVID-19 pandemic threw a wrench into many advisory firm processes, as firms had to adjust to holding meetings virtually (at least temporarily for many advisors). And while traditional written plans could still be produced in this environment (e.g., through email or mail delivery), some advisors used this opportunity (along with improvements in financial planning software technology) to instead shift toward a more collaborative approach to plan preparation and delivery, a trend that appears to have stuck as in-person meetings have returned.

More Advisors Are Taking A Collaborative Plan Approach

As financial plans have become more comprehensive, the time demands on advisors (particularly for those producing custom-written plans) have increased accordingly. But along with new analytical capabilities and report types, several financial planning software programs have also added collaborative financial planning software interfaces (e.g., MoneyGuidePro's Play Zone and eMoney's Decision Center), making it easier to share dynamic, interactive financial plans with clients (whether on a screen in the advisor's office during an in-person meeting or via screen-sharing during a virtual meeting) instead of producing a static, written version of "The Plan".

In fact, the results of the 2022 Kitces Research study, "How Financial Planners Actually Do Financial Planning", show that a collaborative approach is now the most common way for advisors to prepare and deliver plans, reflecting a shift from prior years. According to the Kitces Research study, a "collaborative" approach to plan development (where planning software is used as a collaborative tool [e.g., via screen sharing or a conference room screen] live in client meetings) is now the most common, used by 47% of respondents (compared to 32% in 2020, although there were some slight revisions to the wording of the question this year that could account for some of the increase). This was followed by 25% of respondents who reported using a "custom" plan approach where advisors developed a custom-written plan for each client's circumstances, 19% primarily producing "comprehensive" plans consisting of printed reports from financial planning software, and 9% using "calculator" plans that calculate the client's needs or gaps, which helps the advisor identify specific products to implement.

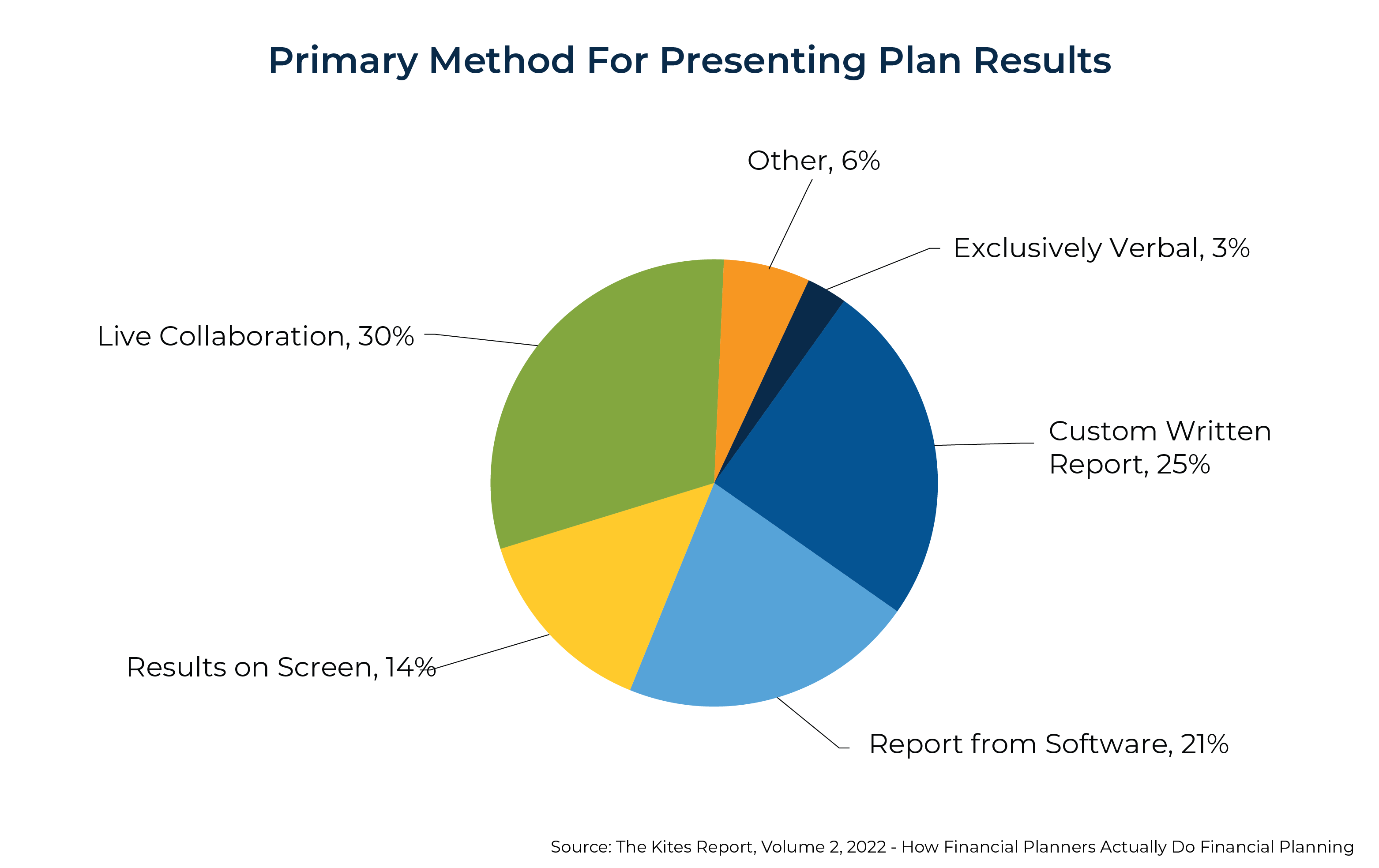

Along with preferring a collaborative approach toward developing financial plans, advisors also most often use a collaborative approach when presenting plans as well. According to the Kitces Research study, 30% of advisors primarily present plans through live collaboration with the client, compared to 25% who review a custom-written report, 21% who present a printed report from financial planning software, and 14% who present results on screen (without collaboration).

These data show that the percentage of advisors delivering plans on-screen (30% live collaboration + 14% results on screen = 44%) is just about equal to advisors providing written plans (25% custom written reports + 21% reports from software = 46%). As previously discussed, this could reflect the acceptance of virtual plan delivery among clients who became used to this method during the pandemic.

Collaborative Planning Does Not Necessarily Lead to Greater Productivity

While there are many potential qualitative reasons for taking a collaborative approach to financial planning (from the ease of updating the plan to facilitating planning conversations during client meetings), the Kitces Research study explored whether creating plans this way is associated with greater productivity (as measured by factors such as revenue and take-home income) and client engagement as compared to other approaches.

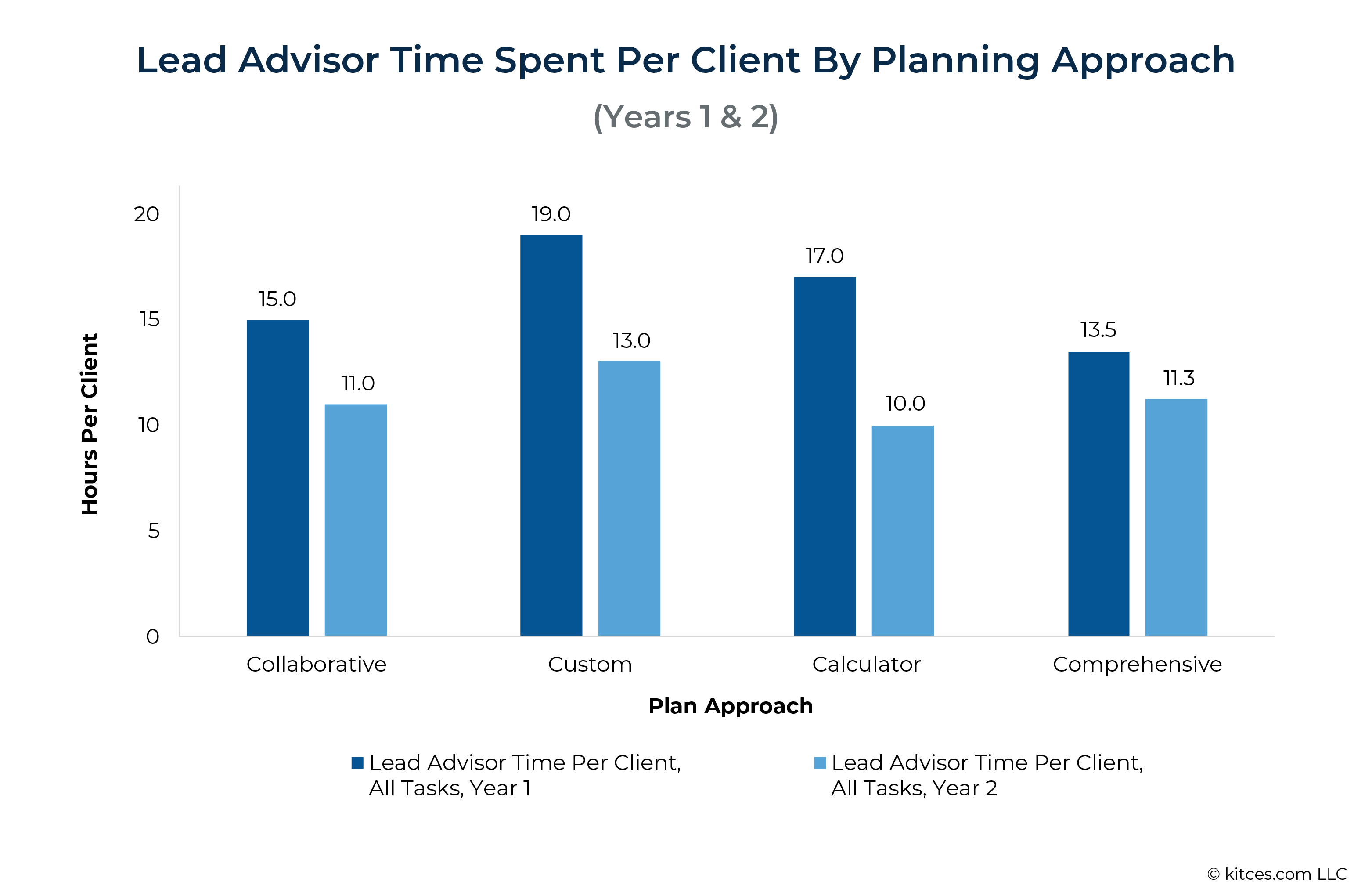

Kitces Research study results found that using a collaborative plan development approach saved lead advisors time compared to those producing custom-written plans, but not necessarily compared to other plan development approaches. According to the study, lead advisors using a collaborative approach spend a median of 15 hours per client on tasks in the first year of the relationship, compared to 19 hours for those producing custom plans, 17 hours for calculator plans, and 13.5 hours for comprehensive plans. A similar trend can be seen in the second year as well, with lead advisors producing collaborative plans spending a median of 11 hours per client, compared to 13 hours for those producing custom plans, 11.3 hours for comprehensive plans, and 10 hours for calculator plans.

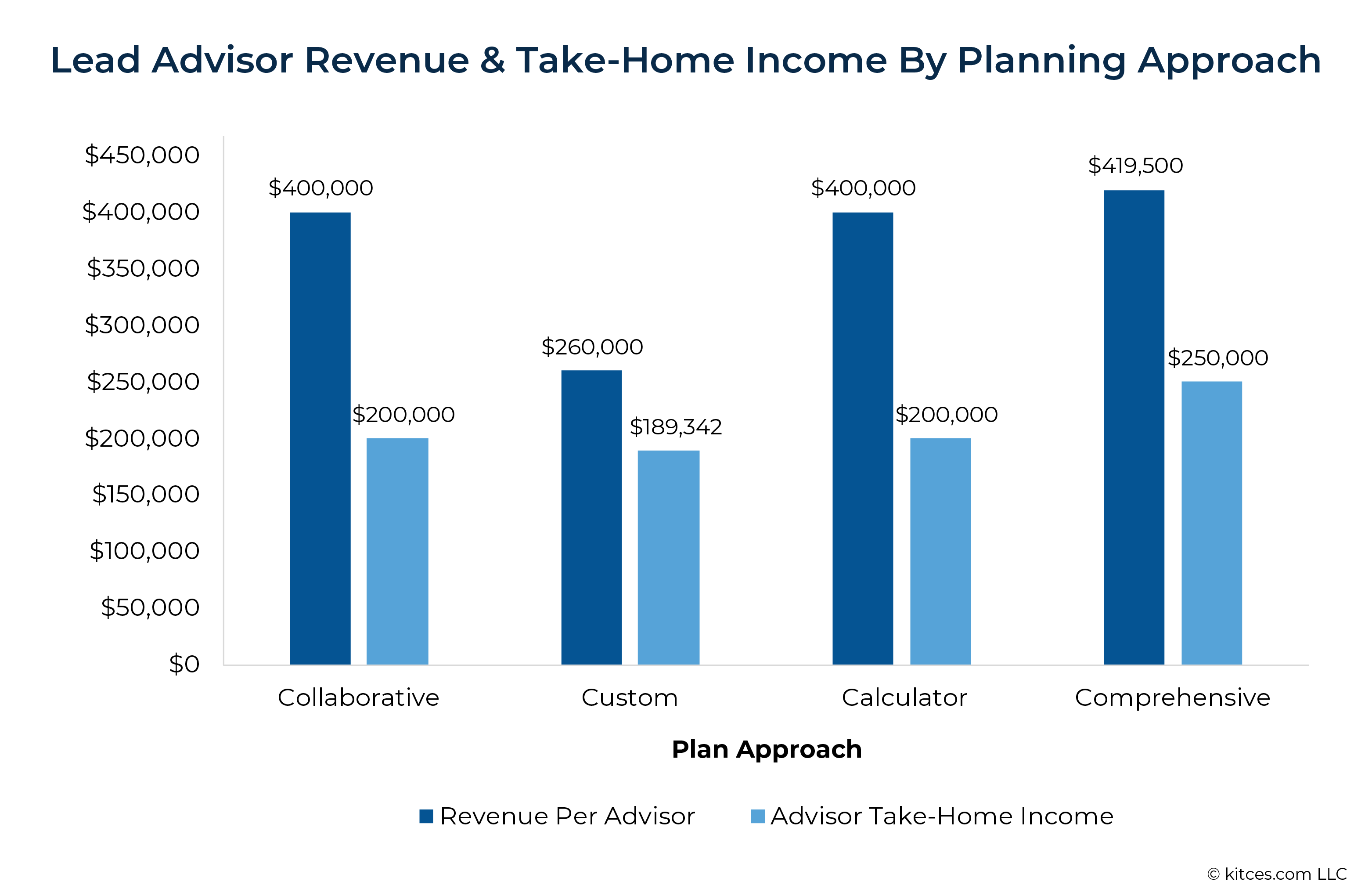

Similar trends can be seen when comparing advisor revenue and take-home income across different plan development styles. For instance, advisors who primarily use the collaborative approach to plan development reported a median of $400,000 in revenue per advisor, greater than the $260,000 for those producing custom-written plans, but largely in line with the $419,500 for those taking a comprehensive approach and the $400,000 for those using the calculator style.

Further, for advisor take-home income, those using a collaborative approach reported a median of $200,000 income, compared to $250,000 for those producing comprehensive plans, $200,000 for those using calculator plans, and $189,000 for those creating custom plans.

Altogether, the Kitces Research data suggest that the collaborative planning approach is correlated with greater revenue, income, and time savings compared to those producing custom-written reports. And while these metrics are similar compared to those with other planning approaches, the collaborative planning approach has other potential benefits that could help advisors boost client satisfaction and, potentially, retention.

How A Collaborative Planning Approach Can Facilitate Client Engagement

One of the benefits of a collaborative approach to financial plan development is its flexibility, both for the advisor and their client. For instance, during an annual meeting, a client might ask an advisor whether retiring 5 years earlier than they originally planned would be possible. While advisors producing static plans might have to go back after the meeting to model an early-retirement scenario and then report back out to the client, a collaborative approach could allow the advisor to quickly analyze the scenario as a demonstration in real-time, providing the client with an answer during the meeting.

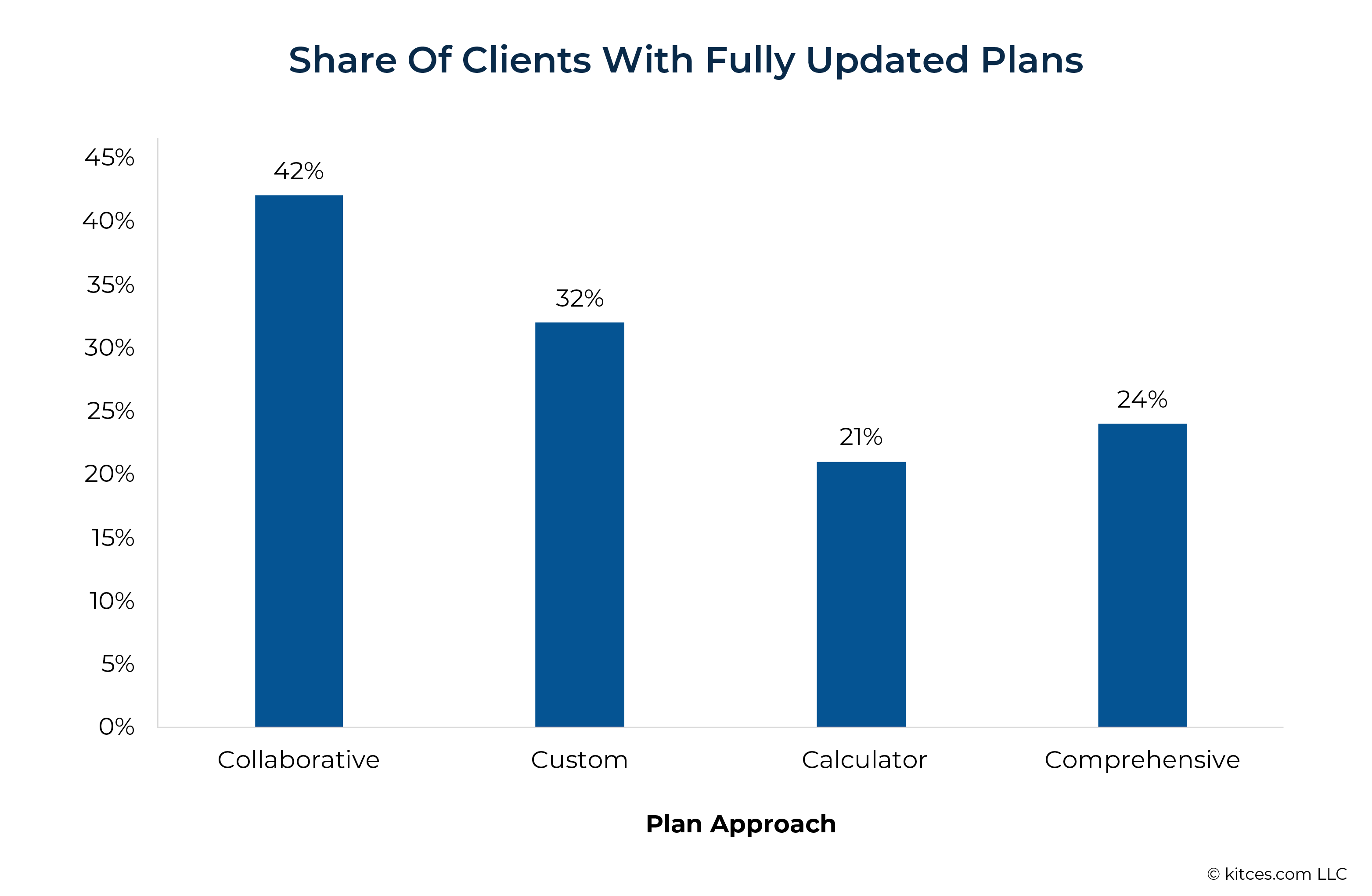

The Kitces Research study found that, within the past year, advisors using a collaborative approach to plan development were more likely to provide clients with fully updated plans, with a median of 42% of clients receiving one (further demonstrating the trend away from providing a single static plan), compared to 32% for those producing custom written plans, 24% for comprehensive written plans, and 21% for calculator plans.

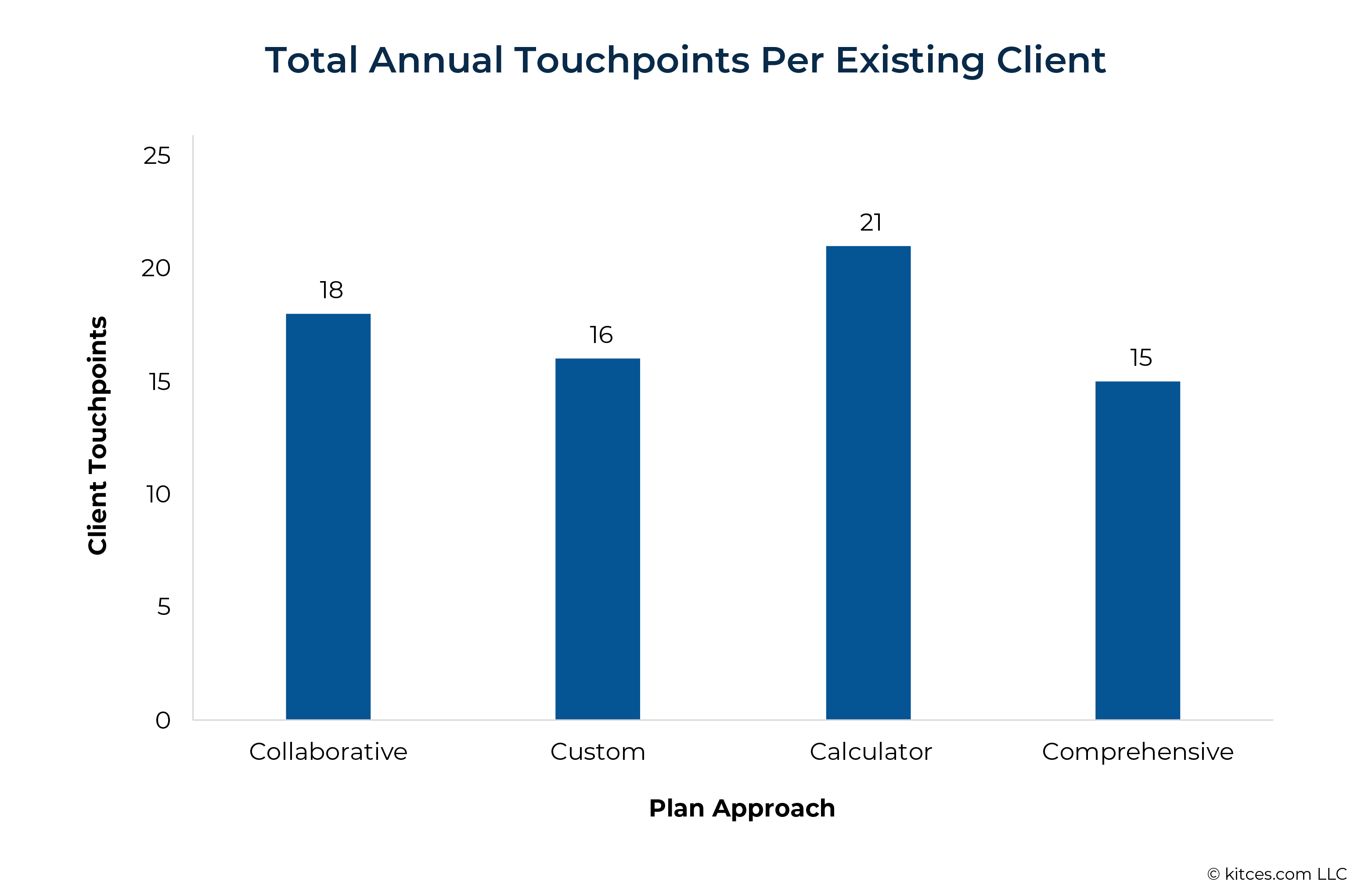

In addition, the Kitces Research study indicates that advisors taking a collaborative plan preparation approach tend to have more touchpoints (e.g., in-person meetings, client-specific emails, or client webinars) for clients after their first year with the firm (a median of 18 per year) compared to those producing custom written plans (16), or comprehensive plans (15), only exceeded by those taking a calculator approach (21).

In sum, Kitces research data suggests that while the potential revenue and income benefits of a collaborative plan approach are mixed (on average, advisors who take this approach fare better than those producing custom-written reports, come in about even with those taking a calculator approach, and fall behind advisors using printed plans from financial planning software programs), advisors producing collaborative plans tend to update client plans more frequently and have more client touchpoints throughout the year.

Which could likely lead to better client retention over time (and potential client amenability to fee increases), given the ease of making plan adjustments and increased engagement the advisor can facilitate (advisors can also consider sending clients some of the topics to be discussed during the meeting in advance to promote client engagement). For advisors who are currently taking a collaborative approach (or are considering doing so), there are many software solutions that can enhance the collaborative planning experience for clients, while also providing a convenient interface to develop collaborative plans together with their support staff!

Leveraging Technology And Staff Support To Develop And Deliver Collaborative Financial Plans

Advisors considering a collaborative approach to financial plan development and delivery (or who are already doing so) have a range of software options that can enhance the collaborative planning experience. In addition, staff members included in the planning conversation can further enhance the delivery of collaborative plans.

Financial Planning Software Used By Collaborative Planners

As previously discussed, financial planning software programs are increasingly integrating collaborative elements that allow advisors and their clients to run analyses in real-time. Among advisors primarily taking a collaborative planning approach, eMoney is the most popular financial planning program, with 42.7% adoption (compared to 39.2% adoption among all respondents regardless of planning approach), according to the 2022 Kitces Research study, "How Financial Planners Actually Do Financial Planning". One of the key features of eMoney for collaborative planning is its Decision Center, which allows advisors and their clients to simulate different scenarios and access reports, charts, and data modeling the scenario results across a range of planning areas for use in client meetings.

After eMoney, the second most popular financial planning software program among planners using a collaborative approach is MoneyGuide Pro, with 31.9% adoption (slightly below its 32.2% usage among all respondents). MoneyGuide offers the Play Zone, an interactive feature that lets advisors and clients use a series of sliders to simulate how changes to retirement age, expenses, and other factors affect the predicted success of their plan, as well as its Wealth Studios feature designed to interactively demonstrate advanced estate planning strategies, address client cash flow questions prior to retirement, and model dynamic net worth over time.

The third-most popular financial planning program among those using collaborative plans is RightCapital, at 23.9% (slightly more than its 22.8% overall adoption). RightCapital's dashboard lets advisors and their clients adjust plan assumptions in real-time, and its Blueprint feature provides an interactive space for clients to see the big picture of their finances and adjust goals as necessary.

Additional Software Options For Collaborative Planners

In addition to 'core' financial planning programs, advisors can use collaborative software features for specific planning topics such as tax planning as well. In this category, Holistiplan was dominant, with 80.8% of respondents who produced collaborative plans using the software. With a digital deliverable and instant scenario analysis, this tool could help advisors who want to go deeper into tax planning with their clients during meetings and model potential tax strategies in real-time.

In addition to the tools discussed above, advisors engaging in collaborative planning can also find tools to meet their needs within the Advice Engagement category on the Kitces Financial Advisor Technology Map and AdvisorTech Directory. Advice engagement tools are intended to deepen engagement in the advice process and increase the likelihood of prospect or client buy-in and follow-through with the advice recommendations themselves. Among other tools in the category that can be used to spark planning conversations (either virtually or on-screen) that help advisors take a more collaborative approach are Asset-Map (which can be used to visually illustrate a client's financial life) or fpPathfinder (which provides flowcharts and checklists around key planning topics that can help guide conversations with clients).

Managing Collaborative Planning Meetings

One of the advantages of using printed reports in client meetings is that the advisor has already 'done' the work in preparing the plan, so they can focus on the conversation without having to manage technology (perhaps beyond their videoconferencing tool of choice). Collaborative planners, on the other hand, have to manage both their planning software (to produce and present the plan) and the client conversation at once. It is important for these advisors to 'know their stuff' when it comes to inputting new information and running scenarios in their financial planning software, as they are performed live in the meeting (as opposed to meetings held with written reports, where the advisor can take their time after the meeting and get back to the client).

One way advisors using collaborative plans can ameliorate this situation is to use the "Kirk-Sulu Method" (coined by Dr. David Lazenby, referring to the dynamic between Star Trek characters Captain James T. Kirk and Lieutenant Hikaru Sulu), by which the advisor (if they are not operating as a solo) includes a team member to help run the technology during client meetings. Notably, the assisting team member (e.g., an associate advisor or paraplanner) will need to be well-trained in the software (both in terms of how the advisor wants to present information as well as running scenarios live during the meeting) to ensure meetings work smoothly but could act as a force multiplier by allowing the lead advisor to focus on driving the conversation with clients.

Ultimately, the key point is that as technology has improved and virtual meetings have gained popularity among advisors (and their clients), many advisors have adopted a collaborative approach to financial plan production and delivery. Which can create a more interactive planning experience (compared to static written plans) and more frequently updated plans (while potentially spending less time on plan preparation in advance), while potentially increasing client engagement (as well as follow-through on the advisor's recommendations) and improving client retention!