Executive Summary

Financial advisors often approach discovery meetings with prospects as an opportunity to ‘sell’ the value of the financial planning services they provide. This is often done by having the advisor learn about the prospect’s needs and show the prospect how the advisor can help them achieve their financial goals, ideally motivating the prospect to sign up for the advisor’s services. But for some prospects, the value they will get from an advisor is not just in the dollars and cents of planning, but also in making changes to their behavior. Which means that advisors can help prospects get on the path to change (often starting with actually signing up for the advisor’s services!) by using financial psychology and behavior change principles with effective discovery meeting questions.

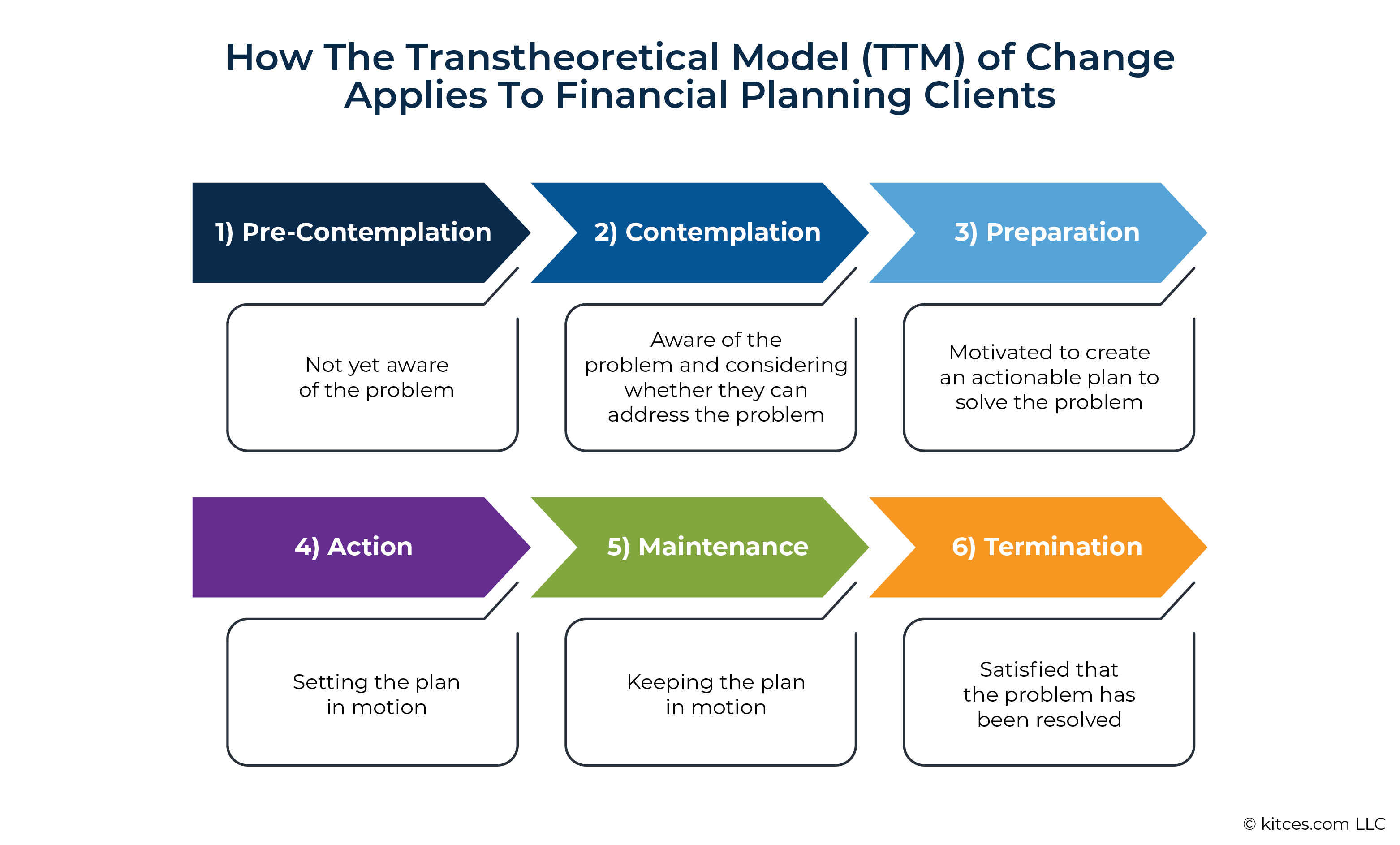

The Transtheoretical Model (TTM) of change offers a framework that can help financial advisors motivate clients who might be resistant to or struggling with change. TTM involves a 6-step process, where each step is designed to help individuals progress through change. Notably, the TTM process intersects with the financial planning process and the common challenges that arise in financial planning meetings can often be aligned with and explained by the different stages of TTM. For instance, new prospects might still be in the pre-contemplation stage of TTM, when they aren’t clearly aware of the problems they should solve, or they may be in the contemplation stage of TTM, when they are aware of a problem but aren’t yet ready to take action on it. In these cases, deciding whether there is value in engaging with an advisor at all and whether they will be able to follow through on what the advisor will ask them to do are often the key challenges for prospects that the advisor can address in the discovery meeting.

With this in mind, crafting the right questions to help prospects absolve themselves of the doubts they may have about an advisor’s value and their own ability to take on the responsibility of following their financial plan can serve both the prospect and the advisor well – because building up a prospect’s confidence in the advisor’s value and in their own capability to follow their plan (with their advisor’s support, of course!) will increase their own chance of success as well as the likelihood that they will sign on as a client.

Accordingly, there are 3 questions advisors can ask to address doubt by understanding what makes their prospects feel dissatisfied. These include asking about the prospect’s (dis)satisfaction with their net worth, with their financial decision making and self-confidence, as well as with their financial relationships. Together, these questions can help the advisor discover specific challenges that the prospect faces and start a conversation about how working with the advisor could help address these issues.

There are also 3 questions that explore the forces leading prospects to delay and procrastinate. These include exploring how prospects value action, talking about next steps, and asking the prospect to get started working with the advisor. These questions and the resulting discussion can help spur prospects to take action by officially becoming a client.

Ultimately, the key point is that while asking these 6 questions all together might not necessarily result in more prospect discovery meetings or better conversion rates, advisors might find that new clients are more likely to comply with their plans and take action on their tasks when this approach is used from the start of the relationship. Because at the end of the day, the more advisors are able to support the process of behavior change in their client relationships, the easier and more impactful their client work will become!

Discovery meetings, for most advisors, are often akin to sales meetings: they take place with prospects – not with clients – who need to be ‘sold’ on the financial planning engagement. Which is an important consideration, as having a sales perspective during the discovery process can impact how the prospect and advisor ultimately benefit from the meeting.

For instance, discovery meetings can help the advisor and prospect learn about one another, decide whether they will enjoy working together, and help them envision the scope of work that will be done through the engagement. And by focusing on the sales perspective, the discovery meeting can also clarify how the prospect’s specific needs and connect those needs to the advisor’s value, ideally motivating them to sign up.

However, another way to approach discovery meetings is through a behavioral change perspective, as the goal for many advisors is often to help prospects change some aspect of their behavior to achieve the prospect’s desired goals. And sometimes, the biggest change for prospects can be making a commitment to work with an advisor – which, for many, is something they have never done before. Even when behavior changes are beneficial, they can still be hard to implement. For example, shifting from a do-it-yourself approach to engaging with a financial advisor for professional advice can be a change that requires a good deal of motivation, going beyond simply understanding the transactional nature of what happens in a sales meeting.

The reality is that many discovery meeting questions framed through a transactional sales meeting perspective don’t often get to the driving factors that motivate a prospect to sign up and commit to a change that would allow an advisor to help them in the first place. Considering how financial psychology and behavior change principles can be integrated into a discovery meeting can help advisors find new ways as an impactful way to encourage prospects to become clients and even to motivate them to stay on track with their financial plans once they decide to sign up.

Discovery Meetings Can Be Challenging Because Many Prospects Are Resistant To Change

The 7-step financial planning process, as described by CFP Board, consists of specific stages that start with establishing the scope of work, moving on to understanding the prospect’s circumstances, and then gathering information to identify values and selecting goals. Accordingly, discovery meetings often aim to define the scope of work based on the prospect’s goals involving an immediate (or very quick) shift of focus on figuring out the specific goals the prospect is seeking to attain.

But asking about goals is not necessarily the best way to motivate a prospect to engage with the advisor or to take action on the steps to be laid out in their plan if they decide to become a client. For example, some prospects may prefer to learn more about the advisor before they are comfortable discussing their goals. For others, identifying goals may be part of a long process that they prefer to address only after engaging with the advisor, which they can only do once they are certain the relationship will be a suitable fit.

The key point is that the financial planning process wasn’t designed with behavior change in mind; it does not directly address how advisors can work through the potential resistance that prospects may have against their advice. Historically, financial planning has placed little emphasis on the psychological aspects of behavior change. And while the psychology of financial planning was recently added as a new category of study for CFP certificants in 2021, there are still few resources to help financial advisors address how they can support clients who want to change but are having trouble doing so.

Fortunately, the Transtheoretical Model (TTM) of change, proposed by psychology researchers James Prochaska, John Norcross, and Carlo DiClemente, offers advisors a framework that can help them motivate clients who may be resistant to change. While TTM is most famous for helping people quit smoking, it has also been used to research and inform the way people make financial decisions. TTM involves a 6-step process, where each step is designed to help individuals progress through change.

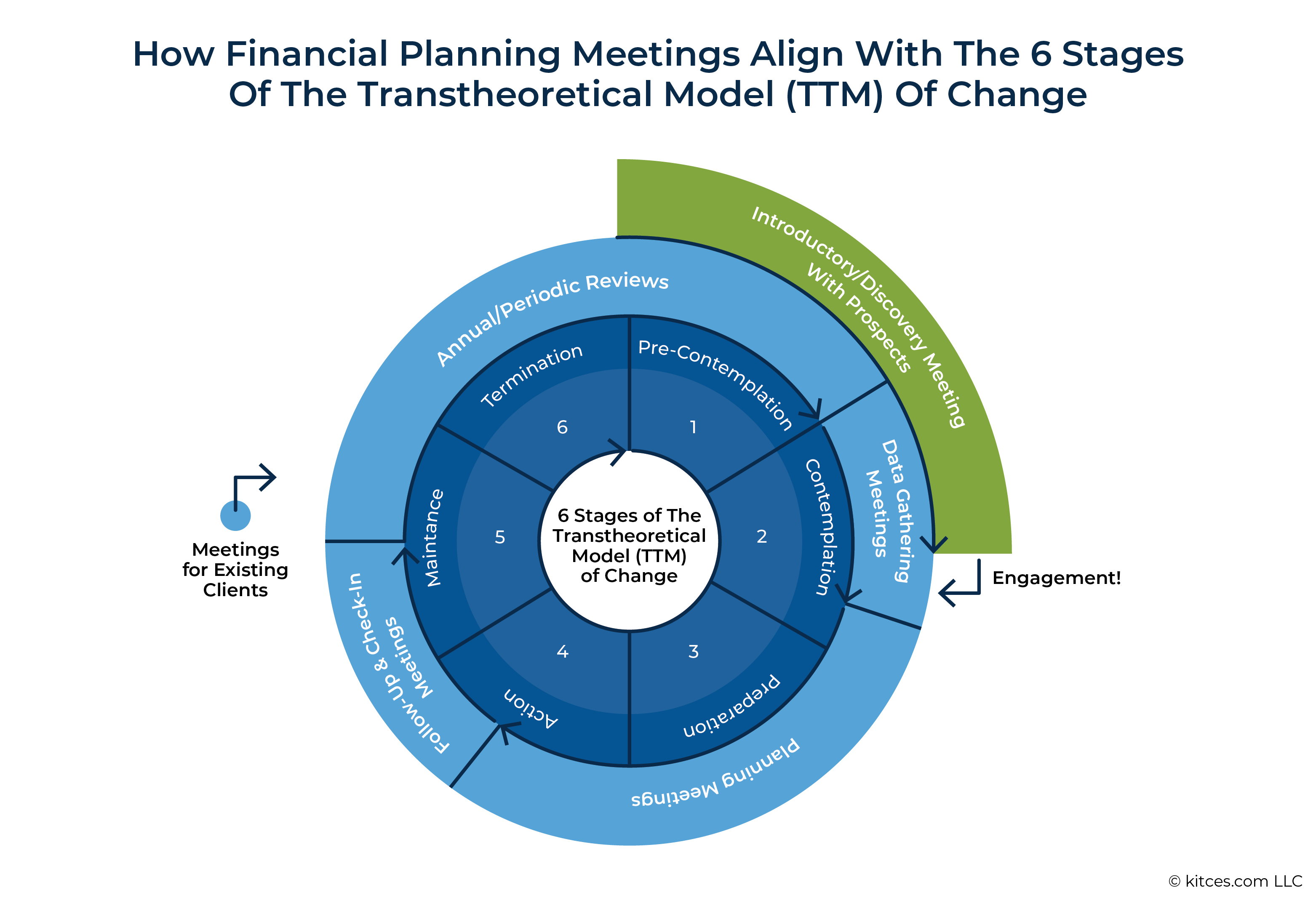

Notably, the financial planning process intersects the process of behavior change as described through TTM at several points, as the graphic below illustrates. The common challenges that come up in financial planning meetings can often be aligned with and explained by the different stages (and their associated challenges) of TTM.

For example, new prospects in a discovery meeting may still be in the pre-contemplation stage, when they aren’t clearly aware of the problems they should solve, or they may be in the contemplation stage when they are aware of a problem but aren’t yet ready to take action on the problem.

Similarly, in meetings with existing clients, advisors may have difficulty gathering data for clients who are in the contemplation stage because they might not be quite ready to take action, which can lead to procrastination and unresponsiveness to their advisor’s requests.

When it comes to discovery meetings with new prospects, TTM can be especially helpful for advisors to understand why prospects might resist taking action. Basically, advisors and prospects won’t always see eye to eye on the advisor’s value, especially when prospects are in the pre-contemplation stage of change. For instance, some advisors tend to convey their value by first asking about goals and then explaining how their services can help address those goals.

But the reality is that during a discovery meeting, many prospects are simply not ready to discuss goals and are instead seeking to understand the relationship value of working with an advisor. Because the first change that comes even before taking action on financial goals is making a choice to work with an advisor in the first place.

Not that most prospects wouldn’t value a retirement roadmap, but for prospects who are still in the contemplation phase, deciding whether there is value in engaging with an advisor at all is really the first course of action. Furthermore, the prospect may be doubtful not just about whether they should work with an advisor but also about whether they will be able to follow through on what the advisor will ask them to do.

Overcoming Doubt And Delay Are Often The Main Discovery Meeting Challenges

Doubt and delay are 2 key emotions that new prospects often experience in discovery meetings. Yet many advisors tend to focus on future goals, financial values, and money histories, which are not typically effective in overcoming a prospect’s doubt and inclination to delay taking action. And sometimes, discussing these ideas can even leave prospects feeling overwhelmed, as the reason they came to an advisor in the first place was to get help sorting these things out!

Instead of focusing on future goals, values, and money histories, advisors can consider an alternative set of questions based on behavioral change research that focuses on current concerns: What is it that the prospect is most dissatisfied with right now that fuels their doubt? And how does the prospect value action that can alleviate their tendency to delay?

Combating A Prospect’s Resistance Fueled By Doubt With The Force of Dissatisfaction

Crafting the right questions to help prospects absolve themselves of the doubts they may have about an advisor’s value and their own ability to take on the responsibility of following their financial plan will serve both the prospect and the advisor well – because building up a prospect’s confidence in the advisor’s value and in their own capability to follow their plan (with their advisor’s support, of course!) will increase their own chance of success as well as the likelihood that they will sign on as a client.

One strategy that can help individuals overcome feelings of doubt is to identify the painful and difficult experiences they may currently be struggling with. Furthermore, prospects will be more likely to move forward and make a commitment to changing their behavior if they are convinced that the value of working with a financial planner or accomplishing their goal is worth the effort involved in the process. Which means that advisors can leverage a prospect’s loss aversion to fuel a different line of questioning, focusing more on what it takes to increase life satisfaction (i.e., what can be done to alleviate any current pain points) than on how to achieve future goals (which may not even be clear yet for many prospects).

Accordingly, questions about dissatisfaction can be highly effective in identifying a prospect’s most relevant pain points in areas where the advisor can truly add immediate value. 'Scaled’ questions about dissatisfaction – such as, “On a scale of 1 to 10, with 10 being completely satisfied, how satisfied are you with college planning?” – can be especially impactful because they make it easy for the advisor to naturally segue into asking good follow-up questions.

And asking the right follow-up questions not only helps the advisor establish trust and connection in the new relationship but also provides more insight into the prospect’s values and priorities. At the same time, a dialogue that helps prospects articulate their dissatisfaction can help them understand their issue more clearly and viscerally, which can rouse them to move beyond doubts that may inhibit them from taking future action.

Importantly, while asking questions about what makes a prospect dissatisfied can ultimately illuminate goals or values to include in a financial plan, these questions are really most useful because they focus on what’s most concerning or painful for the prospect right now, which is a more powerful discussion when compared to a more vague future goal that may (or may not) make them happy 5 or 10 years down the road.

Curtailing A Prospect’s Inclination To Delay By Highlighting The Value Of Action

In addition to questions about what makes a prospect feel dissatisfied, questions that explore the value of action can also be very useful in discovery meetings. Advisors want prospects to sign up, take action on their plans, and feel better about their money (as do clients/prospects themselves!). As such, asking questions about how the prospect places value on taking action, what motivates the prospect, and what they want to get out of the planning engagement can be an extremely useful and uplifting conversation that can be especially helpful in addressing feelings that trigger procrastination and delay.

Like questions that explore a prospect’s dissatisfaction, those that broach the value of action also shed important light on how advisors can motivate prospects and help them achieve their desired outcomes.

A common challenge with respect to discovery meetings isn’t so much about how to conduct the meeting but is often more about a lack of action after the meeting. Asking prospects more about their current concerns and the things that they are most dissatisfied with, how they feel about the changes lying ahead, and the benefits and actions they hope for when working with an advisor will offer more insight into what to expect from a prospect and how to support them as clients down the road if they do choose to sign up.

6 Discovery Meeting Questions For Prospects Based On Behavior Change

When it comes to the Transtheoretical Model (TTM) of change, most prospects in discovery meetings with advisors tend to be in the contemplation stage, where they are aware of a particular problem they would like to address but still need to address strong feelings of doubt and delay.

Accordingly, there are 3 questions advisors can ask to address doubt by understanding what makes their prospects feel dissatisfied, and there are 3 additional questions that explore the forces leading prospects to delay and procrastinate by assessing how they value action. And while asking these 6 questions all together might not necessarily result in more prospect discovery meetings or better conversion rates, advisors may be pleased to notice that new clients are much likelier to comply with their plans and take action on their tasks.

Question #1: Dissatisfaction Surrounding Net Worth

While some financial advisors might request prospects to bring account statements to their discovery meeting, this is not necessary to understand a prospect’s satisfaction level with their net worth. Actual account balances are not important; ballpark numbers can work just fine and may even feel more comfortable for prospects to discuss. Consider how these scaled questions are used to explore a prospect’s feelings about their net worth:

Advisor: You have a general picture of your net worth. On a scale of 1 to 10, how satisfied do you feel with where you’re at?

Prospect: 7.

Advisor: Okay, but why not an 8 or higher?

Prospect: I just keep wondering about whether there ever be enough.

Advisor: Please say more about that...

A significant amount of understanding can come from the advisor’s simple request to say more about how the prospect answered the first question. In this example, the advisor is about to gain insight into the prospects’ feelings about their financial values and financial goals – without ever asking about financial goals or values.

Notably, the conversation can go in different directions depending on how the prospect answers. Another prospect who might be more satisfied with their net worth might respond something like this:

Prospect: I’d say I’m at about a 9. I’ve worked very hard to save my money, and I think I’m in a good place. I’d just like to better understand how my assets will support my retirement goals.

While this prospect’s confidence and comfort level are good signs of a positive situation, it could also signal that recommending more savings might not be well received because the prospect isn’t experiencing any immediate pain about their financial situation. If the prospect really does need to save more, the advisor may want to consider how to broach the subject strategically in such a way that will help the prospect understand the importance of the recommendation.

Alternatively, a prospect may feel worse about their net worth:

Advisor: You’ve done a great job saving for retirement. On a scale of 1 to 10, how content do you feel with where you are?

Prospect: 2.

Advisor: Okay, 2. Tell me, why didn’t you say 1?

Prospect: Well, I’m here, and I am trying. But otherwise, I just feel so lost. And you don’t know this, but I’ve made some bad decisions. Things might look okay to you now, but they could have been a lot better.

Advisor: I appreciate you sharing that with me. We all look back on past decisions and behavior and believe things could be better; I do it, too. But you are also right that trying and not giving up… taking the time to come here… those are big steps.

A great deal of trust was just delivered through this exchange. Information is shared in an entirely different way when the question prompts a prospect to think in different ways. And while people don’t generally like to talk about their financial mistakes, asking the right type of questions can encourage prospects to share information that may make them feel vulnerable and naïve.

Additionally, when prospects realize the source of their dissatisfaction during a discovery meeting, advisors can use this insight to help the prospect understand how engaging a financial advisor and making behavioral changes around their money can be worthwhile. Ultimately, if their current situation is more painful than hiring an advisor to help them implement the change to alleviate the pain, the possibility that they will engage the advisor will be much higher.

Other questions that can be helpful to explore how prospects feel about their net worth:

- Tell me a bit more about your retirement savings; do you feel that your current savings are adequate?

- On a scale of 1 to 10, with 10 being completely satisfied, how satisfied are you with college planning? Or saving for a new house? Or your brokerage/investment account balance?

Question #2: Dissatisfaction With Financial Decision-Making And Self-Confidence

The second question that can help advisors find ways to connect their prospects’ dissatisfaction with feelings of doubt asks about their financial decision-making process. It is not always obvious to the prospect that engaging with an advisor will involve some level of change in the way they make financial decisions, and prospects who struggle with making decisions on their own may find a great deal of motivation from the support a financial advisor can offer them.

Alternatively, prospects who are satisfied with their own financial decision-making may not be as open to changing even when asking for the advisor’s opinion. Either way, the advisor and the prospect can learn about what to expect from one another in their work together.

Other questions that can be used to ask about financial decision-making and self-confidence include:

- In our initial meeting, we talked about how you wanted to change the way you are currently making financial decisions. Tell me about the changes that would be most (or least) appealing to you.

- Share with me a bit about how satisfied you are with your financial self-confidence when it comes to making financial decisions.

- On a scale of 1 to 10, with 10 being totally confident, how confident or satisfied are you with your plans for your next large financial expense?

Question #3: Dissatisfaction Around Financial Relationships

The third question revolves around satisfaction with finances associated with personal relationships. Humans often struggle with doing the ‘right’ thing for themselves and are often more motivated when it comes to taking care of or acting in the best interest of loved ones. People might not quit smoking for their own health, but they’ll quit smoking for the sake of being around longer to spend more time with their kids. And while some people won’t take a walk for their own benefit, they will take the time to walk their dog every day.

The same thing often applies to financial decisions, which means that advisors can often find ways to move prospects past doubt through questions about relationships and money. For example:

- Tell me how satisfied you are on a scale of 1 to 10 – where 10 represents total satisfaction – with the amount of money you spend on your adult children.

- Share with me a bit about how you feel about your parents’ financial situation and how satisfied you are with the impact of their living arrangements on your own lifestyle.

- On a scale of 1 to 10 – where 10 is amazing – how satisfied do you feel about your level of communication about money, retirement, and estate planning with your spouse?

The crux of these satisfaction questions is finding points of dissatisfaction and getting the prospect to talk more about the specific challenges they face. Which is why follow-up questions are immensely useful; while scaled questions often segue naturally into good follow-up questions asked by the advisor, answering follow-up questions can be deeply insightful – and impactful – for the prospect.

The following exchange details how good follow-up questions can provide valuable insight into a prospect’s pain points:

Advisor: Share with me a bit about what you know about your parents’ financial situation. On a scale of 1 to 10, where 10 is most satisfied, how satisfied you are with how your parents’ plans will impact you as they age.

Prospect: Man. I wasn’t even thinking about my parents, but yeah, that has been a major source of contention for my family. I would score that a 3. Is that something you could help with?

Advisor: Certainly; what happens within a family can have a huge bearing on the family’s financial situation and it would definitely be an area we could review in your financial plan. I am curious, though, what made you answer 3? Why wasn’t your score lower?

Prospect: Well, my sister and I just started talking the other day about my dad’s health, which isn’t as good as it used to be. I’ve been worried about him, and I guess that’s why I scored my answer so low. But he’s still able to get around and is usually in good spirits, and that’s why my score wasn’t a 1 or a 2.

Advisor: I appreciate you sharing and providing more insight. Feeling uncertain or uninformed when it comes to money and family is difficult. I take it this is something that you would want to address if we were working together?

Prospect: Absolutely. We’re worried that he really shouldn’t be driving on his own and how we’ll manage to help him get around to where he needs and wants to go. Any tips you have about how to tell your dad they can’t drive anymore? We haven’t spoken to him, but his health is important and it’s going to influence both my situation and my sister’s.

Had the advisor simply asked about the prospect’s financial goals, values, or money histories, the prospect probably wouldn’t have revealed his concerns about his father’s situation. But by starting with questions that address satisfaction across different aspects of a person’s life, advisors can find a lot of clarity in unexpected places. Clarity about what isn’t working and where dissatisfaction exists – these are pain points that can serve as the impetus to create meaningful and relevant goals throughout the client relationship.

Question #4: Exploring How Prospects Value Action

After 3 rounds of questioning around dissatisfaction, doubts have been addressed and most prospects are going to be primed with feelings of needing and wanting help from an advisor. So the next questions can begin to explore what is causing them to delay taking action and how ready they are to receive help.

Questions about the value of action can inspire prospects to take action, and they can also provide the advisor with more information that will help them work most effectively with a prospect in the coming weeks and months if they sign up as a client.

Some questions that can condition prospects to think positively about the challenges ahead and assess how they feel about taking action include:

- What do you hope will happen as a result of getting started on your plan?

- What would be the first sign for you that financial planning is working for you?

- What do you look forward to most about becoming a client?

- Share with me a bit about what you think will be the first moment of relief or triumph once we start working together.

Getting prospects to talk about the benefits of change can ultimately help to overcome the feelings of delay. Consider the following dialogue:

Advisor: Tell me, what are you looking forward to most about working together?

Prospect: I just want to feel lighter. I am stressed about my finances, and I know I need to get my finances organized so I don’t feel that way anymore. I want to believe that you’ll help me organize my affairs, and that working with you will help me face some things I’ve been avoiding. I know this will help me come out on the other side feeling lighter, clearer, and more in control.

The prospect above is not exactly sure what they will be expected to do, but answering the advisor’s question is helping them acknowledge how engaging with the advisor can potentially move them away from the disorganization that they currently feel and bring them the relief that they seek.

Alternatively, the way a prospect answers the advisor's question can help the advisor gauge whether the prospect is really ready to take action. For example, consider this prospect’s response:

Prospect: I don’t know. I just know that doing nothing is not going to work. I need to have some accountability. I want someone to help me feel more organized.

This prospect seems unclear about what their actual pain points are and the specific course of action they want to follow. Accordingly, the advisor may want to backtrack and explore the person’s current doubts a bit further before moving on to discussing the next steps.

Question #5: Talking About Next Steps

When it comes to addressing the reasons that a prospect might delay taking action, a crucial consideration is simply the prospect’s curiosity about what the next steps may involve. If someone has never worked with a financial advisor before, they probably won’t know what to expect. They won’t know what comes next, and feeling anxious about not knowing can cause the prospect to put off taking action. As such, asking questions about the prospect’s own questions and concerns can help alleviate some of the prospect’s anxiety about next steps.

The following are some examples that may encourage the prospect talk about their concerns about the process:

- What else can I answer for you about the next steps?

- Share with me any worries or hang-ups you have about taking the next steps.

- Give me some insight into any questions that have come up for you about getting started and taking the next steps since we have been talking.

Question #6: Let’s Get Started!

The last question is simply to ask the prospect to get started, as closing out a prospect discovery meeting by asking for the prospect’s business and commitment to take on the next steps is a good way to start the process of working together.

Here are a few questions that can open the conversation:

- I would be delighted to begin working together with you; what are your thoughts?

- I have the paperwork here to get us started; shall we go over everything together?

- I am so glad you came in, and I’m excited to get started! Where are you on a scale of 1 to 10, where 10 means you want to sign the paperwork...?

Prospects will sign up if they feel ready; if they are not, they will tell you. Either way, everyone leaves the meeting with clarity. Using this 6-question discovery process will help advisors build trust and value with new prospects, learn about the prospect in hopes of building a plan, and motivate prospects to take action. At the same time, these questions will offer advisors a better understanding of the important pain points their prospects are facing and the ways they can most effectively support the prospect in making the right changes should they decide to sign on as a client.

Discovery is difficult. Goals and values can be insightful topics to discuss, but talking about satisfaction and feelings about taking action now may be more useful conversations, especially at the start of a financial planning relationship. Ultimately, good financial planning, at its core, is about helping clients implement and maintain favorable behavior changes. And the more advisors are able to support the process of behavior change in their client relationships and in their meetings, the easier and more impactful their work with prospects and clients will become!

Leave a Reply