One of the biggest trends in the investment industry in recent years has been explosive growth in the variety, availability, and use of exchange-traded funds (ETFs). Not only because they are more tax efficient, have more flexible trading, and are typically less expensive – which has made them a popular way to implement passive investing strategies – but also because even advisors who actively manage portfolios themselves appear to be used ETFs are the core “passive” building block for their active ETF strategies. However, the industry still shows that the overwhelming majority of advisors still use mutual funds as well, which in turn raises the question: how, exactly, do advisors choose between mutual funds versus ETFs and select the particular investment vehicle they’re going to use… and from the asset manager’s perspective, what should fund companies be doing to get their investment solutions in front of advisors?

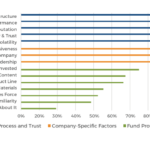

In this context, a recent industry study published by Erdos & Morgan provides a fascinating look into what advisors actually view as the most important factors when selecting fund providers. Not surprisingly, performance and fees rank were top-ranking factors, but advisors also place a high value on a fund provider’s approach to managing volatility and their perceived trustworthiness… and surprisingly (or not) weight at all on the fund company’s marketing materials, wholesalers, or “thought leadership” white papers. And the trend is especially pronounced amongst the RIA channel, which sits the furthest from traditional commission-based fund distribution models, and appears to be the most likely to take a “don’t call us, we’ll call you” approach to selecting fund providers to work with.

In fact, another study from Advisor Perspectives (also looking at fund company selection by advisors) found that advisors are becoming increasingly sophisticated in regards to evaluating a fund’s fees and performance, instead of relying on the higher-level “rankings” from research providers (e.g., Morningstar’s star ratings). And to the extent that advisors want “value-added” services from fund providers, the desire is not for practice management advice, but simply more accessibility to deeper investment expertise, from having more direct access to fund managers and research analysts, and demanding that wholesalers themselves be increasingly investment savvy (with real investment expertise like CIMA certification) as well.

The bottom line, though, is simply that with all the rapid changes occurring in the industry, there is growing recognition that the traditional distribution approach of fund providers and asset managers is changing. Yet thus far, fund companies appear to be struggling to adapt, leading to especially low reputation scores from RIAs compared to advisors working at broker-dealers, and substantial negativity towards traditional wholesalers. The good news, however, is that in the end, client assets still have to be invested somewhere… which means there is a substantial opportunity for the fund providers that can learn to adapt most quickly to the new normal of how advisors select investment solutions.