Executive Summary

While the number of business models for financial advisors continues to grow, from its commission-based roots, to the AUM model, and more recently to hourly and retainer models, the fundamental challenge is that virtually all of those models are still focused on the "traditional" domains of financial planning, including retirement, insurance, estate, taxes, and investments. When the reality is that for a huge swath of Americans, their needs for financial advice are focused on issues like credit card debt, building an emergency fund, or just getting their head around their budget for the first time. The problems are half about financial literacy, and half about behavior change and forming good financial habits around spending and cash flow... neither of which are part of the typical engagement with a financial advisor.

But what's the alternative? Increasingly, it's a new domain being called "financial coaching" instead. And in this guest post, Garrett Philbin of Be Awesome Not Broke (a financial life coach who helps people get out of debt and save towards their goals!) shares some of his own thoughts, tips, and processes, and guidance for those who want to try running a financial coaching practice instead of a traditional advisory firm. From the regulatory and compliance issues, to the business model and how to charge clients (because yes, there are people who really do pay for this kind of help!), the software and tools that can help, to the actual services and deliverables provided to coaching clients.

Ultimately, the key point is to recognize that financial coaching is emerging as a distinct service from what we traditionally do as financial advisiors, and one that reaches a distinct clientele (who have been grossly underserved by the financial advisor marketplace so far!). For some, that means coaching is an appealing way to expand an advisory firm to reach a new type of clientele. For others, it might even be a preferable alternative to the "traditional" path as a financial advisor, with what is still a $100k+ income potential. In fact, as Garrett notes, financial advisors and financial coaches can be an excellent professional relationship to cross-refer clients who need the services of one or the other!

So whether you've heard of financial coaching but don't know what it is, have been thinking about adding financial coaching services as an offering, want to become a financial coach instead of a financial advisor, or are simply interested in how your clients may benefit from working with a financial coach... I hope that you find this guest post from Garrett to be helpful!

If you are reading this, odds are that you’re either a financial advisor, or interested in becoming one. Your mission is to enable people to live their ideal lives by making the most of their assets, and investing wisely for that future. Helping people and doing right by them is what made you (or makes you want to) get into this line of work.

There is a clear business model for helping people who already have a healthy amount of money to invest – the AUM model. Also, growing in popularity, is the monthly retainer model being championed by the XY Planning Network, allowing advisors to work with people with minimal assets. Yet, what about people who come to you with no assets at all, or even a negative net worth? Those with credit card debt, no emergency savings fund, and no idea of how much money is coming in, going out, or where it’s going… but they want help. How can financial advisors help them?

In reality, that person is not a good fit for a financial advisor, at least given how most operate today. Instead, that person needs a financial coach.

The term “financial coach” may be new to you. And to make it just a bit more confusing, there are many monikers often used synonymously, including money coach, financial life coach, certified money coach, etc. But, in a nutshell, whatever name you hear, the goal of a financial coach is to educate clients on the basics of personal finance and, as a team, create a spending plan that reflects the values and goals of the client. The coach then empowers clients to take responsibility for their decisions, supports their continual learning and growth, and serves as an accountability partner throughout the process.

This post is divided into three sections. Since the world of financial coaching is most likely unfamiliar to you, the first section is all about what financial coaching is, and how it differs in approach and practice from what financial advisors typically do. Next, I’ll talk about the business model for financial coaching, how coaches get paid, and the structure of this nascent industry. The third section is all about the how-to. I’ll walk you through my experience of starting a financial coaching firm from scratch and offer up a roadmap for how you can do the same.

So whether you are a recent grad or career changer looking at options within the field of financial advising, are an advisor already in the industry who might prefer to transition to a career as a financial coach, or want to pitch this new service model to the boss of your firm, there is much to be gained from this post. So sit back and get ready for a Kitces-length explanation of What Financial Coaching Is and the Best Practices for Becoming One!

A fun side-note: posts by others on the Nerd's Eye View blog, like Sophia Bera, Andrew McFadden and Daniel Wrenne, helped guide me down this path, so my hope is that I can help you in a similar way.

Why I Became a Financial Coach

Financial coaching is, in many ways, fundamentally different from financial advising or personal financial planning, and many financial coaches come from outside of the world of financial services. My story is no different.

I studied Music Business in college and worked for five years in the music industry in New York City. This included a stint with Sony Entertainment and, for two years, head of client relations and business development for two companies I had started with a couple of college friends. I eventually realized that the music industry wasn’t where I was meant to be, and what I really wanted to do was help people as a teacher and mentor. This desire to teach/mentor grew out of a two-year, full-time volunteer program I did after college—before my time in the music business—where I worked with low-income, at-risk high school students. I absolutely loved it!

So, I pulled a complete 180 from the music business and decided I wanted to start helping people with their money. I’m not sure where the “money” part came from, but once the idea got into my head, I couldn’t get it out. At the time I had no idea what form that would even take. I simply became more and more drawn to the idea of teaching and mentoring people around this topic of money—one that can cause so much stress, anxiety and pain in our lives.

Fast forward: Today I’m the founder of Be Awesome Not Broke where I work as a fee-only financial coach, helping people get out of debt, save towards their goals and stop feeling guilty about their relationship with money. I run a location independent business, have brought on 20+ clients since January 2016, and truly love what I’m doing. Becoming a solopreneur and financial coach has been the most challenging, exciting, gratifying, scary and fear-inducing undertaking I’ve ever taken on, but I wouldn’t change it for the world. That “Freedom!” that I help my clients achieve...I’ve tasted it myself.

But again, this has been no walk in the park. But I want to share my story, experience, and learnings so far in this nascent industry of financial coaching, in the hopes that you can apply some of it towards growing the practice and life that you want.

What Is Financial Coaching? (And What Is It Not?)

A fairly simple way to explain financial coaching is to contrast it with what a financial advisor does.

Financial advisors tend to focus on implementing financial products and strategies, while financial coaches focus more on the basics of personal money management, behavioral change, and accountability to a client-driven spending plan. And while financial advisors most commonly help to manage wealth that already exists, a financial coach’s job is to provide a client the knowledge, skills, and behaviors that will help them build wealth in the first place.

Another major difference between financial coaching and advising is that coaches typically have no tie-in with products at all; they do not manage investments, nor sell insurance. We might educate our clients on the basic concepts of insurance, investing, diversification (which isn’t considered giving financial advice, as I’ll discuss later), etc., but we never provide specific recommendations on where to invest. In many cases I don’t even discuss the above topics with my clients because they aren’t at the point where they have assets to invest; they are more worried about working their way out of debt or building up their emergency fund.

In that way, financial coaches are an integral asset and valuable complement to traditional financial advisors. When a client has met his or her goals of positive cash flow and some wealth accumulation, I often refer that person to a financial advisor, so they can move on to the next stage—comprehensive planning—something I am neither an expert in, nor licensed to do. Honestly, to compare coaches with advisors is like comparing apples and oranges - one is not better than the other, and seeing them as either/or misses the point. Both are incredibly important and help people use their money better to reach their goals. But they do different things, and in practice work typically work with different types of clients with different needs.

I, personally, love to mentor and teach, and financial coaching allows me to dive into the emotional, behavioral, and educational side of money. This approach does require more hand-holding, keeping the client accountable, and devising ways to help the client embrace new habits that will support their financial goals. That’s because the ultimate goal of coaching is to teach clients how to fish—to get them to the place where they have the basics down, and don’t need my help anymore.

So, let’s talk about what I actually do as a financial coach. A financial coach is just that. A coach. The relationship is highly client-driven, and I am engaged/hired by the client to support his or her personal goals and values. For my clients, I provide education and help them take a look at their personal relationships with money, habits, and emotional issues. I give them a platform for distilling what “awesome” would look like in their lives, now and in the future. I offer encouragement when the process gets difficult, keep them on track, and hold them accountable to their stated goals and directives (which can, of course, change with time).

Here is an example what that financial coaching process might look like.

- Build awareness around spending habits. Most clients I work with have never made a budget, or if they have they couldn’t stick with it for more than a few weeks. This means my first task is to help them discover how much money is coming in, how much is going out, and where it is going.

- Dream your “Awesome” lifestyle. Since coaches view money as a tool rather than a goal, I provide an opportunity for clients to explore and define the life they want to live—not just in retirement, but now! That’s not an endorsement of the YOLO philosophy, but rather a challenge to question the status quo, ask what they really want out of life, and challenge them to think about how they will make it happen for themselves today, not in 30+ years. This means taking a hard look at personal values, fears around money, and desires for life.

- Explore emotions and behaviors. It’s easy to tell people what to do. It’s much harder to get them to do it! Humans are inherently irrational when it comes to money, so a coach’s job is to help clients identify their stories/patterns of behavior, and get them to understand that it’s often their own beliefs about money that are at the root of their spending issues.

- Address their tough financial problems. Establish an emergency fund. Manage debt, and create a plan to pay it down.

- Accumulate 3-6 months savings. Most clients of financial coaches have never had 3-6 months of money saved at once, so this is both a practical challenge of how to put the funds away each month, and a behavioral one (since they’ve never done it, it can appear overwhelming, scary, and feel unattainable).

- Develop a spending plan and budgeting system that actually works for that client. Some clients love getting into the weeds with Mint or YNAB, while others will never stick with the constant categorization that those tools require. It’s important to know what tools work with what personality type and approach. Otherwise, you’re forcing a square peg into a round hole.

- Support and Follow-up. Upon completing the process, a client will often continue to engage a coach, to call upon him/her in “times of weakness”, when other life challenges come into play, for general questions, emotional support, clarifications, etc.

The Financial Coaching Business Model For Getting Paid

I believe that cash flow is king. It’s the engine that powers the car, and if people don’t have that piece down, they can’t be financially successful in the long run. It’s no surprise that, while many of my clients have healthy incomes, they have very little (or negative) net worth. Therefore, fixing their cash-flow issues is paramount. Yes, helping people with cash flow issues can be frustrating and challenging but, for me, it’s ultimately the most rewarding because it has the greatest impact on their ability to enjoy life. And there are SO MANY PEOPLE that need this kind of help. From a business model perspective, there are only so many people out there already part of the “mass affluent” with $100k+ ready to invest with a financial advisor. But, if you open it up to those who make good money but have minimal assets, the potential size of the pie grows exponentially.

The Blue Ocean Opportunity For Financial Coaching

The state of financial literacy, savings, and levels of debt in this country is astounding:

- 62% of Americans have only enough savings to pay for a $500 or $1,000 emergency.

- 56% of people have less than $1,000 in their checking and savings accounts combined.

- The average household with revolving credit card debt carried a balance of $6,885 as of June 2016 and pays $1,292 a year in interest.

- Despite rising resources for financial literacy, people still seem to struggle to apply the information to their financial decisions when the time comes.

The number of people who need help with their money is staggering. This is why there has been such an explosion of financial bloggers over the past five to 10 years. There’s an untapped sea of people who need help, but there are virtually no professionals with business models to serve them because it is impossible to serve these people who have minimal assets under an AUM model.

Nonetheless, there are definitely opportunities to serve the needs of these people. It simply has to be done on a fee-only basis, and ideally in ways that scale, with approaches from fee-for-service coaching, to more scalable solutions like group coaching (which I have done), creating a course, selling digital workbooks, etc.

Financial coaching for those struggling with their cash flow, credit card debt, and a lack of savings, require skills outside of what is traditionally required of a financial advisor. In much the same way that artists in the music industry have had to expand beyond simply songwriting/performing and become experts at marketing/branding. I see parallels here for the financial advisory world.

Will People With Cash Flow Problems Really Pay For Financial Coaching?

As soon as financial advisors hear what I do, I’m often asked: “If people already have cash flow problems, are they willing to pay? And how are they able to pay?”

A short answer to the first, and I don’t mean it flippantly, is YES. People are willing to pay.

The reason they are willing to pay is that, by the time they find me, they are at the point where they’ve been struggling for years (often longer), and are ready to make a change. They realize that how they’re operating isn’t working, isn’t sustainable, and won’t allow them to live a life they actually enjoy.

Regarding the “how”… Some pay from their savings, some commit to spending less on X/Y/Z category and pay me from there, and others put it on a credit card.

Which brings us to a common follow-up question, “Is it right to charge someone money who, by definition, is already struggling with cash flow?”

Again, my answer is yes. When I work with people I am teaching them skills, habits, and knowledge to serve them for the rest of their lives. They are already spending (most) of their money on things that bring them zero return, both financially or in terms of happiness, and aren’t bringing them any closer to their goals. Investing in their own financial health and future is a much better use of their money.

If a client makes $100k/yr. and pays me $1,500, do I think I can help them save at least $125/mo. over that first year? You’re damn right I do. And if I hadn’t been providing value beyond what I’m charging my clients by now, I’d be out of business.

A Deeper Look At The Financial Coaching Business Model

While I can’t speak to every financial coach out there, the most common business models for financial coaches will be familiar to those in the Garrett Planning Network (no relation!), NAPFA and XYPN communities, as they share similar characteristics.

As mentioned earlier, coaches work on a fee-only basis. Because we do not handle investments or sell insurance (aren’t registered to do so), we cannot sell products or charge on an AUM basis.

In terms of how we set the fee, there are a variety of approaches. Since the model of financial coaching isn’t about having clients for life (again, we’re teaching them how to fish by helping them master the basics and then sending them back out on their own), our fees are often based on a fixed period of engagement—i.e. $2,500 for a six-month program. That doesn’t mean, however, that every client will become an expert fisher(wo)man after that initial time together. Therefore, some coaches offer a monthly retainer option (much like XYPN) or per-hour/single-session options so those people can continue access to the coach if they want additional support going forward. Some are even experimenting with group coaching models as well.

Others (like myself) charge on a percentage of income. However, having worked with the percentage-of-income approach for a while, I am moving away from that in favor a tiered income-based pricing system (but with a cap). I’ve realized that, while I believe the percentage-of-income model is a fair one—in other words, I can save someone who makes $300k much more in pure monetary terms than I can someone who makes $100k—the higher income earner feels greater sticker shock when they see such a large dollar figure. Even though they’re paying the same percentage of their income as someone making ⅓ as much, that large number scares them. And that’s not what I want.

Ultimately, it’s about what the market wants and/or feels is fair. There is no “perfect system”, beyond finding one that your clients will pay for, which in the aggregate can produce at least a livable wage for you as the financial coach.

How Much Does A Financial Coach Make?

There is no hard-and-fast answer for what financial coaches typically make (i.e., no “benchmarking” data), of but let’s use a realistic scenario to see how it plays out.

If you charge $2,000 per client for a six-month engagement and are able to work with 30 clients every six months, you could earn a total of $120k/yr. In terms of clients, that would be 5 new clients per month, which is manageable for a financial coach because you don’t have the large up-front time investment that an advisor does in putting together and delivering a big up-front financial plan.

Notably, because financial advisors often work with more affluent clients, and can potentially get paid more from each client, there is likely still more financial upside potential as a financial advisor. Simply put, there is just no way a coach can earn $10,000/yr from a single client, the way an advisor can by charging 1% on a $1 million portfolio. Unless you want to spend every waking minute coaching, which leaves very little time for everything else you need to do in order to run a business! Nonetheless, the potential to generate $120k/yr in revenue, with very little in expenses, still gives you the potential to earn more than double the median household income in the US!

For those who have aspirations for even higher income levels, you’ll need to think of ways to scale up the services you offer. I’ll talk more about this later, but in short it means providing services like group coaching, an online course, etc., that allow for more financial leverage on your time.

On the other hand, since the market for people needing financial coaching is much larger than the market for traditional advisory services, there really is a great opportunity (and need) for services and products that scale, if you want to build a financial coaching business to do it.

The Question of Compliance As A Financial Coach

The good and bad news of being a financial coach is being able to freely market and promote what we do. Because as it currently stands, the world of financial coaching is an unregulated industry, unlike advisors whose advertising (and other activities) are highly regulated. meaning we don’t have to worry about the same kinds of advertising compliance constraints. But that also means consumers have to do at least some due diligence on their prospective financial coach because there are no regulatory standards.

In fact, anyone who wants to call themselves a financial coach can do so, set up a website, and start working with clients. The reason we can do this is that financial coaches don’t give investment advice, manage investments, or sell insurance. Therefore, financial coaches don’t need to get licenses such as the Series 7 and 66 (if a broker), Series 65 (if an RIA), and/or state insurance license for insurance/annuity products. In addition, since we are not able to sell any products, and are fee-only by definition, we don’t carry the potential conflict of interest.

There is some grey area however about what constitutes investment advice, and when a financial coach might trigger the requirement to register as an investment adviser. While coaches can’t advise on what investments to buy (if they want to avoid being required to register), can they at least advise on asset allocation? Can they recommend a backdoor Roth conversion, since that is the moving of assets and not the buying/selling of specific securities?

I’ve spoken with the New York Department of Taxation and Finance, as well as the Attorney General’s office of NYC, and was told that I should review existing statutes and determine my own interpretation. It appears that in New York, advising a client to place their savings in a high-interest online savings bank doesn’t require investment adviser registration (as it may be “advice” but a bank account doesn’t fall under the definition of an investment security), as would advising someone to put their money in a 401(k)/IRA since the accounts themselves aren’t securities (they are merely shoe-boxes that house securities). However, I wouldn’t be able to advise which fund they should invest in. This is just for New York, however, so you should look at your own state’s statutes and if necessary inquire with your state securities regulator before proceeding.

(Michael's Note: In at least some states, the mere fact that you have CFP certification and hold out to the public as such means you are presumed to be providing at least some investment advice, and may be required to register for that reason alone.)

Additionally, because we are fee-only, and our fees are not wrapped into an AUM structure, clients are very sensitive to whether the coaching they are getting is worth the price. I’m not saying this model of charging is better, as it can create a “what have you done for me lately” attitude that can obscure the longer-term nature of results. Yet, since our fees are transparent and directly related to our effectiveness, this means our compensation and continued employment relies heavily on reputation and doing good work. Which is a natural point of accountability to consumers, even without more direct regulatory oversight.

At the end of the day it is important that people who hold themselves out as financial coaches are able to competently and compassionately help their clients. That’s why we get into this industry in the first place. If a baseline level of competency for financial coaches can be systematized and shown to improve their ability to positively affect their clients, then I’m all for it. It would, however, need to encompass more than just facts and figures like the CFP exam and focus on both the financial and behavioral aspects (left/right brain) aspects of what we do.

Requirements And Training To Become A Financial Coach?

While you don’t need to be registered, obtain any licenses, or have required certifications to become a financial coach, that doesn’t mean you shouldn’t look into at least the latter. It’s imperative that, as a service professional, you’re aware of where your blind spots are. Do you even know what you don’t know? What would help you better serve your clients? And if you don’t know what you don’t know, what positions can you put yourself in, or who can you connect with, that will help you see those blind spots?

There are formal training programs such as the Accredited Financial Counselor (AFC) designation, available through institutions like the Association for Financial Counseling and Planning Education (AFCPE). You can think of the ACFPE as the CFP Board for financial counselors and coaches. The AFC designation emphasizes the foundations of financial coaching, from education to mentoring and accountability. Below is a list of what an AFC designation should enable a financial coach to do (per the AFCPE website):

- Educate clients in sound financial principles.

- Assist clients in the process of overcoming their financial indebtedness.

- Help clients identify and modify ineffective money management behaviors.

- Guide clients in developing successful strategies for achieving their financial goals.

- Support clients as they work through their financial challenges and opportunities.

- Help clients develop new perspectives on the dynamics of money in relation to family, friends, and individual self-esteem.

While I believe formal education can be useful (I’m currently pursuing the AFC designation myself), I’m equally if not more so a proponent of informal self-education. If you have the desire to learn, there is little (if anything) you can’t learn by voraciously reading and connecting with leaders and practitioners in your field. This served me well when starting my business, and the more formal education has helped to augment what I’ve learned from the school of hard knocks.

Whichever you may choose, look at it through the lens of “where are my blind spots, and what would allow me to better serve my clients?” Whether it’s informal self-education or a more formal certification, as long as you’re asking yourself the above question, you’ll be on the right path.

(Michael's Note: Golden Gate University has also recently rolled out two formal Financial Coaching-related educational programs tied to their financial planning Master's program: "Coaching Skills for Financial Professionals" and also "Facilitating Financial Health".)

A Step-by-Step Guide: How to Start Your Own Financial Coaching Practice

By now you should have a good idea of what financial coaching is, as well as how it complements and differs from financial planning. So it’s time to transition from the “what” to the “how”, and dive into what it takes to start your own financial coaching practice!

Since no two people will do anything the same way, I won’t approach this as, “here is how you should do it” without knowing the details of your particular situation. Therefore, I’ll share with you the only perspective I know—my own. I’ll walk you through what has worked for me, what hasn’t, and present my experience as a case study. You are welcome to analyze it and apply the most relevant/helpful parts to your own journey.

WARNING! BEFORE YOU START!

Before you launch a financial coaching practice, there is one single thing you should do that will save you years of mental anguish: make sure you have a long enough financial runway, or a large enough war chest (or whatever you want to call it), or some other plan to handle the “income gap” when you still don’t have many (or any) clients yet!! This is the one piece of advice I can give you that will have the biggest impact on whether you ultimately succeed, both financially and professionally.

Some reasons for this are obvious—you have to eat and you need a place to sleep, and if you don’t have enough savings to provide for these things while building your practice, you’ll run out of money and have to close your practice and get a job again.

But the overriding reason is this: If you feel financially insecure, you may be inclined to make decisions that put your own financial interests over the interests of your clients. If you don’t give yourself enough runway and, after six months realize you desperately need to sign an additional four clients that month in order to not go broke, then it’s no longer about the client—it’s about you. You may start taking on clients who aren’t the right fit, raise/lower your rates so they don’t reflect the actual value you’re providing, or become so worried about your own finances that you can’t be a compassionate, effective coach. None of these options are good. So, definitely make sure you have enough in the bank, or have side-income coming in to help support your transition before you make the leap.

I started Be Awesome Not Broke with approximately $25k in the bank, enough to last me just over a year if I were to make $0 over that time. I got this number by adding what my bare-bones living expenses could be, with what I thought business expenses would average out to a month for the first year. I had side-hustles up my sleeve if I needed to make additional money (which I did over the first few months to stop the hemorrhaging), and doing so ended up giving me additional peace of mind.

On a specific-to-me side note, one spending category I highly underestimated that first year was my professional development expenses. I was transitioning into an entirely different industry and while many of the skills I needed I already had, I realized that I wanted/needed to take some coaching courses to help me grow as a coach and entrepreneur. The downside: I spent about $5k dollars on personal coaching that first year that I hadn’t planned for. The upside: I learned a heck of a lot, in particular from the EmpowerMentorship group coaching program from Dale Thomas Vaughn (a coaching group for men). I also got comfortable with what it felt like to pay a lot of money for coaching, which served me when I eventually started having those same conversations with prospects.

1. Setting Up Shop As A Financial Coach

These are the basics. They take time, thought, and research, but once they’re done, they’re mostly done.

Name your business

This is something most people fret over and they spend a lot of time trying to come up with the perfect name. My advice is to spend enough time to land on a name that doesn’t suck. Don’t aim for perfection. Go for something that is good enough.

The reason being (especially in this space) is that people aren’t going to hire you because of your name; they will hire you if they like you. Most company names in the financial planning/coaching space are pretty bland anyway (except for Be Awesome Not Broke!) so it isn’t like a “standard” name will drive clients away.

Pick something you’re 80% confident with, and go. If deciding on a name is stopping you from actually starting the business, then you need to pick something and move on.

Decide on your business structure

I chose to form an LLC, based on advice from my lawyer (because he knows more about it than I do). I would recommend doing the same in your situation; find someone you trust and go with their advice.

It cost me $200 to file for my Articles of Organization in New York. I didn’t submit a notice of my filing in the newspaper because it costs $1,000+ in NY and that’s a damn racket. There don’t appear to be consequences and so, out of principle, I wasn’t going to pay.

Get a Federal tax ID number

You will need it to open a business checking account, credit cards, file taxes, etc. Don’t worry, it’s one of the easiest steps throughout this entire process. Either Google “how to get a federal tax id number” or just go here.

Open a business checking account and get a business credit card

This is important to do right off the bat so that you can keep your personal and business expenses separate from the beginning.

In the future, when you want to file taxes or estimate monthly business expenses, having your business expenses in a separate account and on a separate card will make your life so much easier. Seriously, just do it.

Accounting software—pick your poison

The earlier you decide on your accounting software and start using it, the easier your life will be down the road. Note: this means a true double-entry accounting software, not an invoicing software that has some accounting functionality like FreshBooks. I love FreshBooks, but it isn’t true accounting software.

In the small-business space, there are two major players: QuickBooks and Xero. I’ve personally used both—QuickBooks in my music business days, and now Xero—and I would recommend Xero. I simply find it more intuitive and easier to use.

One thing to note: if taking ACH payments is important to you (to avoid 2.9% credit card fees) then I might recommend QB over Xero. With Xero you have to use a 3rd-party to handle ACH payments and it’ll cost you about $30/month. in fees, plus a lot of setup time. QuickBooks comes with ACH integration built-in at, I believe, a flat $.50/transaction, which is as good as I’ve found anywhere.

Client agreement

There is a bit of a “chicken or egg” problem when creating your first client agreement. You want to have this finished before your first client for obvious reasons: you want to have a binding document that outlines the expectations/deliverables for both you and the client so that the client sees you’re an actual business and not some fly-by-night operation, etc. Yet, when you’re at the stage of not yet having had a client, you may still be figuring out what your offerings are and how to package together your services.

My recommendation: pay someone to create a solid, basic client agreement for you (I worked with Alan Johnson, our company lawyer from my music business days, whom I’d highly recommend), and then update it as your service offerings and processes solidify.

Website

It doesn’t need to be perfect, especially when you’re just starting out. The most important thing is to have one. You want to spend enough time to have it accurately describe what you do and what you’re about. However, if you find that it is keeping you from actually getting out there and getting clients (i.e. spending hours upon hours until your site is “perfect”), then you’re using it as a crutch and an excuse to not put yourself out there.

There are so many platforms that allow you to create a damn good-looking site incredibly easily, so there’s really no excuse not to have one. If you have zero website experience, use a Squarespace template. If you want a little more flexibility, use WordPress and pay $50 for a great-looking template.

Don’t make the mistake I made. I traded services with a friend who helped me build my website, and it took me WAY longer than it should have because we built it from scratch (and it took forever because that is what you get when you don’t pay someone). A template will never give you all the things you want, but it will create a structure for you to work with, which will ultimately help it go live faster.

2. Create Your System/Process

I imagine some of you are thinking to yourself “why the heck would someone begin working with clients, or even THINK of working with clients, before they had their system and process figured out?” It’s a valid question.

But here’s the thing. The financial advisor industry already has a process that most financial advisors adopt, i.e. several up-front meetings followed by quarterly/semi-annual meetings. There already exists a generally accepted framework that advisors can adopt, tweak, and make their own.

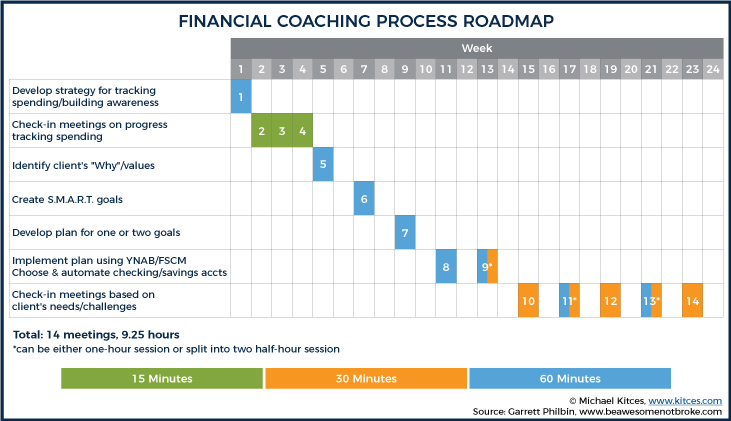

Financial coaching is a much more nascent field, and there aren’t standardized ways of delivering services to clients. As I mentioned earlier, I’ve found that the clients I work with need a lot of hand-holding and guidance early on, so I’ve created a system that offers nine hours of meetings over six months in varying 15-, 30- and 60-minute chunks. This is different from what I was offering six months or twelve months ago, as my target client niche has solidified, and what support they need has become clearer.

Essentially, you’ll need to take some time to test out what works best and tweak as you go. While there is no industry-wide standardized client services schedule, I would recommend a structure that has at least one meeting a month over the term of engagement—ideally more in the beginning. As clients are learning information and habits for the first time, it’s important for you to be there and offer support every step of the way.

Your process, ultimately, will very much depend on the psychographics of your niche clientele. My clients are people in their late 20’s to late 30’s who earn a healthy income (generally $80k - $200k) and whose biggest obstacles are how to pay down debt (credit cards, car loans, student loan debt) and build good spending habits. While these demographics play some part in determining how I’ll charge clients (i.e. fee-for-service rather than an AUM model since they often have negative net worth), it’s their psychographic traits that really determine how I deliver my services.

For example, most of my clients share similar beliefs: they feel they “suck at money” and can’t figure out how they’re successful in their jobs but so bad at their finances. They want help building a plan and feel they need an accountability partner to help walk them through it. These things are what I build my process around, and why I’ve ended up with a high touchpoint, intensive program that focuses as much on emotions and behaviors as the numbers.

Test it out

While your process will never get to the point where it’s “perfect” (it can always be tweaked/improved), when you start out, it will be anything but. Because of this you should be transparent with your early clients and price your services accordingly.

For me, this meant working with several friends whom I either didn’t charge or coached in exchange for services. They knew they were beta-testers for my initial process, and it was with them that I figured out what actually worked in real life, vs. what sounded like a good process on paper.

Make it better

I originally offered six meetings over three months to those beta-testers, but soon realized it wasn’t enough time for people to process this new information and have their newfound habits stick. I was able to get across all of the information, but the timeframe was so condensed they didn’t have time to internalize it. This led me to increase the amount of time for the program (from three to six months) and add three additional one-hour meetings over that time.

It took about nine additional months to come up with the process I have now, which is a mix of 15-minute, 30-minute and 60-minute meetings. These changes happened because I realized that, in the beginning, when I’m having people track their expenses for (often) the first time, they don’t need a full one-hour meeting with several weeks in between. What they need is short 15-minute check-ins each week to see how tracking is going, what is working/what isn’t, and a space to share what they are learning about their habits. Yes, it requires more frequent meetings on my end, but it’s been invaluable to clients and has made them more successful as a result.

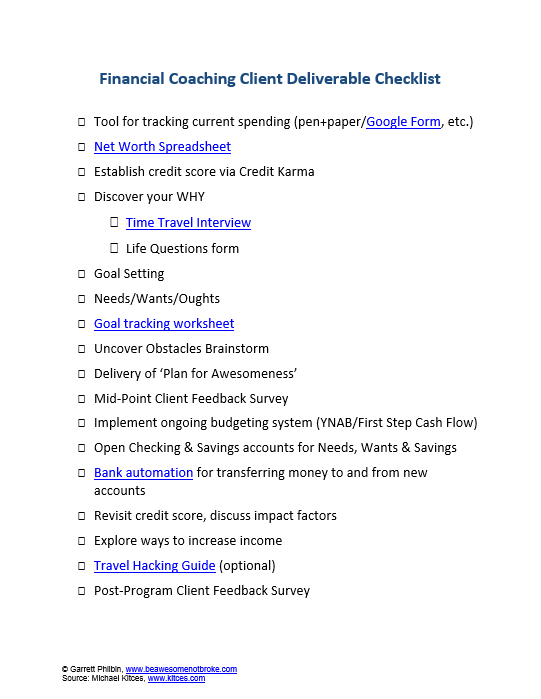

It is important not to be married to whatever you come up with first. “Test and adjust” will be the name of the game during these early days, and it’s important to listen/survey your clients to see what is working and what isn’t. And feel free to be as creative as you want! This is a new field so who knows, you may come up with a model that serves as the framework for other coaches to use, moving forward. If you’re curious, you can click here to check out an outline of the Client Deliverables I now offer to my coaching clients.

Final thoughts on process

Unlike most financial advisor models, my process and pricing is not built around working with a client for life. I am helping to educate clients on the basics of personal finance, help them adopt more positive behaviors/habits, and ultimately teach them how to do this on their own. Eventually, they will outgrow me and no longer need what I do.

This is a more difficult model to sustain than what traditional advisors do because it requires more prospecting to keep a steady flow of new/replacement clients in the pipeline. It can also mean coming up with additional service offerings, like group coaching, online courses, paid webinars, etc.

Personally, I enjoy the challenge of discovering new ways to distribute my coaching and thinking of ways to make it scale, and I enjoy the variety. Yet there may come a time when I yearn for a simpler model, perhaps working one-on-one with clients for life. And if/when that time comes, it’ll be time to come up with and test a different client process!

3. Marketing As A Financial Coach

I am not going to pretend that I can give you all the marketing advice needed to start and sustain your business. That being said, here are the three important points I will share about marketing.

Know your story

People are going to hire you because they like you, not because your website looks the best or your service offering can serve them better than other coaches. They are looking for someone they can trust, relate to, and with whom they are comfortable sharing some of the most vulnerable parts of themselves.

This means you need to know what makes you special. What about your story, your experience, your process will resonate the most with your ideal client? Why will they want to work with you, over some other coach with a pretty Squarespace website?

My story? I have the desire to help people discover what their most “awesome” life can look like, and how to use money as a tool to accomplish that. Simple. Clear. Effective.

Know your niche

If you listen to the XYPN podcast then I am beating a dead horse, but this is so incredibly important. It’s good to know your own story, but you can’t authentically convey who you are, what you do, and how you can help people if you don’t have a clear picture in your mind about who you are talking to.

I’ll be honest. Because financial coaching is such a new field, you already differentiate yourself by simply putting yourself out as a financial coach. So few people are in this space that you naturally stand out. This buys you some time if you don’t know who your niche is. People of all stripes will want to work with you simply because there are relatively few options out there.

That, however, is a terrible long-term strategy. Eventually, you will need to define whom you are talking to so your marketing can truly resonate and draw those people to you. And from a process standpoint, if you are working with clients who are all over the demographic/psychographic spectrum, you’ll never be able to have a standardized process or offering. You don’t want to have to constantly reinvent the wheel.

Don’t worry. If you choose a niche and ultimately don’t love it, you can always pivot. You aren’t married to your niche for life. In the same way, your process and offerings will evolve, so will your niche. Pick one, try it out, and if they don’t end up being your ideal clients then pick anew.

Communicate your story your way

Once you know your story and your niche, you’ll want to communicate who you are, who you help, and what you do.

The biggest piece of advice I can give is to pick the channels that most authentically let you be you! If you are a good writer, send out a weekly newsletter or start a blog. If you are a great storyteller, be a guest on other people’s podcasts or create your own. Do you come across really well on video? Then start a YouTube channel.

My point is, don’t simply start a newsletter or force yourself to tweet because it’s what you think you should do. Instead, do what allows you to be your most authentic self, because that is what you’ll be comfortable enough doing to stick with it over the long term. If you hate doing it, people will see your lack of enthusiasm, consistency, and passion. No one is forcing you to do anything, so pick the channels that truly are best for you.

4. Getting Financial Coaching Clients

This is not a challenge specific to financial coaching, it’s a conundrum that all service businesses face. If you do not get clients you will not make money, your firm will not survive, and you will no longer be able to help people. Therefore, it is critical to have ideas, before you start, of where you will find good prospects. These are people who know they need help, are actively looking for help, are willing to pay, and able to pay for that help.

Everyone has his or her own sources of new clients. But, as a point of reference, here is a breakdown of where my clients come from. As of now, they primarily come from three places:

- Referrals from financial advisors: 40%-50%

- Referrals from past clients/friends: 30%

- Response to outreach (podcasts, webinars or presentations): 20%

Partner with financial advisors

This is where a majority of my clients come from, and I took this directly from the playbook of financial advisors who start their own firms. As a new advisor (who typically has smaller or no minimums), it’s recommended you reach out to established firms with higher minimums and ask: “I’m curious, what do you do with people who don’t meet your minimums?” This can lead to a series of conversations where, if all goes well, you may be on the receiving end of prospects that don’t meet that company’s minimums but are a great fit for you.

The way I pitch it to financial advisors (which I talk about in my interview with XYPN Radio) is that advisors get inquiries from people who think they need financial planning, but in reality are in debt, don’t have assets, and need help with budgeting/cash flow/accountability first. These prospects are a perfect fit for me because that’s the sandbox I play in.

However, there will come a point when those people will outgrow me (i.e. are out of debt, starting to save and executing their plan) and will be ready for financial planning, at which point I’ll need an advisor to refer them to. This means I can take prospects who weren’t initially a good fit for the advisor and bring them to the point where they actually are ready for financial planning—in essence expanding the Blue Ocean of potential prospects for financial advisors. And it makes for a very positive potential cross-referral relationship with other financial advisors.

Establish a referral system with clients

Outside of referrals from financial advisors, this is the next largest source of new clients for me. However, you need to be intentional and have a system to get those referrals. Simply providing good service and thinking, “clients will appreciate what I do and refer people my way” is not a system. I found this out first hand.

Here are two important points to keep in mind.

First, don’t expect your clients to know the kind of client you’re looking for. Define clearly who your “ideal client” is, and communicate this to your clients multiple times (as once is not enough). Ask them, “do you know anyone who is X/Y/Z (attributes of your niche client) who could use support similar to what I was just able to help you with (i.e. pay off credit card debt, create a savings plan, etc.)?”

Second, create a clear path for client referrals. A client may say, “Oh yeah, I referred someone your way!” but that just meant they told a friend at a bar: “My financial coach is awesome!” and left it at that. Give clients who have a potential referral an email template they can send to that referral. Ask if you can reach out directly to their referral, promising that if you don’t hear back after one phone call/email you will leave it there and not spam/call eight times a week.

The bottom line: to get referrals from clients, either give them tangible actions to take, or establish a protocol on your end. Don’t leave this part up to chance!

Outreach Marketing – Making Yourself Visible

The remainder of my clients come as a result of my outreach marketing – they connect after hearing me on a podcast, viewing a webinar, or attending an in-person presentation. Remember, it’s important for you to communicate in a way that plays to your strengths, and talking/presenting are the most natural mediums for me (contrary to what this blog post might make you think!).

Just because they’re the most natural for me, however, doesn’t mean I was immediately good at them. Each approach – podcasting, video, and speaking engagements – has taken lots of work. I still have lots of room to improve, but I have intentionally focused on getting better in each area. I started a podcast with a friend who is also an entrepreneur, where our sole purpose was to get better at podcasting. The podcast never went live, but going through that process made me an exponentially better guest and host. I started doing Facebook Live videos just to get used to seeing myself on camera and get a sense of what plays well on video and what doesn’t, which I will use as a launching-off point for my YouTube channel. And for speaking engagements? I’ve just said “yes” to any opportunity that came across my plate, from gigs at the local library to guest presenting at colleges to FPA events, and even a talk at the county jail!

You will not be good the first time you try to do something, but don’t let that discourage you. Whatever marketing channel you’re most comfortable with, put yourself out there and stick with it. People will eventually and inevitably be drawn to what you do if you’re excited and passionate about it.

Don’t forget to tell the world you are a Financial Coach!

This may sound obvious, but don’t forget to tell the world you are a Financial Coach when you actually launch your practice to be one.

When you start your own company and are trying to figure out what the hell you are doing and how you are going about it, you will often doubt yourself. You will go through periods where you feel like a failure, don’t trust in the value you provide, and can’t believe anyone in their right mind would pay an “impostor” like you money for what you’re doing.

I had these feelings (quite often) when starting out, and it stopped me from telling the world what I was doing and how I could help. This meant I would send out my newsletter and talk about money tips, but never directly tell people how I could help them with those issues. I think it took me a year before I explicitly said, “THIS is what I do for a living and THIS is who I can help—anyone interested?” Lo and behold, I got three clients!

Of course, don’t be obnoxious about it. Don’t have self-promotion be the only thing you share on your Facebook wall. Don’t just tell anyone who will listen, “Hey, I’m a financial coach!” and don’t share what you do in a way that feels inauthentic. But if you truly believe that what you offer is able to help people, then you have an obligation to tell them as much.

5. Technology Tools Of The Financial Coaching Trade

This is not meant to be an exhaustive list of every technology tool you might need. Instead, this is a breakdown of the most useful tools I use to run my business and be more efficient. Remember, don’t spend unnecessarily and sign up for every tool out there simply because you might need it or it can help you even just a tiny bit. But don’t be cheap, either. There are tools that, for $10-$15/mo., will save you many hours of work each month, making them more than worth the price tag.

Email Automation:

Aweber - $19/month

I use Aweber to manage my e-newsletter and drip marketing. It’s pretty good and isn’t too difficult to set up campaigns, email automation, etc. That being said, there are some features that I feel should be standard that they’re just testing out in beta. I’m sure I could be doing 99% of the same things with a free version of MailChimp, but there’s just too much of a switching cost at this point.

Client Relationship Management (CRM):

Contactually - $35/month

I use Contactually as my CRM. I use my CRM more as a follow-up tool for leads, contacts, and clients rather than a place to store everyone’s data, and Contactually works really well for that. It’s on the expensive side and I don’t use it as much as I should, but I love that you can place contacts in different “buckets” depending on how often you want to follow up with them, and get reminders based on that bucket. Great for differentiating warm leads, that should be followed up with soon, with people who just need a check-in twice a year.

Video Conferencing:

Zoom - $15/month

Can you get by for free with Skype? Probably. But I use Zoom and love it because it doesn’t require clients to download any software, it’s encrypted, I can record video easily, and I can have 3+ people on at once (which is very handy when couples I’m working with are calling in from different locations).

Calendar Scheduler:

Calendly - $10/month

I personally use Calendly, but you can use ScheduleOnce, Acuity, etc., with, I’m sure, similar results. The main reason to have this is to limit email back-and-forth about scheduling, which is obnoxious. Another great reason is that you can block out different days/times for different types of activities (i.e. client meetings vs. prospect calls vs. anything else), allowing more availability for client meetings and prospect calls for example, and less time for less urgent things.

Budgeting Tool:

First Step Cash Flow - $50/month

I used to have most clients sign up with YNAB (You Need A Budget), but found that many struggled with keeping track of every transaction over time and eventually fell off the wagon. First Step Cash Flow is a tool that allows clients their own login, helps them budget out their take-home pay to zero, and serves as the framework to set up bank automation, which means they don’t have to track every transaction. The user interface looks like it was created in the ‘90’s (it’s a glorified spreadsheet), but the most important question is, “does it help clients better budget their money and do they stick with it?” And the answer is yes.

Second Brain (Notes):

Evernote - $3.99/month

With so many different things going on all the time, if I don’t take notes, then it didn’t happen and I don’t remember it! Evernote works as my external/second brain. And for how incredibly valuable and easy to use it is, it’s a steal.

Accounting:

Xero - $30/month

I previously used FreshBooks for invoicing/accounting, but since it’s not a true accounting software, I decided to bite the bullet and switch to Xero. I’ve used QuickBooks Online in the past and it’s pretty good (has come a looooong way), but ultimately heard great things about Xero and wanted to give it a shot. It’s built specifically for small business and I really like it and would recommend it. The only issue is, it doesn’t offer ACH integration (QuickBooks Online does for $.50/transaction). This is a great way to reduce credit card transaction fees, which can be a lot. I’ve had to use a third-party workaround for $30, and while it saves me that and more by processing fewer credit cards, it was a bit of a pain to set up. So if you rely on ACH payments, perhaps consider QB.

Web Hosting:

Bluehost - $16/month

I use Bluehost and it includes my Google Apps suite for my website ($5/mo), plus domain renewal every year ($15.99/yr.), and cloud hosting ($10.99)/mo. A lot of people hate Bluehost, but I haven’t had any problems… at least, not yet (knock on wood). I’m sure with some additional research you could find better options?

Email Reminders:

Yesware - $15/month

This may seem a little steep in price for some, but having email reminders has saved my life on many occasions. There are two good options out there in Yesware (which I use) and Boomerang (which I previously used) and I’d recommend either. The most important feature is that Yesware/Boomerang can send reminders to me if someone doesn’t reply to my email in x-number of days. If I’ve reached out to or followed up with someone, I always ask for a reminder within 5/7 days in case the person hasn’t replied. I would let so much communication drop without this feature, so if you’re anything like me, do yourself a favor and buy it.

6. Staying Sane As A Financial Coaching Start-Up

So much goes on when starting a business that you can feel as if you’re truly going crazy—the roller coaster of emotions and finances, and just so much to do.

Here are some useful tips to help you make it through the start-up phase, and keep everything in perspective.

Accept Impostor Syndrome

Impostor Syndrome is extremely important to acknowledge. If you decide to start your own financial coaching firm you will (at times, or often) feel like you have no idea what the hell you’re doing, feel like a fraud, wonder why anyone would ever hire you, believe that you have nothing to offer, and convince yourself that you’re crazy to charge whatever you’re charging because you aren’t worth it. In short, you may feel like you’re an imposter for saying you can do what you’re doing, and trying to charge what you’re charging. This has been my experience, but also the experience of fellow coaches, financial advisor friends, and people in the larger industry who are way more successful than myself.

My suggestion: don’t fear Impostor Syndrome, and don’t try and fight it. Instead, acknowledge it whenever it stops by to visit, and welcome it in as an old friend. Realize that it is only the byproduct of you doing work that matters, and work that’s pushing you outside of your own comfort zone. Each time it shows itself, just know you are on the right path. This takes away its power, allowing Impostor Syndrome to become a barometer for whether you’re on the right path, instead of something to be feared.

The bottom line: Realize that you don't have to know everything. You just need to know more than the person you're helping, be able to convey value using what you know, and help them. That's it.

Develop your support network

Make sure you are actively in communication with friends/family who love you, support you, and genuinely care about your success.

This is not woo-woo. It’s absolutely critical to the success of your mental health and your business. A friend of mine, Kendra Wright, calls entrepreneurship, “a 24/7 personal growth experience”, and if you don’t have people to encourage you along the way or call you out when you let work take over too much of your life, you will not succeed.

In addition, build a network of people who are either doing the same thing you are (getting into financial coaching), just starting their entrepreneurial journey, or just a bit ahead of where you are right now. This allows you to ask real humans real questions about things you’re struggling with in your business, which is 1,423x better than running that question through your head all day, driving yourself crazy and never reaching an answer.

So join a Facebook group of fellow coaches (or create your own), join/create a Mastermind Group, or reach out to people you admire who are already in this space. But whatever you do, make sure you don’t go it alone.

You can’t, and shouldn't, work all the time

I’ve had to learn this the hard way.

I used to think that working all the time was just what you had to do when starting a new business. While it’s true that, yes, you need to invest more time and energy into building this than probably anything else you’ve done in your life (unless you’ve raised a child, which in that case, wins), you must give yourself permission to rest, take time off, have fun, let loose and be happy. Otherwise, not only will you be a miserable ascetic who others don’t want to be around, but the whole reason for starting your own business (living the life you want) won’t be happening.

Remember, it’s about them, not you

This has been really helpful for me when I need to put things in perspective. There’s a quote by Zig Ziglar that goes, “You can get everything in life you want if you will just help enough other people get what they want.”

Whenever I get stuck in a scarcity mindset and wonder where my money will come from this month, I think about what I need before what the client needs, that’s my cue to press pause. That’s when I have to step back and remind myself “it’s about them, not me”. And, probably not surprisingly, this is often when my most creative ideas come out, and when I’m most satisfied and positive about this path I’ve chosen.

In Closing…

WHEW! I appreciate you taking the time to read all the way to the bottom, as I know that is a lot of information. We covered not just what financial coaching is, but how it differs from financial advising. You saw several different business models for financial coaching, as well as how coaches get paid, and why that model works. And lastly, you got the roadmap for how I started my own financial coaching firm, along with tips/insights for how you can do the same.

If you’re thinking to yourself “heck yes I want to become a financial coach, but this is a lot to do!” then join the Facebook group that I run for Financial Coaches here so you don’t have to do it alone. It’s an incredibly supportive community of over 400 financial coaches who are helping each other launch and grow successful coaching businesses.

You can also download a checklist of all the Client Deliverables I provide to my coaching clients, that you can use as a template for your own coaching, if you wish.

Thanks again for taking the time to read this post, and if you have questions specific to this article you can contact me directly at [email protected]. I wish you the best as you go out into the world and do this awesome work that we’re lucky enough to do every day.

So what do you think? Have you considered providing financial coaching services? Is there a need to refer clients to professionals who specialize in coaching? Please share your thoughts in the comments below!