Executive Summary

Welcome to the October 2023 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

This month's edition kicks off with the news that custodial platform Altruist is eliminating the $1 per account monthly fee for its portfolio management and reporting technology for advisors on its platform, which on the one hand suggests that the economies of scale Altruist has achieved in the wake of its move to become a fully self-clearing custodian have been such that it can now afford to 'give away' its software, while on the other hand serves as an ominous sign for standalone portfolio management technology platforms that they could stand to be disrupted if more custodial platforms decide to compete on their technology offerings and eliminate the need for advisors to pay $5,000-$10,000 each year for a separate provider.

From there, the latest highlights also feature a number of other interesting advisor technology announcements, including:

- Holistiplan, after achieving success with its tax planning and analysis software, has announced an investment from Lead Edge Capital, signaling that it may be ready to expand into other financial planning areas beyond tax – but with a slew of new 'Holistiplan for X' startups in the marketplace, it may have a harder time repeating the exponential growth of its early years and as it seeks to fulfill the original 'holistic' aspirations of its founders.

- FMG Suite has acquired compliant texting solution MyRepChat to integrate into its full-service tech stack, underscoring the potential of text-based communication as a marketing tool – but also highlighting advisors' challenges with integrating texting into their marketing and client communications workflows, as well as the fine line between texting as an effective communication method and one that's disruptive and irritating to both the client and advisor.

- Investment analytics platform YCharts has launched a new feature for building and generating proposals for prospective clients, becoming the 2nd most popular analytics and recommendation tool this year (after Nitrogen's rebranding earlier in 2023) to expand into the increasingly competitive category of sales enablement – underscoring the idea that as advisors use technology to provide more and more value for their clients, there's increasing demand for tools that help advisors sell that value as well.

Read the analysis about these announcements in this month's column, and a discussion of more trends in advisor technology, including:

- Brand design consultancy firm Intention.ly has launched Advisor Brand Builder, a tech-enabled service solution that automates much of the process of designing a unique advisory firm brand at a lower cost than a full-service branding process – showing how, when a provider 'tech-ifies' a service by automating everything possible and applying human expertise only when it's needed most, the resulting product can often be spun off and sold on a standalone basis.

- Testimonial IQ has launched the latest solution for advisors to gather and showcase client reviews and testimonials in the wake of the new SEC Marketing Rule – but it remains to be seen whether clients will let themselves be directed to a third-party site to leave a review, or if they'll instead naturally gravitate towards the general sites (like Google and Yelp) that they already use to search for other businesses.

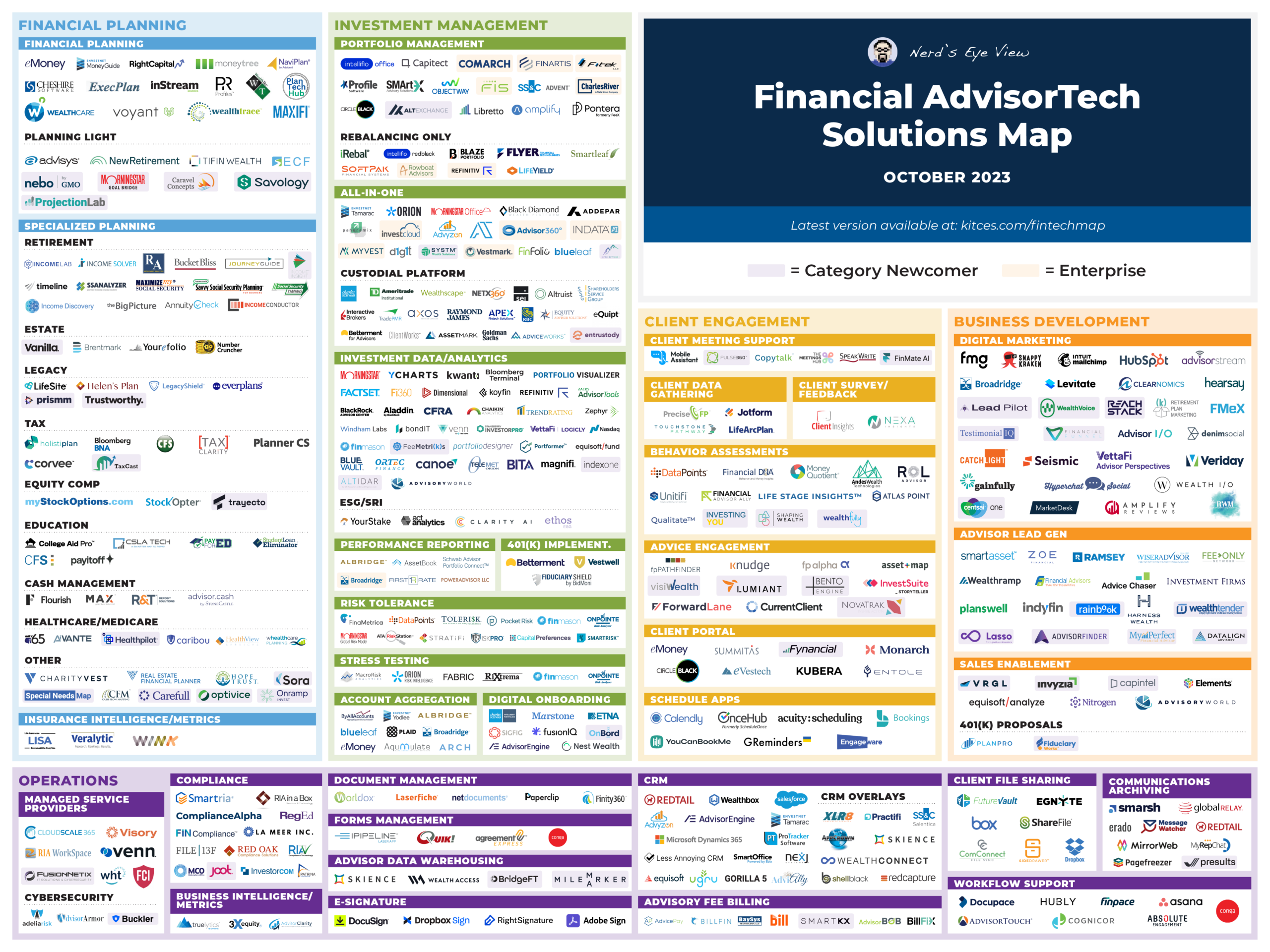

And be certain to read to the end, where we have provided an update to our popular "Financial AdvisorTech Solutions Map" (and also added the changes to our AdvisorTech Directory) as well!

*And for #AdvisorTech companies who want to submit their tech announcements for consideration in future issues, please submit to [email protected]!

Reaping The Profitability Benefits Of Becoming Self-Clearing, Altruist Starts Giving Away Its Portfolio Management Technology For Free

The business of RIA custody is one of high costs and, for those that can succeed, high rewards. It's expensive to provide the core systems required to manage a custody platform: capital requirements and control systems for having actual custody of clients' investment holdings, accounting and record-keeping, trading, tax reporting, and legal obligations across a wide range of account types add up to a high cost of entry into the industry, and RIA custodians require immense economies of scale to compete and survive in the business. Which is why most of today's leading RIA custodians didn't even come into the business directly, but instead got their start either as retail broker-dealers (e.g., Charles Schwab and Fidelity), by serving other broker-dealers before adding RIA custody (e.g., Pershing and RBC), or by providing a technology overlay to other existing platforms (e.g., TradePMR and SSG). However, once a custodial platform has reached the requisite scale, it can be an incredibly profitable business to be in. For example, in 2022 alone Schwab Advisor Services generated more than $2.3 billion of net income on gross revenue of nearly $5.2 billion, for a profit margin of nearly 45%. Hence the decision of all of the above platforms to enter the custody business once they'd achieved the size and scale to make it economically possible.

More recently, however, the potential rewards of RIA custody have enticed a new crop of startups to try to directly surmount the challenges of building and scaling an RIA custody platform from scratch, rather than coming at it indirectly by leveraging custody and clearing systems originally built for other purposes. The most notable member of this group has been Altruist, which has raised hundreds of millions of dollars in capital investment (including a most recent round of $112 million in Series D fundraising in April 2023) as it has competed aggressively for the business of startup and breakaway RIAs, as well as for former TD Ameritrade advisors looking for an alternative to Schwab in the wake of the Schwabitrade merger.

When Altruist first launched, one of its selling points was offering portfolio management and performance reporting tools to advisors on its platform for $1 per account per month (and for free for the first 100 accounts), including for accounts that were custodied on other competing platforms. This was a significant savings opportunity for advisors, given that using similar technology from a standalone provider like Orion, Black Diamond, or Tamarac typically cost a benchmark rate of $30-$50 per account annually (versus Altruist's annualized $12 per account), meaning that Altruist's solution was only around 1/3 to 1/4 of the cost of traditional portfolio management software, which itself can easily add up to $10,000 or more for a 'full' advisor's client base (and often a minimum of $5,000-$10,000 per adviser, per year, just to get started). More broadly, then, Altruist effectively became a competitor not only in the custodial space, but also in the crowded AdvisorTech market for portfolio management and reporting tools, as it vied to fill both roles within an advisor's tech stack in a single integrated platform at a fraction of the cost.

How Altruist was able to provide tech tools for cheaper than the standalone portfolio management and performance reporting providers has to do with the economics of the custody industry relative to AdvisorTech as a whole. In short, the custody business is just bigger: The revenue and profits of a company like Schwab (which as noted above netted $2.3 billion in 2022) are orders of magnitude more than even the biggest standalone AdvisorTech companies, which generally measure their profits in the tens of millions (e.g., even the 'mega AdvisorTech deal' of MoneyGuide being acquired by Envestnet for $500M was based on less than $20M of earnings in 2018, or 1/100th what Schwab earns!). Which ultimately, in the view of Altruist and its founder Jason Wenk, made it worthwhile to compete with the likes of Schwab and Fidelity for advisors' custody business by building and tech tools giving them away for 'free', since the cost to do so was a relative drop in the bucket compared to the long-term economics of the custody business at scale.

But if the cost to custodians of providing a competitive technology offering is so trivial that it makes sense to provide it at a discount (and since ultimately the goal is to attract advisors to Altruist's custody business, where the profits would more than make up for the cost of the technology), then the obvious question is: Why charge $1/month, or anything for the technology at all?

And so, Altruist last month announced that it is eliminating the monthly $1 per account technology fee for its custody clients (although the fee still remains for accounts not custodied at Altruist, underscoring the point that it really is the profitability of the underlying custodial business that is allowing the technology pricing change to happen).

The timing of the announcement makes sense given that earlier this year, Altruist announced that it was winding down its historical relationship with Apex Clearing (on whose custodial platform Altruist had previously served as an introducing broker-dealer) and becoming its own self-clearing custodian, the upshot of which was that Altruist could now capture the full revenue opportunities of its custody business rather than paying a significant platform fee to Apex. Which is in addition to the scaling benefits Altruist has achieved through both organic growth and its acquisition of SSG earlier this year (which have, according to Wenk, resulted in Altruist more than tripling its on-platform assets so far in 2023). Adding everything up, it seems likely that – even after eliminating the technology fee – Altruist could be more profitable now than it was at the beginning of 2023 before its flurry of announcements.

From an industry perspective, Altruist's offering of heavily subsidized (and now free) portfolio management and reporting technology has profound implications for the AdvisorTech landscape. While Altruist's main competition is the other major custodial platforms that don't provide such technology, Altruist also presents a threat to many of the largest AdvisorTech companies today that are built around portfolio management and performance reporting (such as Orion, Black Diamond, and Tamarac) – because after all, if an advisor can fulfill those functions for 'free' through its custodial provider (which can afford to give it away because it can generate enough profits as a custodian to make up for it), why would they pay $10,000+ per advisor to a third party platform to do so? Much as the lucrative business model of Garmin's standalone GPS devices was disrupted by Google giving away Google Maps for free (because Google didn't have to make anything on navigation because it could monetize more advertising opportunities by simply having navigation users), portfolio management software providers are at risk to be disrupted when Altruist (and perhaps other custodians in the future) begin to package more of an advisor's core technology into their custodial offerings at minimal or no cost.

From the custodial perspective, Altruist's announcement on its surface represents a doubling down on the growth engine that has served it successfully, which is attracting new RIAs for whom the switching costs of moving to a new custodian or reporting platform are nonexistent, and who are the most likely to balk at the cost of third-party reporting software. In the long run, however, Altruist's tech-included offering may very well also be a competitive play for larger enterprises that often spend tens to hundreds of thousands of dollars on portfolio technology today (across what can be dozens of advisors and thousands of clients for a mega RIA). Which means that Altruist is not only positioned to use its integrated technology features to attract new firms, but also to drive a wedge between RIAs and their existing competing custodial relationships by giving them a chance to eschew the 'expensive' third party portfolio management software that traditional custodians' force' advisors to need to buy for themselves to operate.

Ultimately, it remains to be seen how many firms will actually be willing to switch custodians' just' to pursue software savings, and Altruist has to execute a high-quality portfolio management software solution on top of building its own core custodial platform… but as the saying goes, "My competitor's margins are my business opportunity" – and Altruist seems uniquely positioned to undermine the costs and margins of third party portfolio management software by boosting the margins of RIAs themselves, which may allow it to compete even more aggressively with other RIA custodians that can't offer RIAs on their platform that same level of cost savings, all in one fell swoop.

Holistiplan's Investment From Lead Edge Capital Signals It May Be Planning To Get More 'Holistic'?

Collecting and analyzing client data has long been a pain point for advisors. At a basic level, most clients don't have a clean set of data to hand over to the advisor to start the process of creating a plan – that's why they're coming to the advisor to help sort things out in the first place. At best, they likely have a loose collection of account statements, tax returns, and other financial records, in PDF or paper form, that they hand over to the advisor en masse to pore over for the information they need.

The challenge for advisors is that it's time-consuming to review page after page of client documents. Although advisors can minimize the amount of time they spend on document review through training and/or repetition to quickly find the key information they need, there's still a baseline level of manual work involved in paging through a document, finding the important line items, and transcribing numbers into other software for analysis. At worst, this process can lead to the advisor missing important information, but in any case it's often difficult to charge a high enough planning fee to justify the time spent just on document review.

In this vein, Holistiplan launched in 2019 to automate the process of reviewing and extracting information from tax returns. Founded by Roger Pine and Kevin Lozer, a pair of financial planners turned tech entrepreneurs, Holistiplan's software would take uploaded PDFs of tax returns, scan through the forms for the information advisors would need to know, and analyze and display that information to advisors and clients in a clean, user-friendly format. It so effectively streamlined the process of reviewing tax returns that it was an overnight success, winning XYPN's 2019 FinTech Competition and soon thereafter garnering several thousand advisor clients. In around 4 years, Holistiplan's user base has reportedly surpassed 20,000 advisors, and has garnered a 42% adoption rate among advisors in the most recent Kitces Research on Advisor Technology. The most telling commentary on the extent to which Holistiplan has popularized the approach of scanning original documents to find planning opportunities may be that it has gotten the 'Uber for X' treatment: It's now shorthand for any other platform that comes along to adopt a similar approach (e.g., VRGL is now 'Holistiplan for financial statements', Wealth.com is 'Holistiplan for estate documents' and FP Alpha is 'Holistiplan for P&C documents').

Up until now, Holistiplan was a bootstrapped startup funded solely by its founders' own capital contributions. However, the company announced in September that they have taken an unspecified investment stake from Lead Edge Capital. What's notable about Lead Edge is its propensity for investing into mega-growth companies: Its portfolio includes names like Zoom, Spotify, Alibaba, and yes, Uber. But as impressive as that roster is, and as significant has Holistiplan's growth has been so far, it's hard to imagine Holistiplan achieving quite that level of exponential growth going forward. Because realistically, Holistiplan in its current state remains a fairly niche product, limited to the relatively small segment of financial advisors who offer tax planning: Of the 283,000 financial advisors in the US, less than 100,000 are CFP certificants who are most likely to offer holistic financial planning, and only a certain percentage of those planners will offer in-depth tax planning to the extent that they would benefit from a tool like Holistiplan. In other words, it's possible that Holistiplan has already tapped a significant portion of its potential market for users – leaving the question of what Lead Edge is expecting the company to achieve from here now that they've added their stake.

What seems most likely is that Holistiplan will use the investment to grow not just in terms of raw user count, but also in the breadth of solutions it provides – in other words, that the partnership with Lead Edge will allow it to expand beyond 'just' tax return analysis and into other areas of financial planning, which will allow it to grow its revenue through user fees for a wider range of apps. Because as Holistiplan co-founder and CEO Roger Pine himself noted on the Financial Advisor Success Podcast during Holistiplan's first year in business, the original vision for the software wasn't solely focused on tax, but rather (as the name Holistiplan itself implies) to pull together information from multiple areas of clients' financial lives and present it in a clean and intuitive format. In a way, the initial success of Holistiplan's tax offering hampered its ability to carry out that vision, and it has largely spent the last 4 years without outside capital working to scale up its tax offering to meet the wave of demand it brought on (while also, on the back end of the platform, navigating numerous major changes to the tax code and to tax forms themselves, each of which requires significant updates to the software's code to ensure the accuracy of its results).

But now, with fresh investment capital, it seems that Holistiplan is angling to fulfill the original promise of its brand name. What's different now compared with 2019, though, is that there is a slew of competitors that have popped up to become the Holistiplan of other areas, which means that Holistiplan the company will need to compete to put out a better product (as well as master the notoriously difficult balance between offering an integrated slate of products that work well together, and offering the ability for advisors to pick and choose the products they want rather than an all-or-nothing bundle) in order to fulfill the growth demands of its new investment partner.

Put differently, Holistiplan itself may now be trying to be the "Holistplan for X" – and the pressure is now on to see if it can do so as well as the original.

FMG Acquires MyRepChat To Integrate Compliant Texting Into Its Advisor Marketing Platform

In the days before the internet and cell phones, communications between financial advisors and their clients or prospects was mainly verbal. Meetings were then, as they are now, typically face-to-face, and when the client had a question for the advisor between meetings they would either make a phone call or drop by the advisor's office in person to talk. While written correspondence did occur, it was mostly limited to formal communications on company letterhead. Complying with the regulatory obligation for advisors to archive copies of their written correspondence, then, was a relatively simple matter of making a carbon copy or Xerox of the letters that were mailed to clients, and putting it in a client file where it could be pulled if requested during a regulatory exam.

The digital age, however, brought with it an explosion of new ways to write out our communication, and as the ways that consumers communicated with each other shifted, so did the ways that advisors communicated with current and prospective clients. Starting in the late 1990s with the widespread adoption of email, and continuing into the 21st century as texting, social media, and messaging apps successively gained prominence, the channels that advisors used to communicate with (and often, market to) clients mirrored the ways that people connected with each other outside of work. In particular, the evolution of text messaging as a communication medium exemplifies this shift: Originally people used texting primarily within an immediate circle of family and friends to whom they were willing to give out their phone number, but as businesses realized that customers were much more likely to open, read, and engage with a text message than an email, texting became used for everything from support requests to appointment confirmations to identity verification, along with a wide range of (both solicited and unfortunately sometimes unsolicited) marketing messages.

But advisors have been relatively slow to adopt texting as a communication tool. Not because it wasn't effective (indeed, the greater one-to-one intimacy of a text message makes it arguably more desirable of a medium for financial advisors than email or social media). Rather, it was because texting – like other digital communications channels – fell under the umbrella of 'written communication' (or advertising in the case of communicating with prospects), and the regulations that obliged advisors to retain and archive such communications (despite stemming from an era when written communication was relatively sparse) applied to it as well. Which was a challenge, because unlike email and social media communications that are generally stored on decentralized servers and cloud networks that compliance can access and oversee directly, text messages typically go directly to an advisor's personal device, are there stored locally, and can be easily deleted – a potential nightmare for compliance departments needing to oversee the communications activities of their advisors, which led many firms to simply prohibit the use of any client communication via text.

To this end, MyRepChat emerged in 2017 as the earliest of a handful of companies (which since has grown to include Smarsh, MessageWatcher, and Redtail Speak) that solved for meeting the compliance archiving obligations around advisors using text messaging. What made MyRepChat particularly notable was that beyond easing the ability for advisors to text compliantly, it also included features aimed at helping advisors use text communication more effectively, such as the ability to schedule messages, create customized auto-replies, and build workflows to enable faster replies to incoming client texts.

In that context, it's notable that digital marketing platform FMG Suite has acquired MyRepChat to bring its compliant texting technology into FMG's increasingly comprehensive marketing stack.

From FMG's perspective, the deal makes sense because it adds one of the few marketing channels that FMG didn't provide support for – they already provide marketing strategy and content in areas like advisor websites, email, social media, and events, so it's natural to make text message support a part of that all-around toolkit as texting continues to gain traction as a marketing channel. And given that arguably the biggest challenge other than compliance obligations that advisors have around texting is how to fit it into their existing marketing processes, FMG seems uniquely positioned to integrate MyRepChat's texting capabilities as part of an all-around marketing strategy rather than one-off responses to client questions.

Notably, though, many advisors have still been reluctant to adopt text messaging in their businesses thus far. Because although a text message is an effective way to get a client's attention, that fact in itself can have downsides: First, as most people with a cell phone are well aware, getting too many texts from any business – particularly ones that aren't in response to a question sent by the client in the first place – can quickly become irritating, and advisors wary of crossing that line may not want to venture too far into text messaging. Second, the attention-grabbing nature of text messaging is just as true for the advisor, and having a mobile device constantly pinging with client text messages can easily be disruptive for an advisor trying to focus on other work.

Which ultimately raises the question of whether FMG's implied positioning of texting as more of a marketing solution than an ongoing communications tool for existing clients may get more adoption (or not). On the plus side, a more marketing-based text messaging approach from FMG where text communication is more smoothly integrated into an advisor's marketing workflows – and thus more under their control – may make it easier for the advisor themselves to manage. In which case FMG will stand to benefit if it can help advisors capture the marketing potential of texting without it becoming too annoying for the client or the advisor. With the caveat that when most advisors have long struggled to implement effective marketing systems at all, and tend to rely on existing client referrals and one-to-one in-person networking, will advisors be ready to hop onto the 'next hot marketing trend' of text messaging with prospects and take what might be viewed as a more "salesy" outbound marketing approach in the first place?

YCharts Launches Proposal Generation As Analytics Tools Increasingly Pivot To Sales Enablement

Although one of the dominant trends of the financial advice industry in the 21st century has been advisors going beyond investments and into more comprehensive financial planning, the reality is that most advisors today still build their businesses (and actual revenue model) around managing client portfolios. This is most demonstrated by the fact that the dominant share of advisors charge on an Assets-Under-Management (AUM) basis, while functionally the majority also still provide investment management – typically on a discretionary basis – to all of their clients. Which means that, while the conversations and planning often turn to wide-ranging topics from taxes to college savings to retirement planning, advisors can't really escape the obligation they have to demonstrate why they – and not a third-party manager, robo advisor, or the client themselves – should be managing the client's portfolio, and why their approach is likely to be better (or at least not worse) than what the client already has in place. At the most basic level, this means that when offering advisory services to a prospective client, the advisor will at some point have to illustrate how they will manage the client's investments differently, and what the tangible effect of changing to the advisor's approach will be.

Surprisingly, however, there haven't always been many tools that could help financial advisors create proposals to show even a simple current-versus-proposed portfolio comparison for the client, much less providing a broader investment management 'pitchbook' that would illustrate in depth the advisor's offering, their investment management expertise and process, and how it connects to the client's goals. Historically, proposals were largely the domain of Morningstar, from the days when advisors would print 1-page Morningstar reports of mutual funds that they were recommending to show why they were better than the mutual the client may have already held. And fund companies like Vanguard offer portfolio analytics tools to compare current versus recommended portfolios, though of course the existence of a fund company's branding on a proposal raises obvious questions about the objectivity of the recommendations.

But in recent years, there's been a seeming resurgence of tools to help advisors demonstrate their value with their portfolio recommendations, broadly known as proposal generation tools, which is essentially sales enablement technology that helps advisors convert an already-interested prospect into a client during the final stages of the sales process. And what's interesting is that not only have there been a number of startups looking to enter the proposal generation space, but often those sales enablement solutions stem from tools that were nominally designed for analyzing data and developing recommendations. Most notably, earlier this year Riskalyze, known originally for its risk tolerance software, pivoted and rebranded to become Nitrogen, a 'growth platform' – which effectively doubled down on how advisors had been using Riskalyze not just for determining risk tolerance of a client for compliance purposes, but also assessing the risk tolerance of prospective clients and whether their portfolios were constructed to align with that risk tolerance (and whether the advisor's more-diversified portfolio was likely to be a better fit). In other words, providers that brought technology to the market to help advisors add more value for their ongoing clients have increasingly realized that there's also an opportunity in helping advisors to sell that value to prospective clients, and are accordingly building more sales features into their existing products.

And so it's notable that now this month, portfolio analytics platform Ycharts announced the launch of its own investment proposals tool. Similar to other sales enablement tools, Ycharts Proposals allows advisors to show investment analytics comparing the advisor's recommended portfolio to what the client currently has, along with other reports that can be drag-and-dropped into a design tool to build presentations customized with the advisory firm's branding and disclosure language. Additionally, Ycharts is introducing a Talking Points feature that allows firms to create and distribute customized analytics and language firmwide to ensure consistent messaging across all of the firm's advisors during the sales process with prospects.

From an advisor perspective, Ycharts' Proposals and Talking Points tools represent yet another choice in the increasingly competitive landscape for proposal generation tools for advisors. The decision of which tool to use likely comes down to an individual advisor or firm's style: Those who use and like the 'risk number' approach pioneered by Nitrogen might prefer sticking with that tool, but others that come from a more quantitative and chart-heavy portfolio metrics approach are more likely to prefer to build their proposals on Ycharts' analytics chassis.

For Ycharts, the expansion into proposals makes sense not only because it strengthens their competitive position in the category of investment analytics (for which Ycharts, along with Kwanti, has emerged as the only meaningful competition to Morningstar's dominant market share according to the most recent Kitces Research on Advisor Technology), but also because advisors have historically paid more for solutions that help them bring in new revenue than they do for those that 'just' help them support and maintain their existing revenue. In other words, Ycharts can command a stronger price by leveraging its analytics for proposals that advisors can use to get new prospects, than it could simply for providing tools for investment research or existing client reviews.

From the industry perspective, the shift of AdvisorTech toward sales enablement in response to firms' demands for ways to show their value creates some surprising competitive dynamics. While YCharts' investment analytics solution would not have seemed like a natural rival to Nitrogen with its origins in risk tolerance, those firms suddenly find themselves on a competitive path with each other as they each expand beyond their own roots to meet in the category of proposal generation and provide more sales enablement to advisors. Arguably there's enough room for both companies to be successful in their efforts, as they each appeal to different types of advisors depending on how they like to tell their investment story – but between the two, and other newcomers like VRGL and Invyzia, what was a few years ago a sparsely-populated box on the Kitces AdvisorTech map has quickly become one of the most high profile and competitive categories of technology for advisors!

Intention.ly Launches Advisor Brand Builder To 'Tech-ify' The Brand Design Process

If you're starting an advisory firm, one of the first steps towards implementing a marketing strategy is to build a brand – a logo, color palette, or more broadly a mood or vibe that you want your marketing materials, website, client reports, etc. to express. It's important to do this well, since a prospective client's first impression of an advisory firm is likely to come from its website, ads, or even a find-an-advisor page, all of which are likely to prominently feature the firm's branding, and a professional-looking design will likely create a more positive impression than one that looks relatively slapdash.

The best way to create a brand is likely to hire a professional design or marketing consultant, who will go through a process involving questionnaires, mood boards, color palettes, and often many iterations on logo and font designs before landing on the one that works best. The challenge with that approach, though, is that going through a consultant or agency to design a brand (along with associated collateral like business cards, letterhead, and Powerpoint templates) can easily cost $5,000-$10,000 and upwards, while firms that are just getting going (who are the ones most likely to need a brand design) typically have limited capital and many other startup expenses, including things like compliance consulting for initial registration and legal documents for entity formation that are strictly more necessary for the firm to get off the ground.

If an advisor wanted to save money on creating a brand, they'd essentially have 2 options: They could pick a generic brand template from a site like Canva, which while reasonably professional-looking, isn't likely to be very memorable or capture what makes the advisor unique; or alternatively, they could go the DIY route, and perhaps hire a freelancer from a site like Upwork or Fiverr for some of the design work, which while likely to be unique may end up misfiring on conveying what the advisor actually wants it to (while also potentially using up valuable time and attention during the hectic startup phase).

But while a professional eye can make a difference between a brand that's memorable and professional looking and one that's less so, it's possible that it isn't strictly necessary to pay a consultant to take you through every step of the process. There's a theoretically finite number of font and color combinations, each of which could be associated with a mood or a combination of keywords or phrases that capture what the firm is about. If your firm's focus is on, say, creating retirement plans for circus performers, then in theory there could be a technology solution that allows you to type that into a box and returns 3 different branding options to choose from that by its big-data calculations would make a reassuring and positive impression on circus performers. It could even be possible to automatically generate a logo that's a stylized version of the first letter of the firm's name. It would be good to have a human professional available to help with any tweaks once the broad themes are set, but there's no reason that with sufficiently sophisticated technology – either built on AI or just a very robust database of font/color combinations and associated phrases – wouldn't be able to automate a large part of the branding process and create at a brand that's at least good enough for a large percentage of startup firms.

In this vein, design consultancy firm Intention.ly has announced the launch of Advisor Brand Builder, a website that takes advisors through an initially self-guided questionnaire, then feeds the responses through a 'brand generation engine' that serves up 3 separate style boards to choose from, and eventually brings in personalized support from a "Personal Brand Concierge" to review and finalize the selected option. The end result is a professionally designed brand (including logo design, color palette, brand imagery, and assets like email signatures, PowerPoint templates, and letterhead) that, at a one-time cost of $2,999, is more than an advisor would pay for a generic brand template or to do it themselves, but is significantly cheaper (and likely done in far less time) than most full-service branding processes would be.

Notably, Advisor Brand Builder is not purely a technology solution: It doesn't just spit out a finished product like a generative AI tool might. Ultimately, Intention.ly's marketing team still reviews the automated output and works with the advisor to fully align it with their brand story, with the technology simply automating most of the steps of discovery and iteration that lead up to that point. Which means in practice, Advisor Brand Builder isn't a tech solution per se, but rather a tech-enabled services offering (akin to Snappy Kraken's recently-launched Freedom360 outsourced marketing platform), where the product and the expertise behind it are still human-guided, but the workflow has been 'tech-ified' to the extent that it's nearly fully automated up until the point where the human support is really needed – and which the company is now aptly branding into a standalone offering.

For advisors, then, Advisor Brand Builder fulfills an unmet need for startup firms that have high stakes for the quality of branding that they show up with, but on a limited budget. It's also fittingly a clever brand exercise unto itself, by highlighting that when a company systematizes its own services down to the point where nearly everything that can be automated has been, it becomes its own product that can be sold on a standalone basis alongside the more bespoke 'flagship' option.

Testimonial IQ Launches A New Solution For Advisors To Gather Testimonials, But Will Clients Get On Board With A Standalone Review Site?

Just under 2 years ago, the SEC updated its marketing rule for RIAs for the first time in decades, unwinding what had been a historical ban on advisors using any kind of client testimonials or reviews in their marketing. At its core, the old rule was about making sure that advisors didn't use client testimonials to market the performance of their investment returns, which was rife with opportunities to cherry-pick the best client experiences and create misleading impressions about the advisor's skill. But in more recent years, two large-scale shifts have occurred: First, as advisors have added more and more financial planning advice beyond the portfolio, there are more (and more relevant) skills that an advisor's client could speak to other than their investing ability. And second, consumers have begun to increasingly look to the experiences of their peers in deciding on professionals to hire, with review sites like Yelp, Angi, and Google becoming the go-to places for assessing the quality of numerous professionals. The SEC's updating of the marketing rule was thus needed to reflect the realities of the advisory industry and the way that consumers shop for services today.

Of course, clients were always able to leave reviews for advisors on independent third-party sites like Google or Yelp. What changed with the update of the marketing rule was that advisors were now allowed to ask clients for reviews, and to subsequently showcase client reviews and testimonials in their advertising materials and on their website. And up until the release of the new marketing rule, there was no single site (like Angi for home services) where clients knew where to go to search specifically for advisors, read reviews, and connect with the highest-rated advisors. In short, there's a mixed bag of new ways that advisors can use to leverage the opportunity provided by client reviews in light of the new marketing rule, and in the years since the new rule came online, a frenzy of new startups has arrived aiming to help them do so.

In practice, though, because there's not just one way to use testimonials, not all startups are alike in the way that they approach the opportunity. Some are trying to become the next HealthGrades (but for advisors instead of doctors), seeking to be the go-to place for clients to review and search for financial advisors, which has been the approach of platforms like Wealthtender and IndyFin (which was recently acquired by Wiser Advisor). At the other end of the spectrum are platforms that, recognizing that 'generalist' third-party review sites like Yelp and Google tend to be the first place that consumers look for reviews, help advisors ask clients to leave reviews on those sites, and monitor the reviews left on the advisor's behalf – a niche filled by Amplify Reviews.

And recently, newcomer Testimonial IQ launched with yet another solution to help advisors take advantage of the opportunity of testimonials. It introduces a third approach, alongside the two described above, by creating a central site where, at the invitation of their advisor, clients can write their review and choose which channel to post it on (e.g., social media or Google). The reviews are sent out through those channels, and advisors can monitor and share reviews (via their website, social posts, or in email campaigns) directly through the platform.

Advisors have long sought out ways to show their value in the marketplace, and client reviews and testimonials are one way to do so by highlighting how well the advisor is serving their existing clients. As advisors get more comfortable with the requirements around testimonials – e.g., providing required disclosures, keeping necessary books and records, and not cherry-picking investment results – advisors will likely lean further into the opportunity to highlight client reviews on third-party sites, and gather their testimonials on their own websites, and there will be a hunger for technology that can make it easier to request, document, and showcase testimonials in one form or another.

The question going forward is which ways consumers will choose to engage with advisor reviews as they become more available. Because regardless of what's easiest from the advisor's perspective, it's ultimately the consumer's choice of where they go to read and write reviews of their advisors. And it's currently an open question whether standalone sites like Wealthtender that gather their own reviews (and double as a lead generation service to match clients with highly rated advisors) be able to generate a critical mass of reviews and SEO to gain traction, or whether consumers will continue to rely on the platforms they already use (like Yelp and Google).

Which ultimately may mean that the winner of the testimonial race may not necessarily be the one that most seamlessly solves the challenges of requesting, documenting, and displaying testimonials, but rather which platform (or platforms) correctly intuits what the search habits of consumers will be when they start to search for advisor reviews in earnest. In other words, will consumers want to use a standalone platform (or one of multiple competing platforms), or will the existing moats of general review sites like Yelp be such that the most effective way to use testimonials will be to go where consumers already are? And if that's the case, does it present challenges to platforms like Testimonial IQ that require clients to go through a third-party interface (mainly for the convenience of the advisor) rather than going directly to the site for reviews? Time (and consumer habits) will certainly tell.

In the meantime, we’ve rolled out a beta version of our new AdvisorTech Directory, along with making updates to the latest version of our Financial AdvisorTech Solutions Map (produced in collaboration with Craig Iskowitz of Ezra Group)!

So what do you think? Is 'free' portfolio management and reporting software enough of a cost-saver to make switching custodians worth the hassle? Is text message an effective way to communicate with clients or does it risk becoming too irritating? Will every financial planning and analysis tool include a proposal generation feature in the future? Let us know your thoughts by sharing in the comments below!

Leave a Reply