Executive Summary

Welcome to the June 2019 issue of the Latest News in Financial Advisor #FinTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors and wealth management!

This month's edition kicks off with the news that Vanguard is apparently working on a new "technology" platform for advisors – adapted from its own Personal Advisor Services solution – that, at a minimum, appears to be a form of robo-advisor-for-advisors offering, and may even be an entire RIA custodial platform to compete with the likes of Schwab, Fidelity, TD Ameritrade, and Pershing… and potentially force the other custodians to stop charging more for Vanguard (and DFA) trades and instead reconfigure their own custodial business models to be better aligned with the advisors they serve?

From there, the latest highlights also include a number of other interesting advisor technology announcements, including:

- Goldman Sachs acquires United Capital for $750M, at the least to expand into the "mass millionaire" wealth management marketplace… and possibly to leverage UC’s FinLife technology platform to power its own RIA custodial solution in the future?

- Morningstar launches its own Model Marketplace but chooses a more "fee-only" approach of charging for its software directly and not being compensated by asset manager incentives, even as most model marketplace competitors are reducing the costs of their software (subsidized by asset manager revenue-sharing commissions)

- Carson Group partners with Galileo Money+ to offer independent RIA clients traditional banking services, from a checking account paying 1.24% to a savings account paying 2.20%, along with a debit card, online bill pay, and mobile check deposit.

- 280CapMarkets announces its first enterprise partnership (with United Planners) to offer its BondNav solution for individual bond trading as rising interest rates increase the demand for advisors to build individual bond ladders

- OpenInvest launches Optimus, a new Direct Indexing solution structured as an SMA that relieves advisors of the need to implement their own Direct Indexing strategies but with the flexibility to customize index funds to specific client ESG preferences

Read the analysis about these announcements in this month's column, and a discussion of more trends in advisor technology, including Redtail’s cybersecurity incident that exposes a slice of private client data (as the challenges of managing a growing web of third-party integrations becomes exponentially more complex every year), RIAInABox launches its own cybersecurity training solution for RIAs and their employees, Salesforce rolls out a new "big data" initiative for Financial Services Cloud users in partnership with its Einstein AI platform, and North Capital launches its own proprietary financial planning solution for free to consumers for lead generation as Zoe Financial wins the Morningstar FinTech competition for its new digital lead generation platform for advisors… as the FinTech world struggles to recognize that the real challenge to serving the masses is not the technology to serve them, but the marketing difficulties and high client acquisition costs to reach them (and gain their trust) in the first place!

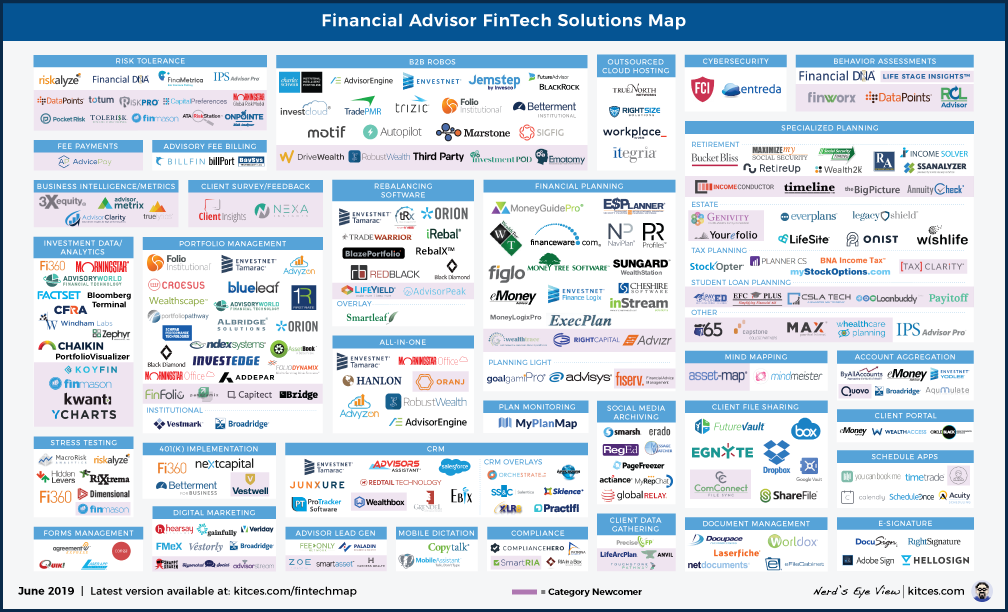

And be certain to read to the end, where we have provided an update to our popular new “Financial Advisor FinTech Solutions Map” as well!

I hope you're continuing to find this new column on financial advisor technology to be helpful! Please share your comments at the end and let me know what you think!

*And for #AdvisorTech companies who want to submit their tech announcements for consideration in future issues, please submit to [email protected]!

Will Vanguard Launch A Direct-To-Advisor Custody Platform As The Ultimate Distribution Channel For RIAs? As the rise of discount brokers caused the traditional brokerage industry shift from its roots of stock and bond trading into the distribution of mutual funds in the 1980s and 1990s, the underlying business brokerage model similarly began to shift from collecting commissions for trade execution and into participating in mutual fund 12b-1 and sub-TA fees instead… a shift that was epitomized by the launch of the Schwab OneSource platform in 1992. The challenge, however, is that not all mutual funds have been willing to pay such back-end distribution and servicing fees, especially as advisors and investors increasingly focus on mutual fund (and now ETF) expense ratios… for which the fund companies that don’t pay the back-end fees, like Vanguard, tend to have the lowest cost (and increasingly most popular) funds. In turn, this has led to friction between the subset of fund companies – like Vanguard and also DFA – that refuse to pay such fees and the RIA custodial platforms that make their funds available, resulting in the custodians charging higher ticket charges on such trades to make up for the lost revenue. And because those fund companies won’t pay anything on the back end – and because advisors don’t pay anything upfront to use their custodians either – those won’t-pay-on-the-back-end fund companies are typically excluded (or in the case of TD Ameritrade, included and then later removed) from the various “No-Transaction-Fee” ETF and mutual fund lineups as well. Which last summer led Vanguard to expand its own no-transaction-fee ETF platform that will allow virtually all fund companies to be traded for free – recognizing that when Vanguard already gets the majority of all fund inflows, it will likely enjoy the majority of all flows on its NTF platform anyway. In other words, Vanguard’s “open architecture” NTF ETF trading platform effectively became a direct-to-consumer technology distribution channel for its own funds. And now, the rumor is that Vanguard is looking to go “direct-to-advisor” as well, repurposing the technology from its Personal Advisor Services (PAS) platform into a potential RIA custody platform to launch in 2021… and likely to highlight that it will allow Vanguard mutual funds and ETFs to be traded without any transaction fees for advisors as a kind of vertically-integrated technology distribution channel to advisors. Of course, the caveat is that Vanguard had an RIA custody offering once in the past – in the late 1990s and early 2000s – which it ultimately exited to focus on its “core strength” of asset management, and it remains to be seen whether Vanguard can really offer a full-suite competitive custodial technology offering for RIAs given the high demands of the independent RIA community today. On the other hand, given the sheer volume of Vanguard fund assets being purchased on other RIA custody platforms where RIAs would love to reduce trading fees to clients, the reality is that competing RIA custodians may not be able to afford to take the risk that Vanguard will be successful, and feel pressure to restructure their own business models to be less reliant on back-end 12b-1 and sub-TA fees before Vanguard potentially forces their hand. Thus, ironically, Vanguard’s new RIA custody offering could be highly disruptive to the existing business model for competing RIA custodians, even before it gets around to launching – and seeing if the offering is successful – in the first place? Which in turn means Vanguard can “win” and ensure more equal distribution of its funds in the marketplace without trading fees, even if it never gains traction with its own RIA custody offering anyway?

Did Goldman Sachs Buy United Capital For Its Revenue… Or To Repurpose Its FinTech For RIA Custody? The financial services industry was abuzz this month with the blockbuster deal that the venerable Wall Street firm Goldman Sachs bought "upstart" wealth management RIA United Capital for a whopping $750M. On a base of nearly $25B and estimated revenue of close to $250M, the purchase at nearly 3X revenue (and a rumored 18X EBITDA) was generous by typical industry averages, but not outlandishly high given United Capital’s size and scale (which often commands a valuation premium in the marketplace). And Goldman is anticipated to have numerous opportunities for growth from here, including the potential distribution of Goldman Sachs Asset Management (GSAM) solutions through United Capital, and expanding Goldman Sachs into the "mass millionaire" wealth management marketplace (in between its Marcus online banking solution and the ultra-HNW Goldman Sachs Private Wealth offering) that Goldman CEO David Solomon estimates can be doubled in relatively short order. But the untold story of Goldman’s acquisition of United Capital may not be UC’s core wealth management business and sizable AUM and revenue, but its FinLife CX technology platform – a wealth management CRM solution built around Salesforce but with deep integrations to MoneyGuidePro and eMoney Advisor and its own unique wealth-management-centric client portal. On the one hand, Goldman Sachs may simply expand FinLife CX into an entire "digital wealth management experience" to grow its new United Capital brand (with rumors already emerging that Goldman is working on an "advisor-led and digitally empowered" wealth management tool). On the other hand, though, United Capital was already trying to leverage the FinLife CX solution by selling it to other advisory firms… a path that, if Goldman Sachs continues and extends further, could quickly (with Goldman’s resources and reach) turn it into a competitor of Envestnet (and perhaps Commonwealth’s new Advisor360 platform), or even be packaged together into a wealth-management-centric RIA custody offering and for larger RIAs serving affluent clientele (akin to Fidelity’s Wealthscape with ever-deeper integrations into eMoney Advisor). In fact, given that United Capital was arguably purchased at a "market rate" for its AUM revenue alone, Goldman Sachs may have pulled off a steal-of-a-deal by acquiring the FinLife CX technology along with it… raising the question of whether someday, Goldman might even spin the United Capital wealth management business back out, and just keep the FinLife CX technology core to scale its own B2B RIA platform business?

Morningstar Finally Launches Its Model Marketplace… As A "Fee-Only" Platform For Portfolio Models? The Model Marketplace arrived with a bang in early 2017, as one platform and then another, from Riskalyze (through Autopilot) to TD Ameritrade (through iRebal), announced that they were going to launch a “model marketplace” for advisors. The essence of the model marketplace is that, in a world where advisory firms increasingly focus not on individual security selection but on constructing diversified asset-allocated portfolios, a “marketplace” can make a series of such models available for advisors to choose from, alleviating much of the time and effort it takes for an advisor to construct his/her own models… but without forcing the advisor to actually delegate to a third-party TAMP (because the advisor can implement the model themselves using the rebalancing software that model marketplaces are typically built into). Over the past two years, the number of providers offering model marketplaces have proliferated, though their "popularity" appears to not be a function of advisor demand, but instead asset managers offering revenue-sharing incentives to the model marketplaces as a distribution expense; thus why Jemstep (owned by Invesco) recently announced its digital advice platform via the Salesforce app exchange, AdvisorEngine (owned by WisdomTree) did a deal with IFP’s 200 advisors, and Oranj went so far as to offer its advisor platform entirely for free in exchange for advisors using the model marketplaces it offers (where Oranj is compensated by the asset managers whose ETFs appear in those models). The caveat, though, is that when model marketplaces are driven by the economics of asset managers, the resulting models are not necessarily objective, and what models are or are not available in a marketplace risks being driven more by which asset managers can pay the most, than necessarily which ones are the best (the fundamental challenge of such a conflicted distribution model for models). Yet notably, when Morningstar announced this week that its own Model Marketplace is finally going live (via its Morningstar Office Cloud platform), the company specifically noted that it will not accept any incentives from platform participants, ostensibly opting instead to be content with the economics of selling Morningstar Office Cloud licenses themselves and being paid for the software in the first place (which advisors can use to research and screen various models). From the Morningstar perspective, the decision to monetize the model marketplace through the software advisors pay for themselves – rather than via the upstream economics of asset managers paying for distribution – is an admirable choice to hew closely to Morningstar’s roots as an objective data analytics company. From the broader industry perspective, though, Morningstar’s decision to operate a more “fee-only” style of model marketplace in a world where virtually every competition is running a more traditional commission-based model (compensated by asset managers for the assets they collect into the asset manager’s funds and ETFs via their model marketplace) sets up a striking battle to play out in the coming years: will advisors really be willing to pay Morningstar Office Cloud software fees upfront and out of their own pocket to get “free” access to its model marketplace, when competitors like TD Ameritrade give iRebal away for free (and perhaps someday, Envestnet giving Tamarac away for free!?) and let the platform be compensated directly by clients (not out of the advisor’s pocket) via ETF and mutual fund expense ratios instead?

Carson Group Engages Galileo Money+ To Launch High-Yield Checking And Savings Accounts And Debit Cards For Its RIA Clients. For nearly 10 years of ultra-low interest rates in the aftermath of the financial crisis, “cash” has yielded so little that no one (neither clients nor advisors) really cared how the cash was invested; instead, the goal was simply to stay “fully invested” and minimize the zero-yield cash altogether. Now, however, as interest rates are rising, the yield on cash – and the differential in cash yields from one bank or custodial platform to the next – has suddenly become relevant again. Except now, cash itself can be moved with relative ease in a purely electronic transaction – a process that was still difficult at best in the mid-2000s when cash yields were last high enough to matter – setting the stage for an increasingly aggressive fight for highly mobile cash. In fact, the opportunities to attract assets through competitive cash yields is leading not only to a crop of next-generation online banks like Ally, but also the launch of new online banks from traditional providers (e.g., Marcus from Goldman Sachs), and even robo-advisors and other FinTech startups like Robinhood and Wealthfront that are launching competitive-cash-yield offerings. In fact, the strategy is working so well that Wealthfront boosted its entire AUM by $1B (or nearly 10% of its total asset base) in the span of just two months by offering a competitive cash yield. However, advisors have largely struggled to offer their clients similar solutions, as the existing RIA custody and broker-dealer models are heavily reliant on taking a healthy scrape from cash yields in order to fund their business models (in fact, almost 50% of Schwab’s entire company revenue is interest revenue on its client cash!). Which in turn has opened the door for competitors like MaxMyInterest and StoneCastle to roll out competitive-cash-yields-for-advisory-firms solutions that allow advisors to offer better yields to clients… even at a "cost" of disintermediating their own custody and clearing firms in the process! And now, high-profile RIA Carson Group is taking the offering one step further, in a new offering in partnership with Galileo Money+ that will provide clients both a 1.24% yield checking account and a 2.20% yield savings account (both FDIC insured), replete with a debit card, online bill pay, and mobile check deposit capabilities. On the one hand, such an offering gives Carson’s RIA the potential to significantly boost its AUM and revenue as Wealthfront has done (though the firm notes it has not yet decided whether to charge AUM fees on Galileo cash positions). And on the other hand, even if it’s not a direct revenue opportunity, arguably consolidating even more assets under the advisor’s purview helps to improve retention by making clients “stickier” and allows independent RIAs to provide clients a more holistic financial solution including checking and savings that historically was only available for advisors working in banks. At a minimum, though, the increasingly high-profile efforts of leading advisory firms to provide clients with alternative cash solutions to what their own RIA custodians provide raises the question of whether custodial platforms will eventually be forced to re-tool their own cash-yield-dependent business models, as FinTech solutions make it increasingly easy for fiduciary RIAs to minimize the RIA (cash) custodian’s revenue for their own clients’ (external cash yield) benefits instead.

280CapMarkets Announces First Enterprise For Its New BondNav Bond Trading Tool. A decade of pervasive low interest rates has not only subdued advisor interest in managing cash positions; it’s also reduced the relative interest in investing in (or owning at all) significant bond allocations as well, with FPA’s Trends In Investing research showing that individual bond use has declined from 60% of advisors in 2006 to barely over 40% of advisors today. Yet with the prospect of a rising interest rate environment, individual bond investing becomes more appealing (by buying individual bonds that can be held to maturity at par value to mitigate the impact of rate increases)… not to mention a growing number of advisors working directly with retired client for which it’s often popular to hold (laddered) bond positions as a short-to-intermediate-term bucket in the early years of retirement. The caveat, however, is that direct bond investing is still a far more opaque market than buying individual stocks, especially with most advisor trading platforms today built primarily for investing into mutual funds and ETFs and perhaps individual stocks (but not individual bonds). It’s in this context that 280CapMarkets has built its BondNav solution: a platform to facilitate finding, pricing, and trading individual bonds (starting with municipal bonds and now including corporate bonds as well), without the advisor needing to rely on what are still ultimately a buyer-beware bond trading desks. Accordingly, the essence of BondNav is to make it easier for advisors to find and then get best execution pricing on their bond trades; in fact, to fully commit to the model, BondNav generates its revenue not by charging a fee for the software, but by splitting the cost savings it creates in its bond trading execution (for which it provides a Best Execution report to validate the savings it generated). And now, broker-dealer United Planners has announced that BondNav will be made available as a bond trading platform for its 450 advisors, even as BondNav showcased at the recent ScratchWorks FinTech competition that it is also gaining traction in the RIA marketplace as well. Of course, BondNav is still a moot point for the majority of advisors who aren’t buying and selling individual bonds in the first place, and are simply using bond mutual funds or ETFs; nonetheless, for what may soon be a growing number of advisors who do buy and sell individual bonds for clients (particularly in the face of rising rates), where getting best execution can still be a real challenge, BondNav seems well positioned to bring some long overdue transparency to the individual bond marketplace for financial advisors.

As Direct Indexing Gains Interest, OpenInvest Launches Optimus To Build ESG-Customized Index Alternatives. One of the key original benefits of the mutual fund was the ability to not just manage the assets of multiple investors on a pooled basis, but specifically to gain the trading economies of scale of engaging in fewer and larger (and more cost-effective) trades to reduce the transaction costs of investors. Yet the reality is that, over the decades, the cost to execute a stock trade has plummeted… to the point that today there’s virtually no material cost reduction in trading fees for mutual funds relative to what individual investors can obtain for themselves anyway. Which in turn is leading to the rising phenomenon of “direct indexing” – eschewing mutual fund and ETFs to buy various stock indexes, and instead simply using technology to individually and directly buy all the stocks in the index instead, which both allows the investor to eschew the expense ratio of the mutual fund or ETF, and gain additional tax-loss-harvesting benefits by being able to individually loss-harvest each of the stocks in the index (instead of only being able to loss harvest based on the overall returns of the entire index). In fact, at the recent InsideETFs conference, industry guru Matt Hougan called Direct Indexing the next $100B opportunity. The caveat, however, is figuring out how exactly to distribute Direct Indexing solutions to advisors, who even with technology may not necessarily want to be responsible for the volume of trading execution that’s necessary to implement Direct Indexing for clients. According, FinTech upstart OpenInvest has announced the launch of its new Optimus direct indexing solution for advisors, which will provide the technology for advisors to not only facilitate direct indexing but to even customize those index allocations for particular ESG preferences of clients (e.g., “buy the S&P 500 but with an underweight to fossil fuels and vice stocks and an overweight to green energy companies and women-led companies”), and then facilitate the actual investment management process through an SMA structure… effectively allowing advisors on the Schwab, Apex, or Interactive Brokers platforms (and sooner Fidelity and Envestnet as well) to work directly with their clients through the Optimus technology to customize Direct Indexing funds for their clients that OpenInvest then implements (for a 20-40bps fee depending on advisor assets, plus whatever asset-based pricing fee the advisor can negotiate with their custodian that clients pay for the actual trade execution). Ultimately, it remains to be seen whether Direct Indexing really gains traction, and if so, whether advisors will prefer to entirely control the technology to implement it themselves, or to outsource it to an SMA structure as OpenInvest has done – but with providers offering Direct Indexing tools beginning to gain traction, it seems only a matter of time before the industry figures out the best way to distribute the strategies… especially given the sheer size of the mutual fund and ETF marketplace that’s at stake to be disrupted.

Digital Lead Generation Takes Center Stage As Zoe Financial Wins Morningstar FinTech Competition. As financial technology increasingly takes center stage in driving advisory industry trends, FinTech literally took on a stage at the recent Morningstar Investment Conference, with a new FinTech competition set to discover the industry’s next big FinTech startups. From the field of 21 competitors, this year’s winner was Zoe Financial, a new digital lead generation site for advisors that aims to match consumers directly with pre-qualified advisors on the platform (who must be fee-only, have CFP certification or the CFA designation, and undergo additional vetting). Following on the heels of the company’s $2M seed round of capital last October, Zoe reports that it has already driven more than $100M of assets to its advisors on the platform, for which Zoe is paid an ongoing revenue-share of the advisor’s fees. Yet the irony from a FinTech perspective is that, in the end, Zoe is less a traditional “FinTech” solution to help advisors market themselves more effectively, and instead essentially is a marketing platform unto itself, that will win or lose in the long run not by its “tech,” per se, but its ability to scalably generate qualified leads for advisors that actually convert into clients at a reasonable client acquisition cost. In point of fact, the industry is already littered with the corpses of a large number of advisor “matching” and review sites, that built “the technology” (a straightforward advisor matching site) but never figured out how to drive and then scale a sufficient volume of qualified leads. Of course, the fact that many advisors themselves also struggle with high client acquisition costs is precisely why there is such advisor demand for outsourced lead generation services, and why advisors are so willing to pay what often amounts to exorbitantly high client acquisition costs with lucrative (for the marketer) back-end-loaded revenue-sharing deals (because they’re variable-cost marketing strategies that only have to be paid once the client closes and comes on board). Still, though, while companies like Zoe have a significant economic opportunity in the advisor marketplace to use their technology and economies of scale to drive down client acquisition costs lower than what advisors can do themselves (and then get paid a portion of the difference by upselling the value of the leads), in the end, it’s crucial to recognize that lead generation websites are really in the marketing business – not the FinTech business – and will live or die by their ability to create a scalable marketing solution (not just a scalable FinTech platform, per se).

Advisory Firm North Capital Offers Its Own Custom Financial Planning Software Evisor For Free As Lead Generation For New Clients. As asset allocation services become increasingly commoditized through “robo-advisors” and similar technology, advisory firms are becoming more and more financial-planning-focused as a way to extend and differentiate their value proposition above and beyond what the technology can provide. And in fact, the phenomenon isn’t unique to advisors, as even “robo” firms themselves have become increasingly human and financial-planning-oriented in recent years, from Vanguard launching its Personal Advisor Services (“robo” plus human CFP professionals), Betterment launching a premium solution with access to human CFP professionals, Schwab launching its Intelligent Advisor solution tied to MoneyGuidePro, Wealthfront building its own Path financial planning software for consumers, and Personal Capital making its Personal Financial Management (PFM) account aggregation software the center of its entire marketing process for new clients. The latter two are especially notable, as they represent not just a scenario where a “robo” firm offers more holistic financial planning advice with human advisors, but specifically an approach of giving away high-quality financial planning software solutions for free to consumers as a means to engage prospects in a relationship with the firm (in the hopes of eventually upselling a subset of them into the firms’ core investment management solutions). In this context, it’s notable that now independent advisory firm North Capital has decided to engage in a similar strategy itself, converting what was previously the firm’s own Excel-built financial planning tools with clients into an online web-based application called evisor that prospective clients can use for free (and then if they want more help, hire North Capital’s advisors for $200/hour or have their assets managed by the firm for 0.25% through Schwab’s Institutional Intelligent Portfolios platform). Yet while arguably financial planning software can be an effective “prospect engagement” tool (something to draw prospective clients deeper into the advisor’s marketing funnel) before they’ve actually become clients, it’s not clear whether or how North Capital will be able to compete with other more-capable solutions, from Personal Capital’s own PFM dashboard (while North Capital doesn’t yet have account aggregation capabilities), to Wealthfront’s Path (and its slew of Silicon Valley engineers rapidly iterating on the tool), to the prospecting capabilities of eMoney Advisor or MoneyGuidePro’s MyMoneyGuide Labs. Nor is it clear whether North Capital will have the resources to scale the top-of-funnel marketing to generate enough prospects to engage with evisor in the first place, as even with capable financial planning software tools, advisor marketing is definitely not an “if-you-build-it-they-will-come” solution (as even niche attempts like SheCapital learned the hard way). Nonetheless, North Capital remains so optimistic about its solution that it is already planning to release a white-labeled version for other advisory firms to use in their marketing process as well. Though even if the company finds it difficult to compete in a crowded client acquisition marketplace, their efforts still illustrate and emphasize the gap that currently exists for financial-planning-centric middle-of-funnel marketing and engagement tools for advisors to use in their digital marketing!

Salesforce Expands Its Business Intelligence Dashboards In Search Of AI Opportunities With Einstein Analytics. One of the biggest gaps in the FinTech landscape for mid-to-large-sized advisory firms is the availability of good business intelligence software. At a minimum, advisory firms need business intelligence tools to properly understand the true health of their firms, from net inflows and outflows, to the profitability of the practice, and the potential impact of market volatility… ideally broken down to the individual advisor or team. And perhaps even to spot “big data” trends and insights that can provide additional guidance to the firm’s executives. In the case of smaller advisory firms, the business simply doesn’t have enough clients and data to have “big” data problems (and insight opportunities) in the first place; for larger firms, though, the challenge is that the data points live in disparate systems (from RIA custodians to portfolio performance reporting tools to third-party data aggregates to the advisory firm’s own CRM system)… which has made Salesforce an especially popular CRM solution for larger firms, thanks to its more flexible capabilities to pull in and integrate together multiple data sources into a single dashboard. And now, Salesforce is rolling out a series of "commonly used" advisory firm dashboards, powered by their Einstein Analytics (AI) engine. Notably, though, the new Einstein dashboards aren’t merely built to measure "traditional" metrics like advisory firm flows and revenue, but are attempting to leverage Einstein’s AI capabilities to be more predictive… specifically, regarding which clients are at greater risk of leaving (i.e., tracking client churn), and which have a greater likelihood of bringing additional assets to the firm (i.e., organic growth from existing clients). The offering is an extension of some prior Einstein big data applications within Salesforce, such as trying to predict significant client life events, and essentially begin to replicate Morgan Stanley’s own “Next Best Action” AI-data initiative. Ultimately, though, the challenge is that most advisory firms only have "so much" data to feed into the AI in the first place, and arguably many of the biggest indicators of client behavior (positive or negative) occur outside the traditional CRM ecosystem (e.g., frequency of logging into the client portal to check their investment accounts). Nonetheless, in a world where other big data platforms like IBM’s Watson have seemed like a solution in search of a problem when it comes to financial services, Salesforce and its Einstein Analytics platform appears to be taking a more granular, practical, solve-real-challenges-and-expand-from-there approach to advisor big data that is gaining more traction in the marketplace.

Redtail Cybersecurity Lapse Exposing A Slice Of Customer Data Raises Fresh Questions About FinTech Integrations? This month, Redtail announced that it had experienced a “data exposure” back on March 4th that left a slice of about 1% of its client data exposed on the internet, including client first and last names, physical street addresses, dates of birth, and Social Security numbers. Notably, there is no actual evidence that the unsecured data was actually accessed by any unauthorized parties, and the exposure was not a breach of Redtail’s own cybersecurity defenses, but instead a result of leaving unsecured access to the data. For which Redtail is now offering to affected clients free access to LifeLock Defender Preferred (a “credit and identity theft monitoring and remediation” offering from Symantec). The real question, though, is how the exposure came about in the first place, and why it took Redtail more than 2 months to notify advisors and their clients since the incident was first discovered on March 4th. Redtail itself notes that it had to “build specific applications to determine which clients’ data was exposed,” such that the delay in notification and remediation was simply because it took time to determine who was actually impacted in the first place. And also suggesting that the exposure may have been tied not to Redtail just accidentally leaving a client data file outside of its secured environment, but instead due to an API or similar integration component that unwittingly provided access to client data in an unsecured manner. Which is ironic, because Redtail was actually an early partner in CleverDome, a cybersecurity cooperative initiative that’s all about building integrations to partners in a closed network so they’re not exposed on the open internet. Raising the question of whether Redtail is actually migrating its APIs to CleverDome already, and if the recent data exposure was an accidental lapse in an effort to make Redtail’s integrations more secure, or if Redtail’s lapse is just a case-in-point example of the exponentially growing complexity of having so many different custom integrations and APIs on the open internet that the industry needs to migrate to CleverDome and “get under the Dome” even faster (before there’s an even bigger data exposure).

RIAInABox Launches Cybersecurity Training Solution For RIAs. While CRM and portfolio performance reporting vendors that serve financial advisors are often an appealing target for hackers (given the massive amount of stored financial information from account numbers to Social Security numbers), the reality is that fraudsters are also increasingly targeting RIAs themselves in recent years… from targeting RIA servers that may not be fully secured behind firewalls, engaging in wire fraud attempts via email, to spearfishing attempts at RIA employees to gain access to the RIA’s key client systems. And notably, many of these types of data security attacks are driven not by traditional “hackers” who attempt to penetrate secure systems, but more “socially engineered” attacks that attempt to convince the human employees of an RIA to accidentally make a poor decision (from clicking on the "wrong" link that downloads/installs malicious software, to comply with a transfer request for an "urgent" client situation that didn’t actually originate from the client after all). Which means “cybersecurity” for RIAs isn’t just about installing the right firewalls and anti-virus software, but also about employee training to ensure employees don’t get fooled by the fraudsters trying to convince them to do something they shouldn’t. In this context, it’s notable that compliance technology platform RIAInABox is launching a new cybersecurity training solution specifically for RIAs (as contrasted with more generalized cybersecurity training platforms like KnowBe4). For $250/month for a firm (covering up to 10 employees), the RIAInABox cybersecurity training includes both training videos (and supporting quizzes to verify the knowledge was learned) for employees, a separate more advanced module for the firm’s Chief Compliance Officer (CCO), automated tests of fake phishing emails to be sent to employees (to ensure the skills to avoid them are being learned), an inventory tool for employee devices to track whether they’ve been secured, and a system for tracking when cybersecurity incidents do occur and ensuring they are properly remediated. All of which is important because, from a compliance perspective, advisory firms not only have a duty to actually try to be secure with their data but also a duty to demonstrate that they’re taking the proactive steps necessary to verify that their data is secure and their employees have received the proper training.

Wharton Establishes Stevens Center To Support Academic Research On FinTech. The famous Marc Andreessen investment thesis that “software is eating the world” has been increasingly true in industries from retail (Amazon) to hospitality and transportation (Airbnb & Uber) to financial services (the rise of FinTech). However, as with all major leaps in technology, unintended consequences can sometimes occur, regulators fret about the potential for consumer harm, and not all technology advances bring the benefits that were originally anticipated. A case-in-point example in the context of the financial advisor industry is the rise of the robo-advisor, which early on were touted as a way to expand access to financial advice for the middle class (but in practice have been increasingly focused on moving “upmarket” themselves), and were touted as a “paragon of low-cost fiduciary advice” (but in many cases have since increased their fees and/or launched non-fiduciary proprietary products). And regulators themselves have tried to streamline the regulatory process to support such FinTech innovation… while also more aggressively enforcing against regulatory violations by popular FinTech platforms. The challenge in part is that it’s hard for anyone to figure out where FinTech (or other) innovation will go… and aside from the companies themselves trying to innovate, there has been remarkably little research on FinTech itself, its opportunities, and its potential harms. And so it’s notable that now, a successful Wharton alumni – Ross Stevens of the hedge fund Stone Ridge – is funding an eponymous “Center for Innovation in Finance” specifically to study FinTech innovation, with an approach of bringing together establishing FinTech companies and their executives with Wharton students and faculty… covering everything from “mobile payments to microcredit, from lending to insurance, from cryptocurrencies to financial planning, and more…” From the industry perspective, arguably the best hope of such research is to provide a better academic underpinning for regulators trying to get a handle on the best way to protect consumers as FinTech innovation moves along… and of course, to hopefully provide better insights into the benefits that FinTech innovation can bring to the end consumer, too!

In the meantime, we’ve updated the latest version of our Financial Advisor FinTech Solutions Map with several new companies, including highlights of the “Category Newcomers” in each area to highlight new FinTech innovation!

So what do you think? Will Vanguard really enter the RIA custody business (and if so, will they really be able to gain traction in a largely commoditized custodial marketplace)? Will Goldman Sachs co-opt the United Capital technology to build its own wealth management FinTech platform for advisors (potentially as an RIA custody overlay)? Is Carson right that offering clients a compelling cash yield for checking and savings accounts can make them more sticky (and even increase advisory fee revenue)? And will advisors really still be willing to pay out of pocket for Morningstar’s software if/when/as competing tools become “free” (supported by asset manager revenue-sharing commissions from model marketplace flows)?

I don’t know how you keep up on all this but I’m glad you do or Id be lost in the FinTech world.