Executive Summary

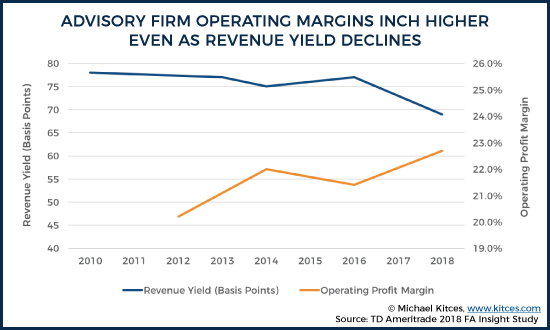

After years of forecasting that robo-advisors would cause fee compression – at best reducing the profitability of advisory firms, and at worst compelling them to fold or at least merge in search of economies of scale to compete – the latest InvestmentNews Pricing and Profitability Study shows that, after holding steady since 2012, pricing power of advisory firms took a precipitous downturn in the past two years, with the average revenue yield of an advisory firm falling from 77 basis points to just 69bps since 2015.

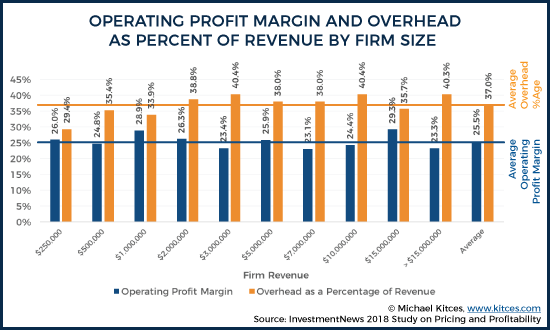

The caveat, however, is that even as advisory firm fees may be slipping, the operating profit margins of advisory firms held steady… and did so regardless of the size of the advisory firm. In other words, while fees may be starting to decline, there is no evidence that it’s adversely impacting the profitability of advisory firms… nor that there’s any need to merge, grow, or gain economies of scale to survive and thrive in a lower fee environment.

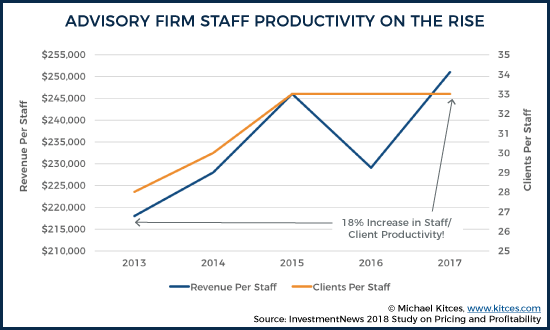

The reason for this miraculous combination of lower advisory fees and steady advisory firm profitability: productivity. In just the past few years, the average number of clients per staff member, and revenue per staff member, is up a whopping 18%, more-than-fully offsetting any decrease in an advisory firm’s average revenue yield! In other words, “robo” technology isn’t causing fee compression and putting advisory firms out of business; instead, it’s reducing the cost of doing business in the first place, leaving firms room to cut fees, in a phenomenon that looks more like “fee deflation” than “fee compression”!

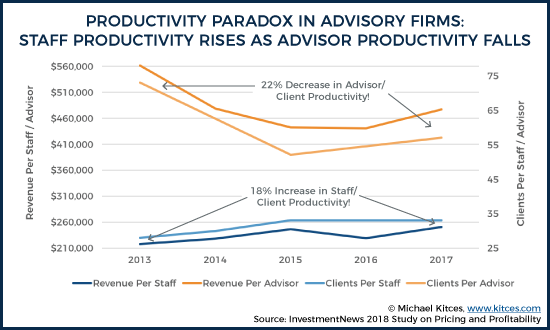

The caveat, however, is that while advisory fees were able to decline in recent years on the back of improvements in staff productivity, the productivity of financial advisors themselves decreased by 22% in recent years, as advisors are compelled to deepen client relationships and do more work with fewer clients to justify their advisory fees in the first place.

The significance of this trend is that a decline in advisory fees (potentially increasing the appeal of consumers to hire a financial advisor), coupled with a decline in advisor productivity (as advisors do more for each client), may soon make the industry’s looming talent shortage (given the 50-something average age of a financial advisor) far more acute. As even today’s financial advisor population can barely serve 15% of all US households, and the CFP certificant population is only numerous enough to serve 4% of households.

Which means, ironically, the greatest threat to the profitability and growth of advisory firms today is not that robo-advisors are or will compress fees, but simply that there aren’t enough financial advisors in the aggregate to capitalize on the opportunities being wrought by the positive fee-deflationary impact of robo technology efficiencies!

The Robo-Advisor Threat Of Fee Compression And The Search For Economies Of Scale

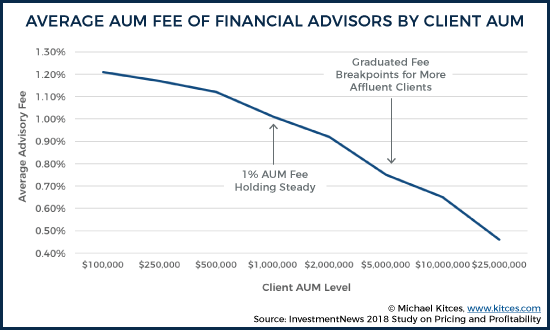

Ever since robo-advisors first showed up in 2012, charging a fee of just 0.25% in a world where financial advisors typically charged a 1% AUM fee, the industry has been abuzz about the “inevitability” of fee compression. Which, given the fixed overhead costs to run an advisory firm, has created substantial concerns in the advisory community that robo-advisors would cause the profitability of advisory firms to crash… and in turn, has likely supported the growing trend of advisory firm M&A, with smaller firms being tucked into larger advisory firms in pursuit of gaining the better cost efficiencies that can come with greater size. In other words, the conventional view is that the best defense to fee compression was to seek greater economies of scale (or risk having operational overhead costs drive the advisory firm out of business).

Except, a look at the latest InvestmentNews Study on Pricing and Profitability reveals that the great pursuit of gaining economies of scale with size is not working out as intended for advisory firms. In fact, not only do overhead expenses actually show a slight rise as advisory firms get larger (not entirely surprising recognizing the need for additional layers of management and infrastructure to execute in a larger firm) but operating profit margins were actually slightly lower in larger advisory firms as well! In other words, as advisory firms grow from less than $50M to more than $1.5B of AUM, there is absolutely no evidence whatsoever that firms achieve economies of scale to improve their margins!

On the other hand, despite the fact that there appear to be no economies of scale emerging from the rising volume of advisory firm mergers and acquisitions, the InvestmentNews study did show, for the first time, that the typical advisory fee that firms charge may be starting to slip in a material way.

Unfortunately, when advisory firms use a wide range of fee schedules, and also have a wide range of minimums (such that a firm with a 1.3% starting fee schedule, low minimums, and aggressive breakpoint discounts as assets rise can actually be cheaper on average than a firm with a 1% starting fee schedule but high minimums), it’s often difficult to figure out overall pricing trends. Because of this, the most straightforward way to evaluate pricing power is simply to look at “revenue yield,” or the total revenue of the firm compared to its total assets under management (which, by virtue of how it’s calculated, simply brings together all fee and asset tiers into a single blended fee).

Back in 2010 (before robo-advisors first showed up), the typical advisory firm’s revenue yield was 78 basis points, and it remained at 77 basis points in 2013, slipped to just 75 basis points in 2014, and then rebounded to 77 basis points again in 2016 (according to sequential editions of the InvestmentNews Financial Performance Studies). All of which is well within the normal margin of error for survey data (and likely just a function of the strong bull market from 2010 to 2014 bringing revenue yields down slightly, after which they bounced back a bit with the flat market returns in 2015), and provided no evidence of any purported “fee compression” threat from robo-advisor competition.

However, in the latest InvestmentNews data, the average revenue yield of an advisory firm slipped quite materially to 69 basis points (bps), which was similarly confirmed in the recently 2018 FA Insight study (which saw revenue yield fall from 78 to 71 bps over the last 2 years of tracking).

Yet at the same time, the feared consequence of declining fees – a squeeze on profit margins – didn’t appear after all, with advisory firm profit margins showed no material impact from the apparent pricing “pressures”! In fact, operating profit margins rose slightly over the past 2 years, despite the decline in revenue yield from 77 to 69 basis points!

How “Robo” Technology Is Impacting Advisory Firm Productivity

So how can advisory firms see a decline in revenue yield (an implied loss of pricing power), while experiencing a small increase in operating profit margins? The answer in a word: “productivity.”

In most businesses and industries, productivity is measured by the hours of time it takes to complete the necessary tasks in the business; e.g., by how many “widgets” are produced per unit of time.

In independent advisory firms, the primary measure of “productivity” is how many staff members it takes in the aggregate to service all of the clients of the firm. Of course, individual advisory firms will vary in their individual staff decisions, but in the aggregate it still takes some combination of staff who are client-facing (e.g., advisors), some that are client-supporting (e.g., client service managers), and some who are simply part of the back-office administration and execution (e.g., investments & trading, operations, management, etc.). Thus, the total number of staff members it takes to support a client base – and the amount of revenue allocable to each staff member – is actually a remarkably good proxy for the overall productivity of an advisory firm.

Across all the participants in its latest research report, the InvestmentNews Pricing and Profitability Study found that the typical advisory firm has 33 clients per staff member, with $251,000 of revenue associated with those 33 clients.

However, 5 years ago, the average staff member was supporting only 28 clients and $219,000 of revenue! Which means advisory firms have had “room” to trim their advisory fees and allow revenue yield to decline from 77 to 69 bps, because the average client load per staff member rose by 18%, and the average revenue per staff member increased by almost 15%!

On the other hand, while the rise of robo-technology tools may be aiding the efficiency and productivity of advisory firm staff members, the trend is very much the opposite when it comes to the productivity of financial advisors themselves!

Because, as the latest InvestmentNews benchmarking study shows, the average advisor (which includes both lead, service, and support advisors working with clients) was responsible for 57 clients, and $477,000 of revenue in 2017. By contrast, back in 2013, the average advisor’s productivity was 73 clients and $561,000 of revenue!

In other words, despite the rise of more advanced technology tools to support advisory firm efficiency, the number of clients that an advisor supports dropped by nearly 22%, and the associated revenue/advisor dropped 15% (likely buoyed by the fact that the client’s portfolio and AUM fees themselves grew over this time period thanks to market returns and partially ameliorated the 22% decline in clients/advisor)!

What these contrasting trends suggest is that the typical advisory firm is leveraging technology to become more efficient in the back office, but is feeling pressure in the “front office” (client-facing advisors) to go deeper with clients, taking more time with clients to provide more financial planning (or more comprehensive financial planning) services to defend their value propositions over investment-only (i.e., “pure robo") solutions.

Which in turn is leading to a composition shift in the staffing of advisory firms themselves, as technology eliminates back-office jobs, while simultaneously bolstering the demand for front-office client-facing advisors!

Fee Deflation And The Talent Shortage Of Real Financial Advisors

Ultimately, the key point to recognize in the emerging decline of revenue yield for the typical advisory firm is not that fees are being “compressed” down by robo-advisors (causing a deterioration of profit margins in the process), but instead that advisory fees are being cut down “voluntarily,” as robo-technology cost savings within advisory firms that allows them to safely pull their fees down to compete for market share! In other words, advisory fees aren’t being compressed by technology competition; they’re being deflated by technology efficiencies. Which appears to be occurring regardless of the size and scale of the advisory firm!

[Tweet “Robo technology isn’t causing advisory fee compression, but IS leading to advisory fee deflation!”]

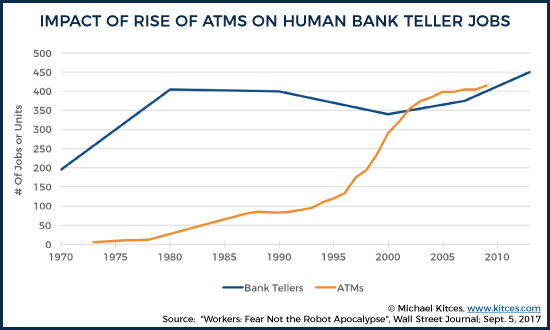

Notably, though, this trend shouldn’t be entirely surprising, and in fact, parallels the end result of similar “automation” technologies being introduced into other industries over the years.

For instance, when the Automated Teller Machine (ATM) first appeared in the 1970s, it was forecasted that the technology would cause severe job disruption… as ATMs literally, in their name, forecasted of the automation and elimination of the nearly 400,000 (human) bank teller jobs in place at the end of that decade. Yet when ATMs were fully deployed, rapidly scaling up from 100,000 to 400,000 machines in just the decade of the 1990s alone, the end result was only a small dip in jobs, followed by a slow but steady continued recovery and subsequent increase in human bank teller jobs even after the ATMs appeared!

In a post-mortem analysis of “what really happened,” economists subsequently found that, while ATMs did eliminate some bank teller jobs, they so decreased the cost to operate a bank branch that banks rapidly expanded their services to more locations, and the dramatic increase in the number of bank branches and customers by opening new more-cost-effective locations more than entirely offset any downside risk to bank teller jobs!

And now, the same trend appears to be emerging amongst financial advisors, as “robo” technology automation eliminates administrative, back office, and other overhead costs, allowing the same staff to service an ever-growing number of clients… while the financial advisor themselves has the opportunity to go deeper with clients (as a way to both provide more value, and also to defend and differentiate their value proposition from “pure robo” solutions).

The caveat, though, is that this emerging trend may ultimately bode poorly for advisory firm profit margins in the future… as while in the near-term, firms have been more-than-able to make up for the reduced productivity of advisors with the greater productivity of the rest of the firm’s staff, in the long run, financial advisors themselves still demand/require higher compensation. Such that when advisors are the only (or at least, bulk) of the remaining staff, the rising costs of advisors (and the lack of any remaining cost savings opportunities amongst the rest of the staff) could put newfound pressure on advisory firm margins.

To some extent, the results in the InvestmentNews research suggest this may already be happening. As a subset of firms, ostensibly by investing more in deeper client relationships with their advisors, are now raising their advisory firm fees. In fact, 73% of the top-performing firms raised their fees back in 2015, and 55% that raised their fees in the past 2 years. And to the extent that advisory firms are reducing fees, it may be driven more by a subset of especially high-priced firms that are coming in line to the median fee, rather than cuts in the medium advisory fee itself, along with an ongoing shift of advisory firms to move “upmarket” to more affluent clients (who pay lower fees in total simply because they reach higher breakpoints on the fee schedule). Because InvestmentNews’ research still shows that the average advisory fee on a $1M account remains stubbornly set at 1.01%.

However, the biggest challenge may simply be that as technology automates the back-office of advisory firms and allows them to lower costs to reach more consumers… there still aren’t enough financial advisors to serve them.

After all, Cerulli Associates estimates that there are only about 300,000 financial advisors in the US today, which at an average of just 57 clients/advisor is a mere 17 million households that can be served (out of nearly 125M households in the US). Which means there aren’t even enough financial advisors to serve “just” the top 15% of all households, much less the rest!

In addition, only about 1/4th of those advisors (or roughly 82,000) have CFP certification to give them the depth and breadth of knowledge to actually add advice value beyond what the technology will increasingly provide. Which only leaves enough CFP professionals to serve about 5M households or just the top 4% of all households! And suggests that the reason so many advisory firms have been increasing their minimums and moving upmarket is not that they have to, but simply because they can, due to a dearth in the total number of advisors today!

Yet what this also suggests is that the emerging talent shortage of financial advisors may soon become much more noticeable, if the declining cost of advice draws in more consumers… only to find there aren’t enough advisors to service them!

The bottom line, though, is simply to recognize how “robo” technology is having a very different impact on the administrative staff productivity of financial services firms, versus its impact on the actual delivery of financial advice. As while technology appears to be automating more of the back-office and make firms more efficient – allowing advisory firms to “voluntarily” reduce their fees – actual financial advisors are not scaling up productivity with technology, and instead are serving fewer clients and going deeper with each of them in an effort to bolster their value proposition instead while still maintaining their profit margins.

Which means, at least thus far, the emerging trend of declining advisory fees is far less about “fee compression” than a more healthy cost-reducing “fee deflation” instead. But with the talent shortage still looming, and the complete lack of any evidence in economies of scale for financial advisors themselves… it’s not clear when/whether that trend may reverse itself?

So what do you think? Are you seeing the same pattern of fee deflation and stable profitability? How do you view the prospect of raising fees moving forward despite? Please share your thoughts in the comments below!

Leave a Reply