Executive Summary

For every business owner, a well-written vision statement can be a tremendously effective tool, helping to clarify the long-term direction in which they want to take their companies. Although advisory firm owners are no different, there’s a difference between a vision statement that helps drive growth, and a vision statement that does little more than serve as a platitude that looks good on brochures, or one that speaks to the financial goals of the owner but not necessarily the aspirations of the business itself. Which, in turn, begs the question: how, exactly, does a growth-minded financial advisory firm owner actually create an effective vision statement for their firm, and does it matter what kind of vision statement they craft?

In this guest post, Angie Herbers – Chief Executive and Senior Consultant at Herbers & Company, an independent management and growth consultancy for financial advisory firms – shares recent research conducted by her company, revealing interesting data about the relationship between vision statements and firm growth, and what that means for advisory firm owners trying to clarify the long-term vision they have for (and improve the long-term growth trajectory of) their practices.

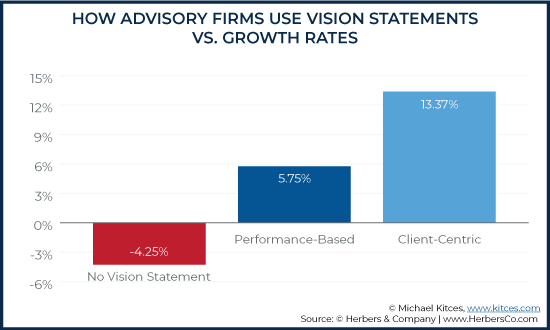

Specifically, Herbers’ findings reveal that revenue for advisory firms operating without a vision statement declined by 4.3% over the past year. Other firms that were operating with performance-based vision statements expressed primarily in financial terms (e.g., achieving a particular revenue, profit, or assets under management benchmark), had an average growth rate of 5.8%. Whereas the third group of firms, which operated with client-centric vision statements focused on serving clients and improving the client experience, had a growth rate of 13.4% – more than twice the growth observed for the firms with performance-based vision statements!

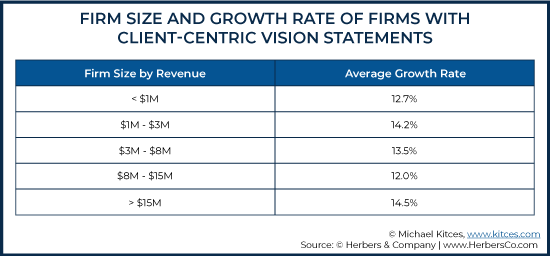

The impact of advisory firm size on the magnitude of growth was also examined for firms with client-centric vision statements; the data revealed that firms with such vision statements had relatively similar growth rates (between 12% – 14.5%) across revenue ranging from less than $1M to more than $15M. Which is interesting, because small firms often have an easier time achieving high growth rates as compared to larger firms; larger firms, on the other hand, have the advantage of leveraging economies of scale (or simply having the ability to merge with other large firms) to facilitate growth. As it turns out, a strong client-centric vision statement appears to impact both.

A deeper look at the psychology of business growth offers potential explanations of why the growth of firms with client-centric vision statements outpaced those with performance-based vision statements. As while centering a firm’s vision on servicing clients will encourage the firm as a whole to focus first on providing high-quality service and continuously improving that service (and thus naturally leading to a better overall client experience, growing reputation, and stronger brand), a performance-based vision statement can easily decouple a firm’s association of client service efforts with revenue generation… which can then (understandably) lead to employees who are distracted by financial performance and individual compensation versus focusing on providing good client service and the actual client experience that powers growth in the long run.

The psychology of why client-centric vision statements appear to be more effective than performance-based ones is also reflected in the approach used by many financial advisors to advise their own clients, where clients are often discouraged from focusing too intently on the details of their portfolio returns, and instead to focus more on their long-term big-picture goals that they have determined will make them happiest (and then simply monitoring and making adjustments to ensure they’re staying on track towards those goals).

Ultimately, the key point is that a well-designed, client-centric vision statement can actually result in a more fruitful outcome than a performance-based vision statement, because maintaining a firm’s attention on making clients happy with great service is generally the more sustainable route to healthy, positive business growth, and will take care of the financial bottom-line in the process.

What do you think about when you hear the term “vision statement”?

Regardless of whether you are using Gino Wickman’s Entrepreneurial Operating System (EOS) or the popular Harvard Business Review one-page business plan, virtually all strategic planning methods will ask you to write a vision statement.

A well-written vision statement is meant to answer the question: “Where are we going?” Vision statements function as the north star of a business. They keep the company focused on the route to be pursued to keep moving in that direction. A good vision statement functions as a map, and should not to be confused with a mission statement that gives a business meaning and purpose; instead, a vision statement gives the business and all those working in it a sense of the direction you will be taking.

However, if you are like most advisory firm owners, when attempting to write a vision statement, your brain will immediately go to financial goals. More often than not, when we ask advisory firms’ owners and leaders about their own vision statements, we hear about vision statements that focus on those financial goals—specifically, the revenue, profitability, valuation and/or the assets under management that owners want to achieve over the next one, five, or ten years.

Nearly twenty years ago when I started Herbers & Company, vision statements followed a simple trend line. Back then, before the industry had many multibillion-dollar AUM firms, most vision statements we heard in our consulting engagements were “to reach $1 million in annual revenue.” In fact, we had a name for it: “The million-dollar achievement.” Today, many of the vision statements we see follow the current trend of wanting to hit “$1B in assets under management.”

Most business consultants and coaches religiously ‘say’ that all companies need vision statements to truly grow. But, at Herbers & Company, our consulting methodologies don’t always subscribe to traditional consultant speak. In theory, a vision statement sounds great to have, but do they have any impact on the growth of advisory firms?

Over the course of the past year, we began to ask deeper questions about what, if any, impact vision statements have on the overall growth of independent advisory firms. We wanted to know if writing and implementing vision statements with our client firms were truly worth our client’s time, effort and resources. Or, are they simply another useless tactic and traditional consultant BS?

Interestingly, what we discovered is there is an art to vision statements. They are extremely important to have, especially when they have nothing to do with the business financials. In fact, we’ve found that advisory firms with the highest growth rates have vision statements that say nothing about business performance or growth!

Vision Statements Vs. Growth Rates In Financial Advisory Firms

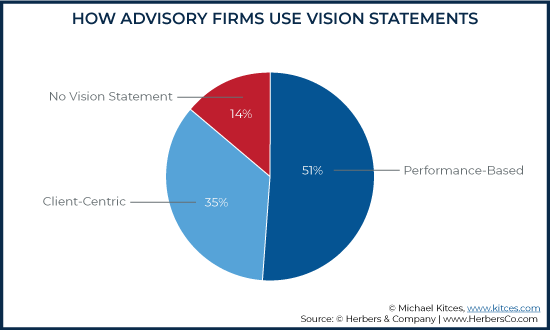

In the past year, we collected vision statements of advisory firms and found the following three primary patterns on how advisory firms used their vision statements (see chart below):

- The first group, consisting of 14.0% of the advisory firms assessed, had no vision statements at all. They operated without one.

- The second group, representing the majority at 51.2% of advisory firms, wrote vision statements expressing where they wanted to take their firms in primarily financial terms. In other words, their vision statements were performance-based, expressing the revenue, profit, valuation, and/or assets under management they wanted to achieve during a certain time period. Some examples are, “Our vision is to have $1B in AUM within five years”; “Our vision is to produce $5M in revenue over the next one year”; “Our vision is to be valued at $20M”; and “Our vision is to maintain 22% profit margin”.

- The third group (34.9%) wrote client-centric vision statements involving how many clients they wanted to serve, and/or improving the client experience and the services that clients receive. Examples of those vision statements included: “Our vision is to serve 1,000 more clients over the next ten years”; “Our vision is to be the most innovative with our client experience”; “Our vision is to serve more clients than we did last year”; and “Our vision is to expand our financial planning department”.

After we grouped the vision statements, we compiled the average annual revenue growth rates of those firms for the previous year. The analysis of firms revealed the following results (see chart below):

- Those who operated with no vision statement had a -4.25% growth rate.

- Those with performance-based vision statements had a 5.75% average annual growth rate.

- Firms with client-centric vision statements had an average annual growth rate of 13.37%!

While having no vision statement at all impacted the growth rates of small- to mid-sized firms the worst, it’s also notable that there were no firms over $8M in revenue that reported not having a vision statement. In other words, all firms who have at least $8M in revenue consistently believed that at least some sort of vision statement was/is essential.

Firms With Client-Centric Vision Statements Have The Highest Growth Rates

As the data reveal, firms with client-centric vision statements had the highest growth rates – more than double the performance-based vision statement category – though at least having a performance-based one was still better than having no vision statement at all.

Of course, when analyzing growth rates of any kind, the size of the firm and how the firm achieved its growth often play an important role in the results. Because while it is a lot easier for a small firm to achieve higher growth rates than a large firm, it’s also sometimes a whole lot easier for large firms to acquire other firms to achieve high growth rates regardless of whether there is a vision statement or not.

We dug deeper to see how the growth rates of client-centric firms were impacted by firm size, and/or if mergers and acquisitions (M&A) had anything to do with their success. We discovered that none of the client-centric firms had acquired a firm in the previous year—all the growth was organic. And the really interesting part is that it turned out firm size didn’t matter!

Categorizing the firms with client-centric vision statements by revenue size revealed the following growth rates:

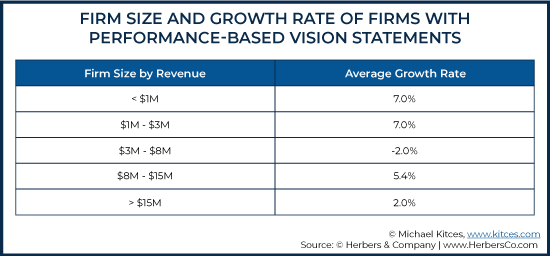

Firms With Performance-Based Vision Statements Show Declining Growth Rates With Increasing Size

With performance-based vision statements, none of the firms surveyed had conducted an acquisition in the past year, but 38% were in discussions in the past year with a potential merger and/or acquisition partner, and 100% of them said they were focused on the current advisory-firm trend of seeking M&A transactions.

Looking at the average growth rates across revenue size of performance-focused vision statements, though, it quickly becomes evident that performance-focused visionaries actually show a declining growth rate as the firm size gets larger. Which begs the question: Is focusing on the money the growth problem?

Of course, as stated earlier, 38% of the firms with these ‘struggling’ growth rates have been in active discussions regarding a potential merger or acquisition recently. Which means it’s possible that in the coming year, these performance-based vision firms’ growth rates may exceed the client-centric vision growth rate through M&A transactions. In Herbers & Company’s experience with growing advisory firms, we see many advisory firm owners who seek to solve a growth rate problem with M&A.

However, in practice, organic growth rates are rarely positive after the three years following a transaction close. And while I have yet to see an M&A report in the media listing the failure of industry M&A transactions, the reality is that not all of them work out. (In fact, we often talk to advisory firms coming to Herbers & Company to clean up a ‘failed’ acquisition or post-merger integration.)

In other words, unless an advisory firm has invested in and hired the human capital necessary to focus solely on M&A and/or shelled out the retainers for M&A consulting teams, advisory firms’ organic growth rates can take a back seat for a five-year period as the effort of the acquisition consumes all the leadership focus of the firm! Which means the growth rates of advisory firms will look awesome in the year of close, but afterward often falls well below where their organic growth rate started prior to close. Or stated more simply, the opportunity cost of M&A transactions, without the proper team in place, tends to come directly from an advisory firms’ organic growth rate. And as the statistics above suggest, even just trying to find an acquisition or merger opportunity is associated with already-slowing organic growth rates (at least compared to firms with a client-centric vision statement, where fewer than 10% of firms were focused on M&A in the coming year).

Having many years of experience consulting, I would encourage advisory firms seeking growth to heed this advice: Do not try to solve an organic growth rate problem with inorganic growth.

While the results correlating decreasing growth with increasing firm size for firms with performance-based vision statements may seem counterintuitive – after all, if you focus on how the business is performing, shouldn’t you be able to impact the financial performance with a performance-based vision? – if you take a step back to look deeply at the possible reasons why a vision statement with a focus on business metrics leads to less growth, it all makes sense.

The Psychology of Business Growth – Focusing On Client Service Vs. Financial Performance

Years ago, a business professor told me, “When building a business, what you financially desire will break your heart. Unless you break the desire.” What he meant was that a desire for more revenues, profits, or value, and focusing on those numbers, will lead business executives to see the people they serve as numbers, too.

In other words, as a business gains success and more clients, the mindset of how you run and grow the business can, at times, become more about what you get out of the business than about what produces the growth. A business—any business—does not produce more money by focusing on money. That’s not how it works.

I have yet to meet an advisory firm owner who started their business simply based on the vision of revenues, profits, or valuations. Traditionally, when financial advisors start their advisory firms, the goal is to service clients the way they want to serve the clients.

Naturally, as you grow, your focus as the company leader and founder shifts to revenue, profitability, and valuation—the financials. In other words, as you get more growth, the more growth you desire.

The problem is, in a service-based business such as financial advice, when a leader’s mindset shifts from simply wanting to service the client well, to wanting higher and bigger returns, the culture of the firm shifts with it. When the focus becomes about the numbers, it’s not on service and support anymore.

In my many years of witnessing advisory firm growth patterns, the following statement has proven to be true:

In this order, if you love what you do, desire to help people, hire people who desire to help people too, then the growth and performance will follow, but not always on the timeline you desire.

Think about it like this: if you focus the vision for your business on making service better, people (including yourself) are always going to focus first on service. As a result, your service will get better and better, your firm’s reputation will grow, your brand will get stronger, and more clients will come to your firm. The more clients you serve, the more the business will serve you.

But, if you put the focus on performance and/or the money the business produces (usually for you), your personal desire is at the forefront of your business decision-making. How does that change the business direction? Simply put, the business becomes all about you, not the clients you serve. And, I can tell you – the easiest way to stop growth is when everything must run through you.

This creates a tremendous disadvantage and challenge for the growth of your business. In an independent advisory firm, what generates growth and valuation are the number of people and assets served, profitability. When you operate a service business, you cannot survive unless that service is sustainable, of exceptional quality, and consistent with your brand and values.

Furthermore, employees follow by example. If your business vision is about financial performance, what do you think the employees are going to do? The culture will become about their financial desires too—the money and compensation they are getting paid.

There are very few people who want to help make a rich business owner richer (unless, perhaps, they are getting rich too). Employees who operate with no vision, and/or get a vision statement revolving around company performance, often fail to see how they can personally benefit and feel rewarded in the work that they’re doing unless they share in it with you. Then, they get bogged down in the details.

When you roll out financial performance visions, employees often want to know how you want to reach that revenue number or valuation. They want you to create processes, reporting procedures, and other measures that they can track to gauge how they are hitting the numbers you want from them. They will begin to waste a lot of time – time that is not being spent on client service. What do you think the compounding effect on your business’ financial performance will be when your employees are spending all their time and energy focusing on return?

Contrast that with a client-centric vision. A service- and people-oriented vision is easy for people to align with, because everyone (or at least, everyone typically hired into an advisory firm) already intuitively understands how to help other people. There is no time wasted explaining how to serve someone, and employees simply focus their time on how to serve people better. In other words, it becomes about something bigger than… well, you, or them, or anyone else getting paid to do the work.

A client-centric vision can produce an immediate transformation because people can simply go and do work they intuitively understand. There’s no intricate benchmarking or reporting necessary for a person to feel that they can begin to serve another person better.

When you think about vision statements from the perspective of human behavior, it’s not counterintuitive at all. Rather, it is the best way to lead people into the future.

How Financial Planning Can Lead the Way With Client-Centric Vision Statements

If you are like many business owners we’ve worked with, it’s hard not to think about financial performance when it comes to envisioning your future firm. You may feel resistant to (re)structuring your firm’s vision to focus solely on service, leaving out financial performance altogether. But, instead, I encourage you to think about the services you provide to your clients as an example of why this would work in growing your advisory firm.

When you talk to clients, do you ask them to focus on daily, monthly, or annual performance returns in their portfolio? Or, do you point them to those long-term financial planning goals around retiring or sending kids to college, and how their behavior will affect their financial health and ability to achieve those goals?

While certain financial metrics are necessary to achieve those financial planning goals, if clients focus on their financial performance first—be it on growth or returns, or in an advisory firm context the revenue, AUM, valuation, or any other kind of number you can think of—it leads to a day-trading mindset. Day-trading to meet short-term financial metrics creates stress and uncertainty, and is associated with day-to-day living, poor decision making, higher risks, an endless desire for more, and wishful thinking. And I don’t know any RIA who wants to think of themselves as a day trader.

Instead, think of yourself the way you think about your clients (and encourage them to think about their own goals), and talk to yourself the same way. You tell clients not to focus all their energy on market performance. Why? Because it’s not something they have much control over. As you may not want to admit it, you have about as much control over your business financial performance as you do over the market – it’s all performance.

Instead, the key question to ask yourself is, “What can I control?” You can control the quality of your client service, your focus on strategic business planning and goals, and making good business decisions each day, one day at a time. It’s that simple.

This is not to say that you shouldn’t be aware of how you are growing and if your firm is profitable. Obviously, you need to monitor your firm’s financial health and what and who you invest your resources in, just as you would on selecting investment products and tracking net worth statements for your clients. If you do for your business what you do for your clients, you’re going to get a good outcome.

Most advisors courageously started their own RIA because they wanted to serve clients differently than how they were required to work with people at brokerage firms or an insurance agency that was solely focused on the financial metrics of product sales. A vision statement focused on financial performance takes you right back to that sales-centric financial “production” focus. Is that the culture you want to create in your firm?

Instead, as the new year takes hold, create a vision statement that focuses on client service; it can be as simple as “Our vision is to serve more clients than we did last year.” Then share it with your entire team. As you do, watch as the transformation throughout your company culture takes hold.

Why is a vision statement under which a firm operates so important? Because the focus you choose for your firm’s direction is key to creating future growth. Where are you taking your firm in five, ten or even twenty years?

I hope your answer (and vision) always remains, “serving clients … first.” Your financial performance will thank you for it in the long run.

I agree with JRPOWER “First I suggest that financial planning firms aren’t different from other firms.” So often the industry itself acts like a lone ranger, when there is so much to learn from other industries.

I wonder how many of the firms surveyed had, in addition to their vision, a mission statement, list of balanced scorecard goals for the year (or each quarter), balanced scorecard strategies to reach those goals, and action plans and then monitored those action plans, goals and strategies and how many had the help of a consultant or coach. Based on my experience, all those things (and a list of other important best practices) are needed with the growth numbers mentioned in the article.

A business is in business to make money by servicing great clients and giving the gift of a great boss to their team. All needs to be included (and more) in the overall growth plan.

There are a number of key points here. First I suggest that financial planning firms aren’t different from other firms. The well-structured vision statement creates a sort of “north star” that fundamentally guides the efforts of every individual and function of the business. Done well that vision statement tends to be bold, aspirational and inspirational. It represents what how the leaders of the firm want their organization to be viewed and a goal towards which all team members should be motivated. A point well taken is that driving the firm to make more money is hardly motivational for most employees. Goals like revenue or market share simply don’t resonate with most employees. As the data show, that tends to be an organic outcome of a well-structured vision. At Matthew noted, perhaps there is some correlation effect in that the better firms are the ones that take the time to properly structure a vision and then lead folks toward that star. I can say personally that in one experience, outside of financial services, I lead a group of people who had done OK in the past, but once we joined together to craft a vision and focus on its achievement, went on to achieve some things that seldom had been achieved. I am absolutely convinced that having the vision agreed on and staying focused on that vision had a significant part in our success. Creating a good vision statement is not easy, but I believe it is well worth the effort. And I do think that, in our space, most people resonate to serving clients in an exceptional way. So I am not surprised that firms that had a client-centered vision were the over-achievers.

Thanks for sharing your insights Angie. Always enjoy reading your work.

Interesting analysis. I wonder how much of this is correlation vs causation (eg firms willing to put the effort into vision statements are the same firms that work hard vs vision statements creating success).

Also, what was your sample size?