Executive Summary

Welcome to the January 2022 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

In this month’s edition, we look back at the four major trends underway in the financial advisor ecosystem that shaped the big AdvisorTech events that occurred in 2021, and what the trends portend for the year(s) to come.

The first driving trend is the ongoing shift of the financial advisor value proposition itself – from the sale of financial services products, to the sale of financial advice itself – which in turn is slowly but steadily reshaping the entire advisor technology stack. Starting with a growing pressure on financial planning software to go deeper – not simpler – and an expansion of various ‘advice-support’ and plan monitoring tools that augment planning software. Which is leading advisor CRM systems to increasingly become the hub, as new startup planning tools build first to CRM systems (not brokerage platforms or portfolio management tools). And an expansion of tools to support more advice models beyond ‘just’ the traditional AUM model (from Assets Under Advisement [AUA] to subscription and retainer models).

The second trend reshaping advisor technology is the growing focus on back-office automation, as it becomes increasingly clear that “robo-advisors” were never a threat to real financial advisors… but the efficiencies they bring are highly relevant to enhancing the productivity of human advisory firms! Which is driving a new wave of investments into both business process automation systems, and more generally anything that can improve the expediency of back-office workflows (from ‘simple’ client note-taking to more complex multi-system workflows), along with greater automation of compliance technology (“RegTech”) in particular. And the need for more integration across platforms – to achieve those efficiencies – is spawning a new wave of solutions that make it possible for advisors to either begin to warehouse their own data (to facilitate their own integrations), or be able to accomplish everything in a single “all-in-one” system that houses all the data and provides all the necessary services (so advisors can just focus on the business itself!).

In next week’s continuation of our 2022 recap, we’ll look at the remaining two AdvisorTech trends – the hunger for (re-)igniting organic growth as advisory firms scale, and how evolving investment trends (given high market valuations and low bond yields) are fueling some of the biggest opportunities in AdvisorTech (as advisors historically will pay even more for solutions that help to create revenue!).

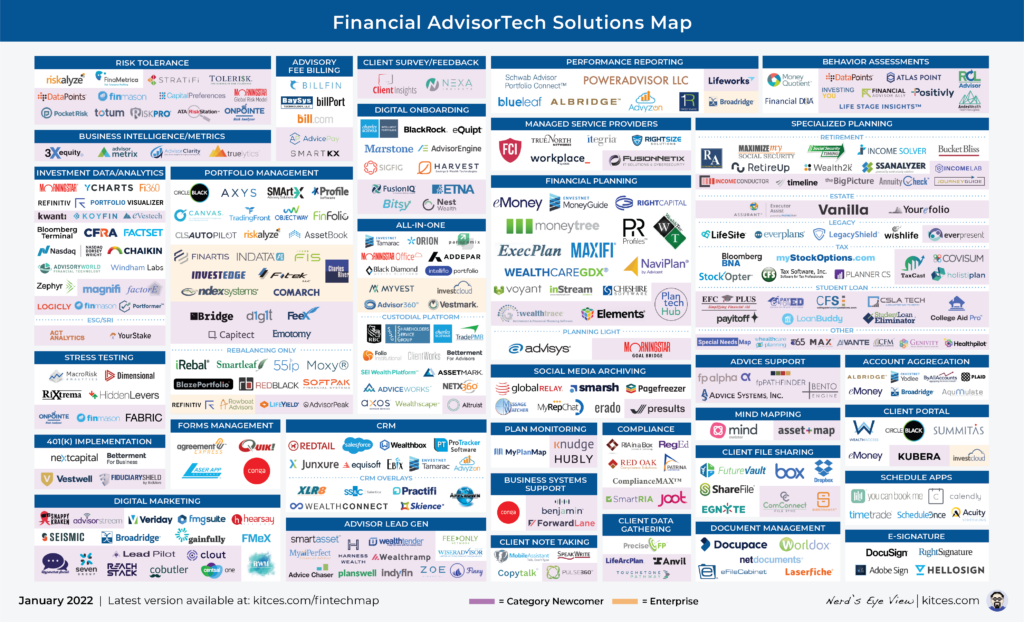

In the meantime, be certain to read to the end, where we have provided an update to our popular “Financial AdvisorTech Solutions Map” as well!

*And for #AdvisorTech companies who want to submit their tech announcements for consideration in future issues, please submit to [email protected]!

The Four Trends Reshaping AdvisorTech

As the saying goes, “innovation doesn’t happen in a vacuum”. To some extent, that’s simply because it takes a lot of perspective on a wide range of stakeholders in any market to understand how a new solution can come together to solve existing problems. And in part, it’s because it takes an ongoing evolution of the underlying marketplace to create new gaps, new needs, and new opportunities into which the innovation can step.

As a result, it’s almost impossible to look at the ongoing innovations in Advisor Technology and not consider them against the backdrop of the broader environment in which financial advisors find themselves. As it’s the evolution of the advisory business itself that causes existing solutions to not be as valuable or relevant as they once were, and creates the gaps into which new AdvisorTech companies can be founded, build solutions, find traction, and grow.

In the broad advisor landscape today, we see four trends that are slowly but steadily reshaping the demands for and opportunities within Advisor Technology:

1) From Products To Advice. The ongoing shift of the advisor value proposition from having the best (array of) financial services products to sell, to selling financial advice itself, which changes the software and advice support systems that advisors use.

2) Automating the Back Office. While robo-advisors were once predicted to replace the human financial advisor, instead the technology appears to have spawned a reinvestment into the advisor’s back office that is now driving a newfound focus on everything from business process automation to building the next generation of integrations (and the advisor-owned data warehouses to drive it).

3) Scaling New Revenue Growth. As advisory firms shift to recurring revenue business models, a separation is occurring between the advisors who service clients, and the (non-advisor-driven) marketing systems that bring them in, spawning a new wave of marketing and lead generation tools.

4) Evolving Investment Demand. The ubiquity of mutual funds and ETFs, coupled with a potential low-return environment for both stocks and bonds, is spawning newfound pressure for investment-centric advisors to bring something new and different to the table, from alternatives, to structured notes and annuities, to cryptoassets, to more personalized portfolios (built on a new Direct Indexing chassis) that reduce the focus on investment returns altogether.

In the first of this two-part series, we explore these advisor trends in greater detail, and reflect on how they shaped the advisor technology events of 2021… and will impact 2022 and beyond!

1) From Products To Advice

When robo-advisors first emerged nearly a decade ago, their business pledge was to deliver what human financial advisors provided for 1/4th the cost (an AUM fee of ‘just’ 0.25%, compared to the ‘traditional’ 1% AUM fee)… setting off a wave of predictions that financial advisors would at the least face intense fee compression in the decade to follow, if not an outright disruption of their business model by technology.

The reality, though, is that while robo-advisors were incredibly efficient at opening and funding diversified asset-allocated portfolios – akin to what financial advisors commonly implement as well – the robo-advisors didn’t actually do what real financial advisors do, which is to provide an ever-broadening range of financial planning advice beyond the portfolio itself. In fact, for years financial advisors themselves have increasingly stated that 50% or more of their AUM fee is actually for financial planning and wealth management advice beyond the portfolio itself. Such that as financial advisors have increasingly bolstered their advice value propositions beyond the portfolio itself, in recent years financial planning fees have actually been rising, not falling! Or stated more simply, it’s not robo-advisors that have threatened the ability of financial advisors to charge AUM fees for ‘just’ implementing a diversified asset-allocated portfolio… it’s competing financial advisors, who are providing more and more non-portfolio advice bundled into an AUM fee that is less and less for the actual portfolio management service anyway.

At the same time, though, the shift of the financial advisor value proposition away from financial services products and portfolios and towards financial advice itself (for which the products and portfolios may just be a small portion of the overall advisory engagement) is actually a profound shift in the tools and technology that financial advisors need to in order to provide a more scalable advice offering. And this shift from “financial advisor to Financial Advicer” is, in turn, driving a number of new, emerging AdvisorTech trends.

a) Financial Planning Software Goes Deeper, Not Simpler

While financial planning software has existed as an advisor technology tool for decades, the reality is that most financial planning software wasn’t actually created to help advisors give unique advice they can charge for. Instead, it was built to facilitate a form of consultative selling, where advisors gathered information about a client’s needs and circumstances, analyzed their situation to determine gaps between their current and desired state… and then provided clients a “plan” of the solutions advisors could implement (i.e., products that could be sold) to fill those gaps. Thus the focus on a Capital Needs Analysis (to determine how much life insurance to sell), an Education Needs Analysis (to determine how much in 529 plans to sell), a Retirement Needs Analysis (to determine how much the monthly contribution into the advisor’s mutual funds for sale), etc.

However, as advisors shift towards creating their value from the advice itself – and not necessarily from the increasingly commoditized products that clients can buy themselves online – pressure emerges on financial planning software to capture those moments of greater complexity where advisors can add advice value beyond simply showing the client gaps into which financial services products can be sold.

The end result is that while arguably the highest profile headline in financial planning software news in 2021 was Assetmark’s $145M acquisition of Voyant – one of the leading financial planning software solutions in the UK, that AssetMark aims to bring to the US to compete with the likes of MoneyGuidePro and eMoney Advisor – in practice Kitces Research shows that the real shift underway in financial planning software is the growth of more ‘specialized’ advice tools that go beyond traditional financial planning software altogether.

For instance, one of the biggest growth stories of 2021 was the rapid rise of Holistiplan, which scans PDF copies of clients’ tax returns and instantly analyzes them to identify advanced tax planning opportunities in minutes (saving the advisor what is often an hour or two of delving page by page through a lengthy tax return). Similarly, a number of new, more specialized retirement planning tools arrived or accelerated their growth in 2021, including Income Conductor, Income Lab, Income Solver, and Timeline, in addition to the ongoing growth of specialized Social Security planning tools like SS Analyzer, Maximize My Social Security, and Social Security Timing. Deeper estate planning tools also saw activity in 2021, with the Envestnet acquisition of Apprise (now MoneyGuide Wealth Studios), and an $11.6M Series A round from Vanilla.

The key point, though, is simply recognizing that as financial advisors go deeper in their advice offerings, the drive of financial planning software is shifting from how to make the process faster, towards a growing demand for financial planning software that goes deeper, instead. Or viewed another way, if financial advisors often spend as much as $10,000 - $15,000/year/advisor on their portfolio management and performance reporting solutions but only $1,500 - $3,000/year/advisor on their financial planning software… as advisors shift from products to advice, their cost structure will likely align, placing significant pricing pressure on investment management platforms, and highlighting a gap for what could be significantly “higher end” deeper and more comprehensive $10,000/year financial planning software of the future?

In the meantime, though, to the extent that financial planning software is failing to step up to the changing landscape, niche specialized tools are rising up and rapidly gaining adoption as they fill the advice software gaps.

b) The Rise Of Plan Monitoring And Advice Support Tools

One of the secondary challenges that arises in the shift from products to advice is that the ongoing advisor-client relationship also changes. As in a product-based world, the primary role of ongoing client meetings is to identify new opportunities to ‘do business’ (i.e., situations where the client may need a new product, or to replace an existing one), while in an advice-centric world, helping clients to implement their ongoing advice recommendations take on a more central role.

Accordingly, 2021 witnessed several new entrants to the category of “Plan Monitoring” tools on the Kitces AdvisorTech Map, including Knudge (which helps clients keep track of the recommendations the advisor has made that haven’t yet been implemented, and provides them follow-up nudges) and Hubly (which helps advisors manage their ongoing Client Service Calendar in addition to monitoring client action items). As in the end, it’s not enough to just ‘tell’ clients what they should do; the most successful advisors in the advice business will be those who help their clients actually follow through to implement the advice (regardless of whether it pertains to a product the advisor sells).

The added challenge of more complex advice, though, is that financial advisors themselves have more pressure to analyze an ever-widening range of client issues, which can be increasingly time-consuming to make sure that ‘everything’ is covered and nothing slips through the cracks. Which is spawning the emergence of a new category of AdvisorTech solutions dubbed “Advice Support Tools”, all built around helping advisors ensure that they (thoroughly but efficiently) cover all the planning issues, including FP Alpha (which ingests client data to help quickly surface planning ideas and opportunities), Advice Systems Inc (which also helps to identify a wide range of planning opportunities based on initial client data), Bento Engine (which provides advisors with advice decision trees and talking points), and fpPathfinder (which provides flowcharts and checklists to ensure that advisors consider all the relevant issues when making a recommendation).

As in the end, when the advice value proposition is driven by complexity and a desire of the client to create change for themselves, the advisor as an accountability partner who provides advice in areas that are too complex to be solved by internet searches alone will require different kinds of tools and technology to make their complex advice more efficient and systematized to deliver.

c) CRM Becomes The New Hub

Over the past 20 years, the rise of the internet, and the emergence of Application Programming Interfaces (APIs), made it possible for even independent advisor technology tools to begin to ‘talk to’ and integrate with one another. The good news is that the ability to integrate ‘anything with anything’ has driven the proliferation of new AdvisorTech solutions. The bad news, though, is that in practice the integrations often leave much to be desired, as the growth in providers – now more than 300 different solutions on the Kitces AdvisorTech Map – leads to an impossible-to-implement mind-numbing ~45,000 different point-to-point integrations.

The end result of this dynamic is that, in practice, certain “AdvisorTech hubs” have emerged, around which a large constellation of independent providers tend to coalesce. Historically, the biggest hubs have been investment platforms (e.g., TD Ameritrade’s VEO) or the major providers that support the investment process (e.g., Orion).

But as the financial advisor business shifts from products to advice itself, investment platforms no longer form the foundational hub they once did. Instead, the advice-centric advisor tends to live more directly around where all of their client advice – and the related advice interactions – are captured: the advisor CRM.

Accordingly, it’s notable that over the past year, a growing number of emerging AdvisorTech solutions are not first building to RIA custodial platforms and investment platforms as they once did. Instead, increasingly the first (and sometimes only) major integrations of plan monitoring and advice support tools are CRM solutions like Redtail, Wealthbox, and Salesforce instead.

The significance of this shift is that it begins to de-emphasize the advisor’s connection to their investment platforms, as their systems, workflow, and ‘data hub’ become less reliant on their investment platforms, and shift to the CRM instead. At the same time, it raises the stakes of CRM competition itself – the success of certain providers over others is no longer just a matter of the CRM platform’s own growth, but also the growth of the providers that have integrated to and are building around it. Which in turn puts more pressure on advisors to pick the ‘right’ CRM system that will not only be able to advance its own feature set, but a growing marketplace of related technology solutions that plug into it as well?

d) New AdviceTech Facilitates New Advice Fee Models

The Registered Investment Adviser (RIA) has existed since 1940, when it was first created by the Investment Advisers Act. For most of its history, though, RIAs were used in a relatively limited manner to advise on institutional portfolios or the select portfolios of ultra-high-net-worth clients, because it simply wasn’t feasible to manage a larger number of clients in a scalable manner, when trading still required a phone call (or a fax machine) one client at a time, and there was no easy way for the advisor to bill for their services.

However, in the 1990s the adoption of the RIA’s assets-under-management model began to accelerate… driven first and foremost by the arrival of technology platforms (i.e., Schwab Advisor Services, and similar RIA custodial platforms from TD Ameritrade, Fidelity, and then Pershing) that were built to facilitate key RIA functions, from portfolio management to simply being able to implement the AUM billing process. In other words, it took technology making both the services of RIAs and the revenue collection of RIAs more scalable, before the model could gain traction.

Accordingly, as financial advisors increasingly adjust from product- and portfolio-based roots towards standalone “fee-for-service” advice models, it is the rise of both advice support tools (which scale the advice delivery process) and more recently advisor payment solutions that are once again catalyzing the shift in business models.

For instance, as advisors increasingly advise on a client’s entire household of investment assets – not just the assets they can directly manage – there is a services and billing gap for “assets under advisement” models, that FeeX is now beginning to solve. As FeeX makes it possible to manage and trade on (and get paid an AUM fee for) a client’s held-away 401(k) assets in a similar manner to the assets they hold with the advisor’s RIA custodian. Which significantly expands the advisor’s potential revenue opportunity, accelerating the shift from AUM to AUA.

The challenge with the FeeX model, though – and more generally, a wide range of “fee-for-service” advice models that are not necessarily tied to a client’s managed account – is that when advisors don’t have an investment account held with their RIA custodian, they don’t have a source from which their fees can be billed. Which in 2021 led to the rise of AdvicePay, which offers a solution that facilitates advice fee payments from bank accounts or credit cards for clients that don’t have an investment account from which they can pay an AUM fee… a trend that started with RIAs and is now accelerating towards hybrid broker-dealer/RIAs pivoting to fee-for-service advice models as well.

2) Automating The Back Office

One of the great ironies of the arrival of robo-advisors is that while the robos predicted that they would replace financial advisors with their technology solution, the advisor community quickly expressed that robo-advisor technology was something they wanted for their practices as well… at a time when robo-advisors could open, fund, and invest a client in 30 minutes directly from a smartphone, but the typical financial advisor still had to fax account opening forms to their investment platform, and follow up with a snail-mail copy of the paperwork with wet-ink signatures.

As a result, the years that followed led to a large number of robo-advisor tools being acquired by ‘traditional’ advisor enterprises (e.g., Blackrock acquiring FutureAdvisor) pivoting into serving financial advisors instead (e.g., JemStep and Vanare | Nest Egg which became AdvisorEngine) or simply building from the start for financial advisors (e.g., RobustWealth).

At its core, the shift of robo-advisors from being a challenger to financial advisors to becoming a solution for financial advisors was simply a recognition that what robo-advisors were really replacing was not the value proposition of a financial advisor, but the back-office functions that advisory firms themselves were eager to automate as well. Or viewed another way, while robo-advisors were not a threat to financial advisors, they did become a threat to the advisor’s back-office staff.

In today’s environment, “robo” automation solutions are typically not referred to as such – at least in the advisor world – but the essence of bringing back-office automation to advisory firms, and the chassis that’s necessary to facilitate that automation, remains a dominant theme in the AdvisorTech landscape.

a) Back Office Efficiency And Workflow Automation

While much of the focus on “advisor efficiency” in recent years has been on trying to make the investment management process more efficient (from digital onboarding tools to rebalancing software), recent Kitces Research on advisor time use shows that the typical financial advisor has already cut their time on investment management down to barely more than 10% of an average week. Instead, the most time-consuming part of the financial advisor’s job is tied more directly to client meetings – specifically, the preparation work in advance of the meeting and follow-up tasks after the meeting, that in the aggregate add up to almost 2 hours of pre- and post-meeting time for every 1 hour in the meeting itself!

Accordingly, the pain points around meeting preparation and follow-up are, in turn, spawning a wide range of new AdvisorTech solutions aiming to automate (or at least expedite) a wide range of meeting-related activities.

For instance, Pulse360 is aiming to drastically cut the time it takes to prepare meeting agendas and capture post-meeting notes and client follow-up. Hubly is developing a Workflow engine that weaves together post-meeting tasks that span multiple systems. ForwardLane is trying to highlight the planning issues that arise for clients that advisors could proactively reach out about. And a wide range of “CRM Overlays” and add-ons are emerging to improve the existing workflow capabilities of advisor CRM systems, such as XLR8, Skience, and Conga.

Notably, in addition to workflow automation solutions emanating from (or attaching to) advisor CRM systems, existing document management systems are also expanding into the world of business process automation (given that most advisor business processes are attached to documents that advisors must handle and process). As highlighted by companies like Docupace, which in 2020 raised a growth equity round from FTV Capital, and in 2021 extended its focus by acquiring onboarding and workflow integration provider PreciseFP.

The key thread throughout it all, though, is that in a product-based world, advisor CRM systems simply needed to track (sales) opportunities and the contact information of prospects through the sales process. But as advisory firms shift increasingly into the (ongoing) advice business, the robustness of advisors’ CRM requirements, including and especially when it comes to ongoing workflows to support ongoing processes for clients, is driving a fresh wave of innovation in business process automation for advisors in and around their CRM systems.

b) RegTech: 'Techifying' Compliance And Integrating (Cybersecurity) IT

The financial services industry is a highly regulated industry – for good reason, given the high stakes of financial advice (and the potential to impact someone’s livelihood and life savings). From ensuring that client assets are secure, to reviewing recommendations for their appropriateness, and overseeing that advisory firm employees are not engaging in any improprieties (e.g., front-running, or other outside business activities that could create a conflict of interest). Which in practice means a number of specialized but very standardized processes and procedures that must be executed on an ongoing basis, either to surveil employee advice or other activity, or simply to prove that such activities are being overseen in the first place.

Historically, though, compliance was primarily a challenge for broker-dealers – for which they had specialized systems to oversee hundreds or thousands of brokers and their recommendations at once – but not for independent RIAs, who more often had to simply ‘oversee themselves’ as small firms or often outright solo advisors, where the owner and the advisor and the Chief Compliance Officer (CCO) were one and the same.

As the recurring revenue of the AUM model has allowed advisory firms to increasingly grow and scale into multi-employee and multi-advisor enterprises, though, ‘techifying’ compliance by turning repeatable processes into technology has become a growing focus of the “RegTech” domain.

In 2021, this was brought into sharp relief with a number of major mergers and acquisitions, including Orion acquiring BasisCode, MarketCounsel and Dynasty Financial Partners making a joint investment into SmartRIA, and ComplySci acquiring RIA In A Box (as well as NRS earlier in the year), as RegTech become a hot sub-sector of the AdvisorTech world with the ongoing shift of breakaway brokers going RIA and RIAs scaling up to the point that they need (and are willing to spend on) technology to scale the execution of their compliance obligations.

In addition to RegTech for compliance, though, a related area that saw an uptick of AdvisorTech M&A in 2021 was Managed Service Providers (MSPs) that nominally provide ‘outsourced IT’ services but in practice have become increasingly popular because they better help advisory firms fulfill their cybersecurity obligations (a level of IT complexity beyond the knowledge of the average independent RIA). For instance, Bluff Point Associates acquired True North Networks (after having acquired True North competitor Rightsize Solutions in late 2020), Smarsh acquired Entreda for their cybersecurity solutions, and RIA In A Box acquired Itegria to expand even more directly from ‘pure’ compliance into an adjacent cybersecurity offering.

The key point is simply that as advisors continue to shift into the advice business, which entails a shift from broker-dealers to RIAs, and RIAs themselves continue to ‘bulk up’ with the steady accumulation of clients that necessitates more employees (and therefore more staff to oversee for compliance purposes), there is a significant positive tailwind for the ongoing growth of (RIA-centric) compliance technology solutions and their related cybersecurity providers.

c) Integrating Advisor Data

One of the secondary effects of the impossibly-exponential number of point-to-point integrations amongst the proliferating number of AdvisorTech solutions is that there is no Single Source Of Truth when it comes to the data. Instead, key investment data may come from brokerage platforms into a portfolio accounting system, contact and communication data is housed in a CRM system, financial planning data lives in its own software solution, etc.

The end result is at best a complex web of bi-directional integrations that try to push-pull data without consistent data standards across the solutions to try to keep updates ‘synced’ across them all. Which means in practice, advisors often still have to maintain double (or triple!) data entry, or be hyper-conscious that the data they see in certain platforms is known to be inaccurate or out-of-date. Which just further slows down a wide range of back-office processes and workflows.

For large enterprises, the traditional solution to this difficulty is to build their own data warehouse, feed all of their data sources into it, standardize the data there, and then push that data into various systems that need it. But in a highly fractured world of small independent advisors, where most firms have 1-8 employees, building one’s own data warehouse and associated integrations simply isn’t feasible.

To fill the void, though, 2021 witnessed an emerging new category of solutions that are aiming to facilitate advisor data in a more centralized and holistic way. Early contenders include Milemarker (which sets the infrastructure to warehouse the data, and the APIs to move the data in/out of the advisor’s systems, framed as an “Integration-As-A-Service” offering), Skience’s Data Consolidation solution (which centralizes and warehouses the data to then engage through Skience’s CRM overlay tools), and Wealth Access’ Data Enrichment and Unification Platform (which is aiming to address the issue in mid-sized enterprises with a particular focus on unifying a client’s financial data across multiple enterprise systems).

Of course, the irony is that if advisors have to buy another technology solution just to house the data for all their other software, it just adds another cost layer to the process that advisors may resist. However, the fractured nature of advisor data, and the business inefficiencies it creates, leave room for advisory firms (especially mid-to-large-sized independent advisors where there are more potential staff savings) to spend on a new category of AdvisorTech that makes the rest work a lot better.

d) The Quest For The All-In-One Holy Grail

From the earliest days of cloud-based advisor technology tools integrating with one another via APIs, there has been a call for more consistent data standards to make it easier to move data from one platform to another. Over the years, initiatives like Your Silver Bullet and CleverDome have sought to bring AdvisorTech companies together to establish more consistent data standards and move data across platforms more easily (and more securely).

Yet in the end, the reality is that once certain data standards and protocols are deeply enmeshed in existing software, it’s difficult-to-impossible to re-write the original data architecture, such that technology companies would at best have to build an entire data transformation layer to conform to an agreed-upon standard. And at that point, it’s easier to just build to a select few integration partners that drive the bulk of their joint users anyway.

Consequently, in practice, de facto data standards have begun to emerge… around the platforms that advisors build their practices around. In an increasingly AUM-centric world over the past 20 years, this has been primarily the independent AdvisorTech tools for portfolio management and performance.

In 2021, this trend accelerated further, Addepar acquired AdvisorPeak to shift from performance reporting into a more all-in-one portfolio management solution, Panoramix launched its own trading solution as an extension of its performance reporting, Invesco consolidated its digital onboarding (previously Jemstep) and portfolio management (previously Portfolio Pathway) and rebalancing/trading (previously RedBlack) into a single solution dubbed Intelliflo, and Orion acquired BasisCode and also Hidden Levers to further bulk up the breadth of its ‘all-in-one’ solution and further differentiate from competitors Black Diamond and Tamarac.

At the same time, though, there is a growing recognition that the AUM model may not be the sole future for financial advisors, and that financial planning software is on the rise as a central system for the advice business. Accordingly, in 2019 Envestnet acquired MoneyGuidePro and Orion acquired Advizr, and in 2021 the focus of all-in-one platforms incorporating financial planning took an accelerated shift with mega-TAMP AssetMark acquiring Voyant, and InvestCloud acquiring NaviPlan.

The key point is simply that to the extent that independent technology providers cannot agree upon their own data standards to generate efficiencies, a growth opportunity remains for major advisor platforms to build or acquire the components they need to achieve consistent data standards by simply being the all-in-one that does it all from a consistent database. With the caveat that historically, all-in-one platforms for advisors have struggled to keep pace with individual best-in-class solutions that chip away at advisor market share… will the latest emerging crop of all-in-one solutions be able to prevail?

Stay tuned next week, for a continuation of this article series looking at the third and fourth advisor trends reshaping Advisor Technology!

In the meantime, we’ve updated the latest version of our Financial AdvisorTech Solutions Map with several new companies, including highlights of the “Category Newcomers” in each area to highlight new FinTech innovation!

So what do you think? Will the ongoing shift to more advice-centric business models drive more growth in various advice-support tools and systems? How much more of the advisor back office can really be automated? Will advisors choose to start warehousing their own data to gain better efficiencies… or just rely on their vendors to provide more all-in-one capabilities? Let us know your thoughts by sharing in the comments below!

Disclosure: Michael Kitces is the co-founder of AdvicePay and is on the Advisory Board for Timeline App, both of which were mentioned in this article.

Excellent overview