Executive Summary

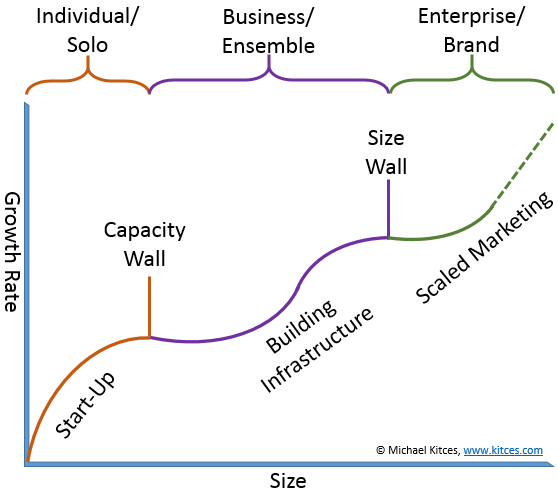

As the world of financial advice continues to grow and evolve, advisory firms are increasingly going through a series of consistent stages in the growth of their firm. There's a start-up phase with rapid growth, followed by a capacity "wall" where the individual advisor just can't handle any more clients. The capacity wall is cleared by converting from a solo advisory firm into a multi-advisor ensemble, with years of potential continued growth as the firm reinvests into its infrastructure. Eventually, though, the ensemble practice hits another wall, as the sheer size of the firm is so large that even the collective efforts of all the advisors and partners is not enough to sustain its growth rate, leading to the fifth and final phase: the establishment of a brand and truly scaled marketing.

What's significant about this progression is not just the fact that the growth pattern happens so consistently, with a series of faster and slower growth phases, but that the walls occur at consistent points as well, and require an able-to-be-anticipated series of steps to navigate them and reach the next stage. In practice, these stage nuances may be masked by the tailwind of market returns (or the headwind of a bull market), which provide an additional level of volatility to an advisory firm. Nonetheless, by focusing on the underlying organic growth rate of new clients and asset flows, the pattern remains clear.

Ultimately, advisory firms that recognize the stages of growth will be best positioned to navigate the inevitable walls that come. But the real challenge of this landscape is to recognize that the firms in the last stage of growth may actually be the best positioned of all, potentially putting a "growth squeeze" on the wider base of smaller advisory firms still struggling to reach the next stage. For those firms that are smaller and wish to stay that way, it will still be possible to enjoy a profitable lifestyle practice. But those in the middle stages may need to navigate carefully, or risk being unable to get past the final growth wall. And in the long run, the largest firms with a visible brand and scaled marketing may actually grow so large and effectively, that it begins to change the growth landscape itself in the future!

The inspiration for today's blog post comes from a recent realization that I've had in talking to so many advisors over the years that advisory firms go through an incredibly consistent series of growth stages, with a number of highly 'predictible' growth walls. The first occurs when the advisor tries to transition from an individual solo practitioner to a true business that extends beyond the individual founder alone. The second occurs when the advisory business tries to grow beyond being just a conglomeration of its ensemble members and into a true enterprise with scaled marketing and a recognized brand. These stages are reflected in the graphic below.

The Five Stages Of Growth

Start-Up Phase

The start-up phase is the beginning of any financial planning firm. It's about bringing in the first clients, getting enough revenue to have sufficient take-home pay to be viable and earn a living. Given the 'failure' rate of the industry, many advisors don't even manage to attract enough clients - or do so quickly enough - to 'survive' in the first place. For those who do make it past the initial start-up phase, the advisory firm can become quite financially rewarding, especially with today's tools and technology that allow for incredible efficiencies and leveraging of an individual's productivity.

Nonetheless, as the focus of work shifts from bringing in new clients to servicing the ones that are now on board, the growth rate begins to slow and plateau. For the largest of practices in the start-up phase, an administrative staff member or two may come on board as well, to allow the firm to grow a bit further. Outsourcing activity may increase as well, as the advisor tries to focus his/her "unique talents" (a la Strategic Coach) and delegate the rest (whether it's outsourced planning or outsourced operations; this is often the point at which we see advisors interested in outsourcing investment management with our Pinnacle Advisor Solutions offering as well).

But ultimately, the first wall is reached: the advisor hits full capacity.

Capacity Wall

For many practice management consultants to financial advisors, the individual capacity limit is known as "the wall", and any individual advisors will eventually hit it as they reach the sheer limits of what one person can manage, even with some technology, efficiencies, and support staff. For highly inefficient practices, the wall can come as soon as $150,000 - $250,000 in revenue. For most advisory firms, it seems to come somewhere between $300,000 and $500,000 in revenue (or similar revenue-per-partner levels in a multi-advisor partnership). As we see from the Moss Adams benchmarking studies, even the top performing solo advisors are barely over half a million in revenue. They've hit capacity; they're at the wall.

In an advisory firm, climbing over the capacity wall requires hiring staff - specifically, junior financial planners who can service and eventually take over client relationships. (Ideally, hired before the wall is actually hit so there's time to get them up to speed and smooth out the growth path, although in practice most advisor clients we see in our New Planner Recruiting offering have already hit the wall.) The decision to hire a professional planner staff member represents the fundamental dividing line between highly efficient solo practitioners, and the formation of an actual business that begins to craft economic value beyond just the capacity of its founder/owner. Notably, this is a line that many advisors choose never to cross - given how incredibly profitable a productive solo practitioner can be, there's not necessarily a need to move beyond the capacity wall (unless the goal is truly to build a large saleable business), and many advisors choose to remain as 'lifestyle' practices.

Ultimately, getting past the capacity phase requires a significant reinvestment back into the business, hiring professional advisor staff who can ultimately increase the capacity of the firm and help it to continue to grow beyond the wall.

Building Infrastructure

The infrastructure stage of growth is often one of explosive growth in business value. As the ability to generate revenue and profits extends beyond the founding owner(s), the advisory firm begins to be less about just the revenue and income of the owner, but the revenue, expenses, net profits, and saleable economic value of the business as a business.

As the name implies, the infrastructure phase of an advisory firm's growth is all about continuing to build the infrastructure and capacity of the firm. A junior planner turns into a team of junior planners. A founding owner begins to add/promote/take on partners, transitioning from a founder-centric business into an ensemble practice. To the extent they're not outsourced, the client service team gets deeper, the investment team gets deeper, the firm hires a manager to handle all the staff (and eventually a COO to manage the firm), along with the firm's first hires for internal technology support and marketing. In essence, the infrastructure phase is a series of mini-walls that the firm continues to surpass by ongoing reinvestment into the depth of staff and infrastructure itself.

In the meantime, as the client base grows, a larger and larger number of clients are available to provide referrals. The firm becomes more credible in its local market, and begins to craft (additional) referral relationships with centers of influence. And the growing number of partners and advisors expands the firm's capabilities to generate new clients from all directions. The value of the business as an entity grows significantly far beyond what the founder alone could have achieved as an individual.

Until, eventually, the next wall is reached: the firm becomes so large, not even all of these efforts together can sustain its growth rates.

Size Wall

The "size wall" in larger advisory firms stems from the recognition that as the business grows larger, eventually the marketing and business development practices that got it there simply cannot sustain at the same rate given the sheer mass of the firm. Given that the growth rate is a fraction, where the numerator is new business and the denominator is the current size of the existing firm, eventually the denominator becomes so large that the growth rate can't help but decline.

For instance, a firm with $10M of AUM and an average household of $500k has 20 clients. In order for it to grow by 20%, it needs 4 new clients a year, or one per quarter (4 clients x $500k = $2M of new assets / $10M of AUM = 20% growth rate). A firm with $100M of AUM and the same average household, though, now has 200 clients and needs 40 new clients, or more than 3 per month to sustain the same growth rate. This is why firms often go "up market" and raise their minimums - at a higher average revenue per client, the numbers aren't as daunting, as getting 20% growth with millionaires will 'merely' require 20 new clients (5 per quarter) rather than 40 (over 3 per month!). As the firm continues to grow, the challenge continues, though; at $200M of AUM even with a $1M average household, the firm once again need more than 3 new millioniare clients per month just to sustain its growth. While firms build out their infrastructure, the pace of client growth can accelerate, but at some point the denominator of the growth fraction just becomes overwhelming; at $1B of AUM and an average $1M household, there are 1,000 clients, and now the firm requires 200 clients, or about 4 millionaires per week to sustain its growth rates. In the short term firms may go up-market and try to raise their minimums to sustain the growth rate, but eventually as firms reach an ever-larger size, the growth rates slow. It's the size wall.

The reasons for the size wall are plentiful. For a firm that has been in place long enough to grow to such a size, a large portion of the client base has already fully tapped its network for referrals (how many more referrals can really come from clients who've already been referring for 10+ years?), and only a small portion of clients are actually "new" enough (perhaps the first 1-5 years with the firm?) to still have a lot of prospects to refer. The center-of-influence referrals may be coming at the same pace, but the half-a-dozen-per-year referrals that were a healthy contributor to growth at $50M or even $200M don't even cover two weeks' worth of growth at $1B of AUM. Many of the advisors in the firm may be reaching their own individual capacity, where they're not pushing their individual growth anyway. And to say the least, the growth requirements far exceed what a handful of partners/founders alone can sustain.

In the end, the size wall for larger advisory firms is more dangerous than the capacity wall for small firms, because the sheer size of the business makes it impossible to simply shift to a low-growth "lifestyle" model, as the lack of opportunities that growth brings may lead to rising staff turnover (as I've noted in the past, "growth" itself forms the basis of a viable career track to attract and retain employees at most firms, and a lack of growth results in a lack of career path). In addition, the number of clients makes even small percentages of client attrition a significant loss of revenue (at $1B of AUM, losing "just" 3% of clients is a loss of $30M of AUM and a whopping $300k of revenue at 1% management fees!).

Getting past the size phase requires the firm to reinvest once again, and convert itself from a conglomeration of individual advisors and an ensemble of partners into a standalone branded firm that can truly scale its marketing efforts as an enterprise. As with the capacity wall, the size wall requires a very significant investment - relative to the size of the firm - to advance itself to the next stage.

Scaled Marketing

The final stage of growth for advisory firms is when the marketing of the firm overall becomes truly scaled, built around a centralized brand that can be supported by a dedicated marketing department, and the business develops real value as an enterprise. The leading example in this category is probably Edelman Financial Services, which added a whopping 4,000(!) clients last year leveraged through Edelman's books, radio and TV appearances, and seminars. Other notable mega-RIA examples working through this stage include Joe Duran's United Capital and their Honest Conversations program, Steve Lockshin's Convergent Wealth Advisors, Ron Carson's Wealth Management Group and Peak Advisor Alliance, and Buckingham Asset Management with their consumer media personalities Larry Swedroe, Carl Richards, and Dan Solin.

Although the details of their marketing and growth strategy vary - some build around a branded public persona, others around a niche clientele, and still others by acquiring or attracting advisors to work under their umbrella - the fundamental point to all of them remains an effort to build a scaled marketing effort that will allow them to maintain and even accelerate growth, despite the sheerly huge number of new clients it would require. Yet for the firms that succeed, the prospective rewards are enormous; as noted above, Edelman's firm alone added more than 4,000 clients last year, with his enterprise alone trumping the growth of dozens or even hundreds of individual advisors.

The end point of this stage is that the largest firms that manage to scale their marketing and attract clients at a lower cost than smaller firms, reaching a point of "marketing inequality" where the largest firms actually grow even larger and increase their market share while the smaller firms are stuck small. In fact, arguably it's the largest firms that figure out how to scale their marketing which have the greatest growth potential, because they are able to truly benefit from the efficiencies of marketing scale that bring down the client acquisition costs that are the greatest growth barrier for most firms. In essence, this is the rise of the "mega firm" and national brands predicted in the various issues of Mark Hurley's often-criticized-but-slowly-becoming-true vision of a world with a small number of large firms at the top and a wide base of small advisory firms that struggle to be profitable or grow at all. And these are entities that create a significant enterprise value.

Reflecting On The Five Stages Of Growth

Ultimately, advisors exist across the full range of the five stages of growth. And as noted earlier, continuing to grow through each stage is not necessarily an imperative, especially for advisors that are still in the "individual" stage and can become a comfortable and highly profitable "lifestyle" practice, deliberately finishing their growth at the capacity wall.

Firms that push through the individual phase into the business phase, though, raise the stakes for themselves. While it's feasible to convert an individual practice into a lifestyle, it's not really feasible to do so as a multi-advisor ensemble practice, both because different partners may have different growth goals and aspirations, and because even if the partners become content with the size of the business, the odds are low that all of the underlying staff infrastructure will be similarly content, which raises the risk of increasing staff turnover that can eventually undermine the value of the business, or collapse it entirely. Thus, while growth for an individual can be done, or not, for the individual's sake, growth for a business becomes a necessary imperative for its own sustainability.

On the plus side, the end point of continued growth, and overcoming the size wall, is the potential to build an enterprise with extraordinary business value, which is the compensation embedded in the risks that are present for failing to do so and getting stuck behind the wall. In fact, many of the largest advisory firms are achieving such scale and efficiencies with their new client growth that they seem to even be out-competing firms from all the prior stages, raising the question of whether the landscape for advisory firm growth itself will shift in the coming years as more and more firms make it into the final stage. We'll see.

So what do you think? Where does your firm lie in the stages of advisory firm growth? Are you hitting one of the walls? How did you get past the last wall? How are you preparing for the next wall that may come?

If you think about that growth curve, the nature of investment decision making changes as an organization is being built. Perhaps the biggest challenges occur before the capacity wall is hit, because few single practitioners have the combination of time and skill to be able to deal with the range of investment issues that they confront. But, even as they grow big and profitable, advisory firms often neglect building a proper investment infrastructure. One aspect of the maturation process is embracing that need and creating a true investment organization as well as an advisory one.

Tom,

Indeed, I think there are a lot of ‘predictable’ investment decision-making process changes that occur through this growth curve as well.

I find for many, the capacity wall is where many first choose to outsource, acknowledging that it’s not a core competency for them.

For those that retain the investment decision-making process past the capacity wall, the expansion of infrastructure usually results in the formation of an investment team/committee, to broaden the investment workload and (hopefully) deepen the firm’s investment resources, but in the process introduces new challenges and potential dysfunctions around the actual decision-making process of a team/committee approach versus a solo founder/owner.

Ultimately, at the upper end of infrastructure and certainly in the scaled marketing phase, I find there’s often – though not always – a complete dissociation of the typical advisor within the firm and the firm’s investment process, as the investment function is fully taken over by dedicated team/staff and the advisor becomes primarily responsible for discussing and reporting results, and matching portfolio models to client needs/goals and risk tolerance, but without any actual “hands-on” role of the advisor in the portfolio.

– Michael

When you use the term outsource for the investment piece of an advisory practice, would you typically be referring to a TAMP. Loring Ward, Symmetry, SEI? I’ve wrestled with using a group like this and the issue that i usually have is the extra fee to the client. Most firms charge at least .5% to the client, so either the client’s fees will go up or my fee must go down. Just curious if these are the types of groups you are referring to when you mention outsourcing and if you any thoughts on overcoming the extra fee, I know your firm has some level of this outsourcing function as well.

Enjoyed reading this. Stages give people benchmarks.

While I use different terms, I’d add Stage 6 – Legacy — Usually legacy of the original owner and how they’ll leave the firm. Even after that happens, there will be other stages, based on the new owners. Kinda like a spiral, ever changing (for the good, hopefully).

Although I wish the stages were cut/dry, often the strengths, life goals, weaknesses, and/or control issues of the owners add or throw a wrench into the mix.

Within each stage of business — even the solo-practitioner stage (your start up stage) — there is always a dance of sorts going on in which one of the three p’s needs the most attention. In the new solo-practitioner stage the profit that comes from servicing clients is first in mind followed by people (part-timers and consultants of various sorts) followed by processes.

Micro-business it’s usually people, then processes, and while profit is there, the other two p’s need attention so that profit continues.

etc.

Thanks so much for writing this. I am a solo advisor generating 1.7M in annual revenue with 90 clients and really starting to think about how to scale in the future (hiring, outsourcing, both…). I am in my early 40s. In my annual business planning I am thinking more about what you call the capacity wall. My desire is to maximize the solo model and there are fewer and fewer advisors whove been where i’m going with the solo model for me to learn from. Your post is a good description for scaling. Thank you!

Mike,

Thanks for sharing!

Honestly, at $1.7M of revenue you’re already doing FAR more revenue than almost any other solo practitioner I’ve met over the years.

On the other hand, by client capacity, your numbers sound dead-on. I find most advisors seem to top out at 75-100 active client relationships (and if the relationships are more complex the ‘soft cap’ tends to be even lower). So from that benchmark, it sounds like you’re coming right up to the capacity wall (albeit with an average of more than $20,000 revenue per client so your total revenue numbers are well above average)!

– Michael

Michael, do you think that some of these scaled firms such as Edelman, Mutual Fund Store, Fisher, reached these pinnacle levels of growth due to their scaled marketing early on? Edelman and MFS both have strong public awareness brands that seem to have grown to this size because of their brands. In essence, they got to the scaled level because of scaled marketing earlier than the 5 stages may suggest. Thanks so much for insightful articles.