Executive Summary

Most financial advisors spend relatively little on outbound marketing – which isn’t entirely surprising, given how hard it is to differentiate and stand out in a crowded marketplace. To the extent that financial advisors spend at all on marketing, it tends to be little more than 1% to 2% of revenues, most commonly on client appreciation events for their existing clients (and, perhaps, a few potential referrals).

Yet arguably, the primary reason that it’s so hard to market as a financial advisor is that we choose to market ourselves as undifferentiated generalists, rather than targeting a particular niche or specialization. Because the reality is that once you choose a specific target market, it becomes far easier to identify specific, targeted marketing strategies that can have a favorable return on investment. Once the financial advisor doesn’t have to fight as hard to differentiate in the first place.

For instance, an advisor targeting retiring architects might join the American Institute of Architects, write a guest post for the EntreArchitect blog, speak on the Business of Architecture podcast and for conferences of architects, while volunteering on Architect association committees and forming relationships with architect-specific centers of influence. For which the financial advisor will likely have little competition at all… because few other financial advisors go deep into the architect (or any other) niche.

In fact, one of the key benefits of targeting a specific niche is the opportunity to take advantage of unique marketing channels that may be highly effective at reaching that particular niche. And in a more cost-effective manner than the broad-based, generalized marketing that most financial advisors have long since found to be ineffective. Because whatever the niche is, there will be some combination of association and/or community organizations, conferences and events, magazines and blogs, and other marketing channels that are specific to that niche, where the financial advisor can focus their marketing efforts for greater return on investment.

The Challenge Of Financial Advisor Marketing

Marketing is hard in any business, but arguably is especially challenging for financial advisors. We have to “sell the invisible” of an intangible service like financial planning. In an extremely crowded marketplace of other financial advisors all trying to market their own comprehensive financial planning and wealth management services, to consumers who can’t tell us apart, in a financial services industry that consistently ranks as the least trusted.

Accordingly, it is perhaps not surprising that industry benchmarking studies show most financial advisory firms only spend 1% to 2% of revenue on marketing (which doesn’t provide for any economies of scale until the firm has several billion of AUM). After all, what would the advisor realistically do with an outbound marketing budget anyway… buy magazine or billboard ads to build a brand?

Instead, most advisors – to the extent they spend on marketing at all – tend to focus on marketing events, where the marketing spend creates the opportunity for the advisor themselves to create one-to-one relationships with prospective clients. Yet even the popularity of buying mailing lists to invite prospects to seminar dinners has petered out, as the “good” zip codes became oversaturated with marketing. And it’s harder to even get existing clients to bring potential referrals to social events, in a world where there are fewer “unattached” prospects (who don’t already have an advisor) than ever before.

The end result is that most financial advisors end out getting the majority of their new clients via referrals from existing clients. Not necessarily because referral marketing is a “best practice”, but simply because when most advisors spend little to nothing on marketing, it’s the only thing left that could possibly lead to new clients.

Yet arguably the real challenge to financial advisor marketing is that, in a world where most advisors advertise themselves as generalists and compete on the breadth of their services (not the depth, but the breadth!) and ephemeral qualities of client service, advisors aren’t targeted enough in order to be effective in marketing. In other words, most financial advisors struggle with marketing because they aren't targeted enough to focus their marketing efforts in a cost-effective manner.

Yet ultimately, this is precisely why targeting into a niche as a financial advisor is so effective. Because when the advisor is targeted to a particular narrow type of clientele, it’s much easier to identify specific, cost-effective strategies to market and reach them!

Formulating A Financial Advisor Marketing Plan To A Focused Niche: Architects

As a case-in-point example, let’s look at how a niche marketing plan might be developed for a particular niche (of which I have no particular knowledge): Architects.

According to Glassdoor, the average income of an architect is almost $80,000/year, and data from the Bureau of Labor Statistics indicates that the top 10% of architects earn more than $130,000/year. And of course, entrepreneurial architects who create their own architectural businesses have the potential to earn even more. So architects certainly have the financial means to hire a financial advisor and pay for financial advice.

In this context, how might a financial advisor create a marketing plan to pursue the niche of architects?

The starting point might be to figure out what architects read. A quick search online reveals a number of lists that show the top blogs for Architects, along with the top Architecture magazines. Of particular note is Architectural Record, a magazine that covers both the “art” of architecture, and the business of architecture, along with the blog EntreArchitect, which helps architects who are trying to build their own small business architectural firms. Would either of these online or print magazine publications accept a guest post or contributing article on a financial topic? Do either have options for financial advisors to buy advertising to target the Architect audience? What about getting a guest appearance on the Business of Architecture podcast?

Alternatively, as a financial advisor you could decide to start your own blog for architects. Consider the financially related issues that might be important to architects? Perhaps it’s how to offer employee benefits in a small architectural firm? Or how to make partner in a large firm? Could you learn and then share insight into how succession planning works in an architecture firm that other architects could learn from? Or how to structure a buy/sell agreement? What about the dynamics of running an architectural business, and benchmarking business results? Or what it takes to go out and launch your own architectural firm and become a small business owner instead of an employee? Notably, many of these are situations where there is “money in motion” and a need to get the advice of qualified professionals. And if you don’t like writing about these topics, you can start a podcast instead. Or a YouTube video channel.

Next, it’s time to establish yourself in the architectural community, and begin to network and find centers of influence. Which means joining an association for architects. The largest association for Architects is the AIA (American Institute of Architects), with over 250 local chapters across the US and more than 90,000 members. Another option is SARA – the Society of American Registered Architects – which has a handful of chapters in some major metropolitan areas as well. Both organizations have membership options for “Professional Affiliate” (i.e., non-architect service providers to architects) that a financial advisor might qualify for. Which then opens the door to attending meetings, volunteering onto a committee, and beginning to network with architects.

And once within the organization, it’s also feasible to begin identifying who the real “Centers of Influence” are – the people who command respect in the community of Architects, from whom a referral or recommendation is worth its weight in gold. Perhaps that’s key leaders in the architectural associations. Or members of the board of directors. Or prominent consultants that work with architects. Or writers in widely read architectural magazines. Or bloggers or podcasters who are influential with their own audience of architects. What would you do to connect with them? Find them at networking events? Reach out to engage in a partnership? Offer to be a resource to them?

Or if you have deeper resources, you might even look to organize your own event, and invite influencers as an opportunity to give them exposure and benefit them (and in the process, benefit you as well)! Could you organize a specialized conference of your own in your niche? Or a pre-conference workshop in conjunction with one of the associations or other major architectural industry conferences? Could you create your own Awards recognition problem for Architects, or some subset of service providers to architects, giving them (and you) something to talk about?

Of course, an even better approach than just finding and networking with Centers of Influence, is to attempt to become one yourself. Perhaps you could do a study on some financial aspect of the business of architecture, and publish the results in a white paper. What’s the best way to break away and start your own architectural firm? Or to attract Millennial architect successors? Or make partner at your architectural firm (and unlock bigger income potential)?

Crafting The “Financial Planning For (Retiring) Architects” Marketing Plan

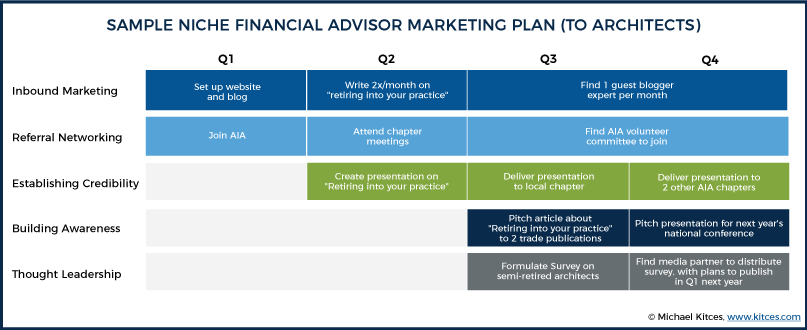

Realistically, no one financial advisor is likely to pursue all of these marketing channels in a new niche at once. But might strategically choose a few to begin with, and plan to add more later.

For instance, our hypothetical financial advisor might decide that his ultimate goal is to do planning for experienced and successful architects who built their own architectural firm and are looking retire (and need to figure out how to successfully retire out from the firm they built). Recognizing that, similar to financial planning, architecture is something that experienced practitioners can do well into their later years with a small subset of clients that they enjoy working with.

As a result, the advisor decides to create a particular focus on architects who want to retire into their practices, harvesting the value of the business they built with an exit sale or internal succession plan, where the architect continues to work as a consultant back to the firm he sold doing “part-time” work in retirement (thus “retiring into” instead of “retiring out” of the practice).

Accordingly, the advisor begins to work on his niche marketing plan to reach retiring architects.

The first is to set up his website for “Architects who want to retire INTO their practices” because they love the work they do (and it pays well, too!). And then the advisor starts a blog where he begins to write about the philosophy of retiring into your practice, and the benefits of being able to maintain a continuing stream of income in “retirement” (including that it makes retirement affordable earlier than you might have realized!). Eventually, he plans to collate the first two years’ worth of blog posts into a book for retiring architects.

Then, he begins to find affiliated professionals that can help to facilitate the internal succession plans or external acquisitions that would be necessary for an architect to have a liquidity event, including banks that do lending for architectural firm succession plans, consultants that can help structure the deal, lawyers who are experienced at drawing up the terms, and accountants with experience doing valuations of architectural firms. These experts are invited to contribute guest posts to the advisor’s new blog, in their respective domains of expertise, as it applies to architects retiring into the practice.

Once the blog is underway, the advisor joins the AIA and begins to attend meetings at his local chapter, and volunteers for the Membership Development committee (because being involved in getting new members to join the association is a great way to meet all the new members who join!) And volunteering also gives him additional opportunities to start building relationships with some of the key influencers in the local chapter.

Next, the advisor offers to present his “Retire into your architectural firm” at a local AIA chapter meeting as a speaker, with the hopes that if it goes well, he can begin to offer the presentation (citing the good audience reviews) to some of the other 250 chapters, and begin to network his way further around the association. If the presentation is popular enough, he’ll try to pitch it to the national conference next year.

In the meantime, he also does a write-up of the presentation, and submits it as his sample work with an offer to start writing a regular column on the topic with some leading industry trade publications, hoping that one will give him an opportunity to submit an article quarterly on the topic of semi-retirement as an architect.

In addition, the advisor begins to develop a survey on part-time consulting work of experienced architects, an area that has never before been studied. What is the typical age of experienced architects that become consultants to their old firms? What are they usually paid? Is it a retainer fee to the firm, or an hourly rate? What kinds of projects do they usually stay engaged with? How many hours do they typically work in part-time semi-retired status? To broaden the reach of the survey – and to have a better place to publish the results – he also reaches out to two mid-sized architectural trade publications with a healthy mailing list, and offers them each one exclusive article write-up about the survey results and subsequent white paper, in exchange for the opportunity to send the survey to their mailing lists.

The end result: an entire full-year marketing plan for this new financial advisor niche, with far more detail and specificity that the typical financial advisor’s marketing plan! Because once there’s a clear target niche, it’s suddenly much easier to identify the tactics and targets for your marketing efforts!

Building A (Sample) Marketing Plan For A Financial Advisor Niche In 2 Hours

Of course, the caveat to all of this is that first you need to have identified your niche, understand the issues that are really important to them, and have begun to do the necessary legwork to gain the knowledge and expertise to serve them. Not to mention identifying and formulating a clear value proposition that is actually relevant to them (which may look very different than the “traditional” financial advisor’s services and business model).

Nonetheless, once the work is done to select the niche, and create an appropriate value proposition, formulating the actual marketing plan to reach prospective clients is much easier, and simply entails deciding which of the various strategies that are available are most appealing to the style/approach of the advisor, as applied to the particular niche.

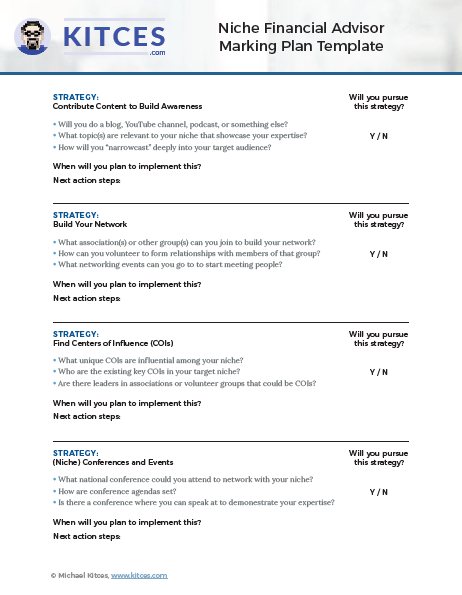

At a high level, prospective niche marketing strategies include:

Create Your Own Content Platform. A content platform, where you both demonstrate your expertise, and invite people to engage with you (e.g., via a mailing list), should be the central hub of any inbound niche marketing strategy. In a world where most financial advisors will be successful with no more than 50-100 core clients, your platform doesn’t have to gain a broad reach – just building a platform that can “narrowcast” deeply into your target audience can be more than enough. Depending on your content style, the platform could be a (written) blog, a YouTube video channel, or a podcast.

Contribute Content To Build Awareness. Once you’ve built a hub to showcase your niche expertise (i.e., your website/platform), it’s time to get the word out. This means sharing/distributing your content on other platforms where your (niche) audience can be found, to lead them back to your website. This could mean submitting articles to industry trade publications, a guest post to other industry blogs, or an appearance on an industry podcast.

Build Your Network. People do business with people they know, like, and trust. Which means you have to get involved in the niche community you’re targeting, to become known, liked, and ultimately trusted. Which means actually getting involved. So choose an association or two to join (whether local or national depends on the niche), or some other community group. And don’t just join – it’s crucial to volunteer, because that’s when you really begin to form relationships with other members of the community, who can ultimately help to refer you and support you. At a minimum, be certain to start showing up for any kind of “networking events” the organization offers, so you can begin to meet people and make connections.

Find Centers Of Influence (COIs). Ultimately, building a network in your niche to be known, liked, and trusted is good. But establishing relationship with key “Centers of Influence” (COIs) – the people in positions of power or visibility, who may be able to drive significant referrals or other opportunities for you, is equally important. Begin to identify who the key COIs are in your target niche. Traditionally for financial advisors, “COIs” were attorneys or accountants who could refer. But in a niche, the best COIs may be completely different. It could be leaders of their associations or volunteer groups. It could be an influential writer, columnist, or blogger. It could be key consultants who are themselves viewed as “thought leaders” and would cast a very favorable halo effect on you if they recommended you. (For instance, one advisor targeting doctors found a powerful COI ally in the administrator who runs one of the more popular blogs and forums for doctors seeking financial advice.)

(Niche) Conferences And Events. A natural extension of the networking process of going to local networking events and joining (and participating in and volunteering in) local association activities is to seek out national conferences and events. Initially, this might simply be as a participant as a networking opportunity, but also provides a chance to see how the event structures its content and agenda, to figure out whether there’s a possibility for you to speak about your financial expertise as a part of the conference or event in future years. While you’re at the conference, find out how their agenda is set, whether they use a conference committee or other structure, and what it takes to submit your content and expertise for consideration for a future event. Alternatively, if you can’t find an event in your niche that is worthwhile or accessible, consider creating your own event in the niche, and trying to attract people to it.

Thought Leadership. One of the best ways to establish yourself in a niche community is to position yourself as a “thought leader” – someone who can provide unique insights and perspective. The fact that you approach the niche as a financial advisor – in a world where there probably aren’t very many other “financial people” in the niche – provides some immediate opportunity. But the real key in thought leadership is not merely to push out what you already know as a financial advisor, but to teach them something about their world (leveraging your expertise). For instance, if you’re targeting professionals in a particular industry, you might gather data and publish a benchmarking study on how to run their businesses more efficiently (or perhaps a subset of their business, such as how to structure a buy/sell agreement, or employee benefits, etc.). Or if your niche is divorcees, you might publish a white paper on the top financial issues to consider in the first year after divorce. Or if your niche is consultants in a particular industry, you could publish a white paper on what it takes to transition from being an employee to a consultant in that industry, how to set up your own personal consulting business, etc.

Advertising. As noted earlier, industry benchmarking studies indicate that the typical advisory firm only spends about 1% - 2% of revenue on marketing, and often that’s targeted towards marketing activities like client appreciation events, rather than outbound advertising. Yet arguably one of the primary reasons that so few financial advisors spend on (or find success with) advertising is because it’s so untargeted. Once you’re targeted to a particular niche, though, it’s much easier to pursue advertising opportunities. And within a targeted niche, the advertising may also be much less expensive. Are there industry/niche magazines or trade publications you could advertise in? What about advertising in a niche blog or on a niche podcast? Would it be worthwhile to sponsor a niche conference or similar event, to gain targeted visibility in your niche?

Pay It Forward. As you build your own platform and visibility, another strategy to deepen your marketing and visibility in your niche is to use your platform to “pay it forward” to others. For instance, you might invite outside experts to provide guest blog posts to your website, giving them an opportunity to benefit from your growing audience (and in the process, making them grateful to you, providing an opportunity for them to ‘return

the favor’ in the future). Similarly, consider creating some kind of “recognition awards” to celebrate successes in the community – from recognizing the best providers in a certain category, or the most successful people in the niche, etc. – as they may want to use your recognition award in their marketing, which gives you the opportunity to gain visibility for your brand based on their promotional efforts. In point of fact, this is why many organizations sponsor various types of “industry awards” events and programs; because it’s actually a good opportunity for the organization that provides the award to get visibility, when the recipients celebrate their win!

Of course, as noted earlier, most financial advisors will not pursue all of these strategies. Or at least, not all at once. Nonetheless, once a specific target niche is selected, it’s often relatively easy to identify initial marketing targets and tactics in just a few hours of online searching, to begin to formulate the financial advisor’s marketing plan and start to “fill in the blanks” for each of the desired strategies.

The fundamental point, though, is simply to recognize how much easier it is to formulate a marketing plan as a financial advisor, once a specific niche clientele or other target market is selected. Because the specificity of who you’re pursuing as a financial advisor makes it far easier to identify specific marketing channels to target… which in turn tend to be far more cost effective, as narrower and more targeted niche marketing strategies are often less expensive with a better potential Return On Investment for your marketing dollars!

So what do you think? What is your current financial advisor marketing plan? Do you think it would be easier to establish a marketing plan if it was targeted to a particular niche? Have you found any marketing tactics to be particularly effective with a financial advisor niche? Please share your thoughts in the comments below!