Executive Summary

Financial advisory clients are bound to experience stressful conditions that can impact their finances at some point during their relationship with their advisor. From market downturns to geopolitical shocks, there are many potential external factors that might make a client nervous about their financial situation. What’s more, the stories individuals tell themselves can lead to decisions that negatively compound the initial impact of the event. For example, a market correction can create fear for investors (particularly those nearing – or even in – retirement), and when they create certain narratives (e.g., “I need to sell all of my stocks now before the market drops further”) they can find themselves in an even worse situation. For worried clients, advisors often serve as a sounding board for many of their stories, putting the advisor in a unique situation to help clients weather their emotional challenges and stay on course with their financial plans.

Advisors naturally strive to offer expert guidance to their clients, but sometimes addressing only the technical intricacies of a client’s plan is not always the most helpful response. For example, reminding a panicking client during a market downturn that they have a diversified portfolio or that corrections are a regular part of market cycles might not resonate with them to truly alleviate their anxiety.

Instead, addressing a client’s upsetting stressors by encouraging them to form new personal narratives can help them understand and implement new perspectives that make it easier for them to address challenging situations in different (and often more successful) ways. In this way, the client can become their own ‘expert’ through facilitation from their advisor. One way for advisors to start this conversation is by asking the client the question, “What would you tell your best friend if they asked you this question?”

This strategy can lead the client to expand their narrative (by serving as an ‘outside’ advisor to themselves) and to potentially accept new ideas that they may already know but have been resistant to acknowledge before. Because reminding a friend that having a well-diversified portfolio is a good way to manage market risk can be easier than reminding themselves of the same thing (as they watch their portfolio value fall during a downturn); at the same time, clients are likely to respond to a friend with more kindness and empathy (versus the negative self-talk they can present to themselves). Thus, going through this exercise can calm and empower the client by revealing a more compassionate and relatable response that they come up with for themselves! Additionally, the advisor is afforded valuable insight into productive ways in which the client might want to respond to the situation.

Ultimately, the key point is that by finding ways to change their own narrative stories, a client can expand how they see themselves and better understand that they can change their role in the story. In this way, they can become empowered and more capable of preventing a stressful situation from compounding negatively. And advisors can play an important role in this exercise by facilitating the conversation and listening actively, enabling the client to craft a new narrative and potential next steps!

New Narratives Can Help To Update Individual Perspective And Increase Resilience In Times Of Change

The world is in a constant state of unpredictable change, and the things that happen to and around us – both good and bad – can sometimes send us into an emotional tailspin that can make it hard to see things clearly, especially when it comes to problem-solving. Yet, when we are faced with a great deal of change and need to process challenging emotions, we sometimes discover new (and better) ways of looking at things. These new perspectives can also reveal new stories that help us find resilience – the courage or calmness we need to face adversity and successfully cope with change.

For instance, we all get stuck with self-doubt from time to time, often using the same particular narratives: You can’t do this. You are too weak. You are too dumb. You don’t have the strength to brave the storm. Narratives like this can be very demoralizing and defeating, as they tend to instill a sense of helplessness. There can also be quite a lot of shame associated with them.

But finding new perspectives and forming new narratives can be an extremely powerful practice because new narratives (or simply more expanded versions of our current narratives) help us identify new stories that help us understand how to address challenging situations in different (and often more successful) ways. In fact, research has been conducted on the efficacy of changing one’s narrative as a form of therapy and a process for change. For example, narrative therapy has helped individuals with depression, body image issues, and marital problems; it has even been advocated by mental health professionals – and used by financial planners – incorporating narrative therapy principles into the financial planning process with clients.

Essentially, when an individual believes (and repeats) something that they believe is true, it can leave them feeling stuck with no apparent solution to change the situation. And when working with a single idea or fact on its own, especially when the statement leaves a person feeling disempowered (e.g., “I am bad at math”; “I have failed at finances before”), it can be difficult to find the motivation to address the situation without a way to conceptualize a larger context of how those facts can fit into a new (and better) problem-solving paradigm.

But widening the perception of the initial fact – to allow for additional possibilities (e.g., “I may have failed to make a good financial decision in the past, but I have failed at other decisions in the past, too, yet I still learned how to do better moving forward”) – can help us to see ourselves differently as more capable problem-solvers who can change and grow. And this subtle shift is often all that is needed to open the door to change.

Narrative therapy is used not only to facilitate change but also to help cultivate a deeper understanding of the self. Through different empowering techniques that focus on finding and using words to create or modify the stories we tell ourselves, narrative therapy establishes the individual themselves as the expert. Because changing how we speak and what we say to ourselves also helps us to change the way we see ourselves.

More specifically, narrative therapy is a process that delineates different stages by the type of questions being asked. The 5 stages that are involved in narrative therapy deal with deconstructing the situation, externalizing the problem, identifying a ‘sparking event’, amplifying a preferred narrative, and formulating audience questions. Individuals answer ‘audience questions’ in order to approach, and ultimately change, the way that they see the issue at hand – because seeing their issue as a friend’s problem changes the way they respond. This allows them to generate new ideas for solving the problem – all on their own, using what the individual thinks and feels about themselves, with questions asked by a facilitator to help them find a workable solution.

By learning how to use new and empowering perspectives and how to set aside negative and unhelpful narratives, we can move from a place of fear and confusion into a place of power and knowledge. And one way to introduce a new narrative is to use the audience question, “What would you tell your best friend if they asked you this question?”

Why The Question, “What Would You Tell Your Best Friend If They Asked You This Question?” Invites New Perspectives

For financial advicers, guiding clients to envision new perspectives to help them face challenges is something they can certainly implement into their practice. This is the value of using narrative therapy in financial planning – advisors can help clients to create many different narratives to find out how to view a challenging situation from different perspectives. And this can be a powerful way to guide clients into developing resiliency and changing behavior.

Furthermore, considering new narratives and perspectives doesn’t mean the financial planner needs to demand that the client forget their old narratives. As while it takes time for old narratives to lose their influence, advisors can simply ask clients to consider new viewpoints – something they are already very good at doing by encouraging clients to consider potential financial planning scenarios and goal outcomes.

If a client is stressed about current events that are frightening – rising inflation rates, gas prices, investments, Ukraine – reminding the client that they have a diversified portfolio or running a Monte Carlo simulation for them probably won’t do much to help them change their narrative to find a better or more useful perspective of their fear. While helping a client understand their financial situation isn’t the wrong thing to do, it can feel incomplete for them when the main challenge they face in reaching their goal involves more emotional or behavioral struggles. Because even though a client may know they are diversified on an intellectual level, they will likely remain agitated about their portfolio in the troubling context of the world as they may perceive it.

Importantly, many clients who may be struggling to cope with uncontrolled change, fear, and stress will probably not find it helpful when their advisor tells them not to worry. In fact, this sort of response can feel dismissive or even insulting, as if the advisor is belittling the client’s fears. Which can be annoying, and can even result in heightening the client’s stress or making them feel ashamed of their thoughts or feelings.

Instead, advisors can ask clients to consider an additional perspective by using an audience question, which can help them to externalize the condition they may be worried about and perhaps see their situation more objectively and clearly.

An example of an effective audience question that engages principles from narrative therapy is, “If your best friend were facing this same problem, what would you tell them?” The goal of asking a client this question is to invite new perspectives on the issue at hand. This type of audience question can result in three things:

- They widen or expand the client’s narrative (e.g., convincing a client who doesn’t think they will make it through the current market dip to consider otherwise by reminding them of how they made it through the last one);

- They push the client to accept a different (and perhaps new) role within the narrative (e.g., they see themselves supporting a family member who is struggling with the issue, shifting their role from the one receiving advice to one giving advice); and

- They invite the client to accept ideas they may already know but have been resistant to acknowledge before (e.g., such as accepting that their well-diversified portfolio is likely the best way for them to hedge market risk), which is more likely to help the client change their stance by using their own thought process, versus someone else telling them what they should or shouldn’t think.

As it relates to the new role, especially in times of high stress and uncontrollable change, audience questions can be used to create new (kinder, more empathetic, and empowered) perspectives. Because when a client is asked, “What would you tell your best friend if they asked you this question?” they will very likely respond with kindness and empathy… which is as insightful for the planner as it is empowering and calming for the client.

For advisors, the client’s answer to this question can offer clues about how the client wants to be responded to (which can help advisors choose good follow-up questions to ask), going beyond just the facts and information the client may actually articulate.

For clients, contemplating and answering the question can put them in a place of power and knowledge. And sometimes, when we can’t help ourselves, it makes us better when we can still help others.

For example, if a client says, “I would tell my best friend that they are a good person, and then I would help them find a way to donate or volunteer,” an easy follow-up question the advisor could ask might explore the client’s own thoughts about donating or volunteering.

The objective of narrative therapy is not to convince or teach an individual to do or think anything in particular; instead, the key point of narrative therapy is to help the individual expand how they see themselves, and to help them understand that they can change their role in the story.

When And How To Ask Perspective/Audience Questions

To use some basic principles from narrative therapy to help their clients consider new perspectives, advisors can start by briefly mentioning pertinent facts about the client’s financial plan (e.g., portfolio diversification) and then continue the conversation with a discussion around finding and implementing new perspectives to deal with stressful conditions that might arise that could potentially change the status quo of their plan. This can be more helpful for the client to deal with their emotional challenges than if they were simply told that they were going to be okay, because letting clients build and flex resiliency on their own so that they can tell themselves that they will be okay can be so much more impactful than someone else telling them the same thing!

So when would advisors ask their clients the question, “What would you tell your best friend if they asked you this question?”

First and foremost, this question is probably not very suitable for prospects or new clients. Imagine that Bob and Tim are new clients who started working with their planner Joanna a few months ago, shortly before Russia’s invasion of Ukraine. Bob and Tim are nervous. They come in and tell their advisor Joanna that they are worried about their new portfolio allocation, seeking reassurance. If Joanna were to respond by saying, “Well, let’s talk about how to deal with your stress. What would you tell your best friend about the impact of Ukraine on their investments if they were worried about market performance?” Tim and Bob would likely respond with something like, “Hmmm, we don’t know. This is why we hired you, so you can tell us! Not so we can guess what we might tell a friend!”

However, this approach can be much more effective for advisors to use with established clients with whom they have had a long-standing relationship – perhaps they have been through a market swing or two together, or the advisor has led them through a large life decision (or several).

Consider the following example to see how an advisor can introduce the question into a client meeting.

Jenny has worked with Tom, her financial advisor, for two years. Jenny originally hired Tom to help her work through her divorce. Today, with the Russia-Ukraine war and rising inflation, things do not feel safe, and Jenny feels her life is spinning out of control.

She calls Tom and says she wants to meet to talk about where he sees the market going. She is worried that the markets are so bad that she will lose everything and that all the saving and financial planning work Tom has helped her through has all been for nothing. Her stress and anxiety are running high.

When Jenny comes into Tom’s office to meet, they have the following conversation:

Tom: Thanks again for coming in, Jenny. I am really glad you reached out.

Jenny: Yes, the world is a mess right now. I really think we should revisit my investment situation.

Tom: I understand that you are very worried about the market and how it may impact your long-term goals. We can certainly talk about investments and run some projections, but before we do, I want to ask you something that I think will give us some good perspective. Tell me, what would you say if it was your best friend who called you, worried about Ukraine and rising inflation? Tell me what you would say to your friend.

[Jenny pauses as she thinks about the question.]

Jenny: I think I would tell her it is going to be okay. I would ask her if she wanted to donate money to what was going on.

[Jenny pauses again and then smiles.]

Jenny: I would probably also tell her to call her financial advisor and double-check that her portfolio is diversified.

In the example above, notice that Tom didn’t introduce the question by asking Jenny what she would say; instead, Tom told Jenny to tell him. Asking, “What would you say?” is a gentler invitation for information, which might be appropriate in some situations, but saying, “Tell me what you would say”, uses language that implies more of an expectation that providing the answer would not cause an awkward or uncomfortable exchange. By doing this, Tom subliminally suggests, “We are close enough that I know you will be willing to tell me this.”

Importantly, Tom set the question up as a way to encourage exploring new perspectives without ignoring Jenny’s request for information about investments. In fact, he reassured her that the conversation was on the table and that he would address her question in a moment.

Yet, before that, he introduced the idea of first examining a new perspective – Tom put Jenny in the advice-giver role and let her think about how she would talk her friend through some challenging emotions (and, in the process, see how she might consider taking the same advice herself). Tom didn’t have to do anything except prompt Jenny to contemplate a simple question.

For clients who may not respond well to this process, there are other audience questions that advisors can use. For instance, instead of (or in addition to) using a best friend, advisors might ask how the client would respond to a family member or their younger self. These different questions might result in slightly different answers but can still give the advisor insight into what should come next.

Here are three additional examples of audience questions that advisors can consider using:

- What would a friend notice about you that would lead them to say that you are confident in times of financial turbulence?

- How would you show others what you have learned about taking an active role in your financial life?

- If your younger self could see you now, what attribute would your younger self admire about you when it comes to your finances?

Consider the following dialogue continuing the earlier conversation, above, between Jenny and her advisor, Tom, who uses additional audience questions:

Tom: [smiling] So I take it that I don’t need to remind you that you do have a diversified portfolio and that we have planned for volatility… Tell me, what would you tell your younger self if they were worried about their financial situation?

Jenny: I would tell my younger self to do something. I know that I am going to be okay because I do save, and I do work with a financial planner, but I know that wouldn’t solve all of her issues. I know she would feel better if she could help in some way, so I would tell her to do something.

Tom: You mentioned “doing something” in your response to your friend, and now even in your response to your younger self. Tell me more about what you mean by that.

In the above dialogue, notice how Tom has led Jenny to her own solution. This approach is far more powerful than explaining investment theories that clients may already have heard before. And while fundamental investment principles can offer valuable insight into portfolio design, they simply won’t address a client’s emotional challenges quite as effectively as techniques taken from narrative therapy.

The important point that Tom and Jenny’s conversation illustrates is that by encouraging Jenny to frame her situation from the perspective of her best friend, Jenny’s advisor helps her realize that her struggle mainly involves coping with the emotional turmoil and that her actual financial situation is not as threatened as she originally thought.

Furthermore, now that Jenny has reassured herself that things don’t look as bad as she originally thought they did, she also realizes that charitable giving is important to her. By addressing fear, stress, and anxiety from a different point of view, Jenny realizes that she feels secure enough to help ensure the security of others… a true – and powerful – 180!

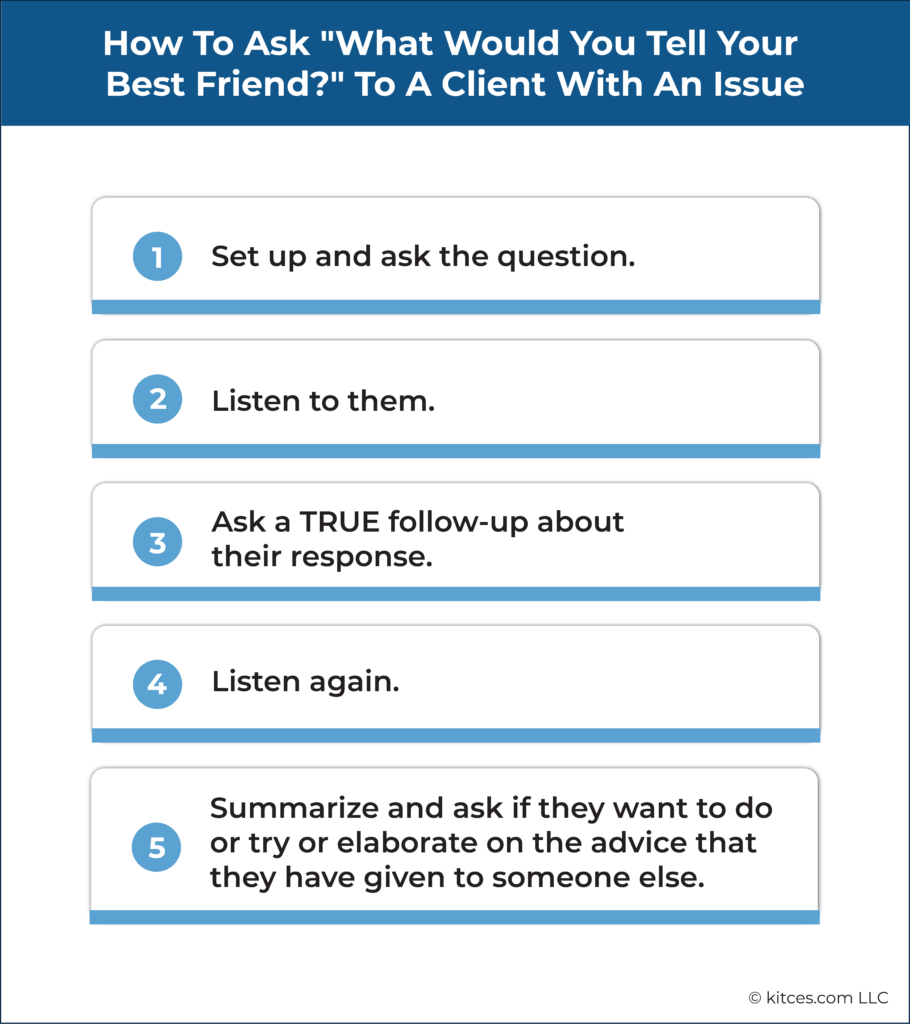

The following steps outline how advisors can lead clients through discussions using audience questions that will help them identify new perspectives and ideas, ultimately leading to feelings of resilience and strength.

- Set up and ask the question. Tell the client the audience question is coming, but also reassure them that their financial information will still be reviewed, especially if it is pertinent to the discussion or if the client has a specific question about their finances to address. Setting up the audience question is key because clients are not going to expect it, and advisors don’t want the client to think they are asking a question to evade addressing the client’s primary concern.

- Listen to the client. It is hard to ask a question and just listen without interjecting or helping the client articulate a response. Yet, listening in this step is especially important for the next step. Listen for emotions. Listen for action. Listen for the knowledge that clients have or recognize in themselves. This will be repeated back and expanded upon in the next step.

- Ask a true follow-up question in response to the client’s answer. After listening very intently, use what was heard by repeating the client’s exact language in the form of a question to take the information further or clarify and expand details.

- Listen again. Clients deserve their advisor’s full attention. Listening to the client’s story with a curious mind will reveal valuable details for the advisor to ask more follow-up questions, leading to a rich and introspective discussion.

- Summarize and ask the client if they want to consider taking their own advice. Repeating what the advisor thinks they have heard and interpreting what they think it means gives the client a chance to correct any details. It is okay for the advisor to be wrong here – they still get to where they intended to go, which is bringing the client to a greater understanding of their feelings and what needs to be done to feel better.

Again, we tend to be more kind, empathetic, patient, and even creative when it comes to addressing other people’s problems versus our own. Encouraging this small shift in perspective through the use of audience questions can help clients to generate new ideas about how to address their own issues and even gives the advisor insight into what clients want – and often need – to hear!

The world can be a very chaotic place, and, given current events and economic trends, advisors may be facing anxious clients with many what-ifs or doomsday worries. But arguing with the client and suggesting that they may be worried for nothing can inadvertently cause them shame or even more anxiety.

Instead, advisors can help clients help themselves by encouraging them to find new perspectives through audience questions such as “What would you tell your best friend?”. Using this powerful approach from narrative therapy, advisors can help clients change their own narratives in how they see themselves and to use these new perspectives to successfully cope with difficult challenges such as weathering volatile market conditions or even managing major life changes.

Leave a Reply