Executive Summary

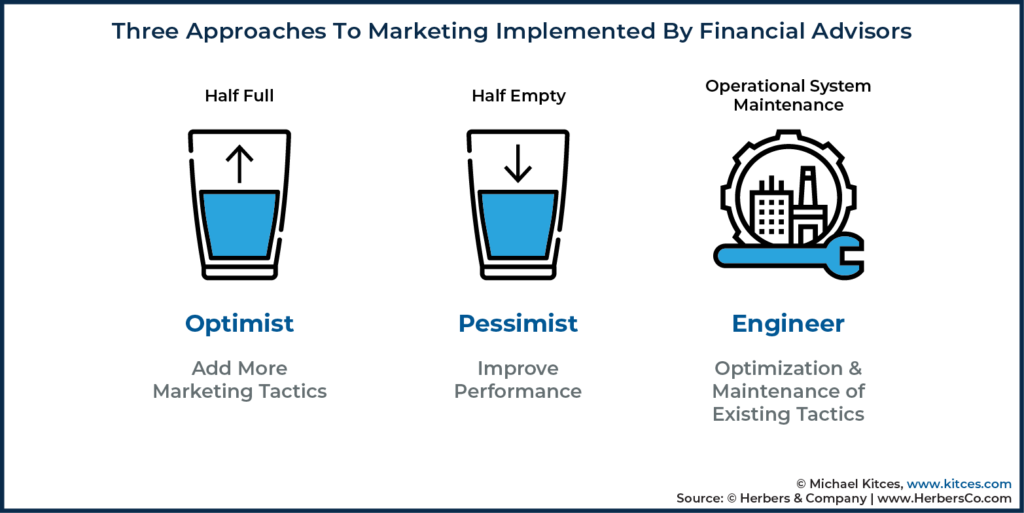

When it comes to marketing strategies for financial advisors who want to grow their firms, there are generally two commonly used approaches. Optimistic “glass-half-full” strategists often decide to invest in a(n ever-widening) variety of marketing tactics in the hopes of attracting more and more new clients, whereas more Pessimistic “glass-half-empty” strategists may often feel that suboptimal business development efforts hold them back from potential growth and will spend their marketing resources on hiring, training, and restructuring their teams to correct the problem with more and better rainmaker advisors. However, these approaches are not generally the most logical way to grow firms, as adding new marketing tactics can be expensive and doesn’t always equate to more clients, and relying on the efficacy of rainmaker advisors is risky (as finding and keeping great rainmaker talent is often very difficult).

In this guest post, Angie Herbers – Chief Executive and Senior Consultant at Herbers & Company, an independent management and growth consultancy for financial advisory firms – explains how a more efficient approach to marketing for growth is to view the process as an “Engineer”, where the firm focuses on one marketing tool proven to work in the past, hones that specific tactic, and then maintains and continuously optimizes the process that supports that tactic over the long run. For Engineer strategists, the advisor marketing process can be broken down into three “ART” phases: Audit, Run, and Tune.

In the Audit phase, advisors and their firms evaluate their current inventory of marketing tools and identify the characteristics of the firm’s typical (and hopefully ideal) client – in a photographic ‘client picture board’. Pictures are important to illustrate the advisor’s ideal client, because the exercise can only be successful if the advisor has a deep enough understanding of their clientele to find the ‘right’ pictures to begin with. Thus, the Audit stage is instrumental in helping advisors to picture their clients clearly, which in turn clarifies how best to connect and speak to those prospects and turn them into the new clients they most want to attract.

In the Run phase, the firm identifies one marketing tactic that will serve to connect (and to keep connecting) with the target client identified and ‘pictured’ in the Audit phase. The focus is on establishing a meaningful rapport with the particular type of target prospects pursuing one specific channel where the firm can best reach out to their audience (e.g., podcasting on a topic that the firm’s clients would be particularly interested in). Which, notably, means that this is not the stage to update the firm’s design elements such as the website or logo. Instead, the important point in the Run phase is simply to focus on one strategy, and prepare to refine that one strategy to be even better… not to layer multiple marketing tactics that spread the firm’s attention too thinly to Tune any one in particular.

In turn, in the Tune phase, advisors review their now-primary marketing strategy, and assess what is working (and what isn’t) by gathering key data to make relevant adjustments along the way. Specifically, lead flow data measuring how many people (who weren’t referred by an existing client) actually contacted the firm to schedule an appointment, is the key statistic that can give insight about how effective the marketing strategy is at connecting with its target audience. Tuning a strategy is often simply a matter of expanding the scope of expertise offered through the strategy (e.g., for a strategy that relies on podcasting, perhaps the scope of topics can include stock options instead of just estate planning), as well as improving how the strategy connects to its target people in a sustainable and consistent manner.

Ultimately, the key point is that advisors who want to grow their firms through marketing efforts don’t need to invest in an array of marketing tactics, nor do they need to restructure their teams to rely on a rainmaker to do it for them. Rather, the more efficient way to successfully market an advisory firm is to focus on the ART of the marketing process – Auditing the firm’s existing marketing efforts to identify and hone one effective tactic to use, Running the marketing strategy identified over a long period of time, and continually Tuning the process to become a successful and sustainable strategy. Going deeper into one specific, carefully chosen strategy, and optimizing it, before choosing to add new marketing tactics into the mix, will likely prove to be a much more effective and efficient process in growing the advisor’s firm… and will serve to connect more meaningfully with its clients!

Advisors across the country are inundated with LinkedIn messages, Facebook advertisements, and industry publications that all relay the same message: If you’re not growing, you’re dying – and the only way to grow and compete is to allocate more of your budget to marketing.

But the pressing question advisors need to solve is not how much they should invest in marketing, but rather how to invest in marketing.

Marketing is a critical component to building any business, but what I have learned is many advisory firm owners do not truly understand how marketing works, what it actually is, and how to invest in it.

What I have found, more often than not, are advisory firm owners draining their businesses on marketing plans, website updates, email campaigns, podcasts, blogs, etc. – tactics – without funneling much or any new revenue back into the firm. This is not to say that tactics are not important. They are. However, without the proper strategic foundation and leadership frameworks, marketing tactics rarely work.

To fully understand marketing and its impact, we must begin at the very top of the organization, with advisory firm business owners and their marketing strategy. All firms have a marketing strategy, whether they know it or not, which typically comes from the founder – the leader of your firm – though most firms don’t know it. It can be subconscious or conscious, written or unwritten. No matter where it exists or how effective it is, it exists somewhere within the firm’s leadership.

Many leaders believe a marketing strategy is a financial projection or a list of goals. What it really is, though, is their actions and behaviors – leadership decisions. So, before we can get into really understanding how to market an advisory firm, we must first get to know the firm’s marketing strategy. And, to do that, we have to look at leadership.

The beauty of being consultants to advisory firm owners and having worked with over 1,000 of them, we begin to recognize shared behavior patterns among leaders. In other words, we see the same core problems repeated many times. When it comes to advisory firm marketing, the behavior patterns are often obvious… and fortunately, that leads to some straightforward strategies in how to reframe the firm’s marketing strategies for the better.

Three Ways Financial Advisors Approach Marketing

There are three types of advisory firm leaders and how they approach marketing strategies: an optimist, a pessimist, and an engineer.

Marketing As An Optimist – Glass Half Full

An optimist, of course, believes the glass is half-full. Their marketing strategy is singularly focused on “stuff”. The typical optimist says, “If we just had a [insert marketing tactic, like, podcast, SEO, better website, etc.], we would have all the growth we need.” Because they’re optimists, they assume the tactics will work, it’s just a matter of getting enough of them in play to do so. Accordingly, most of their leadership decisions, whether they know it or not, are focused on new marketing stuff – they want to fill up the glass.

Generally, when we look at the profit and loss statement of an optimist marketing leader, they are spending most of their overhead on direct marketing campaigns… tactics that give them more at-bats to turn prospects into business, because they’re optimistic that if they keep giving themselves enough swings at the plate, they will get some hits. In practice, this includes direct mail, seminars, radio shows, podcasts, website design, email campaigns, white papers, marketing consultants, etc.

Marketing As A Pessimist – Glass Half Empty

On the flip side is the pessimist. Where an optimist looks externally for more marketing “stuff” to fill up the growth glass, a pessimist believes the glass is half empty. Empty of what? Advisors who can develop more business. At their core, the pessimist does not view their people in a positive light and, as a result, they believe poor growth stems from poor marketing performance from their advisor team.

A typical pessimist says, “Our advisors need more business development training,” and/or “We need to get rid of the advisors who don’t develop business and hire ones who do.” Many pessimists will focus solely on business development training within their advisory teams, hire salespeople, and complain wildly about how their advisors are not developing business.

The marketing strategy of a pessimist leader is clearly seen in their gross profit margin. Often, they spend most of their money on compensation plans, business development bonuses, and salespeople to get the marketing job done. They hire consultants for professional development plans and compensation structures to motivate and push new client acquisition through rainmaking. Their solution is more about performance reviews and tighter control over their people.

The typical pessimist thinks, “Our advisors aren’t performing right now, but if we can just make our people do what we want them to do, our growth problems will be solved.”

Marketing As An Engineer – Creating Sustainable Strategies

I would argue that most of the advisory firm leadership marketing strategies fall into one of the first two categories above, meaning their solution for more growth is either more and better marketing tactics (for the optimist) or more and better business development talent (for the pessimist).

The problem with both approaches is that they are not logical, and because of that, they are often not fruitful, at least not as fruitful as they could be from our marketing perspective.

The flawed logic is that more marketing tactics do not always mean more clients, as it can result in a lot of waste along the way. Often, less is more. Similarly, it’s illogical to assume that growth can be solved by just finding rainmakers, both because they are rare, and because if they are so great at developing business, why do they need to work for your firm (instead of just going out to start their own)?

By contrast, I’ve found over the years with the advisors who I’ve had the privilege of consulting, that those who lead the best firms – the firms that consistently grow year over year, even during down markets – understand that the critical first step of any business is sustainability.

Creating a sustainable marketing strategy requires being intentional about marketing, being able to maintain marketing programs that work, and being able to retain talent who can serve the clients year after year.

An optimist will jump from one marketing tactic to another, often layering marketing on top of marketing on top of marketing, giving no thought to what is working, betting on a positive hope that the next tactic will work better. Optimists change strategies constantly and are always on the lookout for a new marketing plan… and in the process, fail to nurture and sustain the programs that were already working (and might have compounded better and built more momentum over time).

And a pessimist does the same, only they do it with people, often jumping from person to person, hoping they will find rainmakers who stay at the firm for more than five years and letting go of any advisor unable to bring in the clouds to drop the rain, only to lose the ones who are successful at rainmaking when they realize they could actually do it on their own and build their own equity instead.

To maximize the firm’s marketing efforts and thus its growth, it takes skilled leadership to move away from the optimist and pessimist mindset by making decisions with an engineering mindset instead.

An engineer builds a marketing machine, lets it run, and then tunes it year after year, never abandoning it. To grow through external marketing strategies, which include all organic growth marketing strategies that do not involve maximizing client referrals (which are done through client services programs, often called internal marketing), the firm must engineer its marketing.

The ART of Thinking Like an Engineer – How To Audit, Run, And Tune Your Advisor Marketing Strategy

Thinking like an engineer always begins with a process, and the advisor marketing process I’ve found that works is “ART”, which stands for Audit, Run, and Tune. It is a simple yet effective three-step marketing strategy for an advisory firm’s external marketing programs. Let’s walk through each step so you understand the strategic framework to apply to your marketing efforts and how you can begin building external marketing programs that will work for your firm.

AUDIT

To start, you need to know where you are. In the Audit step, you are going to inventory all of your marketing tactics and create a client board. I would encourage you not to be a pessimist by thinking about your people as your problem. Rather, you are going take a hard look at your tactics and who you are trying to attract in the first place.

In this stage, generally, leaders who tend to think like optimists will have a lot of cleaning up to do because there will be a lot of marketing tactics half-running or abandoned. Those who think like pessimists will have extraordinarily few marketing tactics, if any, in their system.

Audit Step 1: Create An Inventory Of Current Marketing Tactics

Creating an inventory of your marketing efforts is simple. To begin, look at your profit and loss statement. Are you spending money on a website, email campaign, podcast, advertisements, an intern to post social media announcements, cold calling, book, etc.? Make a complete list of everything you are spending marketing dollars on. At this stage, all you need is a list; you are not going to do anything with the list (for now) except make it.

In my experience helping advisory firms work through their marketing strategies, the act of making a list is often one of the most eye-opening experiences for advisory firm leaders. A list creates a comprehensive view of everything you are doing; it also clearly shows what you are not doing.

Some of you are going to find that you have nothing on the list except for maybe a website (although we have had clients with no website). And there are other firms who will find that they have an exceptionally long list, full of work that is producing nothing in return (and/or that only a handful of items are producing all the results and the rest are wasted).

The list is the first step to getting you aware of where you are and what you are doing, if anything at all, so you can decide what you should be doing next.

Audit Step 2: Create a Client Picture Board

Good marketing disqualifies as many prospects as it qualifies. In other words, if someone is not the right fit for your advisory business, then that should be clear to them before they even decide to reach out to you for an initial consultation.

You have likely heard business consultants say that when you’re successful, you say no as much as, if not more than, you say yes. Good marketing operates on a similar principle – your marketing efforts need to be narrow enough that the wrong prospects do not get in. In this case, the prospects are the ones saying no to you, rather than vice versa, saving you both the time it would have taken to discover this in a first-meeting that was doomed to fail anyway.

Disqualifying the wrong prospects without scaring away the right ones involves really knowing your clients. It begins with understanding who they are and what is important to them. A large part of knowing your client is being able to look at your current client base and not wishing you had a different group of clients.

Many marketing consultants tell you to find your ‘niche’ or ‘ideal client persona’. Herbers & Co. says… you already know it. Your niche and ideal client persona are defined by the clients you are currently serving. The only thing you need to do is to understand more deeply who they are, and then to add more of them to the system.

Many consultants tell advisors to fill out worksheets and write a bunch of characteristics about their ideal client. While some may find that to be a helpful exercise, at Herbers & Co., we believe if you cannot identify your current ideal client using only pictures, then you do not know them well enough.

So instead, we help advisors put together a ‘client picture board,’ which is a series of photographs that show what the client is like, what they value, and what they need. (Here is a basic sample of a picture board, but often they are much more detailed than this sample.) The goal is to take your time and capture all the qualities of your client base. If you cannot put together the picture board, in detail, you don’t know your clients well enough.

The picture board can include images as simple as showing where the client most likes to eat. Do they prefer a simple restaurant like In-N-Out, or do they prefer Michelin-rated restaurants? What kind of house do they live in? Do they wear a watch—and if they do, is it an Apple Watch or a Swiss creation? What kind of clothes do they wear? Is it an individual or a couple? Are they an executive in New York City, or a creative who lives in a downtown loft with floor-to-ceiling windows? The options are endless.

Whatever kind of client you are serving, the picture board drives all the content and messaging you write and/or talk about within your marketing efforts in the future. The picture board should be incredibly detailed and when you look at it, anyone can see exactly who you are trying to attract to your firm. If you can’t look at a series of pictures on a picture board and identify who you are serving, then your marketing will never work the best it can.

And that is because to understand, connect, attract, and speak to the deeper needs of a person, enough to get them to contact you, you have to first have a clear picture of how they use their money. A person may have a million dollars in the bank, but what does the million dollars represent to them?

The mistake most advisory firms make is that they focus solely on how much money a client has to manage, and not on what the client thinks about, uses their money for, and the meaning behind the money they have. An important and often overlooked aspect of external marketing efforts by advisors is that it is nearly impossible to attract a client based solely on what is in their investment accounts.

A client picture board gets you focused on the type of person you serve, and what their money represents to them. Which, in turn, gets you focused on the service you offer and talking with clients about how those services will help them, instead of talking about you, your firm, and all your accomplishments.

I get it, you want more clients. But from a marketing perspective, the best way to attract them is to talk about them, not you. To do that, you must know them – and really know them well – so well that you can picture them!

RUN

Once you have an inventory of the marketing tactics you have in place and your client picture board in hand, the next step is to run some marketing programs.

Generally (actually, nearly always) advisory firm leaders get their list, look at their picture board, the first thing they think is… we need to update our logo and/or website.

Now, I realize many marketing folks are not going to like me saying this, but let me say this bluntly: updating your logo and website is design. And, at this point, design is a distraction from doing the marketing work. Marketing is about communication and while, ideally, we want you to have the perfect website, the fact is that we need to begin with making meaningful connections using one marketing tactic consistently.

The Run stage is about connecting with people and figuring out how your firm can stay focused on connecting with people. A logo and website redesign can be quite fun, but they don’t bring in clients. Connecting with people does.

So, at this stage we need to find the marketing tactic and the message that connects with people the best, with the goal of attracting as many people as possible who otherwise know nothing about your firm and who were not referred by a client.

In order to attract these strangers, we are going to pick one marketing tactic (from your list or a new one) and one segment of clients on your picture board and run the tactic within your target client. Here’s where many advisory firms get stuck: They look at their client board and realize they have a mishmash of clients and a mishmash of marketing tactics. That’s okay… not a big deal… don’t worry about it! The goal is one thing at a time and all we need to do is get one sustainable marketing program running and do it consistently.

We often get advisory firms asking: “Which marketing tactic and segment should we pick?” To pick the client segment and marketing tactic, use a roulette wheel. Well, I am kidding, kind of. The reality is all marketing tactics work. It’s about finding the one that works for you and the clients you want to attract and do it over and over again. And the one that often works for you and your firm is usually the communication method you and your clients like best. You and your staff might like to write more than speak, so you choose blogging. You and your staff may like conversational communication best, so you choose a podcast. There are hundreds of options to choose from to communicate with people.

With that, here’s an example of what this might look like in your practice.

Let’s say you want to connect deeper with your retirement client segment who are five years away from retirement, and you are most comfortable talking, rather than writing about it. You decide to start a podcast (or refocus the podcast you are currently doing that is unfocused). Make retirement and all the nuances of retirement on your podcast your firm’s ‘thing’.

Now, again, here’s where many firms get tripped up. They think they need to put the podcast on their website, social media, run email campaigns, etc., to make the podcast effective. But much of this is overthinking the process and stops you from actually doing it.

Let’s just say you do nothing with it other than make it available on Apple Podcasts and you kept doing it for at least eight months without putting it on your website, social media, or emailing to your clients? You just did the podcast, and through that experience, you learned and got better with each podcast you did. (And some people may be finding you already because Apple Podcasts is a big marketplace unto itself!)

The problem with marketing that most advisory firms often have is that they try to do too much at one time, which is the core reason it fails. Once you find success at running one program and get used to doing it, then you can begin to layer on more marketing tactics. Or expanding the reach of the tactic you’re already doing.

Thus, the next step might be to post the podcast on social media, making a transcript, and posting it to a blog on your website, etc. Any type of marketing you do depends solely on simply running it and continuing to run it according to your client board.

Once you have your chosen tactic running for a long enough period of time, then you can work on Tuning it, which is the last stage in the ART process.

TUNE

The Tune phase of marketing is all about making the right decisions about what changes to make in your marketing programs to make them more effective, and those decisions all rely on gathering good data. Without good data, you have nothing.

Here is what we don’t ask advisors to track (most marketing consultants disagree with me, but of course they get paid to tune these metrics): email open rates, website hits, and other technical data. Ignore those metrics … really, ignore them!

I have seen some phenomenally successful marketing programs run on the fewest social media followers and terrible open rates by open rate standards. And, I have seen terrible marketing results with high open rates and a lot of social media followers, by industry standards. It’s not about the quantity that matters, especially when you are starting, it’s about the quality of your programs. And many times, it takes extraordinarily little to get marketing right because, as I have said before, marketing is simply good communication.

Here’s what you do want to track, and it’s very simple: lead flow. How many people who are not client referrals are contacting you and scheduling an appointment? Lead flow is measured by the number of contacts you are getting, in a period, who are also scheduling an appointment.

For example, let’s say in October you have ten people download a white paper, six people sign up for your newsletter, twenty people send you an email and two people call you. This is 38 people in October who interacted in some way with your firm. Interaction is a great first step, but the goal is for them to take action. Of the 38, only 20 scheduled an initial client appointment with your firm. Your lead flow is 20. The goal each month is to increase lead flow, because without an appointment with your firm they are still stuck in inaction.

(As a side note: One of the easiest ways we generate growth in optimist run firms (where there are many marketing tactics running) is to send an appointment scheduling link out to everyone who is downloading a white paper and adding themselves to your newsletter list from your website. Many marketing consultants tell you to gather as many emails as you can through downloads, subscriber buttons on websites, etc. and run email campaigns. These are good steps, but instead of just putting them on an email list, send them an email to schedule an appointment with you. You would be surprised at how many clients you can generate by asking them to schedule an appointment. Moving a person from inaction to action is, well… one job of a financial advisor.)

Here is the important part of the Tuning phase: you may only have one person contact you and schedule an appointment in one month, but the goal is to have two people the second, three the third, and so on. The goal is to get your lead flow trending up. You can have a great social media presence with thousands of followers, an email open rate that is off the charts, and tons of website traffic – but if you aren’t getting people to reach out and schedule appointments, then none of it matters.

Tuning your marketing programs is all about expanding on what you are doing well or improving it even further. Often, that means simply expanding your scope of expertise – but not necessarily the types of content you create. Advisors often believe they need to do everything and create podcasts, emails, blogs – everything. The reality is most all marketing tactics work if you do them long enough, so the goal is to pick one and keep it going. Right when you think it’s not working and/or you get bored and tired of doing it, is most often when you start to see results. This is because, well, you got good at doing it. Then, from there, you can layer on more… of the same.

For example, if you have a successful podcast about estate planning, then you already have an audience who follows you for one thing—podcasting. It is much easier to ask them to follow you to a second podcast about a new topic, like stock options, than to attempt to expand into a blog and try to bring your current followers along for the ride.

Or better yet, simply focus on growing the listenership of your first podcast, and figuring out how to better turn your listeners into leads and clients, rather than adding more podcasts, more blogs, and other tactics. Because, again, the key to advisor marketing is sustainability and consistency.

Marketing comes down to one simple idea: When something is working, do not go away from it – go deeper with it. If you do that, marketing is simple and you will have all the clients you need, no matter the size of your firm.

That’s Great!! Thanks for sharing.

Best POS Software and App in Bangladesh.