Executive Summary

One of the largest hurdles for many financial advisors is not in developing the technical skills to be able to give good advice to clients, but in learning how to engage effective marketing strategies that are essential to growing and sustaining a successful advisory firm. Unfortunately, this struggle to attract a critical mass of prospective clients to actually pay for an advisor’s services has resulted in a very high attrition rate in the advisory industry (as high as 70% in the first three years). Accordingly, there has been a great deal of attention on identifying the ‘best’ marketing strategies for financial advisors to help them grow their businesses.

However, there have been surprisingly few studies exploring effective marketing practices in the financial advisor industry over the past years. Which is why we launched the first Kitces Research Survey on Advisor Marketing in 2019, to identify the marketing strategies financial advisors are really using that work (or not), what tools, technology, and systems advisors use, best practices in the most popular advisor marketing techniques, and what advisory firms really spend on marketing (including hard-dollar marketing costs, tools and technology, and staff support). Our study revealed that, while some of the most popular marketing strategies actually being used by advisors were those that required a large investment of time (such as establishing relationships with COIs, social media, and other forms of networking), many of these popular time-based marketing strategies turned out to be among the least effective at using the firm’s resources (i.e., time and money) to generate new clients. Conversely, strategies with comparatively modest investments of time and dollars (like SEO strategies and paid web listings) were far less common among the advisors surveyed in the study, yet ended out having the lowest Client Acquisition Costs!

Accordingly, pursuing more resource-intensive marketing channels – that potentially involve both time and money – can be a worthwhile effort in helping advisors attract more clients (for instance, cultivating relationships with COIs with affluent client bases, which potentially requires many hours of an advisor’s time, could yield more high-net-worth prospects than less resource-intensive marketing strategies) by generating enough new revenue that makes the time invested worth the effort, even if they may seem less ‘efficient’ in terms of the acquisition cost per client than those requiring fewer resources. These considerations become increasingly important as an advisory firm grows in terms of clients and revenue, because the larger a firm grows, the more difficult it is to scale time-intensive marketing channels (like COIs and networking) with that growth, since the advisor’s time gets both more valuable and more scarce. Ultimately, investing into more efficient – and scalable – marketing strategies can be a key component of sustainably growing an advisory firm as it becomes easier to spend the resources on dollar-based strategies than on time-based strategies.

To dive deeper into the costs and efficiency of various marketing strategies, we are excited to announce the 2022 Kitces Research Study on Advisor Marketing, which will examine how advisors’ marketing strategies have evolved over the course of the COVID-19 pandemic and explore further what the fastest-growing advisory firms are doing to market themselves at scale. All advisors are invited to participate and help the advisor community better understand “What Actually Works In Advisor Marketing”– and hopefully gain some insight into how they can improve their own marketing efforts as well!

How To Measure The ‘Best’ Marketing Strategy?

When it comes to professional services – including financial advice – service providers may work with a wide range of clients in a wide range of circumstances, such that it seems almost every professional conducts their affairs at least a little bit differently. Which eventually leads to “best practices” research to determine what the most effective strategy or tactic may be for a particular situation.

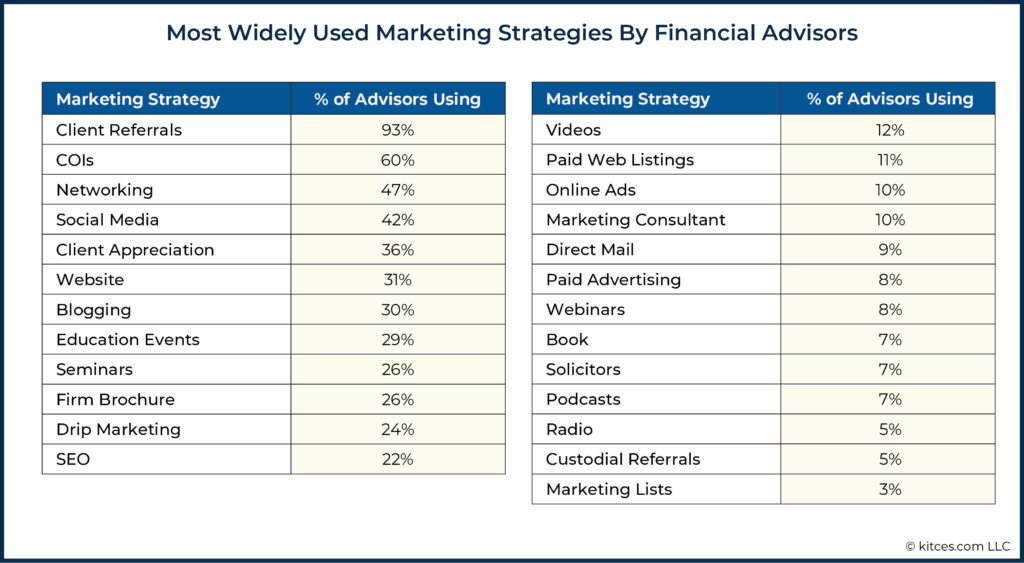

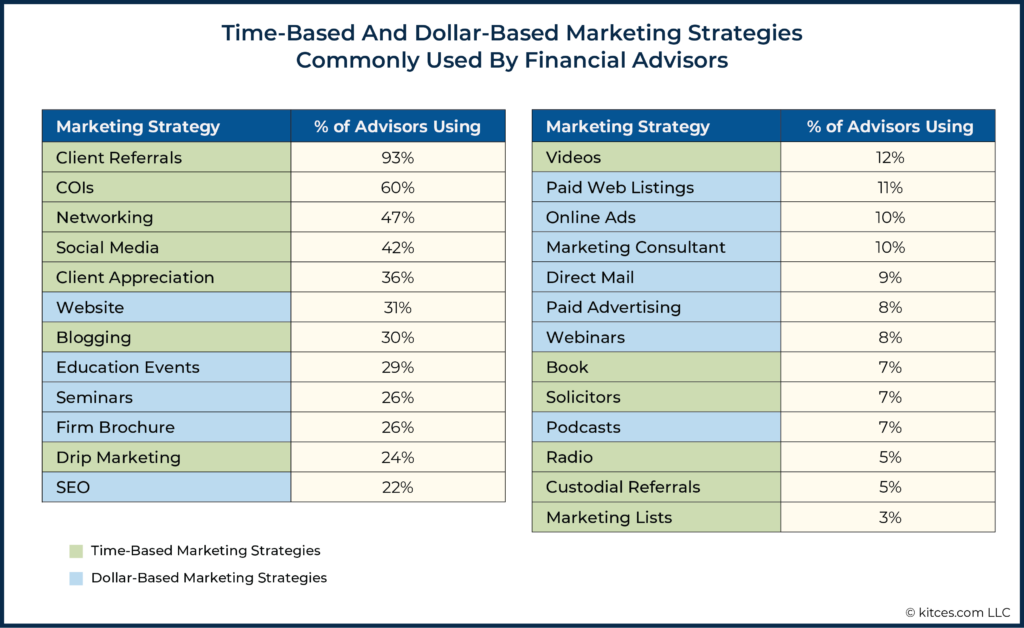

And in the particular case of what it takes to grow an advisory firm, the answer seems rather clear: getting clients by referral, which is overwhelmingly the #1 most adopted marketing tactic by financial advisors, with 93% of advisors in the last Kitces Research on Advisor Marketing stating that they had gained new clients via referrals in the preceding year. (The other 7% were presumably so new they just didn’t yet have any clients to refer them!?)

Overall, the most popular marketing strategies for financial advisors aren’t entirely surprising – they’re the strategies that are often discussed in industry trade publications, including getting referrals from clients, establishing relationships with Centers Of Influence (COIs) like attorneys or accountants who can provide referrals, and general networking strategies (or their ‘digital’ equivalent via social media), along with running client appreciation events.

The caveat, though, is that not all of these strategies require the same effort. Generating growth via referrals is especially efficient because they’re mostly inbound – clients refer because they have a friend with a problem that the advisor can solve, and the advisor often needs to do little to generate the referral beyond the meetings and service that are already being provided to the client.

Whereas other strategies like establishing relationships with COIs or going to networking meetings can be especially time-intensive, requiring hours upon hours of time investment to build the relationship before opportunities begin to come. Which means evaluating which of these are really the best – and not simply the most popular – means looking at not only what’s ‘working’, but how well it’s working, by determining how many clients are generated relative to the investment.

Evaluating Marketing Strategies By Client Acquisition Cost (CAC)

Evaluating marketing strategies based on their investment cost is especially important because, as the earlier chart shows, most advisors choose strategies where they invest their time (e.g., establishing COI relationships, networking, and social media), rather than those requiring a hard-dollar financial outlay (e.g., paid web listings, or buying marketing lists or direct mail, or outright paying for online or print advertising) that tend to be far less popular.

Yet as the saying goes, “time is money”, and more generally, the decision to engage in dollar-driven strategies can actually help free up the advisor’s time – albeit at the financial cost of the strategy itself – which means it’s necessary to evaluate both time-intensive and dollar-intensive strategies consistently, to really understand whether it’s more cost-effective to spend time or dollars to generate marketing growth.

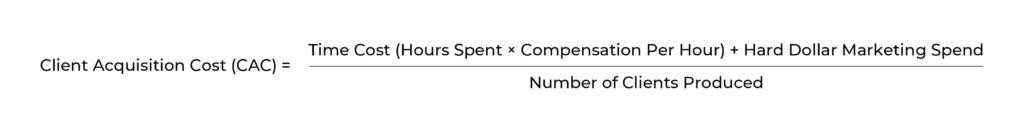

The most straightforward way to evaluate this is to look at the Client Acquisition Cost (CAC) of each marketing strategy – the total cost in terms of either hard dollars or the ‘time cost’ (e.g., the number of hours the advisor spends to get a client, multiplied by the cost of their time based on their own compensation) – and divide the total costs by how many clients that strategy produces.

Which can lead to a very different ordering of what is really the ‘best’ marketing strategy!

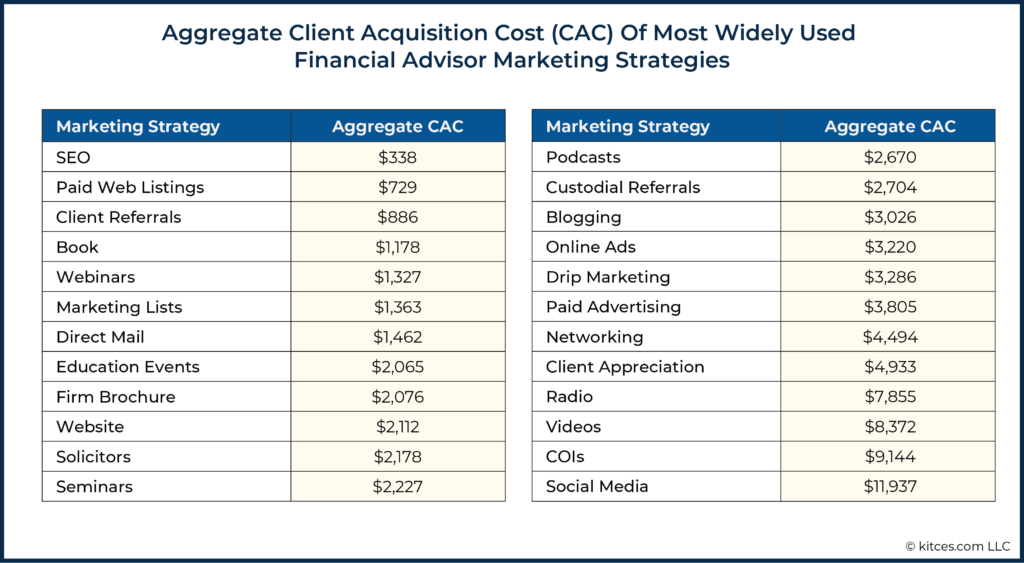

From the lens of Client Acquisition Costs (CACs), which marketing strategies are ‘best’ suddenly looks quite different. Investing into Search Engine Optimization (SEO) jumps to the very top of the list, as while the total investment of time and dollars to optimize a financial advisor’s website once is relatively modest, once done, it can generate an ongoing flow of new clients in the months – or even years – that follow as consumers seek out financial advisors online.

Similarly, signing up for various paid web listings (e.g., the Find An Advisor profiles via NAPFA, the FPA, CFP Board, XY Planning Network, and the Garrett Planning Network) also entails a limited annual cost (typically as part of membership dues, or as a standalone fee in the case of FeeOnlyNetwork), but once signed up can produce multiple clients for that one modest cost.

In this context, strategies like Client Referrals still show in the top 3, as the required investment of time to generate a client is still rather modest, given that most of the time the advisor spends is what they would have spent just to maintain the relationship anyway.

However, other popular time-intensive strategies like networking, working with COIs, and social media, fall to the very bottom of the list, as once the cost of the advisor’s time is considered, it becomes clear that attending as many as one or two dozen hours of meetings to establish a single referral relationship is actually quite inefficient (as reflected in the high Client Acquisition Cost).

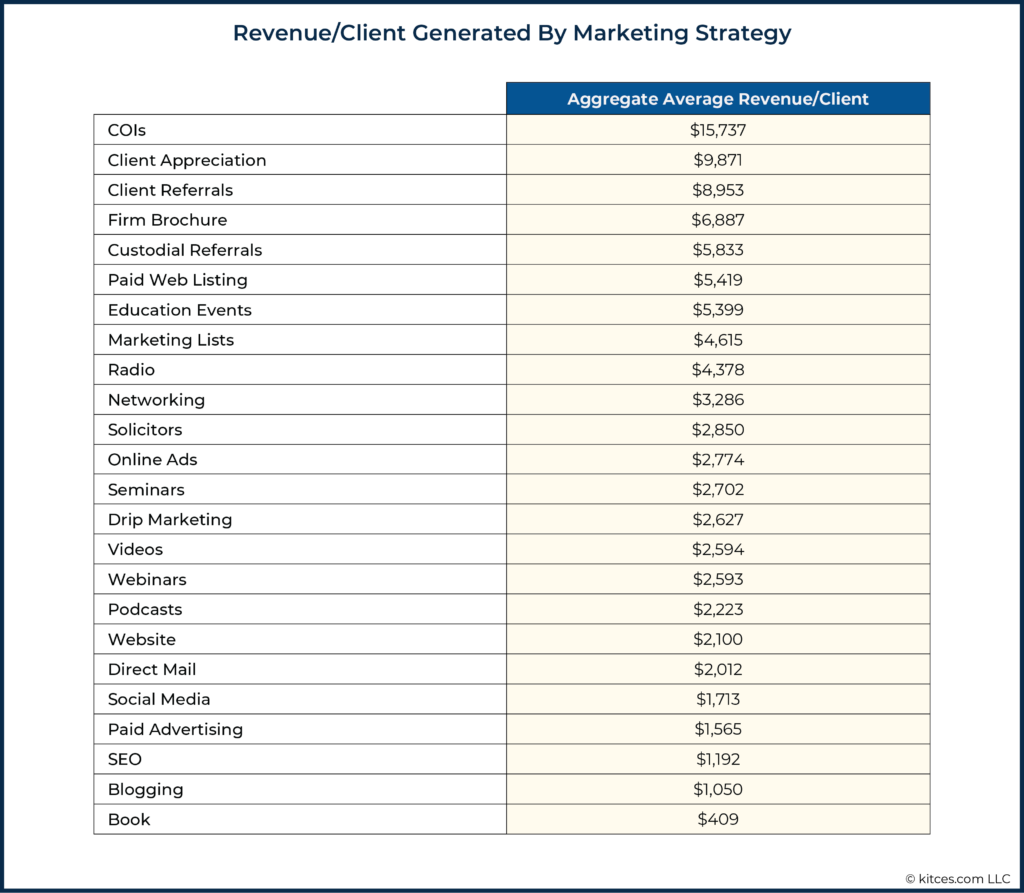

On the other hand, not all advisor marketing strategies produce the same ‘quality’ of clients. In part, because some types of prospects are faster to close depending on their marketing channel – those that come via a referral tend to be more trusting of the advisor (per the referral itself) and close more quickly, while other channels (e.g., cold leads from direct mail) may take more effort to convert to a client.

In addition, the simple reality is that some channels are more likely to generate more affluent prospects, generating a greater amount of new revenue growth for the advisory firm with the same number of new clients.

As the chart above shows, when it comes to generating the most affluent clients, referrals from attorneys, accountants, and other COIs – who are most likely to already have relationships of trust with High-Net-Worth (HNW) prospects in the first place – are the most effective, with an advisor-wide average referral of over $15,000/client (amounting to a $1.5M to $2M AUM referral on average, for most advisors following an AUM model).

And for advisors already trying to ‘clone’ their top clients, appreciation events and asking for referrals from those top clients also tends to produce more affluent clients, with an average new relationship of nearly $10,000 and $9,000/year, respectively. Other strategies that produce relatively affluent prospects include paid web listings, educational events, marketing lists, and custodial referrals.

At the same time, looking at the average affluence of clients highlights that SEO may produce a large volume of clients, but it tends to include a lot of less-affluent clients (given that most advisory firms are not well-targeted to HNW clients via their websites). The same goes for social media and blogging online, and especially for books.

The Efficiency Of Marketing Strategies Accounts For The Cost And Revenue Involved In Obtaining New Clients

Ultimately, the significant impact that client affluence has on firm revenue and profitability suggests that advisor marketing strategies should really be evaluated as a combination of the average expenditure of time and/or dollars to get a new client (i.e., Client Acquisition Cost), compared to the average revenue generated by the new client (i.e., Revenue/Client).

For instance, if an advisor spends $1 in acquisition costs to get $1 of revenue (or perhaps more commonly, spends $5,000 on a marketing event to get a $500k AUM client that will pay $5,000/year in fees), the ‘marketing efficiency’ of the strategy would be $5,000 CAC ÷ $5,000 revenue/client = 1.0. Which, in the long term, is actually quite profitable for the advisory firm, given that the ongoing relationship may stay for 10, 20, or even 30+ years (which means a cost of $5,000 upfront could generate $100,000–$150,000 of cumulative revenue over a multi-decade client relationship!).

Nerd Note:

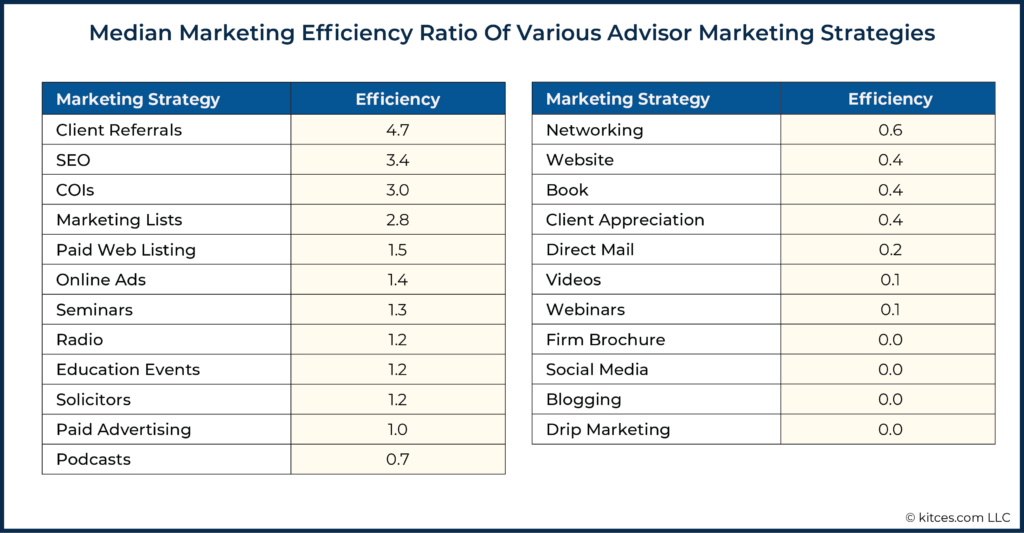

Because the distribution of clients is not consistent across strategies – with some advisors producing a small number of very large clients – the marketing efficiency ratios cited here are based on the median (50th percentile) result, not the average, which should be more representative of what a typical advisor may be able to achieve.

By this measure of marketing efficiency, client referrals once again rise back to the top – generating on average almost $5 of revenue for every $1 of marketing cost – while SEO strategies also rise again (generating on average more modest revenue/client, but at a low enough cost that it is still a good financial deal for the firm), along with COI marketing (which is cost-intensive due to the time involved, but generates a strong ROI because of the affluence of the new clients it generates).

In turn, a number of marketing strategies all generate a marketing efficiency ratio greater than 1.0 (which means the typical new client more than recovers the entire cost of the marketing in just the first year), including marketing lists, paid web listings, seminars, radio, educational events, solicitors, online ads, and other paid advertising approaches.

On the other hand, some marketing strategies still struggle. Given the time involved relative to the clients produced, networking is still inefficient, with a marketing efficiency ratio of less than 1.0. Client appreciation events are also relatively inefficient; as while they do tend to produce more affluent clients, it may only be 1–2 per event, and at a very high cost of time and dollars to execute. While strategies like social media are so time-intensive relative to the few and less affluent prospects they tend to generate that the marketing efficiency ratio is so poor it rounds to zero!

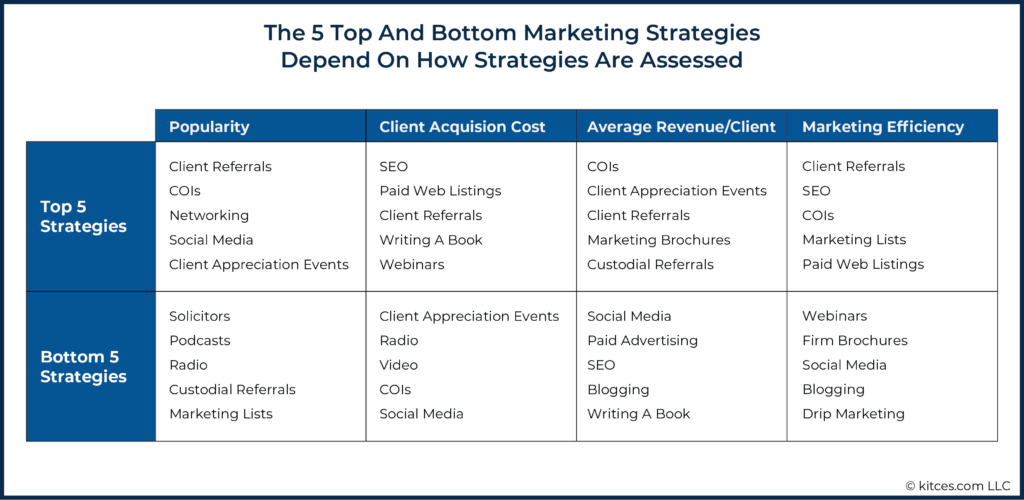

The key point, though, is that the determination of what marketing strategy is ‘best’ depends on how ‘best’ is measured in the first place, as measuring by popularity, client acquisition cost, average revenue/client, or median marketing efficiency, all produce substantively different results!

The Marketing Efficiency Of Hard-Dollar Tactics

One of the interesting dynamics that comes when evaluating Client Acquisition Costs – which are a combination of hard-dollar financial costs and the ‘time cost’ (the imputed value of the advisor’s time for all the hours spent on the marketing strategy) – is that while the financial and time factors both are input costs, in practice, advisors overwhelmingly tend towards strategies that are primarily driven by investments of time and not dollars.

To some extent, this is simply a reflection of the reality that when most financial advisors get started, they have very little in the way of dollars in the bank, and what dollars they do have saved are typically held to maintain their personal cost of living until their practice grows to the point that it can generate a sufficient income to maintain themselves. Which means most advisors don’t have many dollars to spend in the first place. But getting started from scratch means they do have a lot of time – and not many clients yet to serve with that time. So it is only natural that advisor marketing strategies skew towards the available-time-but-not-available-dollars path.

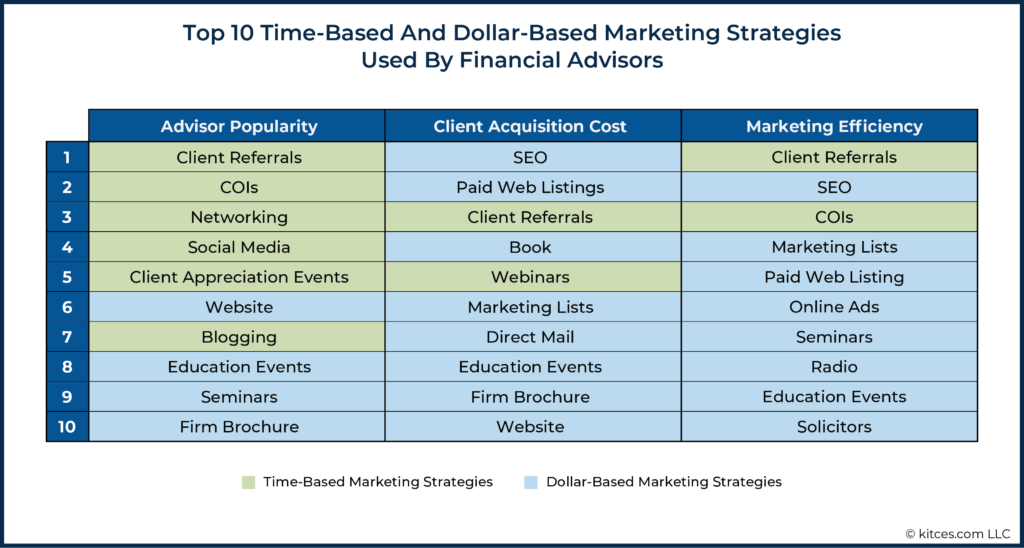

However, when viewed through the lens of not only what is popular, but what generates clients in a cost-effective manner (i.e., has a low Client Acquisition Cost), and what is truly marketing efficient (revenue generated relative to the marketing cost), a different picture emerges: while 6 of the top 10 most popular strategies are time-based, the most cost-effective and marketing-efficient strategies are almost all dollar-based.

In fact, as it turns out, all of the time-based marketing strategies except client referrals (which are especially time-efficient, with an efficiency ratio of 4.7), and COI marketing (which tends to produce more affluent prospects and has a ratio of 3.0) have marketing efficiency ratios below 1.0!

This distinction – that time-based strategies are most popular amongst advisors, but ultimately prove to be the least efficient – appears to be driven by two factors.

The first is that as advisors grow their careers over time, their earnings rise, which literally means their time becomes more valuable (and thus more costly). So what may actually be a reasonably cost-effective strategy early on (when the advisor has little in the way of clients or revenue, so the opportunity cost of their time is very low) becomes very inefficient as the cost of the advisor’s time climbs.

The second is that most advisory firms struggle to expand the capacity of their time-based marketing strategies across the team as the firm grows beyond the original advisor/founder. After all, the amount of time we have available is fixed, and the exposure an advisor can generate from their time is fixed when it’s focused mostly on 1:1 relationships.

As a result, the firm gets larger and larger but the advisor’s growth contribution becomes a smaller and smaller percentage of the firm’s growth. Which eventually leads to the firm hiring new advisors to both service clients and bring in new ones. Except the new advisors have both more hard-dollar costs (in the form of salary), less experience (which means results come slower), and tend to be less inclined towards business development in the first place (or else they’d be starting their own firms from scratch), which means they’re still much less marketing efficient than the original advisor was, even as the firm becomes increasingly reliant on them as growth drivers... leading to waning marketing efficiency of time-based strategies.

By contrast, marketing strategies like a direct mailer announcing an in-person educational event can simply be dialed up or down with marketing spend on a relatively consistent basis. The firm can choose to send more mailers and do more seminars without necessarily facing as rapidly-diminishing returns as trying to expand to more advisors to do more time-based networking and similar marketing strategies.

Scalability Of Advisor Marketing

The challenge of expanding an advisory firm’s marketing and growth capabilities beyond the founder – e.g., by hiring additional advisors to support in business development – isn’t unique to ‘just’ firms that grow beyond the founder’s individual ability to support them. More generally, it’s a constraint for any advisory firm that wants to have more scalable growth, as there’s little way to scale up the founder’s available time, which is fixed.

In other words, if the firm doubles its size and needs to double its absolute level of growth to keep pace, it can’t double the founder’s time dedicated to marketing, and it’s difficult to double the average affluence of the clients the founder attracts. Similarly, a firm that just wants to grow faster, and double its current growth rate, generally can’t double the time it spends on marketing to produce double the results. But… the firm can double its marketing spend.

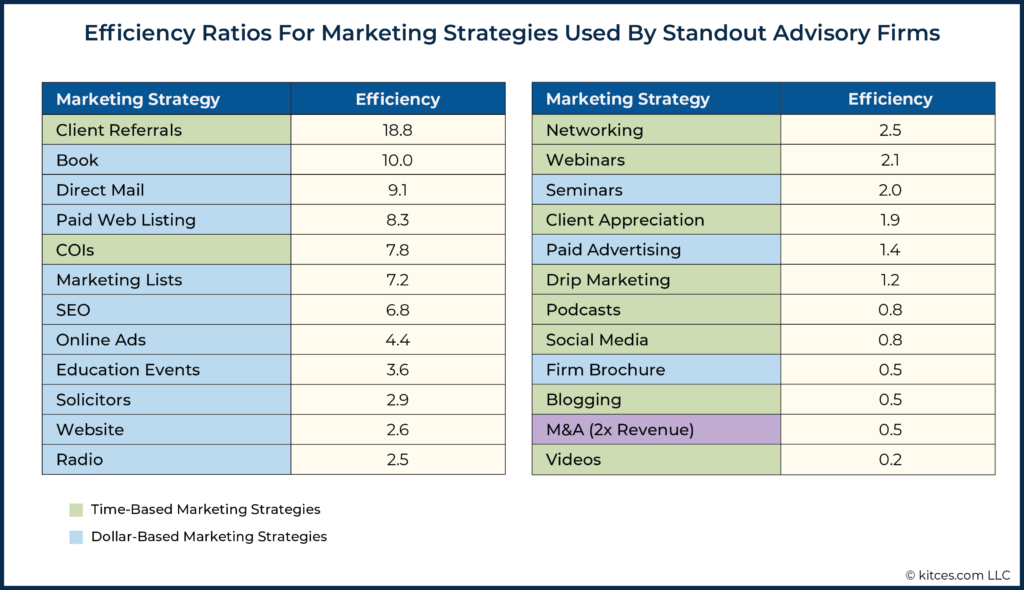

Accordingly, when we look to the Kitces Research on marketing tactics – and their relative efficiency – of the standout firms (those in the top 25% of marketing efficiency), we see that dollar-based strategies continue to dominate, and even the ‘time-based’ strategies are in areas where the dollars support and amplify the advisor’s time, such as writing (and distributing and promoting) a book, or hosting (and buying airtime in more markets for) a radio show.

In fact, the tactics of the most scalable firms include a preponderance of particular strategies that involve ‘create once, implement repeatedly’ tactics, including books, paid web listings, SEO, solicitors, website, and even webinars, along with more repeatable marketing systems like direct mail to bring people to educational events, and outright scalable spending on online ads. All of which can be much more readily increased in volume by simply making a high-dollar allocation to marketing – either by committing a bigger investment to grow faster, or by allocating a set percentage of a firm’s growing revenue to sustain the firm’s subsequent growth.

It's also notable that standout firms have invested more into making especially efficient and scalable marketing programs, with drastically higher efficiency ratios than the typical advisory firm – with dollar-based strategies generating 3X, 5X, and even 10X results.

In other words, if the average firm that spends $5,000 generates 1.4X results ($7,000 in new revenue) with an online ad or 2.8X results (or about $14,000 in new revenue) with a marketing list, standout firms have higher-efficiency ratios with the same marketing strategies, generating 4.4X ($22,000 in new revenue) with their online ads or $36,000 (7.2X) of new client revenue on a marketing list with the same spend. The firms are not only engaging in more scalable strategies, they are also doing a better job of scaling them further!

What’s especially notable is how this compares to the increasingly popular alternative approach for large advisory firms trying to scale their growth by engaging in mergers and acquisitions. After all, a ‘traditional’ 2X revenue cost to acquire a firm is the equivalent of an efficiency ratio of 0.5 (i.e., acquiring $10,000 of revenue for a $20,000 purchase price is the equivalent of generating $10,000 of revenue for a $20,000 spend, or a ratio of 0.5). Which puts M&A at the very bottom of the list of the most scalable growth strategies!

Participate In The 2022 Kitces Research Study On Advisor Marketing

In our upcoming 2022 Kitces Research on Advisor Marketing, we’re aiming to take a fresh look at advisor marketing strategies and how they’ve changed over the past 3 years (both with the ongoing evolution of how advisors market, and with the COVID-19 pandemic as a catalyst that accelerated the adoption of new strategies), to delve deeper into the client acquisition costs and marketing efficiency of various strategies, and to explore further what the fastest-growing advisory firms are doing differently than the rest. In the hope that by better understanding what really works when it comes to advisor marketing, we can help advisors make better allocations of their marketing time and their marketing dollars.

Notably, with this latest Kitces Research study, we’re also changing the process by which we distribute our surveys. Going forward, you’ll be able to create a login directly to the Kitces.com Readers Section, which provides a place for you to save your results and return (if you don’t want to complete the whole survey in one sitting), and will allow us to save your responses for future surveys (so you don’t have to repeat questions in the future that you’ve answered in the past; you’ll be able to review prior information already entered and only update what has actually changed!), making it faster and easier for you to participate and see your results included in the final report.

We hope you are excited about this new advisor research as well and can support us by participating in our new Advisor Marketing study. All participants will receive a free copy of The Kitces Report white paper that we produce, providing you with the latest research on “What Actually Works In Advisor Marketing”… and hopefully giving you some ideas about what you could change and do differently in your own advisor marketing, too!

Thank you in advance for taking the time to participate in this important financial planning research study!