Executive Summary

From the perspective of economics and life cycle finance, the immediate annuity is often viewed as the perfect retirement vehicle; in research dating back to Yaari (1965), it has been shown that for someone whose primary concern is outliving his/her money (as opposed to leaving a bequest to future generations), investment dollars should be annuitized to generate a superior return over bonds (due to mortality credits) while protecting against mortality risk.

Yet economists have long struggled to explain the so-called "annuity puzzle" - the fact that while the research suggests annuitization should be optimal, in practice remarkably few people ever choose to do so. Does that mean they're all just being driven by an irrational decision-making process and just need to be better educated to understand the true benefits of immediate annuities, or is there some other factor at play?

In new research, researchers Felix Reichling of the Congressional Budget Office and Kent Smetters of the Wharton School of Business think they have found a new way to explain the puzzle: the fact that the value of an immediate annuity changes over time due to incremental (and sometimes shocking) changes in health and mortality. In fact, it can be the worst of both worlds - severe health events can simultaneously reduce life expectancy (decreasing the remaining value of the annuity) and increase cash flow needs (to pay for the necessary care). And when viewed in this dynamic context, the value of annuitization can be quite risky indeed; so much, in fact, that Reichling and Smetters find that for those who are relatively risk averse and/or have limited retirement assets, that the most rational annuity allocation might be to avoid them altogether, and the ideal might even be for many to have negative exposure and "short" annuities instead!

Understanding The Reichling/Smetters Study

In the original Yaari framework, which found annuitizing all of an individual's assets to be the optimal retirement solution, the subject's mortality was assumed to follow a deterministic path - although mortality rose naturally with age, it was assumed that once the path of rising mortality rates over time was set, based on the individual's health conditions at the start, it would always evolve in the same manner, without any volatile shocks along the way. Yet of course, in the real world, health shocks do occur, and can change the course of the original longevity path; in other words, some health event happens, and our mortality is materially and permanently changed to a new path, such as when cancer is diagnosed for the first time and life expectancy from that moment on must be reduced.

This presence of potential health shocks is a significant difference from the stable mortality path assumption used in previous annuity research. In principle, it's similar to the difference between projecting investment growth on a straight-line basis versus through a Monte Carlo analysis, where market shocks (i.e., crashes) can happen; while the average Monte Carlo result might mimic the straight line assumption, projecting using only the average and ignoring the volatility along the way can grossly understate the risk of a plan that's based on the average alone. Thus, as with the impact of market shocks on a retirement plan, it's crucial to measure the impact of health shocks along the way as well, or there's a risk that important nuances of risk will be lost in an analysis that focuses on the average alone.

In the context of annuitization, this issue is especially important, as health shocks present an uncertainty that has a unique "double whammy" risk: a significant health event that impacts mortality will not only cause a significant drop in the remaining value of the annuitized payments (which aren't worth as much when mortality risk rises and survival probabilities and remaining life expectancy fall), but the individual may also experience a sharp increase in cash flow and liquidity needs to pay for whatever health event just occurred. In other words, the risks of decreased annuity value and higher costs are triggered by the same health event, which means they're actually correlated with each other in a remarkably undiversified manner, and as a result may be especially unappealing to a risk-averse investor!

Accordingly, the goal of the Reichling/Smetters study was to examine this exact issue: what is the utility of annuitization in a world where potential health shocks and mortality are modeled stochastically (i.e., on a Monte Carlo basis) and investors have some level of aversion to risks, including the risk of needing to use the value of an immediate annuity more for health care at the exact time its value is depressed.

Results Of The Reichling/Smetters Study

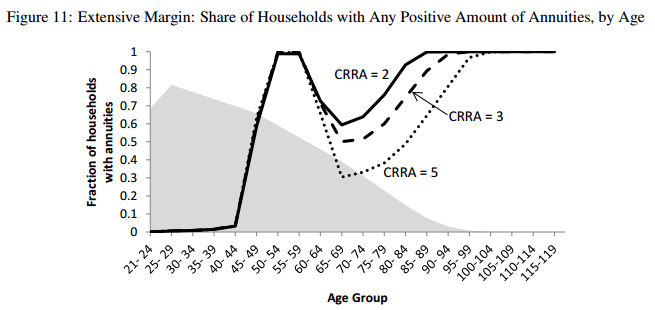

The results of the Reichling/Smetters study find that in fact, once the risk of health shocks is accounted for, the appeal of annuitization is far less than once believed. The figure below from their study shows the percentage of households that would annuitize wealth at various ages given these risks; notably, not only does the appeal of annuitization dip for those in their 60s and 70s, but the higher the risk aversion (i.e., the higher the Constant Relative Risk Aversion [CRRA] coefficient) the less appealing the annuitization! In other words, the more risk-averse the client is, the less they would annuitize in their early retirement years. (By contrast, annuitization fares better for those in their 50s, where the risk of health shocks is lower, and for those in their 80s where the value of mortality credits becomes overwhelming despite the health shock risk.)

Of course, the results do still show that a material number of households would choose annuitization, but further analysis from Reichling and Smetters reveals that the appeal of annuitization still varies tremendously depending upon the details of the household. For households with less in net worth and financial assets - for whom health care shocks represent a more several potential financial hit - the appeal of annuitization is lower (noting that this is the majority of Americans!). By contrast, households that have significant wealth would find annuitization more desirable, but only because they would either annuitize just a portion of their wealth (and pay for the long-term care and medical health care shocks from other assets) or because the payments from annuitizing all their wealth would be so large they could cover health care shocks anyway (e.g., if you annuitize $10,000,000 of net worth, the monthly payments will be so much more than is necessary to satisfy the likely retirement goal that there would be plenty of extra cash flow to handy unexpected events).

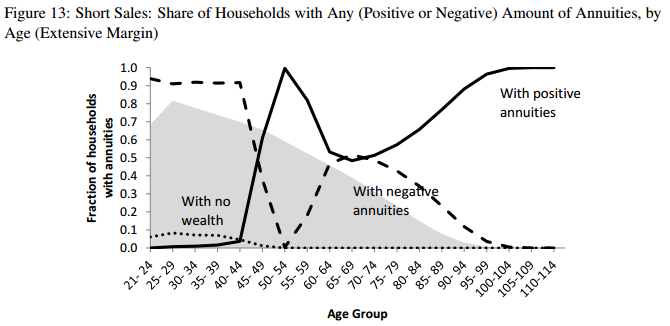

Given that relatively few people have such net worths, though, overall the study found that at moderate levels of risk aversion, only 11% of households would be anticipated to fully annuitize at age 65, only 24% of households would fully annuitize at any age, and only 37% of households at any age would hold any positive level of immediate annuities at all, with the other 63% holding zero in annuities. However, even this result occurred only because the model was "constrained" to the assumption that the most extreme result would simply be to not invest anything into immediate annuities. If instead households are allowed to have a "negative" annuity position, the conclusion is even more surprising, as shown from the study's figure 13 below.

As the results reveal, when allowed to hold negative annuities positions, the Reichling/Smetters models show that a material number of households would be better off shorting an immediate annuity rather than purchasing one, especially those who are young or who are struggling to afford retirement (for whom a health shock would be a financial disaster)! In practice, the authors note that shorting an annuity would effectively be the equivalent of buying life insurance.

Implications For Financial Planners

As noted earlier, it's long been a mystery, especially to lifecycle finance economists, that if immediate annuities are such a great solution according to the research, why do so few people actually buy them?

For many financial planners, resolving this "annuity puzzle" and the low adoption rate of immediate annuitization is as simple as acknowledging that in the real world, most clients don't focus solely and exclusively on their retirement income needs to the total exclusion of legacy and other goals (as the research of Yaari and others virtually always assumes that retirees have zero bequest motives). In other cases, the criticism of immediate annuitization has been focused more on a behavioral basis, including our sometimes irrational tendency to fear that we might buy an immediate annuity, get "hit by a bus" shortly thereafter, and lose everything. Of course, the reality is that the actual likelihood and risk of such a scenario is remarkably low, and furthermore that it can be at least partially mitigated by period certain guarantees. Nonetheless, even with this concern, hypothetically there should be at least some people who really would have no bequest motives, and would be capable of overcoming their "irrational" behaviors, and take the "rational" approach prescribed by the research; yet in the real world, a miniscule fraction of people buy immediate annuities at all, and virtually none of them do so with 100% of their wealth as the models would suggest.

In this context, the Reichling/Smetters research represents a significant breakthrough, in that it shows why even a rational (but somewhat risk-averse) investor would choose not to annuitize, even if there is no bequest motive and the sole goal is to fund retirement, due to a combination of the illiquidity of the contract and the fact that its implicit value declines in the face of health care shocks when the need for money actually rises. To some extent, this may still not be "news" to financial planners, who have long acknowledged that the illiquidity of immediate annuities is a significant factor that makes them unappealing for many clients, especially those of limited means who have few other resources to deal with the vicissitudes of life (even despite the implied illiquidity premium they might earn, similar to investing into a structured settlement annuity). Nonetheless, for an economic research paper to demonstrate that the use of annuities would decline as risk aversion rises is a shocking contrast to what most other lifecycle finance research has shown about the utility of immediate annuitization.

From a more practical perspective, the results of the study go far to make the point that planning for health care shocks - and their cost - continues to represent a significant planning issue for most households. The health care shock impact is the primary driver in the Reichling/Smetters study for the lower utility of annuitization, and in fact they find that for many households the ideal would be to short annuities (i.e., to buy life insurance) instead. After all, just as the implicit value of an annuity would decline when a health care shock occurs that reduces life expectancy, the implicit value of a life insurance policy would rise when a health care shock occurs (a change to a shorter life expectancy makes the expected value of the death benefit greater). In turn, a more valuable life insurance policy after a health shock could in theory be sold for its appreciated value to help fund the required health costs, providing more money at the exact time that it's needed; in other words, annuities are a bad diversifier for health shocks because their value declines when a health event occurs, while life insurance work better because their value tends to rise in such scenarios. Of course, in the real world, outright shorting of immediate annuities isn't possible, and the secondary sale of life insurance through the life settlements market is possible but still a relatively inefficient solution due to its transaction costs, so this may not be an ideal solution in practice. Nonetheless, it still makes the point that immediate annuities are an especially poor hedge for those concerned about the risks of health care costs.

In fact, given the study's focus on the importance of being able to fund health care shocks, ideally the solution for most would likely be some form of "short-fat" long-term care insurance, though the study notes the cost of such coverage continues to be prohibitive for many households (though it may still be more efficient than buying life insurance as an investment to speculatively sell to fund health care shocks!). Still, the results of the study would imply that long-term care insurance is grossly underutilized by households today, and that almost as many households should be buying long-term care insurance to defend against health shocks as those considering annuitization. Furthermore, the results imply that the presence of a long-term care insurance policy - and the associated reduction in exposure to the cost of health care shocks - would/should increase the appeal of annuitization; in other words, immediate annuities might be best specifically when paired together with long-term care insurance, converting the health care shock risk into a steady stream of premiums that can be funded by a steady stream of annuity payments (notably, this would mean not using the newly popular hybrid annuity/LTC policies, which pair together LTC insurance with a deferred annuity, not an immediate annuity).

In any event, though, the bottom line is that the Reichling/Smetters study represents a significant new connection between the academic research on immediate annuitization and what financial planning practitioners observe in the real world - that people like to maintain liquidity and reserves against the unexpected risks of life (such as health shocks), and that in such a world for retirees in particular, immediate annuities may actually be one of the least effective solutions to address such concerns, due to the fact that their value is adversely correlated to the very health shocks against which retirees are trying to protect. Accordingly, the reality may be that the low use of immediate annuities is not a behavioral fallacy or due to a lack of consumer education, but simply an entirely rational way to handle the uncertainties of future changes in life and health.

In the meantime, if you'd like to read the Reichling/Smetters study itself, you can view it here.